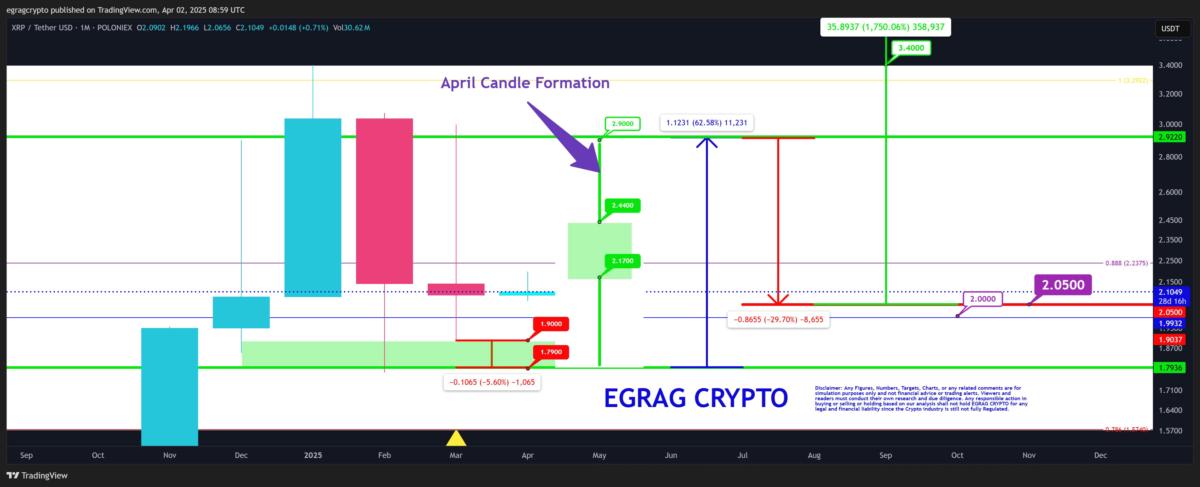

XRP price prediction for April shows 70% rally possible from $1.79 wick

- XRP price forecast suggests a 62–70% rally from $1.79.

- Upside wick could touch $2.80–$3.00 before month-end.

- XRP remains in a “boredom phase” after the SEC case closure.

XRP may be on the verge of a significant price movement in April, as highlighted by crypto analyst Egrag (@egragcrypto).

Using a technical chart built on the XRP/USDT monthly time frame, the analyst suggests that both high and low price points may be tested in quick succession.

These short-term price extremes, or “wicks,” indicate potential volatility within a defined range.

With XRP currently trading at $2.1465, the outlook hints at a wide swing between $1.79 and $3.00 before the month ends—suggesting possible gains of up to 70% from the lower boundary.

Range set between $1.79 and $3.00

Egrag’s price prediction identifies two key areas where XRP could briefly trade during April.

On the downside, the token may test support in the $1.90–$1.79 range.

However, this movement is expected to be temporary, forming what is referred to as a wick, where price dips to a level but quickly reverses.

Source: TradingView

On the upper end, the chart indicates that XRP might spike to the $2.80–$3.00 range.

Similar to the downside action, this move would also likely form a wick.

The analyst emphasises that both the downward and upward moves are expected to be brief, with no prolonged trading activity in those zones.

The prediction does not suggest a sustained breakout yet, but highlights price notations at $2.00, $2.05, $2.17, and $2.44.

These levels imply that XRP could hover around the $2.00 mark for most of the month, building a base for future price action.

70% upside from wick low possible

Egrag’s most striking insight is the possibility of a 62–70% upside rally from the projected downside wick low of $1.79.

This potential price movement would position XRP close to the $3.00 level, assuming key technical thresholds are breached.

The price swing may develop quickly, depending on market momentum and sentiment, but the analyst does not expect a prolonged stay in the upper range during April.

If XRP revisits the $2.00 zone—a region it has recently oscillated around—it may act as a final consolidation point before a stronger move.

While the chart does not predict an exact date for a breakout, the sequence of wicks followed by a base around $2.00 sets up the possibility for a surge.

