Economist warns of a recession: Will Bitcoin and altcoins crash or rise?

Bitcoin and most altcoins have bounced back slightly this week, with total crypto market capitalization approaching the $3 trillion mark.

Bitcoin (BTC) remained stuck above $86,000, while meme coins like Pepe (PEPE), Shiba Inu (SHIB), and Floki (FLOKI) soared by double digits this week.

Mark Zandi, one of the top economists in the U.S. and Chief Economist at Moody’s, has warned that the country may be heading toward a recession.

In a post on X, Zandi said that his top recession indicator was “flashing bright yellow,” signaling a potential downturn in 2025. He pointed to a sharp drop in consumer confidence—down 17 points over the past three months.

His number one recession indicator happens when confidence drops 20 points over three months. He argues that consumers stop spending when this happens, leading to a recession. A technical recession happens when the US economy contracts for two consecutive quarters.

FYI, consumer confidence as measured by the Conference Board is down 17 points over the past 3 months. Remember my #1 recession watch indicator is that if confidence falls by 20 points over 3 months, consumers stop spending and recession ensues about 6 months later. This…

— Mark Zandi (@Markzandi) March 25, 2025

Bitcoin and altcoins would do well in a recession

A recession is a bad period for any economy as the unemployment rate rises and businesses close.

However, history shows that risky assets do well during a major downturn. For example, US stocks embarked on a decade-long bull run after the Global Financial Crisis in 2008.

Most recently, after initially falling, stocks and cryptocurrencies embarked on a strong bull run. Bitcoin surged from $4,000 in March 2020 to $69,000 in November 2021. Similarly, Ethereum jumped from a low of $80 to $4,940 in the same period.

This rebound was driven by the Federal Reserve, which has a long history of intervening during downturns through rate cuts and quantitative easing.

Risk assets tend to perform well when the Fed lowers interest rates, as cheaper capital encourages risk-on sentiment across markets. If a recession occurs, as Zandi warns, Bitcoin and other altcoins may benefit from such a macro backdrop.

At the same time, Bitcoin and other altcoins may do well if the US avoids a recession. That’s because this recession would be self-inflicted by Donald Trump’s tariffs. As such, his ending or scaling down his tariffs would also push investors back to risky assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

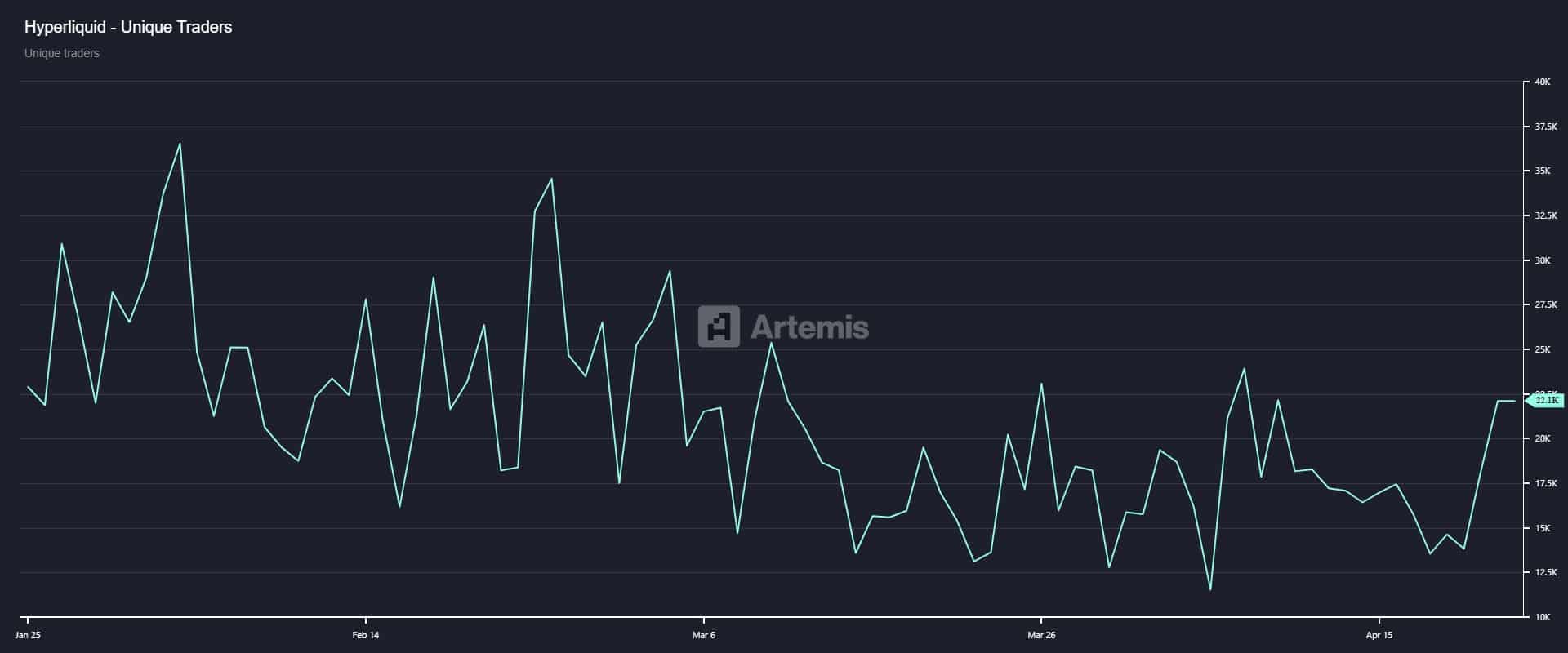

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.