Has Crypto Investing Peaked? Data Reflects the Reality of the Primary Market

How many founders and investors are willing to hodl until the end?

Original Article Title: The State of Web3 Funding - Q1 2025

Original Article Author: Decentralised

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: Over the past few years, early-stage Web3 funding has expanded, but funds have been concentrated in a few companies, leading to increased funding difficulty. After the FTX collapse, LP funds gathered in a few flagship funds, making it harder for startups to raise funds. Token liquidity has decreased, the investment return cycle has lengthened, and the market is more focused on profitability and PMF. Venture capital will not disappear, Web3 infrastructure has matured, and AI development has brought new opportunities. In the future, capital will favor founders with long-term competitiveness rather than short-term token gains. The key question is which founders and investors can persevere to the end and find the ultimate answer to industry evolution.

The following is the original content (slightly reorganized for better readability):

Web3 Funding Status in Q1 2025

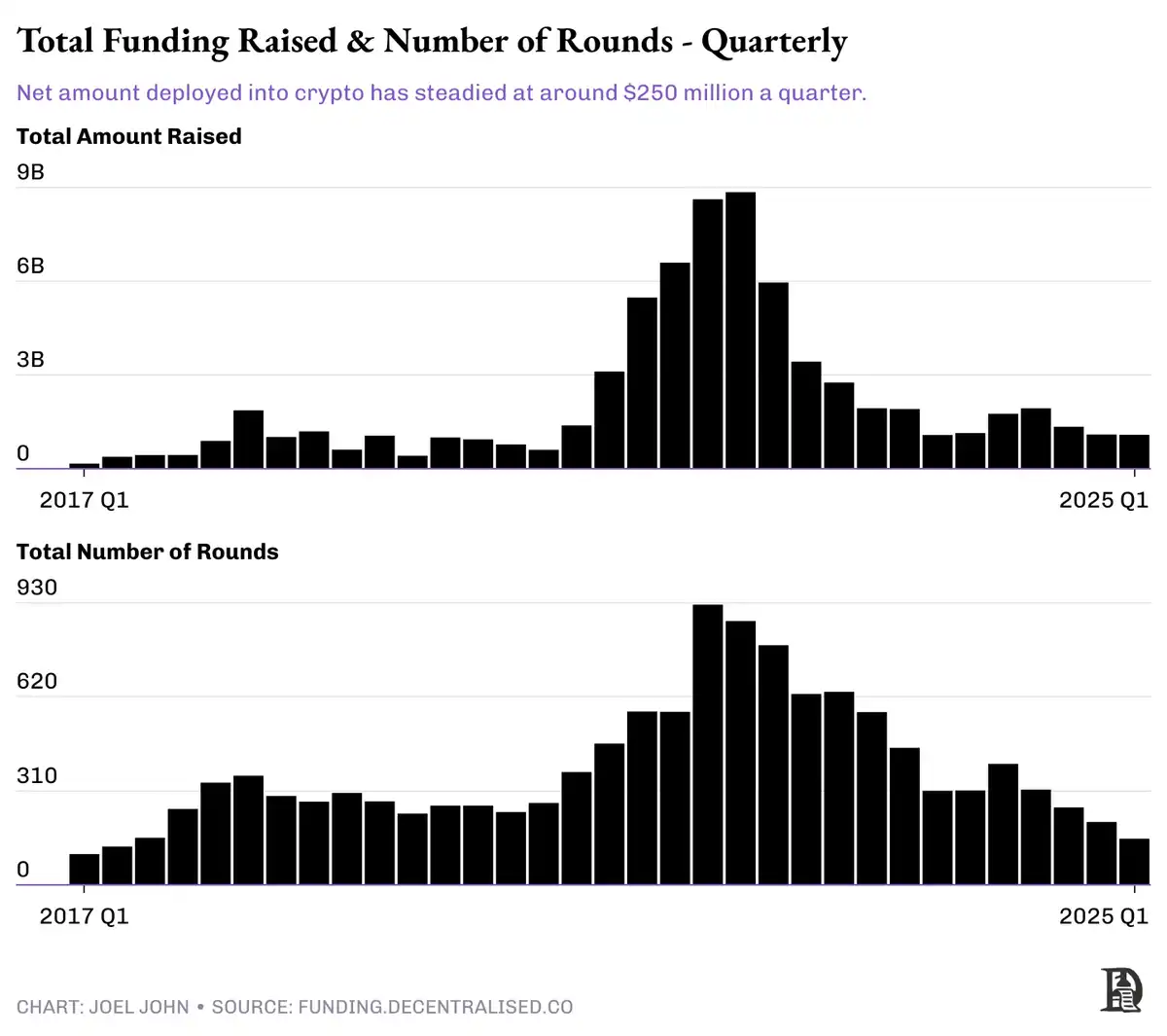

A rational market participant might think that capital would fluctuate, much like many things in nature, with cyclicality. However, venture capital in the crypto space is more like a one-way waterfall—a continuous experiment on gravity.

