Celestia’s (TIA) 30% Price Crash Triggers Record Outflows in 2025

Celestia’s 30% plunge spooked investors, but signals like RSI nearing oversold and CMF inflows point to a possible rebound ahead.

Celestia (TIA) has recently experienced a significant drawdown, losing nearly 30% of its value in the past two weeks. This decline has been attributed to the broader bearish market conditions, which caused panic among investors.

As a result, many TIA holders decided to pull their funds, adding to the downward pressure on the price.

Celestia Holders Opt To Back Out

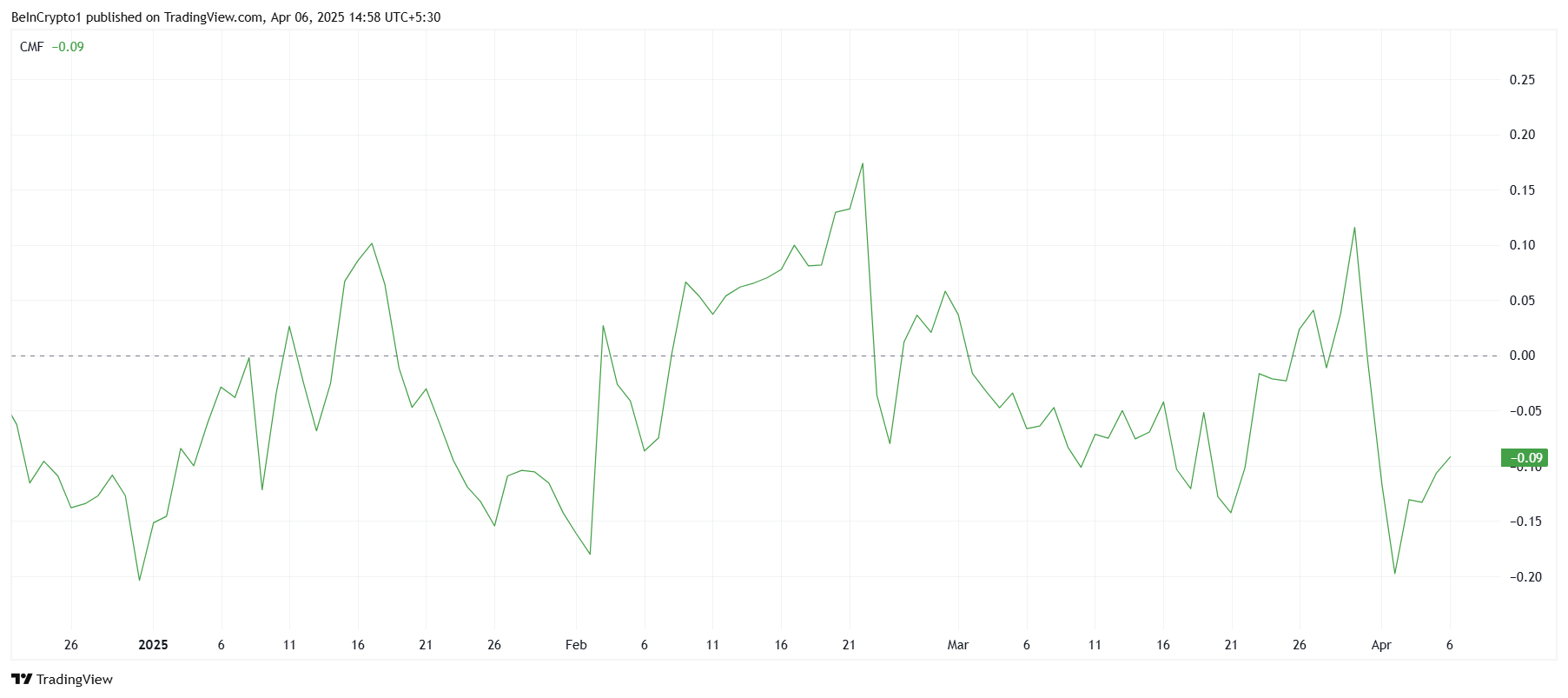

The Chaikin Money Flow (CMF) indicator has shown significant outflows from Celestia, marking the largest selling activity since the beginning of 2025. This reflects the growing fear among investors after the 30% price correction.

However, despite the negative sentiment, there has been an uptick in the CMF recently, indicating that some new investors are beginning to see value in the low prices. These inflows could potentially help stabilize the price and set the stage for a recovery.

Celestia CMF. Source:

TradingView

Celestia CMF. Source:

