Hashrate Approaches Record High as Bitcoin Price Drives Mining Gains

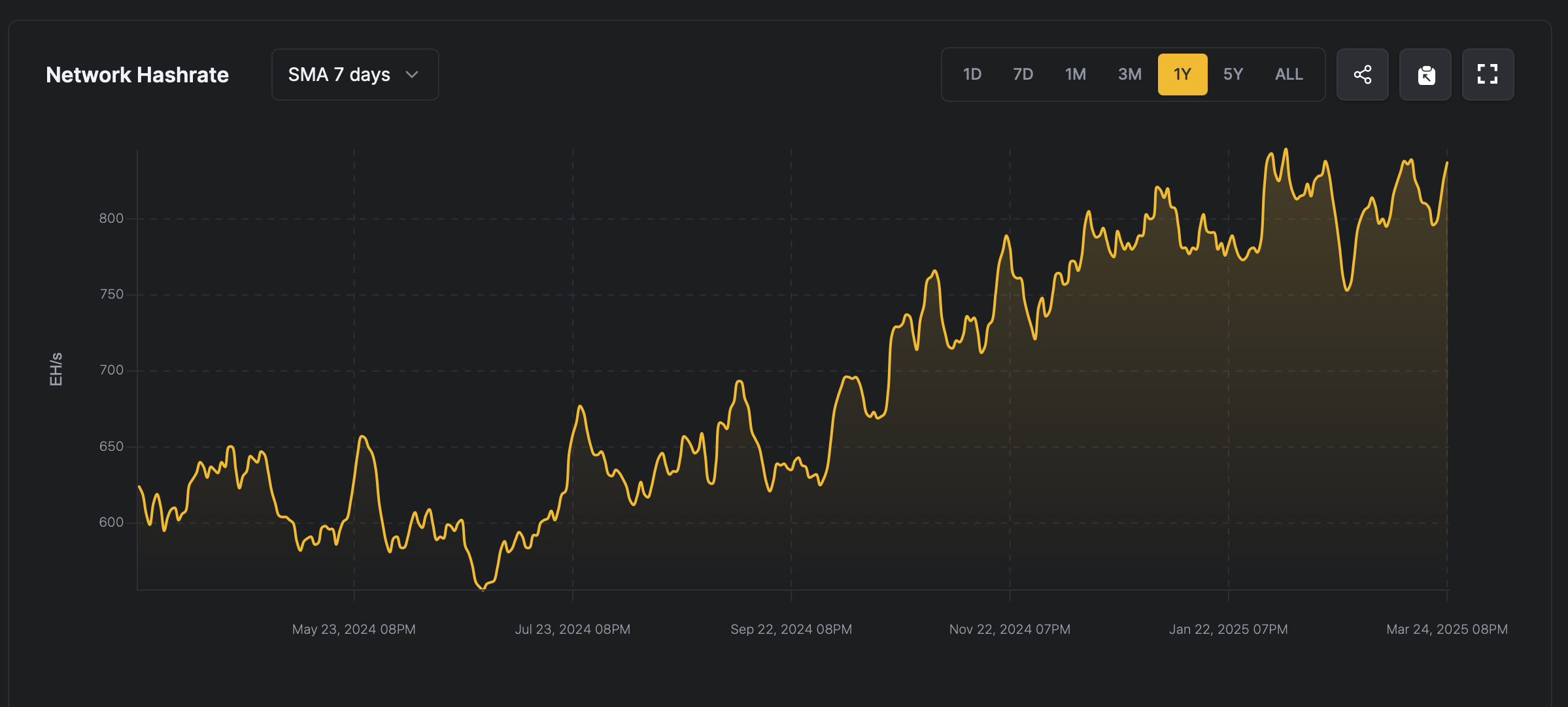

Bitcoin’s hashrate has been climbing steadily, with the network adding 40 exahash per second (EH/s) over the past five days, reaching 836 EH/s—edging close to the protocol’s historical peak. In addition, as bitcoin’s price has moved upward, the hashprice—representing the estimated daily earnings from one petahash per second (PH/s) of computing power—has also seen an increase.

Bitcoin Miners Navigate Tight Margins as Hashrate Nears Peak

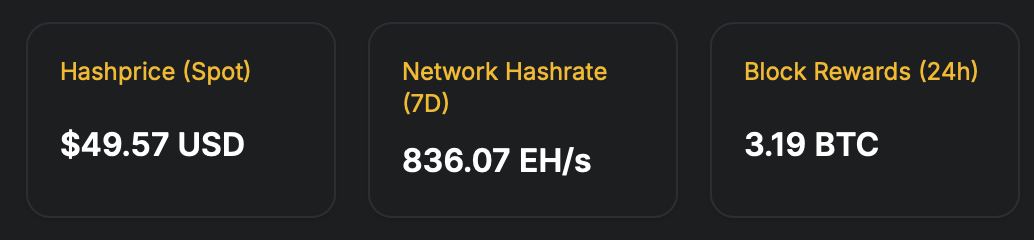

On Tuesday, March 25, 2025, bitcoin miners saw improved earnings compared to the previous week. On March 18, the estimated value of one petahash per day stood at $46.21; today, it has risen to $49.57, according to statistics collected by hashrateindex.com.

