Ethereum Crushes Solana And Regains The Top Spot In DEX Trading

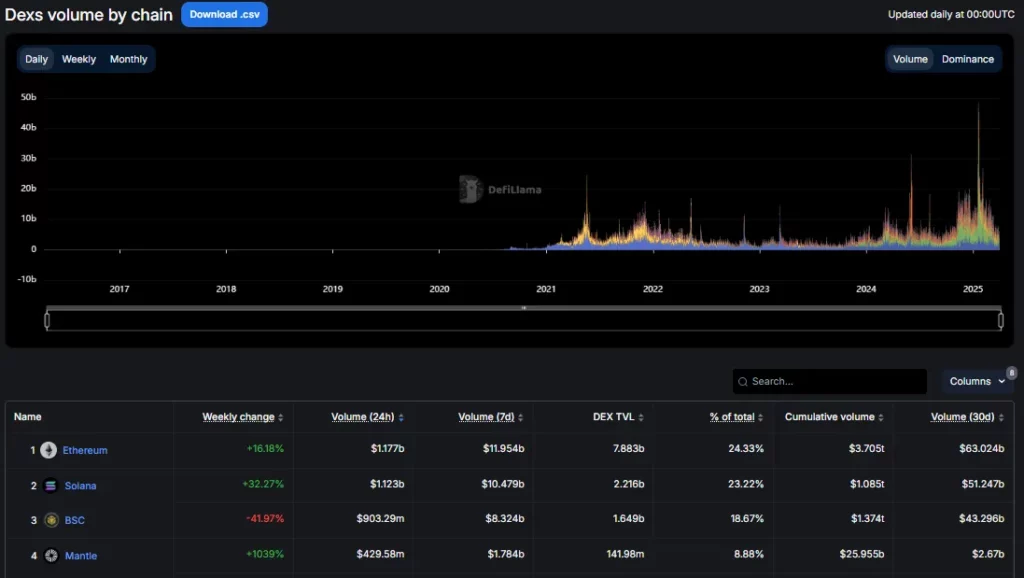

March 2025 marks an important turning point in the DeFi ecosystem: Ethereum regains the top spot in the blockchain ranking in terms of trading volume on DEXs, surpassing Solana for the first time since September 2024. A turnaround that occurs in a pressured market, with a notable decline in activity on Solana, particularly on its flagship platforms.

Ethereum regains the first place in DEX volume

In March 2025, Ethereum recorded a DEX trading volume of $63 billion, surpassing Solana, which only reached $51 billion. Just a few months ago, it was Solana that was leading the dance thanks to its speed and low fees. This turnaround is due to the continuous performance of major decentralized platforms like Uniswap and Curve Finance, which have solidified Ethereum in the lead.

Ethereum surpasses Solana in DEX volume

Ethereum surpasses Solana in DEX volume

This performance is also favored by Layer 2 solutions, which lighten the load on the main chain while ensuring better scalability. These innovations allow Ethereum to remain competitive against blockchains like Solana, which, despite its low latency and minimal fees, has not been able to contain the erosion of its activity on DEXs.

The Drop of Solana

The trading activity on Solana’s DEXs, particularly Raydium and Pump.fun, has experienced a significant drop. The trading volume of Pump.fun fell from $7.75 billion in January to $2.53 billion in March, a decline of 67%. This decline is particularly related to the decrease in the graduation rate of tokens, a key indicator showing that fewer new tokens reach sufficiently high capitalization levels to migrate to Solana’s major platforms.

Drop in trading volume on Pump.fun

Drop in trading volume on Pump.fun

Solana, which was once established as the preferred blockchain for memecoins, has seen the appeal for this sector wane, exacerbated by an overall bearish market sentiment, thus contributing to its decline. Consequently, it will face significant challenges to reactivate its trading volumes. Its future success will depend on its ability to reinvent itself and attract new investors and users into its network.

The emergence and consolidation of Ethereum as the leader of DEXs is not only due to a temporary turnaround. While Solana struggles to maintain its momentum, Ethereum seems therefore solidly anchored in the DeFi ecosystem, thanks to its ability to evolve and adapt to market needs. However, will this performance be enough to pull Ethereum out of the major economic crisis it is currently facing?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZA Miner Introduces Free Cloud Mining Platform for Bitcoin and Dogecoin

ZA Miner, a UK-based cloud mining provider, has officially launched a new platform to make cryptocurrency mining more accessible to a broader audience.

OSC Warns of Surge in AI-Driven Crypto Scams as Canadian Fraud Losses Climb to $640 Million

According to the Globe and Mail report, the Ontario Securities Commission (OSC) is raising red flags over a sharp rise in cryptocurrency fraud across Canada, as scammers now weaponize artificial intelligence to swindle unsuspecting investors.

Arkansas City Planning Commission Rejects Crypto Mining Proposal Amid Strong Community Backlash

The Vilonia Planning Commission has unanimously turned down a proposed cryptocurrency mining facility within city limits, following weeks of vocal opposition from residents.

Bitcoin Climbs to $94,000 Driving Market Above $3 Trillion