Survey Claims 71% of TradFi ETF Investors Want Crypto Exposure

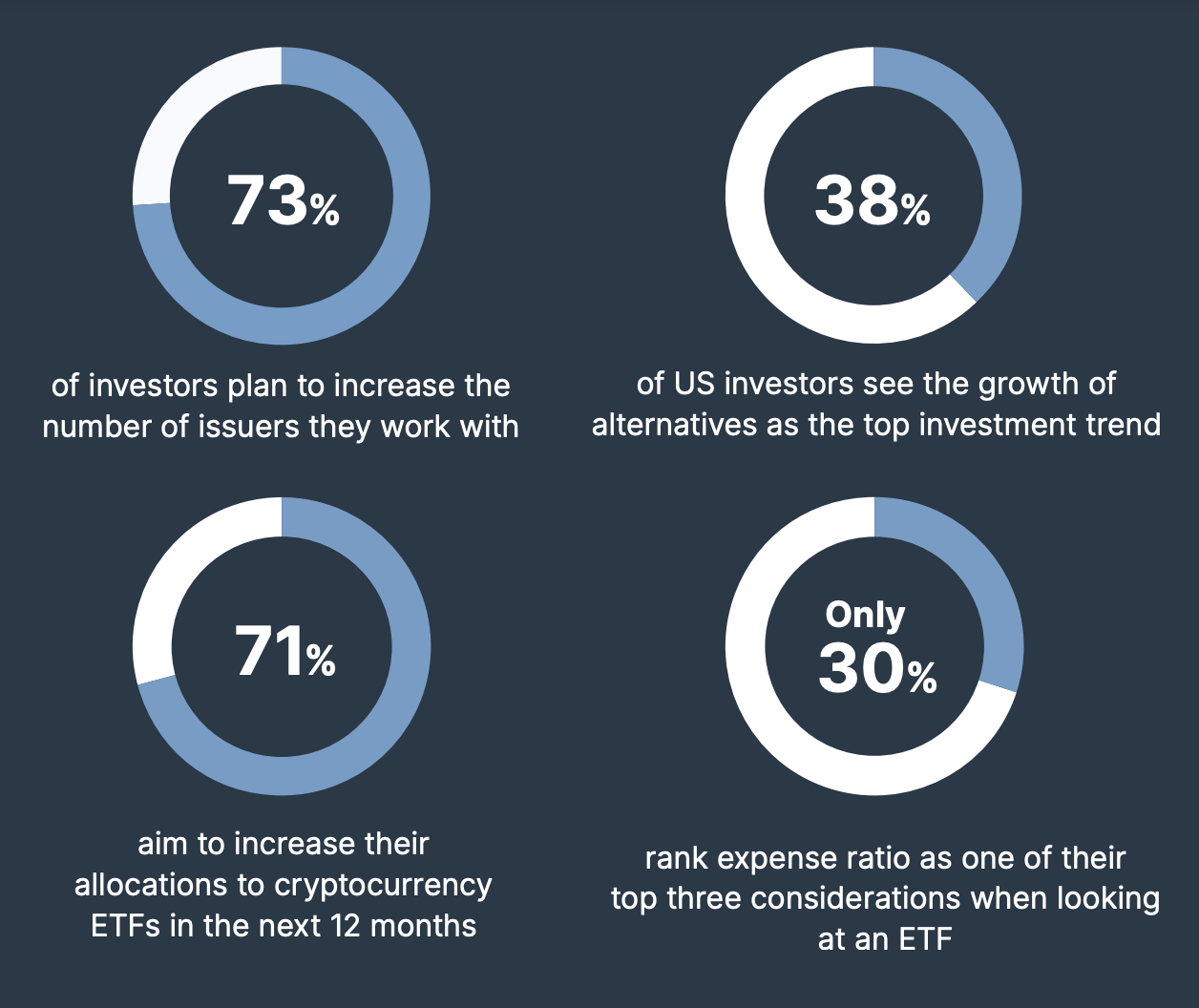

According to a recent survey by Brown Brothers Harriman, 71% of ETF investors wish to invest more in crypto this year. This bullish signal comes as the crypto ETF market is beginning to recover from recent volatility.

The firm is one of the oldest and most prestigious investment banks in the US, adding credibility to its claims. This data also aligns with other surveys that suggest wealthy investors are interested in Bitcoin.

Crypto ETFs Are Becoming Popular Among TradFi Investors

Since the Bitcoin ETFs were first approved in 2024, they’ve ushered in a profound transformation of the crypto market. BlackRock’s IBIT was so popular that some experts declared it the greatest ETF launch ever.

According to a new survey from Brown Brothers Harriman, 71% of ETF investors are planning to further their allocations into crypto.

“Good news for the crypto crowd, 71% [of surveyed investors] said they aim to increase their allocation to crypto ETFs in the next 12 months.. That’s higher than I would have thought, I’d have guessed 40-50% and i’m pretty bullish on this space, relatively speaking,” claimed Eric Balchunas, a prominent ETF analyst.

This survey comes at a fortuitous time for the ETF space and crypto markets in general. Bearish fears have been dominating the space, and US spot Bitcoin ETFs recently took a serious beating.

However, the market is already starting to recover, and issuers have resumed large BTC purchases. This survey shows that more investors are willing to pour liquidity into the crypto market through ETFs.

Brown Brothers Harriman is one of the oldest and most prestigious investment banks in the US, and its survey is a credible indicator of ETF sentiment. Additionally, other recent surveys have drawn similar conclusions.

For example, earlier this month, a poll of wealthy US investors showed high interest in Bitcoin and other major altcoins.

Meanwhile, Bitcoin ETFs have largely recovered this week after seeing net outflow for five consecutive weeks. At the same time, more asset managers are filing diverse ETF applications with the SEC. Given the current positive sentiment among institutional investors, the long-term outlook is likely to be bullish for such funds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Stablecoin Regulation Still Lacks Unity

Despite stablecoins surpassing $200B, US regulation remains fragmented across agencies.A $200B Market, Still No Unified OversightMultiple Agencies, Mixed SignalsWhy It Matters for Crypto and Finance

Bitcoin Bullish Cross Signals Reversal: Is the Rally Starting?

Bitcoin forms a bullish cross, hinting at a potential market reversal. Analysts predict a new rally. Learn what this means for BTC.Bitcoin Bullish Cross: What Does It Mean?Why Is This Significant?What’s Next for Bitcoin?

40% US recession risk could sink Bitcoin below $80K

Terraform Labs to Launch Claims Portal for Creditor Reimbursements

Terraform Labs has announced that its Crypto Loss Claims Portal will open on March 31, 2025, allowing creditors to file claims for losses related to the collapse of TerraUSD (UST) and its aftermath.