Crypto Market Crash: Why Bitcoin, ETH, and XRP Price Are Down?

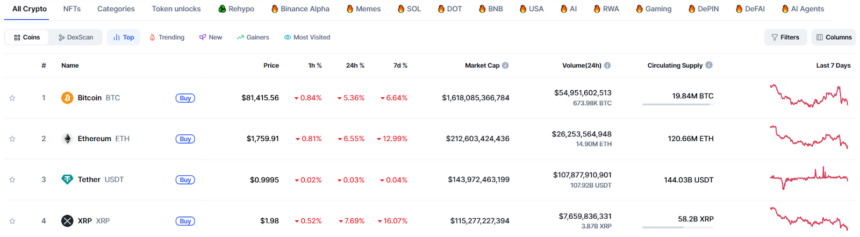

The crypto market has yet again taken a major price drop over the past 24 hours. This has resulted in the market valuation plunging 4.37% from $2.77 Trillion to $2.67 Trillion with a trading volume of $137.24 billion. Following this, the largest cryptocurrency by market cap, Bitcoin price displayed a similar action by retesting its crucial support of $82,000.

Subsequently, the altcoin market which is led by Ethereum ($ETH) and Ripple ($XRP) has also witnessed a bearish outlook over the last 24 hours. With FOMO and FUD-like situations in the crypto space arising, marketers are speculating potential reasons for the recent price action.

While a set of people assume Trump’s tariff announcement to act as a catalyst in the global market dump, others consider multiple factors such as on-chain data, technical sentiments, & politics to have acted as a domino effect for the current market situation.

Through this write-up, we will understand the possible reasons for the fall of Bitcoin, Ethereum, and XRP cryptocurrencies.

Volatility in the Crypto-verse Achieves a New High!

Over the past 45 days, the cryptocurrency market has turned extremely volatile with the Fear & Greed index dropping to 24, indicating rising Fear in the crypto space. While Bitcoin dominance maintains its position above 61%, Ethereum’s dominance has slit to 8.21% with the altcoin index crashing down to 14.

Here are some of the reasons why the crypto market crashed today:

- Trump’s Tariff Announcement: Widely speculated to be the actual reason for the recent crypto market dump. As per multiple reports by top data houses, the odds of a recession in the leading world powers have significantly increased.

- On-chain Data: Multiple on-chain data provider platforms indicate a sharp decline in active wallet addresses and new wallet creations. This highlights a reduction in the accumulation of these digital assets by new investors and traders. A decline in these indicates that marketers are waiting to liquidate their holdings at particular price levels.

Adding to this, whale activity has also turned negative as many whales and dormant wallets have now started to unload their wallets in large quantities.

- Bitcoin & Ethereum ETFs: Another major reason for the negative action is the ETF’s poor performance of both Bitcoin and Ethereum. Notably, both the ETF’s concluded the month of March on a bearish note and have resumed this month with a similar trend.

Let us now take a look at the current market trend of the 3 of the largest cryptocurrencies by market capitalization.

BTC, ETH, & Ripple Breakdown Their Crucial Support Trend Levels!

Bitcoin price today is exchanging hands below the $82k mark with an intraday drop of 5.61%. With this, the Year-to-Date (YTD) return of this coin has risen to -13.43%. Following in the footsteps of the BTC token, the Ethereum price is now trading below its crucial watch point of $1,800 with a volume of $26.23 billion.

Source: CoinMarketCap

Source: CoinMarketCap

On the other hand, the XRP price continues to display its freefall by breaking down its major $2 support trend level. Considering the present market sentiments, the crypto space may continue bleeding this week.

Conclusion:

The crypto market is on the verge of experiencing a major price action, that may push the industry toward a new all-time high (ATH) in the coming time or could pave the way for lower targets. The crypto space is highly volatile currently, making it nearly impossible to jump to accurate conclusions, as multiple factors directly or indirectly influence this market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZA Miner Introduces Free Cloud Mining Platform for Bitcoin and Dogecoin

ZA Miner, a UK-based cloud mining provider, has officially launched a new platform to make cryptocurrency mining more accessible to a broader audience.

OSC Warns of Surge in AI-Driven Crypto Scams as Canadian Fraud Losses Climb to $640 Million

According to the Globe and Mail report, the Ontario Securities Commission (OSC) is raising red flags over a sharp rise in cryptocurrency fraud across Canada, as scammers now weaponize artificial intelligence to swindle unsuspecting investors.

Arkansas City Planning Commission Rejects Crypto Mining Proposal Amid Strong Community Backlash

The Vilonia Planning Commission has unanimously turned down a proposed cryptocurrency mining facility within city limits, following weeks of vocal opposition from residents.

Bitcoin Climbs to $94,000 Driving Market Above $3 Trillion