We may be witnessing the final stage of a frenzy that began in 2017 with the smart contract and ICO boom, accelerated in the era of the pandemic and low-interest rates, and is now returning to a more stable level.

At the peak in 2022, crypto venture funding reached $230 billion. By 2024, this number plummeted to $60 billion. The main reasons for this decline are threefold:

1. The 2022 frenzy led to excessive capital inflow—venture capital poured into many products in a seasonally overheated market at very high valuations, such as DeFi and NFTs, but ultimately failed to deliver the expected returns. OpenSea was once valued as high as $13 billion, becoming the peak of the market bubble.

2. Fundraising difficulties and vanishing valuation premiums—In 2023/2024, many funds faced obstacles in raising funds. Projects that successfully listed on exchanges also struggled to replicate the high valuation premiums of 2017-2022. Due to the lack of valuation uplift, funds found it hard to raise new capital, especially when many investors' returns were underperforming compared to Bitcoin.

3. AI Replaces Crypto as the "Next Big Thing" — Major capital is shifting its focus to AI, leaving behind the crypto industry's once speculative frenzy and premium as the "most promising cutting-edge technology."

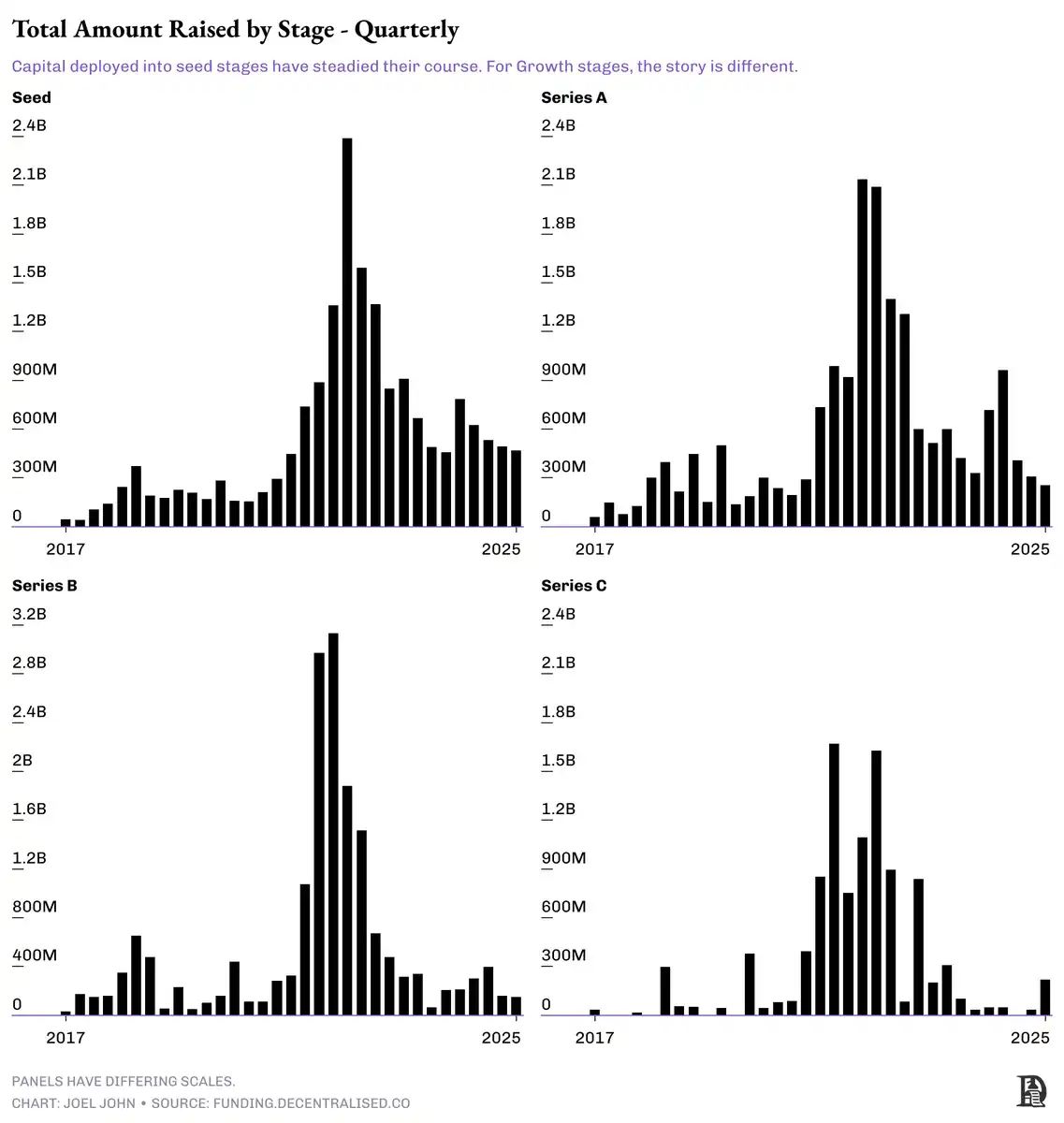

However, the deeper issue lies in the fact that very few startups are able to grow to Series C or D. Some might argue that the crypto industry's primary exit strategy is token listing on exchanges, but when most tokens list and immediately plummet in value, investor exit becomes challenging. This is particularly evident when comparing data across funding rounds.

Since 2017, out of 7650 companies that received seed funding, only 1317 successfully moved to Series A, a graduation rate of 17%. Of those, 344 made it to Series B, with only about 1% (±1%) advancing to Series C. The probability of reaching Series D is only 1/200, on par with statistics from other industries as per @Crunchbase. However, the crypto industry has a unique situation: many growth-stage companies bypass traditional funding routes through tokenization. Yet, this reflects two core issues:

· Without a healthy token liquidity market, crypto venture capital will stagnate. This gap will be filled by liquidity market participants like @SplitCapital and @DeFianceCapital.

· If an insufficient number of companies grow to later stages and successfully go public, investor risk appetite will decrease.

Looking at data from various funding stages, the market is signaling the same message: while capital inflows at the seed and Series A stages remain relatively stable, active investments in Series B and C have significantly decreased. Does this mean the opportune time for seed funding is here? Not necessarily. The key still lies in the details.

