Michael Saylor's Strategy surpasses 500,000 BTC after latest $584 million bitcoin buy

Quick Take Strategy has purchased another 6,911 BTC for approximately $584.1 million in cash at an average price of $84,529 per bitcoin — taking it past 500,000 BTC in total holdings. The latest acquisitions were made using proceeds from the sale of its class A common stock, MSTR, and perpetual strike preferred stock, STRK.

Bitcoin treasury company Strategy (formerly MicroStrategy) acquired an additional 6,911 BTC for approximately $584.1 million at an average price of $84,529 per bitcoin between March 17 and March 23, according to an 8-K filing with the Securities and Exchange Commission on Monday — surpassing 500,000 BTC in total holdings.

The company now holds a total of 506,137 BTC — worth over $44 billion. Strategy's total holdings were bought at an average price of $66,608 per bitcoin, a total cost of around $33.7 billion, including fees and expenses, according to the company's co-founder and executive chairman, Michael Saylor. To put that in perspective, Strategy holds around 2.4% of bitcoin’s total 21 million supply.

The latest acquisitions follow Strategy's announced pricing of its 10% Series A Perpetual Strife Preferred Stock (STRF) offering on Friday, upsizing the deal from $500 million to $722.5 million.

The STRF offering follows the company's previously announced plan to raise up to $21 billion via its perpetual strike preferred stock, STRK, on March 10. Last week, Strategy sold 13,100 STRK shares for approximately $1.1 million. As of March 23, $20.99 billion worth of STRK shares remain available for issuance and sale under the program, the firm said.

The STRF and STRK offerings are also in addition to Strategy's initial "21/21 plan," which targets a total capital raise of $42 billion in equity offerings and fixed-income securities for bitcoin acquisitions. Last week, Strategy sold 1,975,000 MSTR shares for approximately $592.6 million. As of March 23, $3.57 billion worth of MSTR shares remain available for issuance and sale under that program.

Strategy previously acquired an additional 130 BTC for approximately $10.7 million at an average price of $82,981 per bitcoin between March 10 and March 16 — much lower than many of its prior bitcoin purchases, which have run into the billions — taking its holdings to 499,226 BTC ahead of today's announcement.

Strategy's $79.2 billion market cap trades at a significant premium to its bitcoin net asset value, with some investors airing reservations about the firm's premium to NAV valuation and its increasingly numerous bitcoin acquisition programs in general.

Strategy's class A common stock, MSTR, closed up 0.6% on Friday at $304 and is currently up 4.9% in pre-market trading on Monday. It has gained over 90% during the past year but only 1.3% year-to-date, according to The Block's Strategy Price page , in what Bitwise's Head of Alpha Strategies Jeff Park describes as "the altcoin of tradfi."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Rivals Poised for Massive Gains—Turn $100 Into $10K Before Q2 Ends

Movement (MOVE) Price Gains 27% as Accumulation Builds and Bullish Momentum Takes Over

