Solana Eyes $135 as Long-Term Holders Drive Largest Accumulation in 6 Months

Solana is showing signs of a price rebound fueled by six-month-high accumulation from long-term holders, but weak retail interest may delay a breakout.

Solana (SOL) has struggled to gain momentum over the past couple of weeks, and its price has failed to recover significantly.

Despite this, the altcoin has seen signs of stabilization, with long-term holders (LTHs) showing increasing support. This shift could indicate a potential price rise, provided the current trend holds.

Solana Investors Move To Accumulate

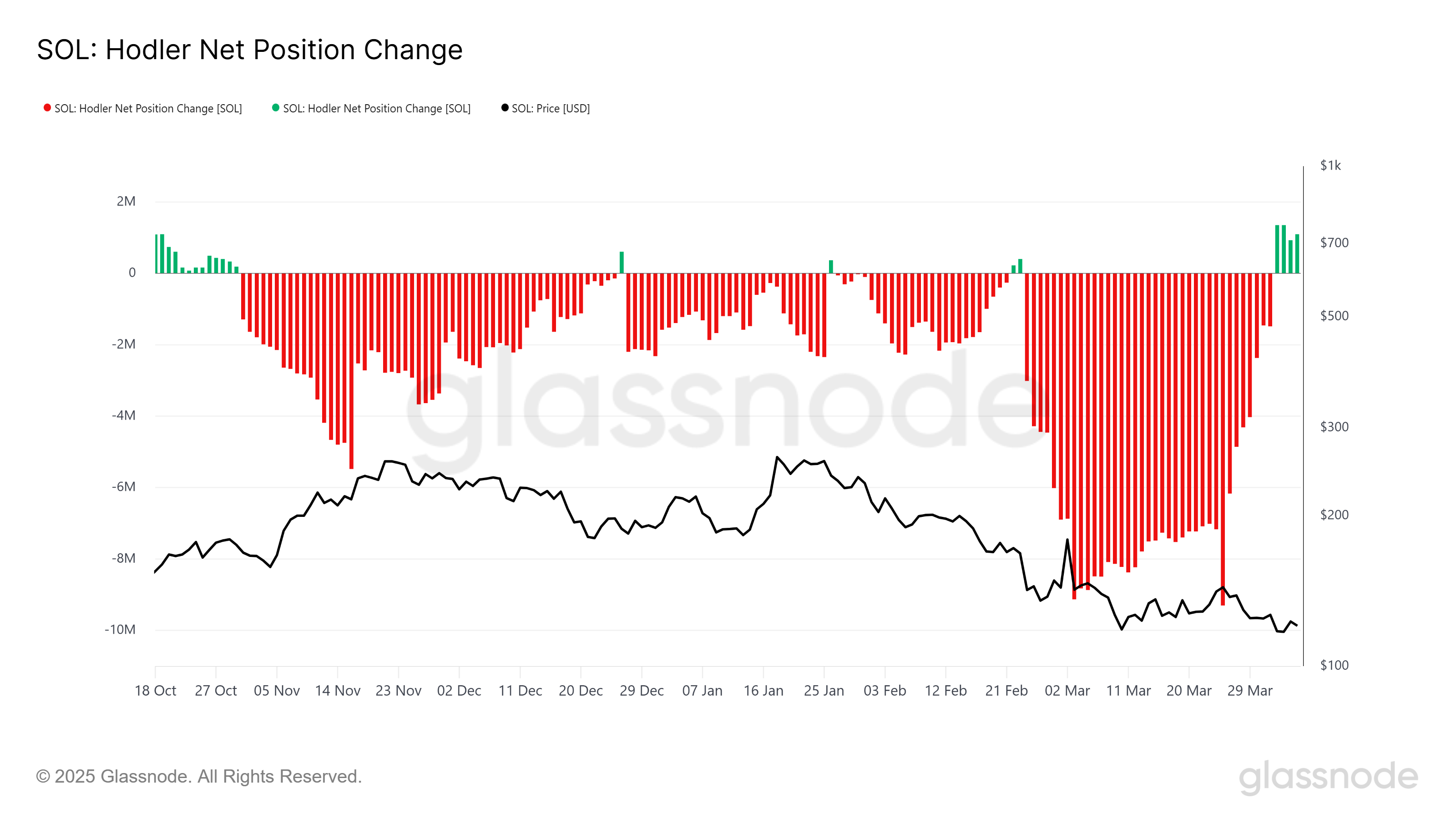

The HODLer Net Position Change for Solana has been positive for the past four days, with consistent green bars indicating that LTHs are accumulating more SOL. This is the longest streak of accumulation in over six months, signaling confidence from long-term investors.

As these investors continue to add to their positions, Solana could build a solid foundation for a price rebound.

LTHs tend to significantly influence Solana’s price, as their holdings reflect longer-term confidence in the cryptocurrency. If this trend continues, the growing support from LTHs could provide the necessary backing to help Solana break through key resistance levels.

Solana HODLer Net Position Change. Source:

Glassnode

Solana HODLer Net Position Change. Source:

Glassnode

However, despite the support from LTHs, Solana’s overall market sentiment is still mixed.