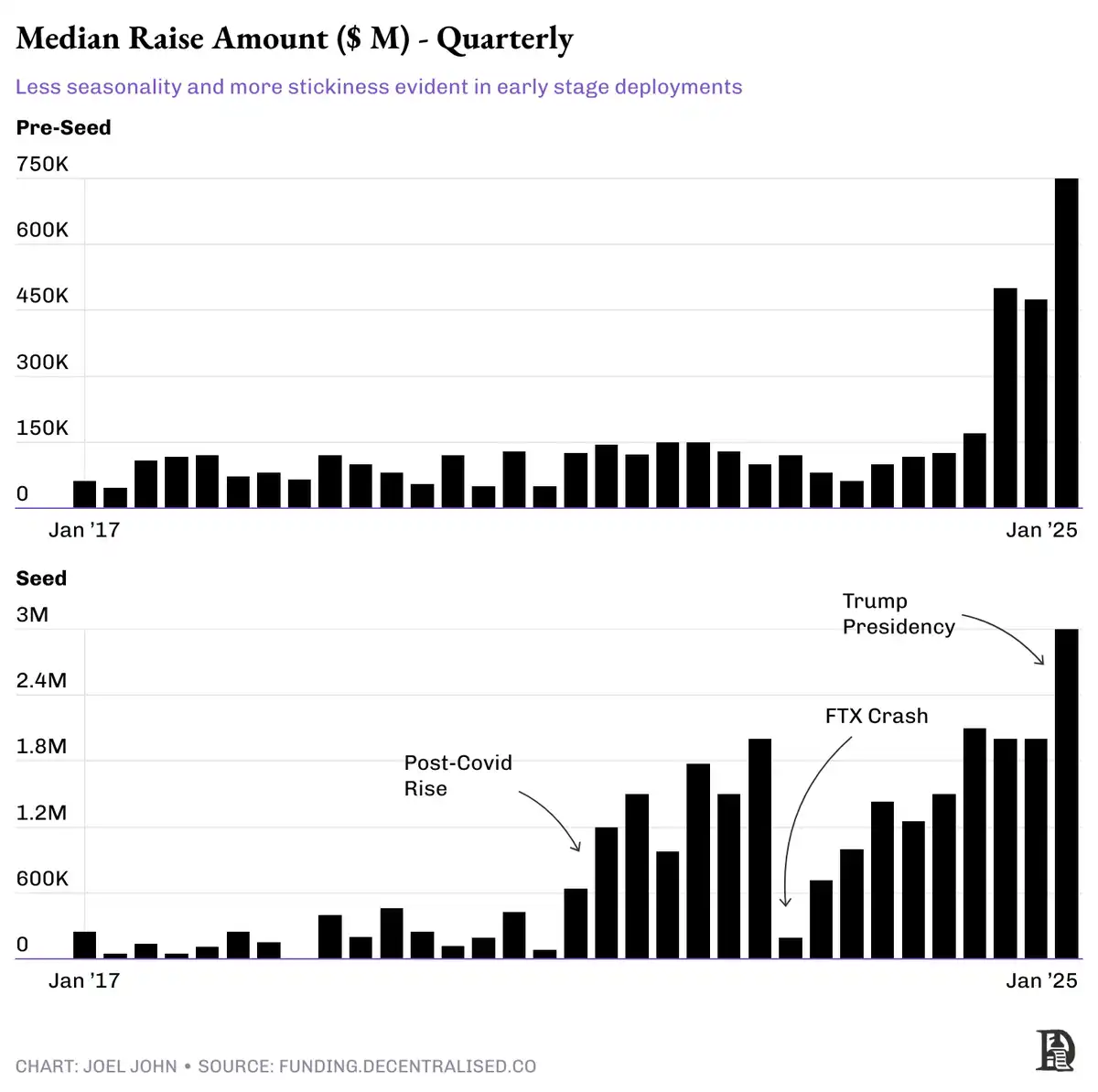

The data below shows the median amount of funding for pre-seed and seed rounds each quarter. Overall, the trend is steadily rising. There are two notable points:

· Since early 2024, pre-seed round funding has seen a significant increase.

· The nature of seed round funding has shifted in recent years.

We observe that while the willingness of early-stage capital to invest has declined, the scale of funding for pre-seed and seed rounds for startups has actually increased. The previous "friends and family round" is now being filled by early-stage funds, a trend that also impacts seed funding. Since 2022, seed round funding has expanded to cope with the rising cost of labor and the longer time required for the crypto industry to achieve product-market fit (PMF). However, the decrease in product development costs has somewhat offset this trend.

The increase in funding amount implies a higher valuation (or equity dilution) for the company at an early stage, which also means that future higher valuation growth is needed to provide returns to investors. Additionally, in the months following Trump's election, there was a significant increase in funding size. This could be related to the change in the fundraising environment for General Partners (GPs) after Trump took office—the increased interest of Fund of Funds (FoF) and traditional allocators has put the early-stage market into a "risk appetite" mode.

What does this mean for founders? Currently, the funding amount for Web3 early-stage financing is higher than ever before, but the funds are concentrated on fewer founders, the funding size is larger, and at the same time, companies are required to grow at a faster rate than in previous cycles.

As traditional liquidity channels (such as token issuance) are drying up, founders need to put in more effort to demonstrate their credibility and the potential their business can bring. The era of "50% discount, new round of high valuation funding within two weeks" is over. Funds can no longer profit from "inflating valuations," and founders can no longer easily raise funds, and the ownership tokens held by employees no longer enjoy the dividend of rapid appreciation.

