Solana Price Forecast: Can SOL Rally to $200 Amid Record Adoption?

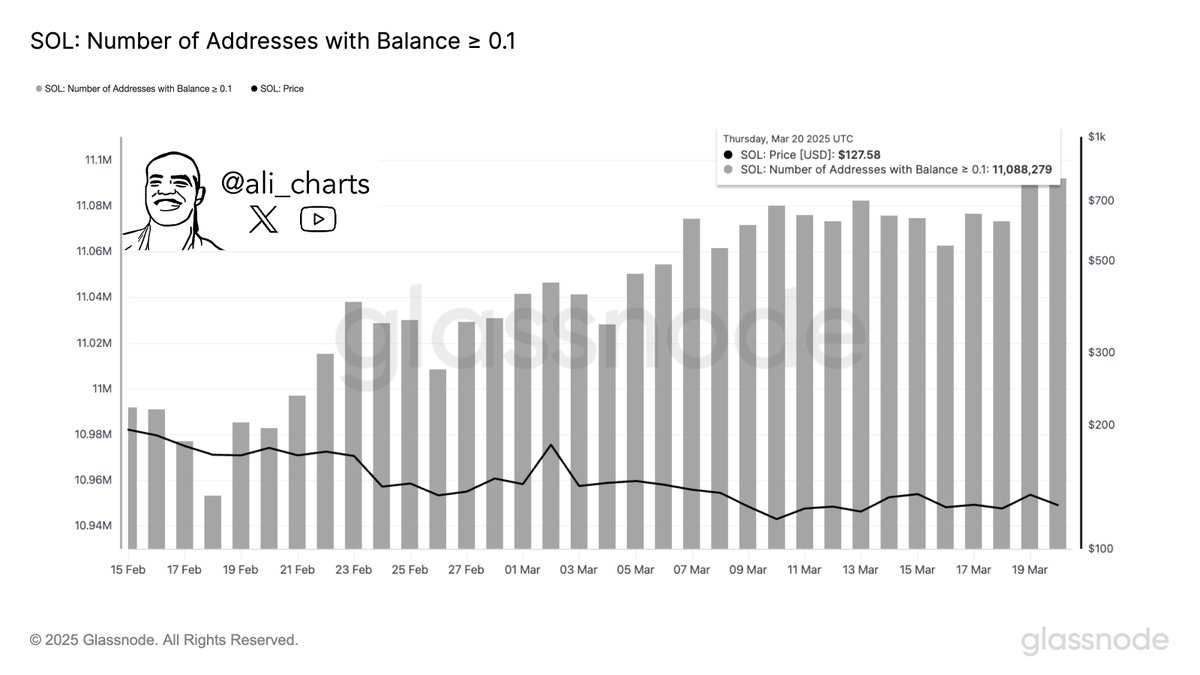

- Solana has surpassed 11.09 million active accounts, reflecting strong user adoption and rising trust in the ecosystem.

- Institutional interest surges with ETFs and Fidelity’s involvement, potentially attracting up to $6B if a spot ETF is approved.

Solana is once again in the spotlight amid renewed interest after reaching a new milestone in its adoption growth. Active accounts with SOL tokens have now reached over 11.09 million, a new all-time high for network activity, according to crypto analyst Ali Martinez. Such a massive spike in adoption not only indicates growing retail interest but also long-term confidence in its expanding ecosystem.

A large part of the recent increase in the momentum is attributed to the institutional interest in the token. In March 2025 there were the famous launches of two futures ETFs-Volatility Shares Solana ETF (SOLZ) and the leveraged Volatility Shares 2X Solana ETF (SOLT). Now, both are live on Nasdaq and have helped spotlight Solana in financial circles.

As more institutional investors gain exposure through these funds, analysts believe these instruments could be pivotal in providing long-term price support. Since their listing, SOL briefly jumped over $136, suggesting that investor appetite is real, and so is the potential for another leg up.

Over 11 Million Wallets Signal Solana’s Rapid Rise

The presence of over 11 million addresses paints a strong picture of Solana’s expanding user base. That figure isn’t just a number—it represents growing trust and interest in the platform’s speed, usability, and vision. Each new user adds more weight to the idea that Solana is ready to play in the big leagues.

The influence of traditional finance players is starting to become more visible, too. Fidelity Investments recently filed a Solana-focused fund in Delaware, signaling its intent to enter the game. With Fidelity managing around $4.9 trillion in assets, even a modest allocation into Solana would be a powerful statement—and potentially a price driver.

Polymarket also reports cautious optimism. As we reported earlier, the probability of the Solana spot ETF approval stands at 88% this year. In fact, it seems that the regulatory authorities’ optimism has changed in a good way, and traditional financial institutes have more open ideas on cryptocurrencies. If the spot ETF goes live, Solana’s price might reach a considerable height, and maybe it will even come close to the $200 barrier.

