Market Drop After Trump's Tariff Announcement

On April 2, 2025, Donald Trump spoke from the Rose Garden of the White House to announce a series of unprecedented protectionist measures, as part of what he now calls the “Economic Liberation Day”. Staying true to his America First creed, the American president detailed a decree imposing massive tariffs aimed at re-industrializing the country and reducing its dependence on foreign imports. Unfortunately, the markets were not expecting what would follow…

Donald Trump announces a new wave of tariffs

In a nearly 45-minute speech on Wednesday, April 2 in the United States, Donald Trump announced a series of new tariffs as part of his “Liberation Day”. Here are the main points!

Base rate of 10% on all trading partners

All countries will be subject to a floor tariff of 10%. This rate may increase depending on the trade practices of each nation.

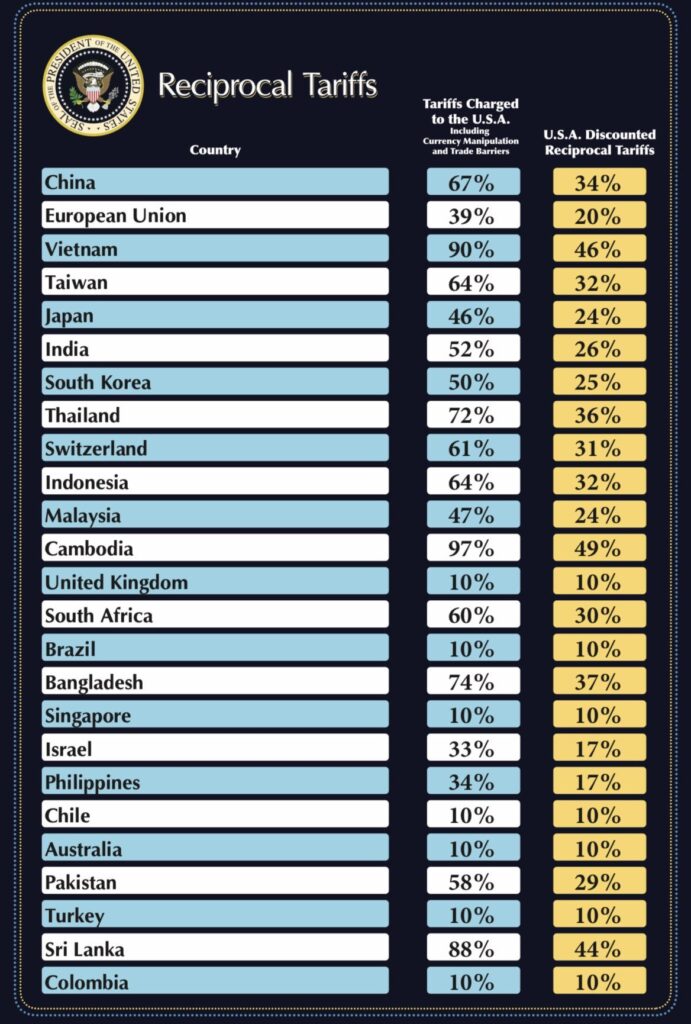

Specific tariffs by country:

- 20% on products imported from the European Union

- 34% on imports from China

- 46% on Vietnam

- 24% on Japan

Trump justifies these disparities by the accumulation of tariffs, non-monetary barriers, and other “forms of cheating” used by these countries.

Tariffs imposed by Donald Trump.

Tariffs imposed by Donald Trump.

Principle of partial reciprocity

“What they impose on us, we will impose on them half of it,” Donald Trump stated, acknowledging that reciprocity will not be total to avoid excessive tensions with certain partners.

25% tariff on foreign automotive imports

Starting this Thursday, April 3 at midnight, any imported car will be taxed at 25%. A measure aimed at forcing automakers to relocate their production.

Tacit ban on industrial relocation

The American president emphasized that “no company will be allowed to set up in other countries,” clearly targeting major American firms that have moved their production.

Donald Trump described this policy as “the declaration of economic independence of America,” stating that it would inaugurate a new golden age, marked by the return of factories, jobs, and lower prices for consumers. What will be the reaction of the stock markets?

Immediate reaction of the markets!

The stock markets reacted immediately to Donald Trump’s statements, with a significant drop in shares. The technology (XLK) and discretionary consumption (XLY) sectors were the hardest hit, recording a decline of about 3% in after-hours trading. Major stocks like Nvidia (NVDA) , Amazon (AMZN), and Tesla (TSLA) fell by more than 4%.

Trump’s announcement regarding the new tariffs marks a turning point in his protectionist policy, aimed at re-industrializing America. However, this offensive from Liberation Day has quickly shaken the markets, triggering significant declines in key sectors. The long-term impact on the global economy remains uncertain and could trigger a wave of panic .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZA Miner Introduces Free Cloud Mining Platform for Bitcoin and Dogecoin

ZA Miner, a UK-based cloud mining provider, has officially launched a new platform to make cryptocurrency mining more accessible to a broader audience.

OSC Warns of Surge in AI-Driven Crypto Scams as Canadian Fraud Losses Climb to $640 Million

According to the Globe and Mail report, the Ontario Securities Commission (OSC) is raising red flags over a sharp rise in cryptocurrency fraud across Canada, as scammers now weaponize artificial intelligence to swindle unsuspecting investors.

Arkansas City Planning Commission Rejects Crypto Mining Proposal Amid Strong Community Backlash

The Vilonia Planning Commission has unanimously turned down a proposed cryptocurrency mining facility within city limits, following weeks of vocal opposition from residents.

Bitcoin Climbs to $94,000 Driving Market Above $3 Trillion