BONK Memecoin Forecast: Potential for 22% Upside Amid Positive Market Sentiment

-

Bonk [BONK] is navigating a pivotal moment, with predictions suggesting a significant upside of 22% as it eyes critical resistance levels.

-

As sentiment shifts in the memecoin market, analysts have uncovered potential for a substantial rally following a steep price decline.

-

According to sources at COINOTAG, “The recent Doji candle formation hints at a possible reversal in Bonk’s price trajectory.”

Bonk [BONK] shows signs of revival with potential gains of 22%, signaling a shift in market sentiment after a considerable downturn.

Technical Analysis and Price Action of Memecoin BONK

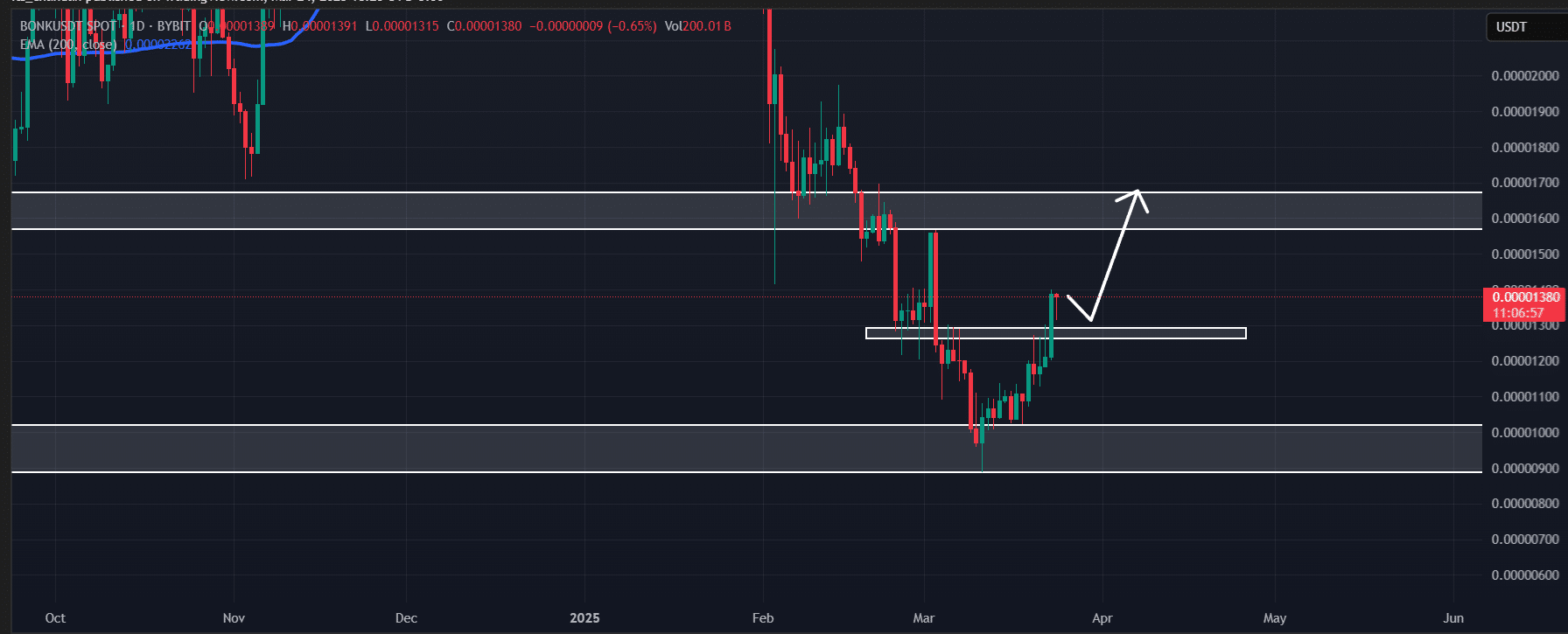

The recent trading activity for Bonk [BONK] has seen an impressive 110% increase in trading volume, indicating rising interest and participation from traders. As noted by COINOTAG, the token has recently performed a breakout above a significant resistance level at $0.000013, fostering a bullish outlook.

This breakout sets the stage for a potential 22% upside move towards the next resistance level at $0.000017, a threshold that previously served as an important support layer in the price action. Currently, at $0.0000138, BONK has gained 8% over the last 24 hours, reflecting positive market sentiment.

