Bitcoin Consolidates Amid Surging Global Liquidity, Indicating Potential for Significant Price Movement

-

Bitcoin is currently in a consolidation phase while global liquidity surges, signaling a potential breakout on the horizon.

-

Historical patterns suggest Bitcoin typically reacts to increases in M2 liquidity, and the current environment might soon trigger a price surge.

-

“Bitcoin’s supply limits and decentralized nature make it an attractive hedge against inflation,” said a COINOTAG analyst.

This article explores the implications of rising global liquidity on Bitcoin’s price dynamics, revealing potential breakout signals and network resilience.

How Does Rising Liquidity Fuel BTC?

Expanding liquidity influences investor behavior, often redirecting capital towards assets that combat inflation and sustain long-term purchasing power. Bitcoin is exceptionally positioned in this context due to its programmed scarcity. With a maximum supply capped at 21 million coins, Bitcoin stands in stark contrast to fiat currencies that can be printed indefinitely. This characteristic strengthens Bitcoin’s case as a robust investment amidst rising M2 levels.

Currently, Bitcoin is valued at $83,640, reflecting a 1.21% increase within the last 24 hours. It’s experiencing tight price compression within a descending channel, facing resistance at $88,197 while having support around $78,668. This constraining pattern, coupled with aggressive monetary expansion, sets a favorable scene for a potential breakout that could align Benz price action with global liquidity trends.

Source: TradingView

Is the Bitcoin Network Showing Strength?

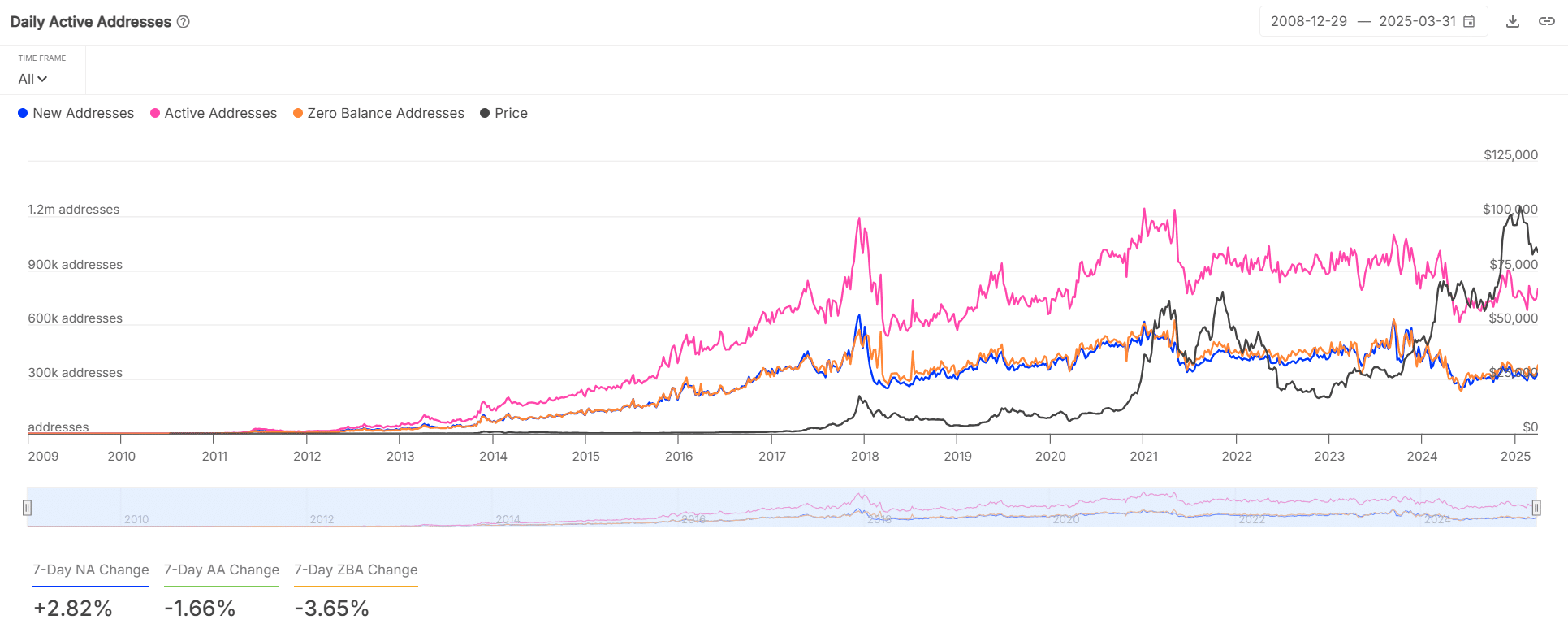

The resilience of Bitcoin’s network continues to provide a robust backing for its macro and technical outlook. Recent data reveals that new wallet addresses surged by +2.82% over the past week, indicating a rise in fresh user participation. Additionally, the number of zero-balance addresses has decreased by -3.65%, signifying that fewer participants are exiting the network. While active addresses saw a minor decline of -1.66%, they remain steady at approximately 800,000 daily, highlighting sustained utilization.

These on-chain metrics paint a picture of a solid foundation. Even amid price consolidation, Bitcoin’s network shows evidence of strength, a common precursor to significant price movements.

Source: IntoTheBlock

Will Bitcoin Wait Much Longer?

As Bitcoin continues to consolidate amidst a vertical increase in global liquidity, the overall equilibrium becomes increasingly precarious. On-chain indicators affirm a robust network, and user engagement remains consistent. The current technical formations are tightening, indicating that a decisive price movement could be imminent. Bitcoin is on the verge of a significant reaction to the ongoing monetary expansion, suggesting that it won’t remain dormant for long.

Conclusion

In summary, rising global liquidity is poised to influence Bitcoin’s trajectory, with both historical patterns and on-chain metrics providing supportive evidence for an upcoming breakout. As Bitcoin navigates its consolidation phase, investors will be closely monitoring the asset’s development for signs of a significant price shift. With its inherent scarcity and growing user participation, Bitcoin remains a focal point for those looking to hedge against inflationary pressures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZA Miner Introduces Free Cloud Mining Platform for Bitcoin and Dogecoin

ZA Miner, a UK-based cloud mining provider, has officially launched a new platform to make cryptocurrency mining more accessible to a broader audience.

OSC Warns of Surge in AI-Driven Crypto Scams as Canadian Fraud Losses Climb to $640 Million

According to the Globe and Mail report, the Ontario Securities Commission (OSC) is raising red flags over a sharp rise in cryptocurrency fraud across Canada, as scammers now weaponize artificial intelligence to swindle unsuspecting investors.

Arkansas City Planning Commission Rejects Crypto Mining Proposal Amid Strong Community Backlash

The Vilonia Planning Commission has unanimously turned down a proposed cryptocurrency mining facility within city limits, following weeks of vocal opposition from residents.

Bitcoin Climbs to $94,000 Driving Market Above $3 Trillion