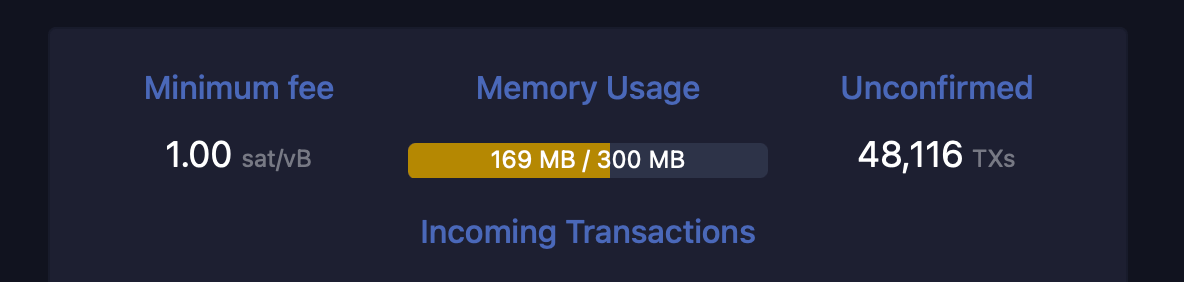

This uptick has provided a modest relief for miners, who had been experiencing tighter margins during the initial three weeks of March. Data from mempool.space indicates a pickup in network activity, with 48,116 unconfirmed transactions sitting in the mempool as of 6:30 p.m. Eastern Time on Tuesday.

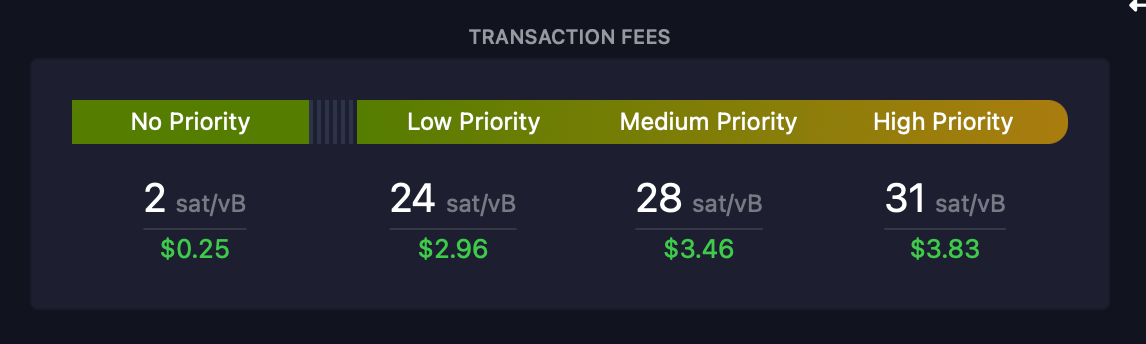

Transaction fees have inched up as well. At the current rate of 31 satoshis per virtual byte (sat/vB), a high-priority transfer now carries a cost of $3.83. The recent climb in BTC’s price is the primary driver behind the revenue boost, as transaction fees have only accounted for 2.14% of total earnings over the past 24 hours.

The latest price movement has also pushed the hashrate higher, with the network gaining 40 EH/s—rising from 796 EH/s on March 20 to 836 EH/s today. This upward trend coincides with a 1.43% difficulty adjustment that took place two days ago at block height 889,056.

Currently, mining difficulty is set at 113.76 trillion, slightly below the all-time high of 114.17 trillion recorded six weeks earlier at block height 883,008. The current shift in network dynamics suggests a recalibration period for miners, balancing operational costs against earnings as difficulty and price fluctuate.

With transaction fees still playing a minor role in revenue, miner profitability appears increasingly tethered to BTC’s market value. As the protocol inches toward historical thresholds, participants may need to adapt strategies to navigate tightening margins and evolving network conditions.

On the other hand, advances in application-specific integrated circuit (ASIC) hardware may also be contributing to the increase in computational output. Empirical analysis reveals that fluctuations in bitcoin’s fiat valuation precipitate corresponding adaptations in network hashrate, manifesting after a temporal delay spanning one to six weeks—a rhythm dictated by miners calibrating operations to align with evolving profit incentives.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Stablecoin Regulation Still Lacks Unity

Despite stablecoins surpassing $200B, US regulation remains fragmented across agencies.A $200B Market, Still No Unified OversightMultiple Agencies, Mixed SignalsWhy It Matters for Crypto and Finance

Bitcoin Bullish Cross Signals Reversal: Is the Rally Starting?

Bitcoin forms a bullish cross, hinting at a potential market reversal. Analysts predict a new rally. Learn what this means for BTC.Bitcoin Bullish Cross: What Does It Mean?Why Is This Significant?What’s Next for Bitcoin?

40% US recession risk could sink Bitcoin below $80K

Terraform Labs to Launch Claims Portal for Creditor Reimbursements

Terraform Labs has announced that its Crypto Loss Claims Portal will open on March 31, 2025, allowing creditors to file claims for losses related to the collapse of TerraUSD (UST) and its aftermath.