Source: TradingView

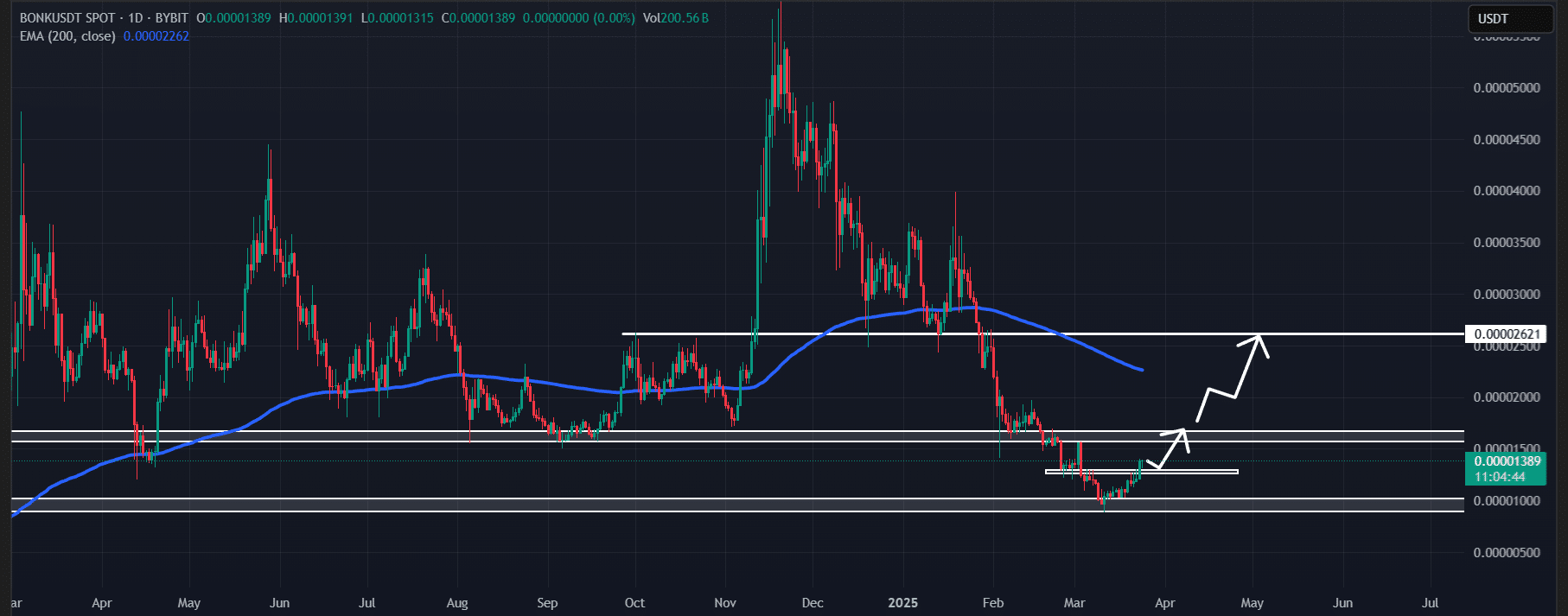

While there is potential for a price increase, it’s important to note that BONK remains below the 200 Exponential Moving Average (EMA) on the daily timeframe, suggesting a prevailing downtrend that traders should monitor closely.

Source: TradingView

Bullish On-Chain Metrics Indicate Investor Accumulation

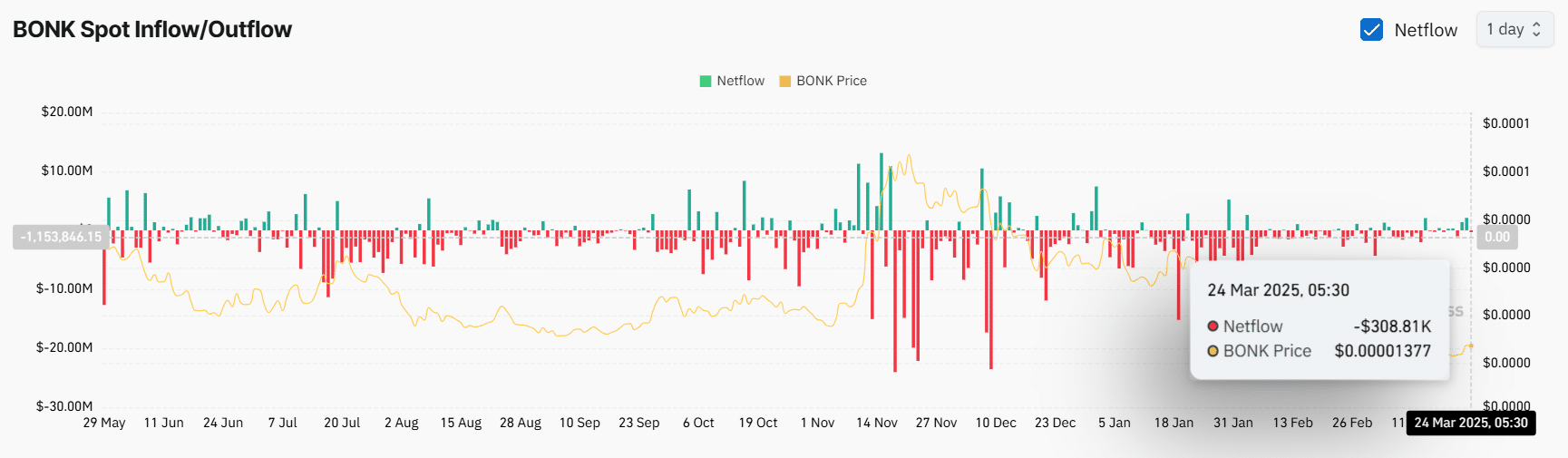

Recent analytics from Coinglass reveal a bullish trend as long-term investors accumulate Bonk [BONK]. Data indicates that substantial outflows from exchanges are occurring, suggesting renewed accumulation activities among long-term holders. Over the past 24 hours, exchanges have documented an outflow of $310K worth of BONK, reflecting a significant movement towards holding rather than trading.