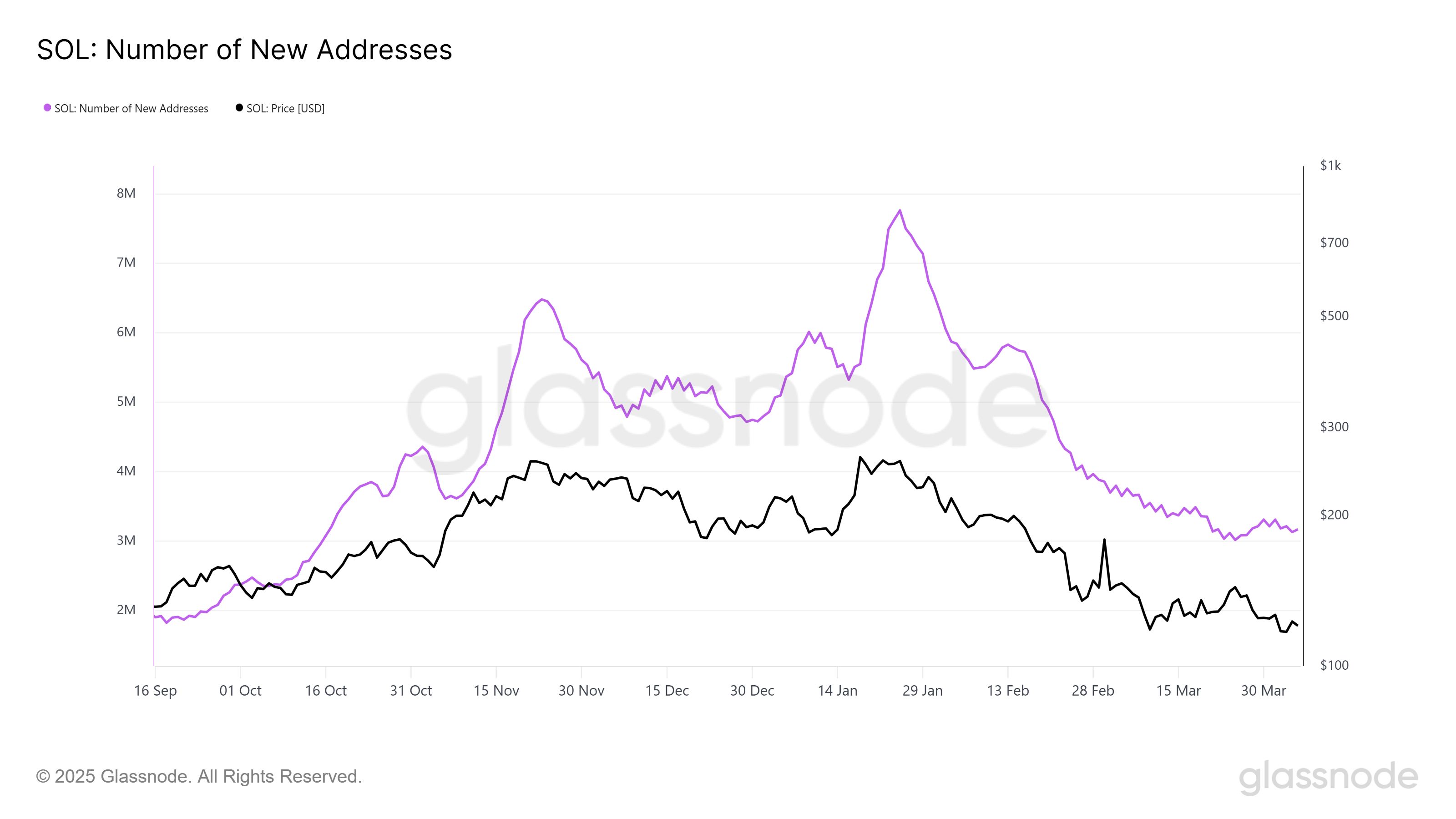

New addresses, an important metric for investor interest, have recently hit a six-month low. This indicates that fewer new investors are entering the market, reflecting a lack of optimism for a recovery in the short term. The last time new address activity was this low was in October, suggesting that investor confidence is currently subdued.

The drop in new addresses could signal caution among potential buyers, affecting the altcoin’s overall momentum. While LTHs continue to accumulate, the lack of fresh interest from new investors could delay any significant upward movement for Solana.

Solana New Addresses. Source:

Glassnode

Solana New Addresses. Source:

Glassnode

SOL Price Vulnerable To Correction

Solana is currently trading at $119, holding just above the crucial support level of $118. While the altcoin is attempting to make its way to $135, mixed market sentiments suggest it may struggle to break through this resistance.

The price could consolidate between $118 and $135 as it builds enough momentum for a potential rally.

If Solana manages to bounce back, it may continue to trade within this range, allowing time for the market to stabilize and support further price appreciation. Consolidation could help SOL gather strength before another attempt to breach the $135 level.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

However, if the price falls below $118, it could signal a shift in momentum, invalidating the bullish-neutral outlook. A drop below this support level would likely lead to further declines, potentially taking Solana down to $109, which would extend investors’ losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?

Whale Buys Back 8K ETH, Nets $159K in 10 Days

Whale repurchases 8,012 ETH at $1,779, repays debt, and earns $159K from ETH trading over 10 days.Whale Re-Enters ETH With $14M BuybackSmart Debt Management and Strategic TimingProfit Through Precision

Solana Price Eyes $162, Cardano Slides Again, While Unstaked Presale Goes Viral in April 2025

Explore a timely comparison of Cardano, Solana, and Unstaked ($UNSD) focusing on real-time utility, price levels, and presale potential. Find out what crypto to invest in for both short-term strategy and long-term value.Cardano Slides Back Into Multi-Year RangeSolana Faces Crucial Test Near Largest Supply ClusterUnstaked Is More Than Hype: A Real Use Case in a Meme-Driven MarketUtility, Timing, and the Case for $UNSD