XRP Network Activity Drops Sharply After All-Time High

- XRP faces drastic drop in activity

- Impact of short-term speculation

- Increased risk for new investors

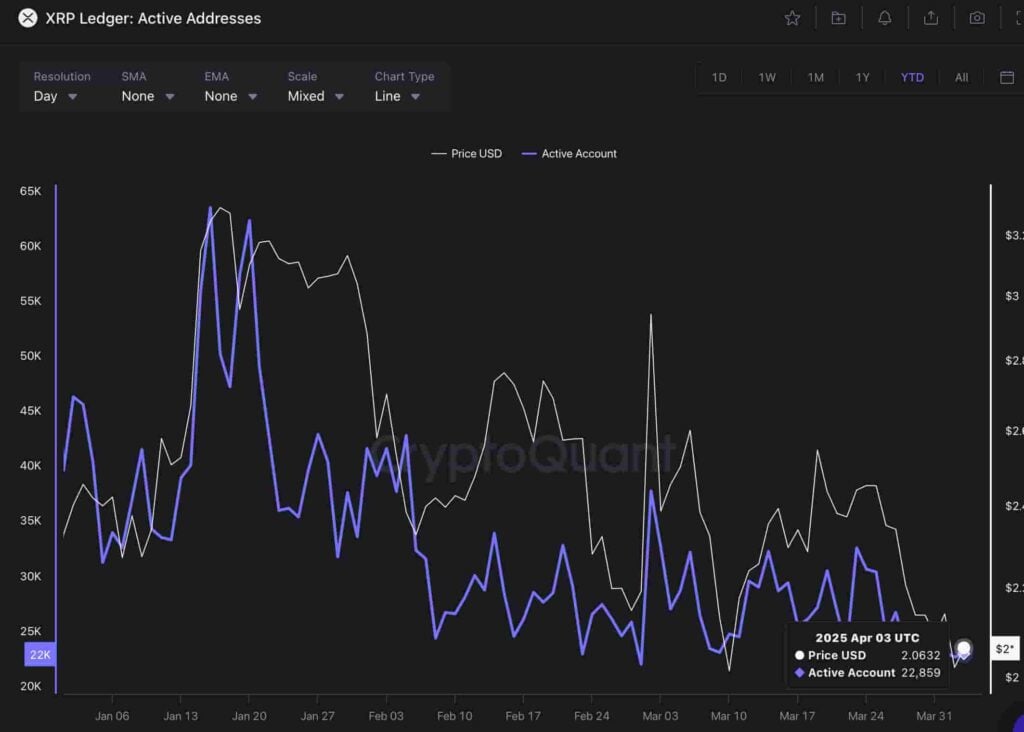

After recording one of the biggest gains in the current bull market, the cryptocurrency XRP is now facing a notable slowdown. On-chain data indicates that daily active address activity has seen a dramatic drop of 65%.

At the height of interest on January 16, 2025, the number of active addresses reached 63.389. However, by April 3, that number had plummeted to just 22.859, revealing a significant decrease in network activity.

This decline coincides with the end of a period of intense speculation that lasted from November 7, 2024, to mid-January 2025, during which XRP appreciated by more than 485%. The initial optimism was driven by the expectation that a crypto-friendly administration would benefit Ripple and its ecosystem. During this period, the number of daily active addresses increased by more than 432,6%.

The initial, predominantly retail-driven momentum has begun to fade, highlighting a classic case of short-term speculation outstripping sustainable demand. The cryptocurrency’s realized capitalization has jumped from $30,1 billion to $64,2 billion, with nearly $30 billion of that increase attributed to capital moved in just six months, according to data from Glassnode.

This rapid accumulation of capital has resulted in a concentration of wealth among new holders, who now own over 62,8% of XRP’s realized capitalization. This phenomenon has raised alarm bells, as many of these new investors may be vulnerable to negative market fluctuations due to their high entry costs.

As enthusiasm cooled in late February, signs of a speculative wave receding began to emerge. The Realized Profit/Loss ratio has been trending downward since January, indicating more frequent losses and fewer profits being taken—a possible harbinger of a loss of market confidence.

Coupled with the decline in network activity, this scenario suggests that many new investors may be facing losses, increasing the risk of panic-driven market exits.

XRP has now briefly dipped below the psychological $2 threshold amid broader market jitters triggered by new global tariffs announced by President Donald Trump. However, the cryptocurrency has since recovered, rising 5,6% on the day to trade at $2,17.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?

Whale Buys Back 8K ETH, Nets $159K in 10 Days

Whale repurchases 8,012 ETH at $1,779, repays debt, and earns $159K from ETH trading over 10 days.Whale Re-Enters ETH With $14M BuybackSmart Debt Management and Strategic TimingProfit Through Precision

Solana Price Eyes $162, Cardano Slides Again, While Unstaked Presale Goes Viral in April 2025

Explore a timely comparison of Cardano, Solana, and Unstaked ($UNSD) focusing on real-time utility, price levels, and presale potential. Find out what crypto to invest in for both short-term strategy and long-term value.Cardano Slides Back Into Multi-Year RangeSolana Faces Crucial Test Near Largest Supply ClusterUnstaked Is More Than Hype: A Real Use Case in a Meme-Driven MarketUtility, Timing, and the Case for $UNSD