Source: Coinglass

This substantial outflow trend may foster buying pressure, further propelling BONK’s momentum upward and solidifying its position in the market.

Traders Show Over-Leveraged Market Behavior

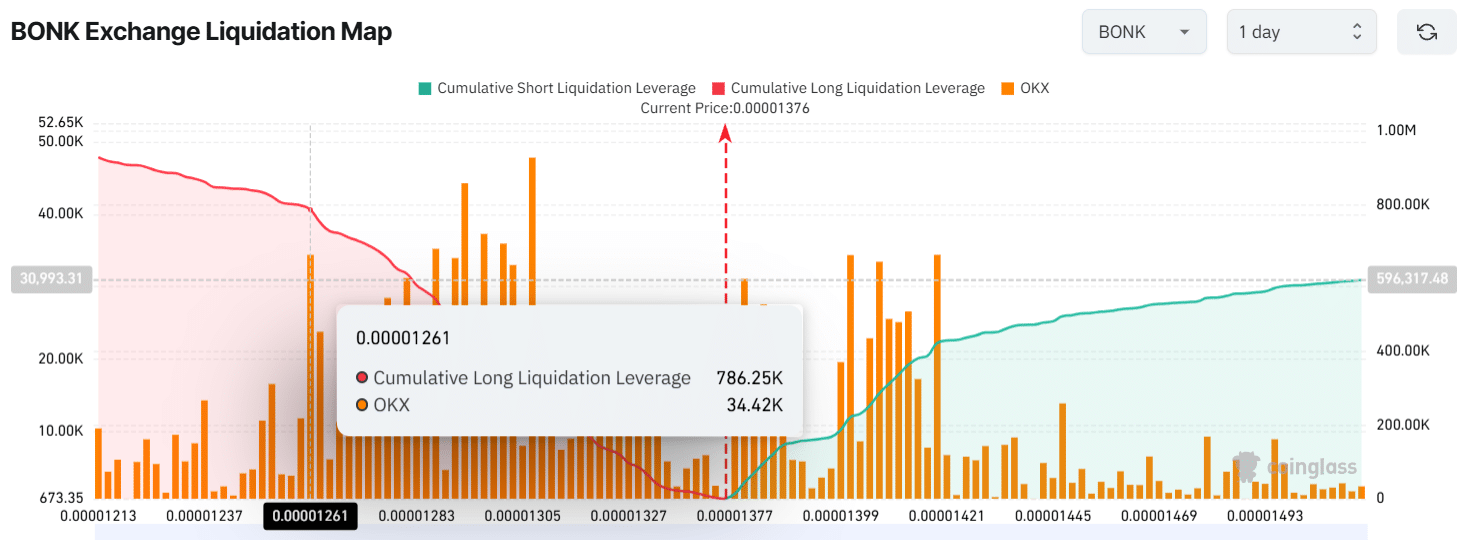

In a notable development, both long-term holders and intraday traders are actively participating in Bonk’s market dynamics. Current data shows traders are over-leveraged, with a lower support level identified at $0.00001261 and an upper resistance level at $0.00001419. As it stands, traders have opened $785K in long positions compared to $425K in short positions, indicating a bullish outlook among traders.

Source: Coinglass

This trend indicates that the bulls are currently in control and may support the memecoin’s potential rally, strengthening the overall sentiment surrounding Bonk [BONK].

Conclusion

In summary, Bonk [BONK] is showing signs of a potential resurgence amidst bullish on-chain metrics and increasing trading volumes. With technical indicators suggesting a 22% upside to the next resistance level, the market is watching closely for further developments. As accumulation by long-term holders continues alongside trader participation on the long side, BONK could be poised for a robust performance in the coming days.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Buyer Battles Begin as BlockDAG Offers 25M BDAG Daily! LINK Price Prediction Leans Toward $25 & TRX Crypto Shows Strength

Catch the next big crypto as LINK price prediction targets $25, TRX crypto shows strength & BlockDAG drops Buyer Battles offering 25M BDAG daily fueling buying frenzy.Chainlink Price Prediction Targets $25 BreakoutTRX Crypto Draws Volume After USDT Mint & ETF HypeBlockDAG Launches Daily Buyer BattlesStrong Moves Are Happening Live

Digital Commodity Capital Adds XRP to Its Portfolio, Bolstering Institutional Interest

BlockDAG Drops Price Pre-Reveal as Fartcoin Gains Traction

XRP Price Target Debated; SHIB Burns and Unstaked Gains