On-chain Data Academy (Part 5): How Many People Are Actually Making Money? A Five-Minute Overview of the Objective Sentiment Indicator PSIP

This article will focus on introducing the on-chain metric PSIP.

Original Article Title: "On-Chain Data Classroom (Part 5): How Many People Are Actually Making Money? A Five-Minute Guide to the Objective Sentiment Indicator PSIP!"

Original Article Author: Mr. Berg, On-Chain Data Analyst

This article is the 5th part of the On-Chain Data Classroom series, with a total of 10 parts. It will take you step by step through understanding on-chain data analysis. Interested readers are welcome to follow this series.

Related Reading: "On-Chain Data Classroom (Part 4): Visualized BTC Chip Price Distribution Chart"

TL;DR

- This article will introduce the on-chain indicator PSIP

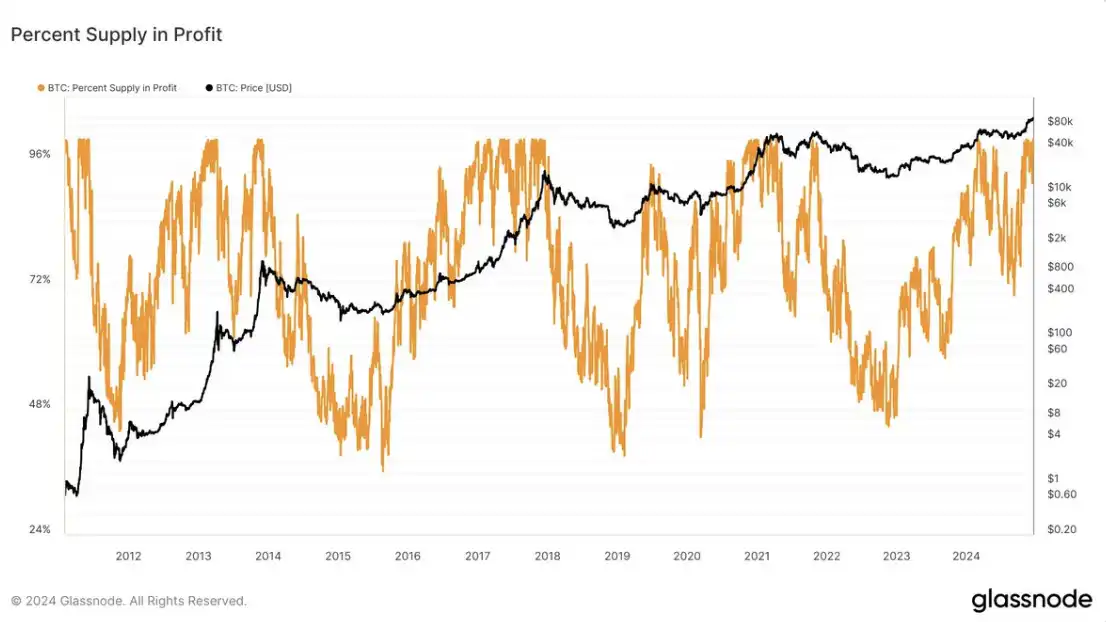

- PSIP = Percentage of Supply in Profit, among circulating $BTC

- It can serve as a guide to market sentiment, with applications in recognizing market tops and bottoms

What is PSIP?

PSIP, short for Percent Supply in Profit, is defined as "the percentage of circulating $BTC that is in a state of profit."

Calculation method:

It distinguishes profit and loss chips by "comparing each $BTC's last transfer price with the current price."

When the current price is higher than a certain $BTC's last transfer price, this $BTC is considered a profit chip.

What if Most Chips Are in a Loss...?

An important application scenario of PSIP is market bottoms. When most chips are in a loss, it is usually a good time to buy the dip.

The logic is straightforward:

Under similar conditions, the more profitable holders, the greater the selling pressure from profit-taking in the market, and vice versa.

As shown in the chart below, historical points where $BTC had PSIP <50% are marked, indicating very precise opportunities to buy the dip

What if the Majority of Chips are in Profit?

As shown in the chart below, the percentage of chips in profit reaches a maximum value of 100%. Therefore, it is difficult to determine a top based solely on high PSIP.

Here is an interesting logic to share: “Observe the Correlation Change between PSIP and Price”

This idea is derived from the following analysis: The Market Pulse – Week 36, 2022

Conclusion

The above is all the content of On-Chain Data School (Part Five). For readers interested in further studying on-chain data analysis, remember to keep track of this series of articles!

If you want to see more analysis and teaching content on on-chain data, feel free to follow my Twitter account (X)!

I hope this article has been helpful to you. Thank you for reading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?

Whale Buys Back 8K ETH, Nets $159K in 10 Days

Whale repurchases 8,012 ETH at $1,779, repays debt, and earns $159K from ETH trading over 10 days.Whale Re-Enters ETH With $14M BuybackSmart Debt Management and Strategic TimingProfit Through Precision

Solana Price Eyes $162, Cardano Slides Again, While Unstaked Presale Goes Viral in April 2025

Explore a timely comparison of Cardano, Solana, and Unstaked ($UNSD) focusing on real-time utility, price levels, and presale potential. Find out what crypto to invest in for both short-term strategy and long-term value.Cardano Slides Back Into Multi-Year RangeSolana Faces Crucial Test Near Largest Supply ClusterUnstaked Is More Than Hype: A Real Use Case in a Meme-Driven MarketUtility, Timing, and the Case for $UNSD