TradingView

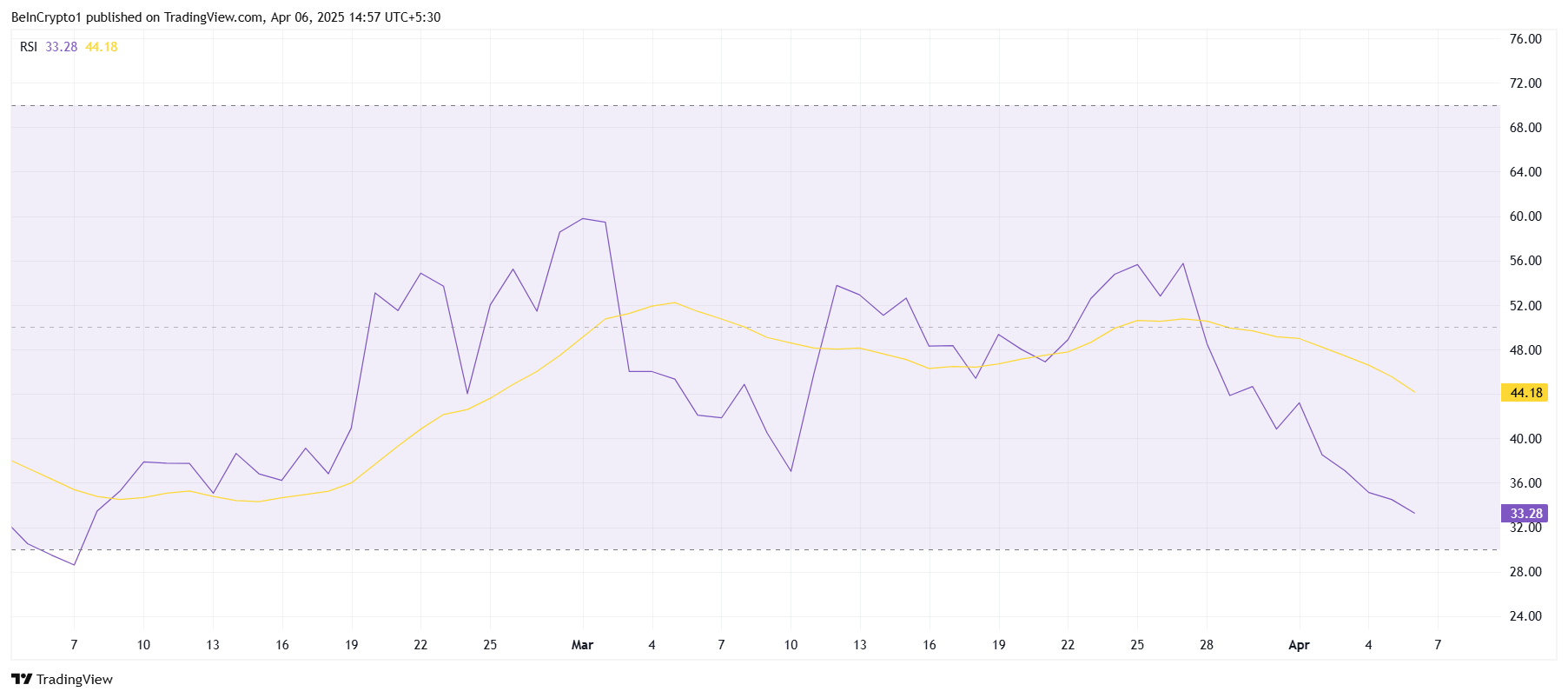

The Relative Strength Index (RSI) for Celestia shows that cryptocurrency is currently on a bearish trend. Stuck below the neutral line at 50.0, the RSI is moving closer to the oversold threshold of 30.0. Historically, when an asset reaches this level, it is considered a signal for a potential reversal, as selling typically slows, and accumulation begins.

If the RSI falls below 30, it could trigger buying interest, as many traders may view the low prices as an opportunity to enter the market.

The current state of the RSI suggests that while bearish momentum is still strong, the conditions are ripe for a reversal. If the selling pressure wanes and buyers begin to step in, Celestia’s price could find support and begin an upward move.

Celestia RSI. Source:

TradingView

Celestia RSI. Source:

TradingView

TIA Price Could Be Looking At Recovery

Celestia is currently priced at $2.62, reflecting a nearly 30% decline over the past two weeks. It is holding just above the critical support level of $2.53. If the market sentiment improves and the RSI hits the oversold zone, there is potential for a recovery.

The influx of new investors could provide the momentum needed to drive the price higher.

A successful bounce from the $2.53 support level could see Celestia pushing through $2.73 and heading towards $2.99. This would signal the beginning of a recovery rally and possibly set the stage for further price appreciation as market conditions improve.

Celestia Price Analysis. Source:

TradingView

Celestia Price Analysis. Source:

TradingView

However, if Celestia fails to hold the $2.53 support, it could trigger a further decline towards $2.27. This would invalidate the bullish outlook, prolonging the downtrend and extending investors’ losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

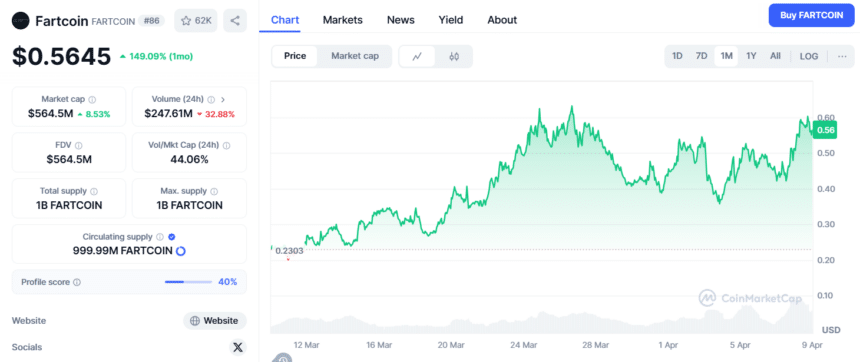

Fartcoin Surges in Value While Market Faces Setbacks

In Brief Fartcoin has increased by nearly 30% in the last 24 hours. Growing confidence among users as exchange reserves decline. Technical indicators predict a potential price target of $0.75.

Ethereum’s Price Drop Signals Potential Buying Opportunities for Long-Term Investors

In Brief The recent price drop of Ethereum may offer strategic buying opportunities. Historical data supports potential recovery after dips below realized price. Investor psychology plays a crucial role during uncertain market conditions.

Whale Makes Bold $1.89M Bet on Fartcoin, Would it play out?

FIL Price Over $150 Emerges as Filecoin Shows Highly Bullish Signals Amid Bitcoin Mirroring 2024 Correction