Solana ETF Could Draw $6B in 6 Months — JPMorgan

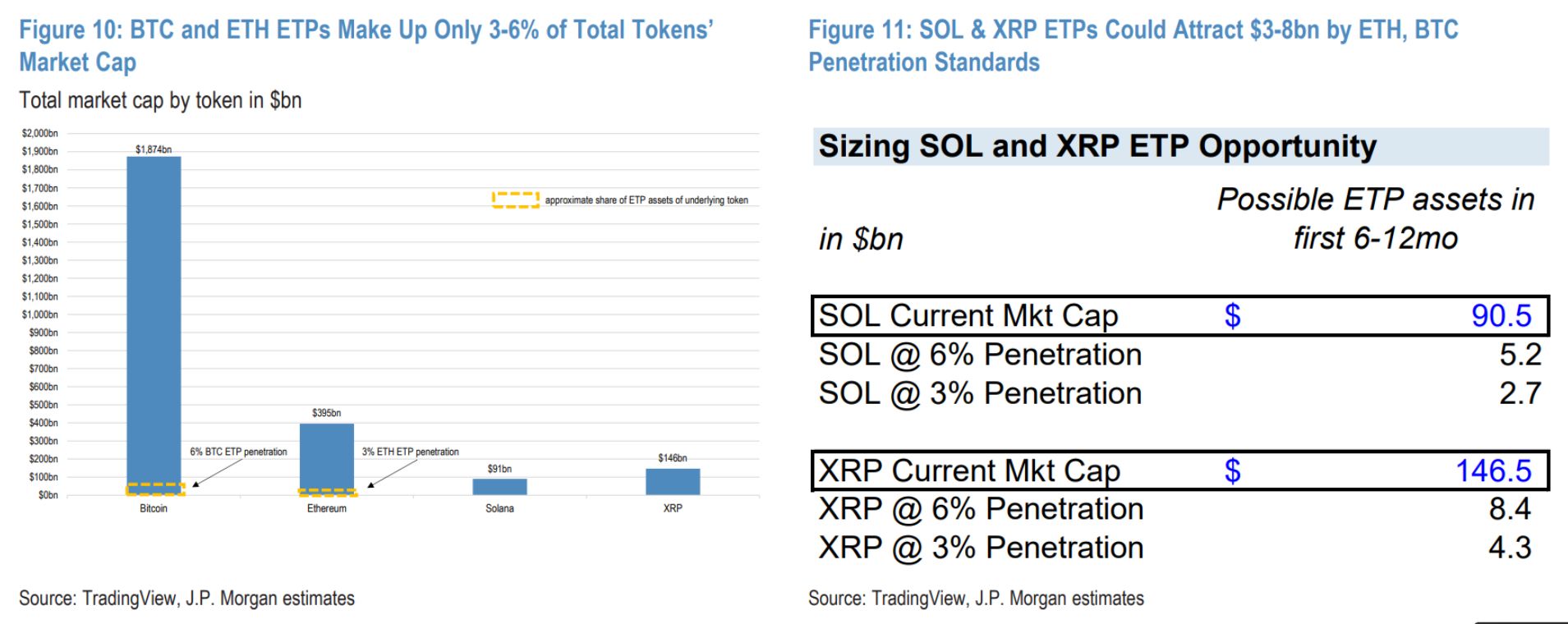

JPMorgan analysts added further insight with a recent projection. Their report suggested that if Solana does secure a spot ETF, it could attract $3 to $6 billion in net assets within just six months.

That would outpace Ethereum’s early ETF adoption rate—a remarkable claim considering ETH’s standing in the market.

“When applying these so-called “adoption rates” to SOL and XRP, we see SOL attracting roughly $3 billion–$6 billion of net assets and XRP gathering $4 billion–$8 billion in net new assets,” the JPMorgan report explained.

Despite the excitement, there’s still a bit of waiting to do. Bloomberg’s James Seyffart pointed out in January that the SEC typically takes between 240 to 260 days to evaluate ETF filings. That means a spot Solana ETF approval might not arrive until sometime in 2026, though momentum appears to be building now.

Recommended for you:

- Solana Wallet Tutorial

- Check 24-hour Solana Price

- More Solana News

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Southeast Asia rides into a Musk-sort of DOGE

Share link:In this post: Southeast Asia is onto Musk-DOGE plans. Indonesian President Prabowo Subianto said that he would cut $19 billion, or about 8.5% of the state budget, this year. Vietnam has cut the number of government ministries and agencies from 30 to 22. Malaysia’s government fired 30,000 contract workers who didn’t have a certificate that they graduated from high school.

More than 600,000 investors in Romania choose crypto over stocks

Share link:In this post: Finance industry officials admit that more Romanians invest in cryptocurrencies than in company shares. Crypto assets have attracted 600,000 investors in Romania, three times more than the traditional stock market. Romanian authorities hope to increase cash flow in the country’s economy through a temporary tax break for crypto investors.

Etoro Files for IPO With Tripled Revenue, 96% From Crypto Trading

Bitcoin flips ‘macro bullish’ amid first Hash Ribbon buy signal in 8 months