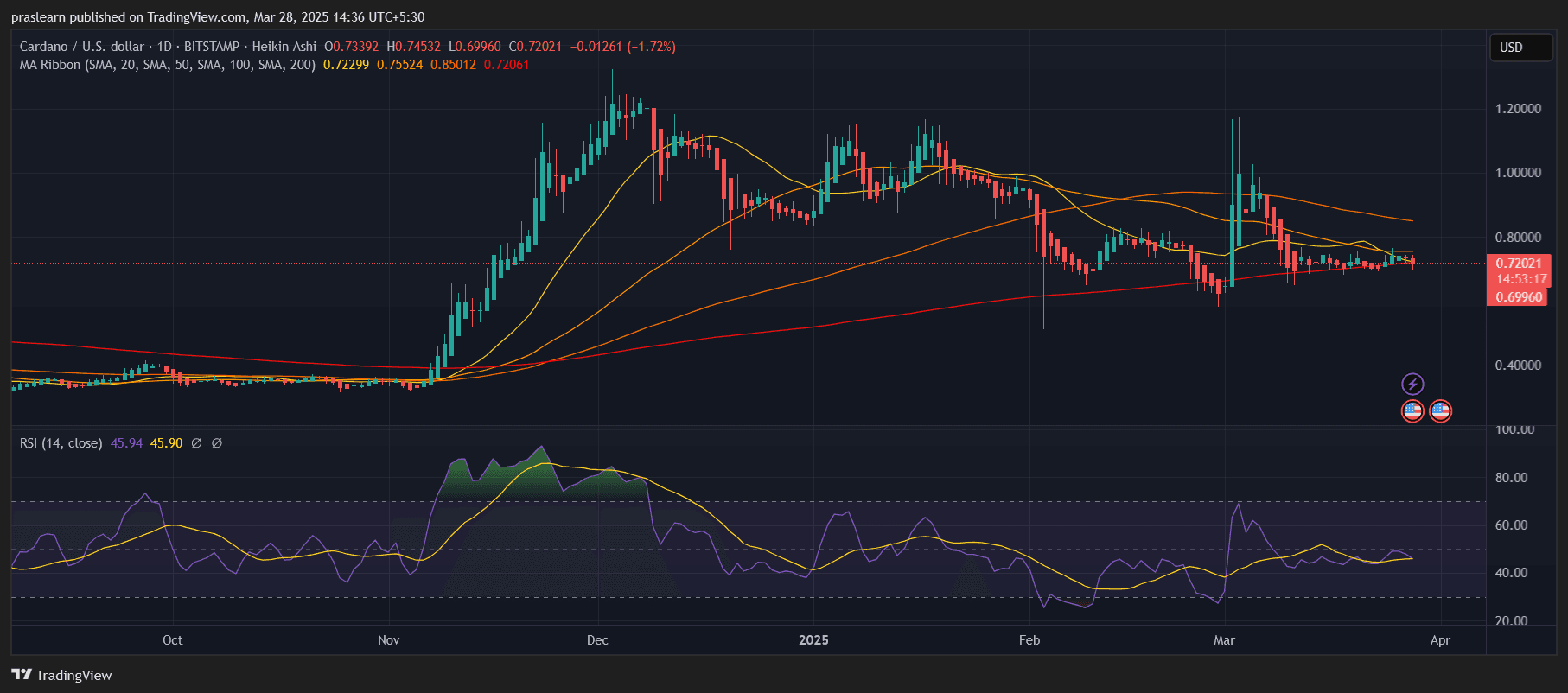

Cardano Aiming for $10? Big Move Coming?

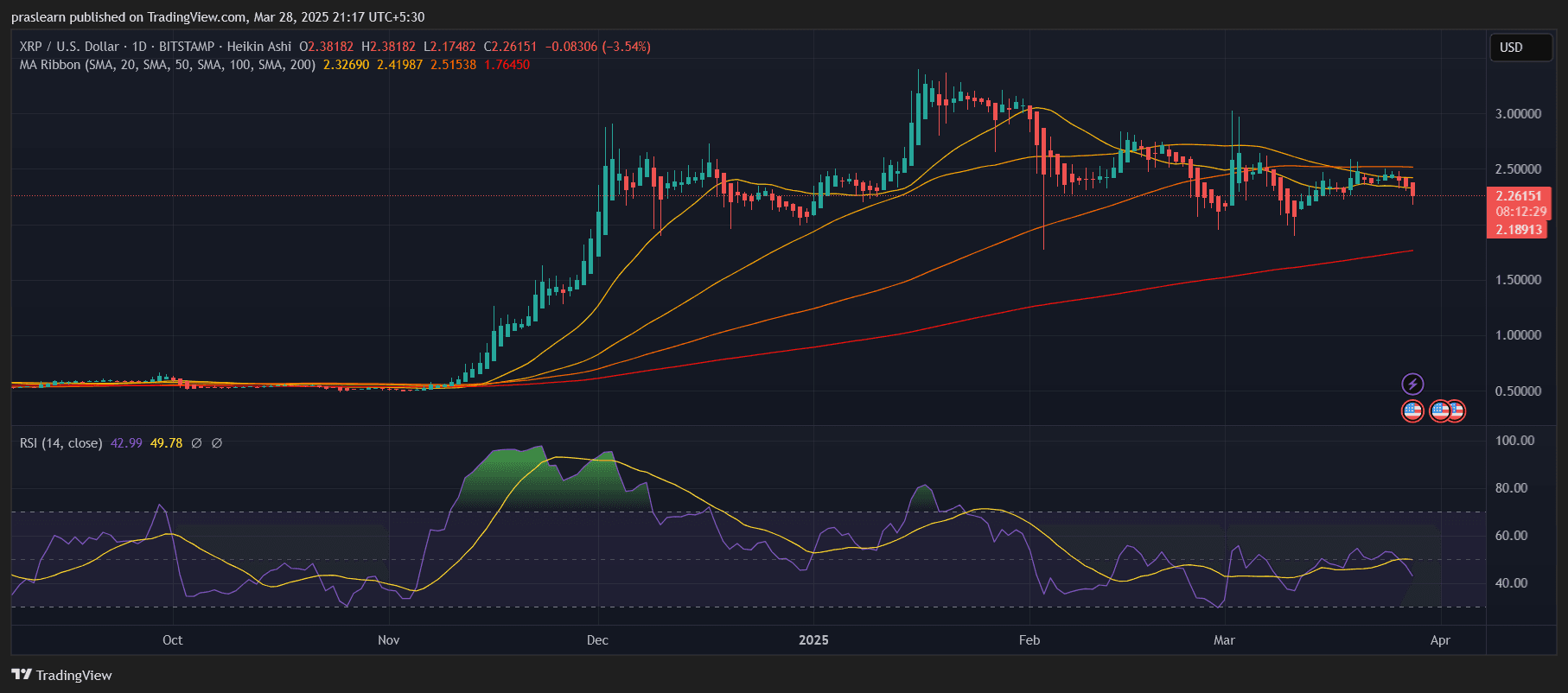

Will XRP Crash? Here’s What the Chart Is Warning Us About