XRP is stuck in the boredom phase

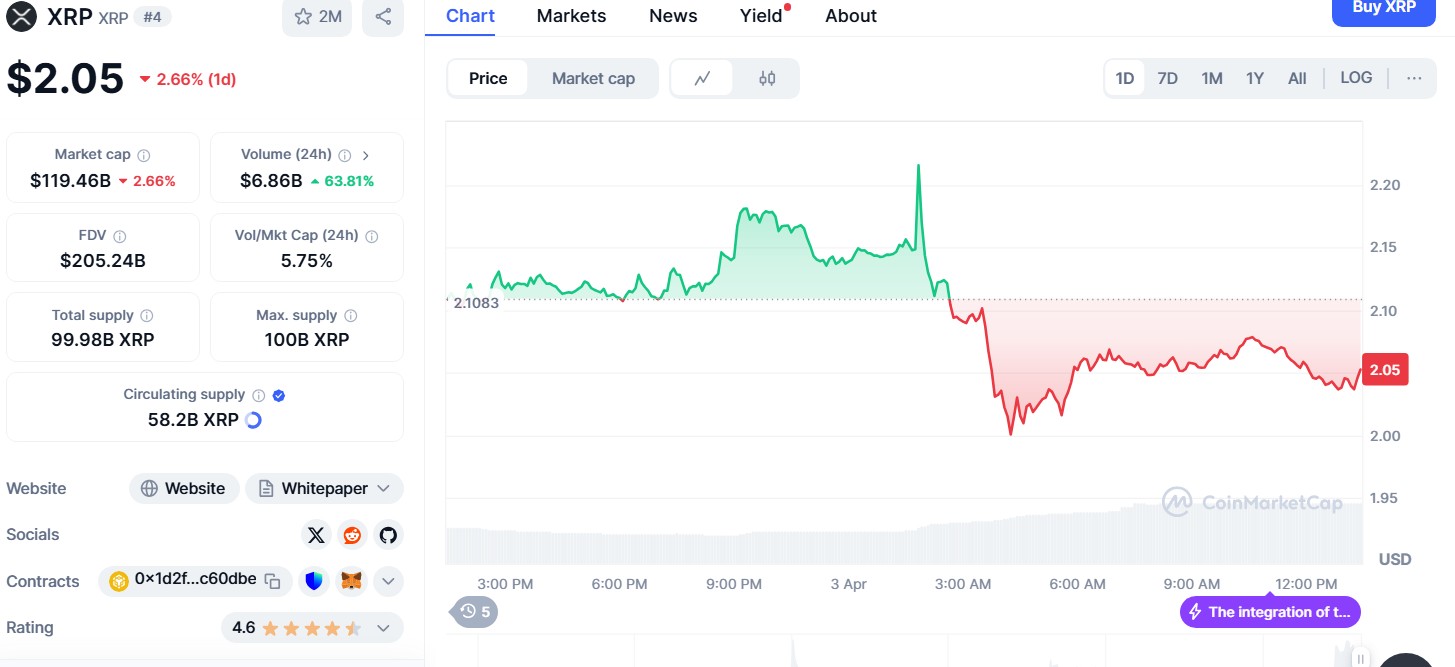

The forecast comes at a time when XRP is largely trading sideways.

Egrag refers to this period as a “boredom phase”, caused by reduced interest and mental fatigue among market participants.

This phase follows the resolution of Ripple’s legal battle with the US Securities and Exchange Commission, which many expected would immediately boost XRP’s value.

Instead, the market has remained cautious. Traders who anticipated a swift post-case rally were left disappointed as XRP failed to break out convincingly.

Current price action suggests that this sideways trend may persist in the short term, making April a potentially critical month for traders seeking directional clues.

Chart signals price shift soon

The latest chart analysis does not call for action but presents technical scenarios that could unfold depending on market conditions.

With XRP hovering around $2.05, its movement toward either end of the projected wick range could serve as a signal for more significant price activity later in the cycle.

Source: CoinMarketCap

The analysis does not include macroeconomic triggers or fundamental changes to Ripple’s utility or adoption, but focuses solely on chart patterns.

It also avoids speculation on long-term targets beyond April.

The technical framework outlined by Egrag continues a theme from his earlier predictions, which have consistently pointed to the importance of patience and mental resilience during periods of low volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZA Miner Introduces Free Cloud Mining Platform for Bitcoin and Dogecoin

ZA Miner, a UK-based cloud mining provider, has officially launched a new platform to make cryptocurrency mining more accessible to a broader audience.

OSC Warns of Surge in AI-Driven Crypto Scams as Canadian Fraud Losses Climb to $640 Million

According to the Globe and Mail report, the Ontario Securities Commission (OSC) is raising red flags over a sharp rise in cryptocurrency fraud across Canada, as scammers now weaponize artificial intelligence to swindle unsuspecting investors.

Arkansas City Planning Commission Rejects Crypto Mining Proposal Amid Strong Community Backlash

The Vilonia Planning Commission has unanimously turned down a proposed cryptocurrency mining facility within city limits, following weeks of vocal opposition from residents.

Bitcoin Climbs to $94,000 Driving Market Above $3 Trillion