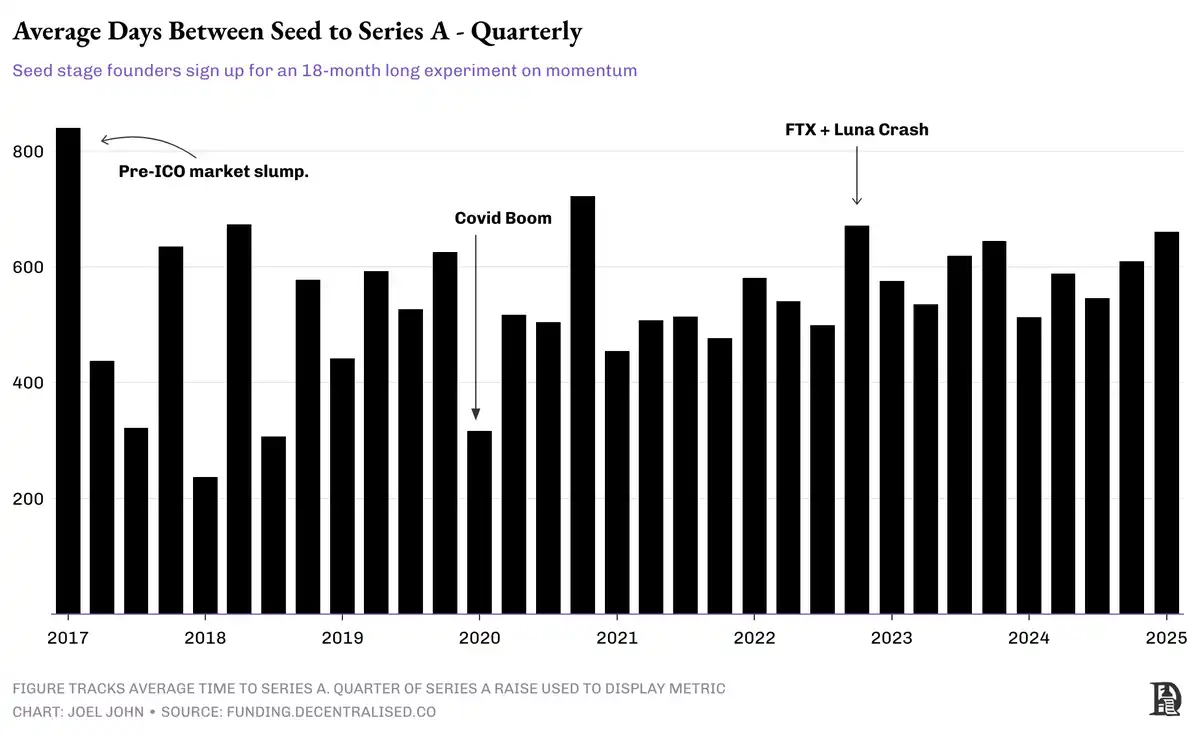

One perspective to validate this trend is the speed of capital flow. The chart below shows the average time startups experience from seed round to Series A. The lower the value, the faster the capital flow, meaning investors are willing to inject more capital into the company at a higher valuation before the enterprise matures to support new seed round companies.

Another key factor is how the liquidity in the public markets affects the private markets. Investors often increase their investments in the private market when there is a pullback in the public market. For example, during Q1 of 2018, there was a sharp market decline, and Series A funding significantly decreased. The same situation occurred again in Q1 2020—during the market crash triggered by the COVID-19 pandemic. For investors with funds in hand, the attractiveness of investing in the private markets increases when opportunities in the public market decrease.

In Q4 of 2022, after the FTX collapse, the market's risk appetite decreased significantly. Unlike previous market downturns where private market funding increased, this collapse directly destroyed the attractiveness of the crypto industry as an asset class. Prior to this, several large funds had already invested substantial amounts in FTX's $32 billion valuation funding, but ultimately, all was lost. As a result, investor interest in the entire industry plummeted.

After the FTX collapse, funds began to concentrate in a few leading companies, which became "kingmakers" and dominated the market's capital flow. Most LP (Limited Partner) funds flowed into these top funds, which were more inclined to deploy funds in later-stage projects to absorb more capital. In other words, the financing environment for startups became more challenging.

The Future of Crypto Venture Capital?

Over the past six years, I have been observing this data, and the conclusion drawn each time has been the same — startup financing will become increasingly difficult. At 24, perhaps I did not realize that this is the evolution pattern of the industry. A market frenzy period attracts a large number of talents and funds, but as the industry matures, the difficulty of financing inevitably rises. In 2018, projects could raise funds as long as they were "on the blockchain"; by 2025, investors are more focused on profitability and Product-Market Fit (PMF).

As token liquidity decreases, venture capitalists have to reassess liquidity and capital deployment strategies. In the past, investors expected to receive returns through tokens within 18-24 months, but now this period has been extended. Employees also need to put in more effort to earn the same amount of tokens, which often have a lower trading valuation. This does not mean that the industry lacks profitable companies, but as in the traditional economy, ultimately only a few companies can capture most of the economic value.

Will venture capital die out? From a jokingly pessimistic perspective, maybe. But the reality is that Web3 still needs venture capital.

· The infrastructure layer has matured to support large-scale consumer-grade applications.

· Founders have experienced multiple market cycles and have a deeper understanding of how the industry operates.

· The Internet's coverage is expanding, and global bandwidth costs are decreasing.

· The development of AI is expanding the possibilities of Web3 applications.

These factors together form an unprecedented period of opportunity. If the venture capital industry wants to "make venture capital great again," they need to focus on the founders themselves rather than how much tokens they can issue. Today, capital allocators are more willing to spend time supporting founders with the potential to dominate the market. This change is the growth process of Web3 investors from "When will the token be issued?" in 2018 to "Where is the market's limit?" in 2025.

Original Article Link: Link to Original

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Donald Trump to Meet Bukele at White House: Bitcoin on Mind?

Two Whale Vaults at Risk of Liquidation as ETH Price Declines

Here’s How High Dogecoin Can Reach If BTC Market Cap Hits $500T As Predicted By Michael Saylor

Wasabi Adds Berachain Vaults With Up To 300% Yields