Ethereum Shows Signs of Sellers Losing Control as $1,800 Support Holds Amid Market Pressure

-

Ethereum’s recent price drop of over 50% has captured the attention of investors, but emerging signals may indicate a shift in market dynamics.

-

Despite the bearish trends, the $1,800 support level remains resilient, showing potential for a future recovery.

-

According to CryptoQuant, “Recent market metrics suggest that sellers are beginning to lose their grip,” hinting at a possible bullish reversal.

Ethereum’s price fluctuations present both challenges and opportunities; analysis points to key indicators suggesting a shift in market momentum.

Potential Signs of Recovery as Sellers Lose Ground

After enduring a grueling year marked by relentless sell pressure, Ethereum’s market landscape is showing promising signs of a turnaround. Analysis from CryptoQuant reveals a bullish divergence forming in the market, despite Ethereum’s ongoing price declines.

One notable indicator is Ethereum’s Net Taker Volume (NTV), which has historically teetered on deeply negative territory. Now, a recent shift indicates a potential decrease in selling pressure. The NTV has recorded higher lows during the recent sell-offs, which is often a signal of bullish market conditions poised for reversal.

Understanding Volume Dynamics Amidst Price Declines

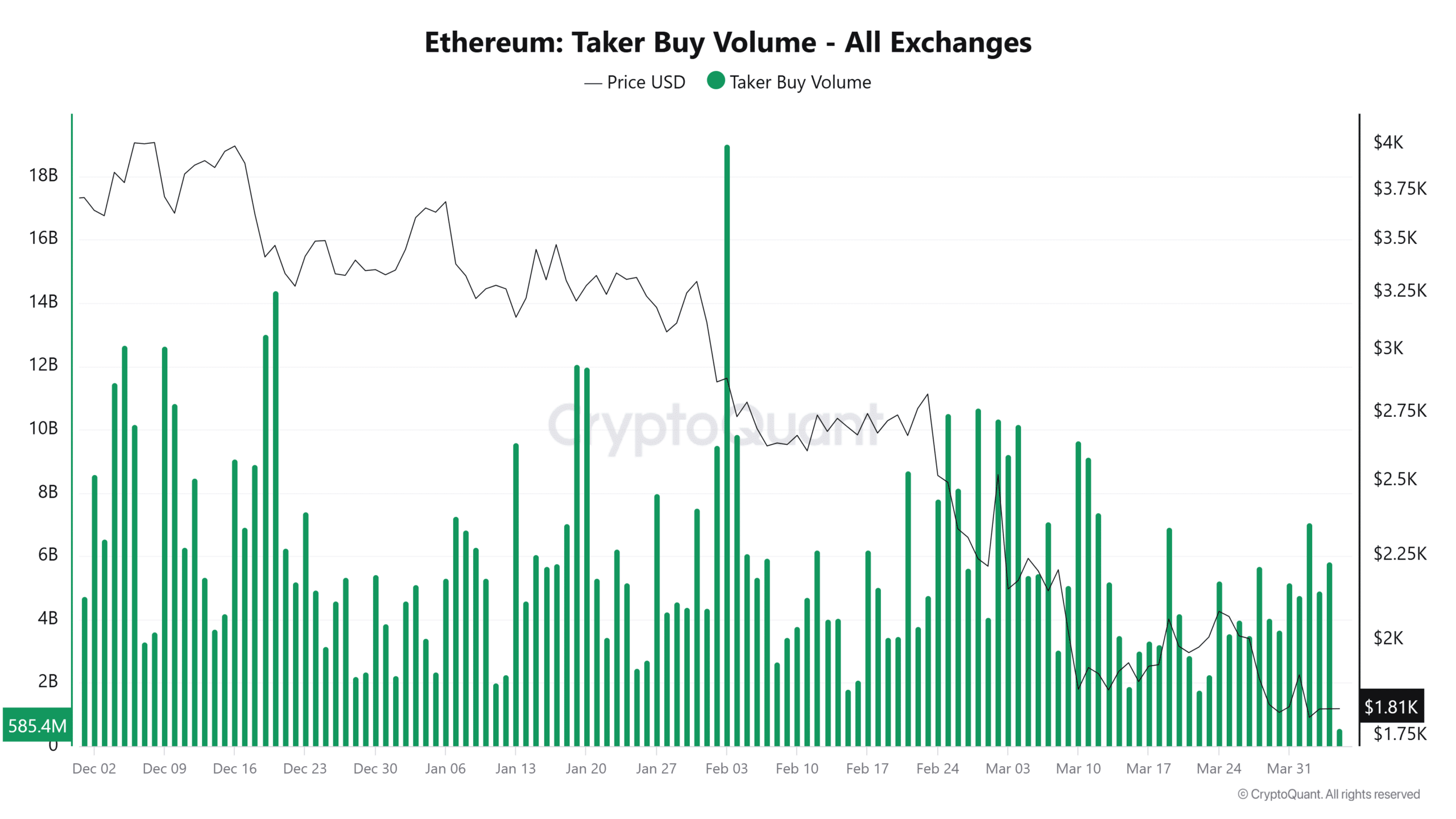

Examining the shifts in Ethereum’s Taker Buy Volume reveals a mix of aggressive buying attempts and the struggle to maintain upward momentum. The spikes observed between December 2024 and April 2025 illustrate volatility but also reflect buyer resilience as they attempt to counteract bearish pressure.

