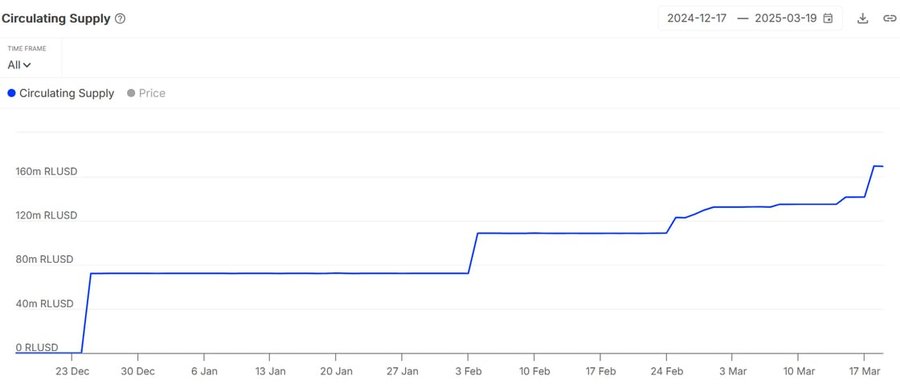

Ripple’s RLUSD Adoption Surges With $160M in Circulation

- RLUSD’s circulating supply hit $160 million, showing rapid adoption across Ethereum and XRPL networks.

- Thousands of wallets now hold RLUSD, reflecting rising trust in Ripple’s expanding stablecoin ecosystem.

Who would have thought that Ripple’s stablecoin, RLUSD, which was initially just part of a limited test, is now starting to steal the market’s attention. From what initially seemed like an ordinary experiment, RLUSD now has a circulating supply of $160 million, according to IntoTheBlock .

In early March, CNF reported that RLUSD surpassed the trading volume of several competing stablecoins and began to enter a wider ecosystem through integration with Revolut and Zero Hash.

Even then, the circulating tokens had only reached 120 million. So, in just a short time, there have been tens of millions of RLUSD tokens spread across the network. This is not a growth that can be considered a breeze.

RLUSD Gains Momentum Across Ethereum and XRPL

Interestingly, RLUSD is not only focused on one network. It moves nimbly between Ethereum and XRP Ledger (XRPL). During January, the total trading volume of this stablecoin reached $7.35 billion.

If calculated, this means that billions of dollars changed hands in just a matter of weeks, an activity that shows how high the demand for this stablecoin is. Like a cake shop that suddenly went viral on social media, RLUSD is starting to attract crypto investors who want something stable yet full of growth potential.

Furthermore, the latest data shows an increase in the number of Ethereum addresses holding RLUSD. In the past month, there has been a spike of around 15%, reaching 2,345 addresses.

Garlinghouse and Deaton Back RLUSD’s Big Vision

Behind the growth of RLUSD, there is a strong push from Ripple CEO, Brad Garlinghouse. He projects that RLUSD has the opportunity to enter the top five stablecoins in the world. This prediction came after the SEC dropped the lawsuit against Ripple Labs—which automatically gave fresh air for further expansion.

On the other hand, John Deaton, a lawyer close to the XRP community, sees the launch of RLUSD as not just an attempt to make money. He considers this step to be Ripple’s clever strategy to achieve regulatory clarity.

With stablecoins increasingly accepted by the market, RLUSD has the potential to strengthen the utility of the XRP Ledger as a whole. It’s like building a bridge between the old financial world and the growing crypto infrastructure.

Earning Trust Fast in a Crowded Stablecoin Market

Looking at the latest data, RLUSD managed to record a daily trading volume of $23 million. Of that amount, around $12.5 million came from Uniswap alone. Interestingly, the price of RLUSD against ETH was at $1.004, slightly above its peg, while against USDT, the price was stable at $0.9995.

This price stability shows that despite being heavily traded, RLUSD is still able to maintain its value—which is certainly the main selling point of a stablecoin.

What is more interesting is how this project has managed to build trust in a short time, amidst fierce competition from big players like Tether and USDC. Like a new kid in school who immediately gets along with everyone because he has a unique style and doesn’t act like a know-it-all, RLUSD is starting to find its own place in the crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Southeast Asia rides into a Musk-sort of DOGE

Share link:In this post: Southeast Asia is onto Musk-DOGE plans. Indonesian President Prabowo Subianto said that he would cut $19 billion, or about 8.5% of the state budget, this year. Vietnam has cut the number of government ministries and agencies from 30 to 22. Malaysia’s government fired 30,000 contract workers who didn’t have a certificate that they graduated from high school.

More than 600,000 investors in Romania choose crypto over stocks

Share link:In this post: Finance industry officials admit that more Romanians invest in cryptocurrencies than in company shares. Crypto assets have attracted 600,000 investors in Romania, three times more than the traditional stock market. Romanian authorities hope to increase cash flow in the country’s economy through a temporary tax break for crypto investors.

Etoro Files for IPO With Tripled Revenue, 96% From Crypto Trading

Bitcoin flips ‘macro bullish’ amid first Hash Ribbon buy signal in 8 months