Market Pulse: Week 14

Amid looming macro risks such as a potential tariff war, low liquidity and rising hedging demand suggest that downside pressure remains a credible threat unless significant inflows return to the market.

Overview

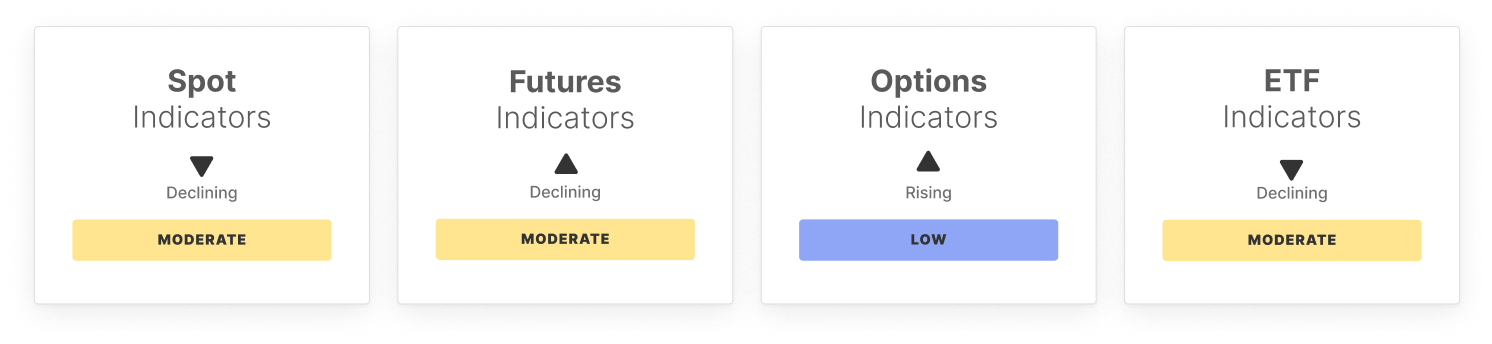

The Bitcoin market remains in a defensive posture as signs of weakness persist across spot, derivatives, and on-chain metrics. Price momentum cooled notably after last week's failed rally attempt, while Spot CVD continued to deteriorate, reflecting persistent net sell pressure. Spot volumes rebounded slightly from multi-month lows, yet remain far below bull market levels, indicating muted speculative participation. In the derivatives market, open interest continues to unwind, funding rates remain below neutral, and perpetual CVD signals dominance by short sellers — a combination suggesting cautious positioning and limited risk appetite.

Options market activity contracted sharply due to the March expiry, with open interest falling well below statistical norms. However, both volatility spread and 25 Delta Skew point to elevated hedging behavior, as traders brace for uncertainty and potential downside. Meanwhile, ETF flows turned negative again after a short-lived rebound, and trade volumes remain suppressed, reinforcing the narrative of institutional risk-off sentiment.

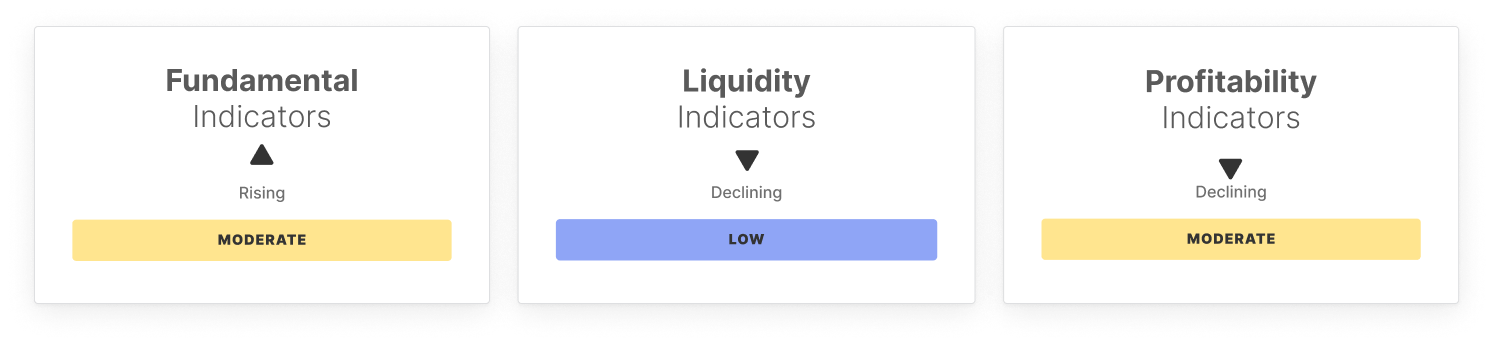

On-chain activity remains weak, with only modest upticks in active addresses and transfer volume during recent volatility. Fee revenue has retraced its short-term gains, confirming a lack of meaningful new demand. Liquidity metrics echo these conditions, with realized cap growth still sluggish and hot capital share continuing to decline. Short-term holder supply ratio remains low, emphasizing a broader shift toward holding over trading.

Profitability metrics also weakened, with Percent Supply in Profit and NUPL both trending lower. Realized Profit/Loss ratio plunged to its statistical low, underscoring a shift toward loss realization as conviction wanes. Overall, the market structure remains fragile. Amid looming macro risks such as a potential tariff war, low liquidity and rising hedging demand suggest that downside pressure remains a credible threat unless significant inflows return to the market.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe now- Follow us and reach out on Twitter

- Join our Telegram channel

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies.

Please read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZA Miner Introduces Free Cloud Mining Platform for Bitcoin and Dogecoin

ZA Miner, a UK-based cloud mining provider, has officially launched a new platform to make cryptocurrency mining more accessible to a broader audience.

OSC Warns of Surge in AI-Driven Crypto Scams as Canadian Fraud Losses Climb to $640 Million

According to the Globe and Mail report, the Ontario Securities Commission (OSC) is raising red flags over a sharp rise in cryptocurrency fraud across Canada, as scammers now weaponize artificial intelligence to swindle unsuspecting investors.

Arkansas City Planning Commission Rejects Crypto Mining Proposal Amid Strong Community Backlash

The Vilonia Planning Commission has unanimously turned down a proposed cryptocurrency mining facility within city limits, following weeks of vocal opposition from residents.

Bitcoin Climbs to $94,000 Driving Market Above $3 Trillion