Source: CryptoQuant

The observed increase in Taker Buy Volume—peaking at $19 billion in February as ETH hovered around $2,882—indicates significant buying interest. Even as the price retreated by April to $1,905, this high volume indicates an appetite among buyers to absorb the sell-side pressure.

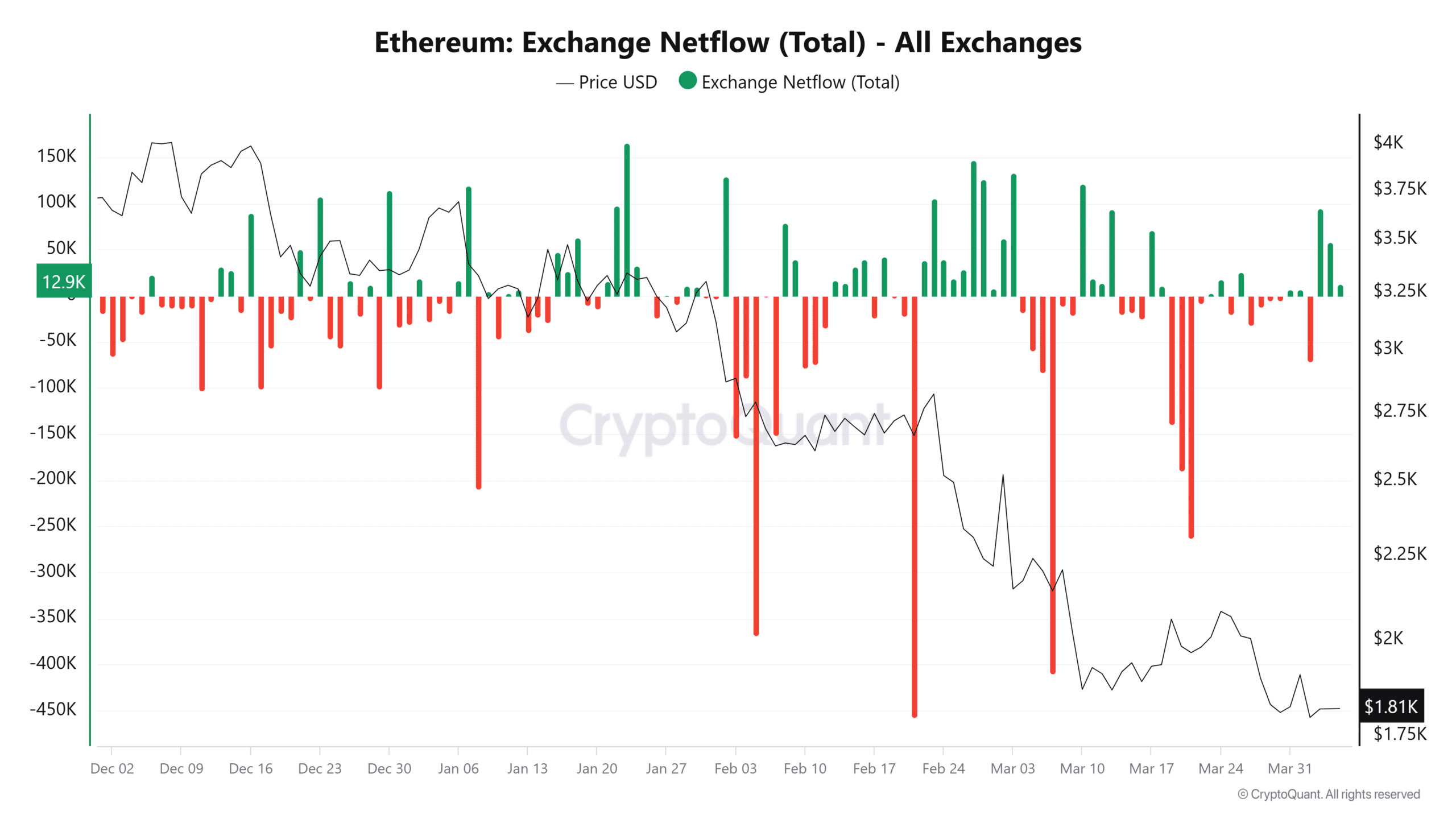

Exchange Netflows Provide Insight into Market Trends

Shifting netflows across exchanges further illuminate current market dynamics. Despite ETH’s price drop from $3,278 to $1,810 between December and March, net outflows from exchanges suggest that long-term holders are accumulating more ETH rather than selling into the market.

Source: CryptoQuant

With withdrawals consistently outpacing deposits during the extended downturn, the data suggests long-term holders are positioning themselves for the next potential upswing.

Technical Analysis and Key Price Levels

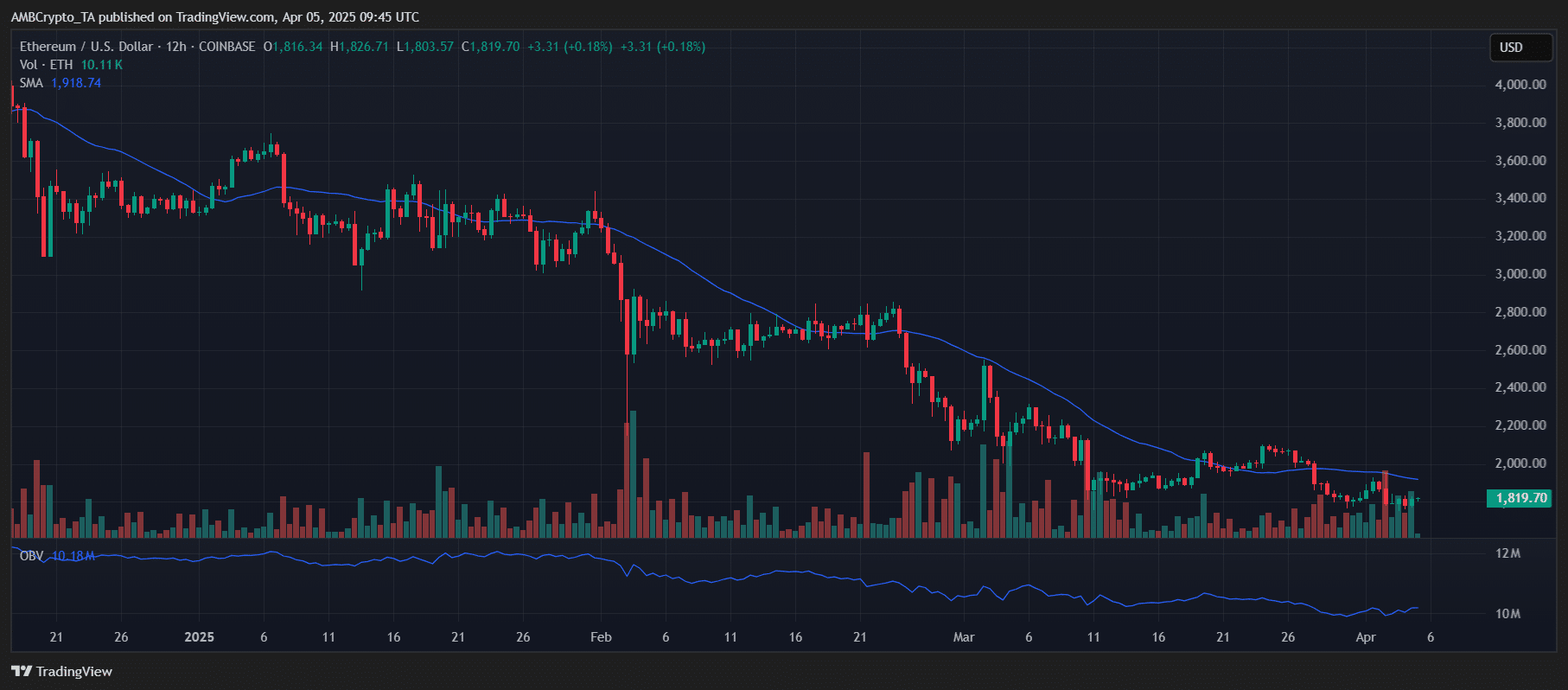

Technically, Ethereum remains in a downtrend, consistently reacting along its Simple Moving Average (SMA), which has acted as key resistance since early 2025. Nonetheless, the remarkable resilience shown around the $1,800 support level may indicate a critical inflection point.

Source: TradingView

The impressive ability to maintain support at the $1,800 level amid growing rifts in investor sentiment suggests a potential shift in tide. Market participants are closely watching for a reclaiming of the $2,000 to $2,200 range, which could imply the beginning of a new upwards trend.

Conclusion

In summary, Ethereum’s recent movements illustrate a complex interplay between selling pressures and emerging buyer interest. The indicators emphasize a favorable setup for potential recovery, as evidenced by the resilience around the $1,800 support level and decreasing selling volumes. If Ethereum can reclaim higher price levels and sustain them, this could provide a roadmap for bullish sentiment in the coming weeks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?

Whale Buys Back 8K ETH, Nets $159K in 10 Days

Whale repurchases 8,012 ETH at $1,779, repays debt, and earns $159K from ETH trading over 10 days.Whale Re-Enters ETH With $14M BuybackSmart Debt Management and Strategic TimingProfit Through Precision

Solana Price Eyes $162, Cardano Slides Again, While Unstaked Presale Goes Viral in April 2025

Explore a timely comparison of Cardano, Solana, and Unstaked ($UNSD) focusing on real-time utility, price levels, and presale potential. Find out what crypto to invest in for both short-term strategy and long-term value.Cardano Slides Back Into Multi-Year RangeSolana Faces Crucial Test Near Largest Supply ClusterUnstaked Is More Than Hype: A Real Use Case in a Meme-Driven MarketUtility, Timing, and the Case for $UNSD