Canary Capital has been repeatedly submitting ETF applications. Has the imitation ETF application become a form of disguised advertising business?

Established just 6 months ago, Canary Capital has already rapidly submitted multiple Shitcoin ETF applications. However, this approach has also raised many questions: how significant is the true demand for these Shitcoin ETFs? Or is this more of a gimmick and marketing tactic?

Original Article Title: "Canary Capital Frequently Submits ETF Applications, Is Shanzhai ETF Application Becoming Covert Advertising Business?"

Original Article Author: Weilin, PANews

On March 20, the U.S. financial institution Canary Capital filed the Canary PENGU ETF application with the U.S. Securities and Exchange Commission (SEC), planning to launch an ETF that holds both the Chunky Penguin NFT and the $PENGU token. According to the proposed scheme, the ETF fund plans to hold 80-95% of the $PENGU token and 5-15% of Pudgy Penguins NFT. This news has sparked widespread discussion within the Chunky Penguin community and the broader crypto market, with even Canary's avatar on social media being the Pudgy Penguin NFT.

Canary Capital, founded just 6 months ago, has already intensively submitted multiple meme coin ETF applications. However, this practice has also raised many doubts: how significant is the real demand for these meme coin ETFs? Or is this more like a gimmick and a marketing tactic?

PENGU ETF News Drives Coin Price Up and Then Down, Will Traditional Investors Enter?

After the PENGU ETF news was announced, the $PENGU price initially surged to $0.0075, up nearly 10%, reflecting the market's short-term optimism about the news. However, as of 7:30 p.m. on March 21, the price had fallen back to $0.0062, an overall 8.63% decline in 24 hours, showing that the market's enthusiasm for the news could not be sustained in the long term. Although there was a significant increase in capital inflow after the news announcement, with a 24-hour trading volume of $135 million, the price trend could not remain strong.

The submission of the PENGU ETF has sparked some controversial voices within the Chunky Penguin community. For example, Chunky Penguin community user @beast_ico stated, "The $PENGU ETF might be the most outrageous thing I've seen recently. We don't even need an ETF for a meme coin, let alone one that's not even 6 months old. If those 'Boomers' (traditional investors) aren't even interested in ETH (let alone SOL), why would they touch something called PENGU?"

However, digital artist @Tuteth_ expressed, "We're really screwed, guys. I've seen all the buzz about $PENGU and the Pudgy Penguin ETF, and it's just nonsense. Some of these people are still my friends. But you don't even realize you're fueling 'tall poppy syndrome' (jealousy of successful people, suppression of leaders). Bitcoin was mocked as the dumbest thing in the world back in the day. The reason we're in this community is to enjoy these seemingly absurd but ultimately real possibilities because we've seen them happen. We've come this far, only to hear that this ETF is going too far? Think about it, you have an animal as your avatar and talk about cryptocurrency with online friends every day. It's all absurd to the extreme—yet you insist on drawing a line here, it cracks me up."

Clearly, the Chonky Penguin community has differing opinions on this ETF application, with some detractors seeing it as a ridiculous hype and supporters viewing it as a natural progression of NFT culture.

Is the S-1 Filing Threshold Low? Canary Capital Successively Applies for Shanzhai ETFs

PANews previously introduced Canary Capital, a crypto investment firm, in October 2024 when it had only been established for a month. Canary Capital's founder and CEO is Steven McClurg, who is also a co-founder of Valkyrie Funds. It is worth mentioning that Justin Sun is also an investor in Valkyrie. In October 2021, Valkyrie was approved to launch the first Bitcoin futures ETF in the United States. Steven McClurg left Valkyrie Funds in August 2024 and founded the crypto investment firm Canary Capital in September, announcing the launch of the first HBAR Trust in the U.S. on October 1. Subsequently, Canary also applied for the SUI ETF, an ETF tracking Axelar (AXL) price, Litecoin (LTC) ETF, AXL Trust, Solana ETF, and XRP ETF.

Some analysts have pointed out that the low cost of S-1 filing may be one of the reasons for the recent surge in Shanzhai Coin ETF applications. According to analyst Jason Chen on March 7, "S-1 is the first step in registering an ETF, and what is the threshold for submitting an ETF's S-1? There are two key thresholds. Firstly, the company must be U.S.-registered with asset management and financial operations, and secondly, it needs to spend around $100,000 to cover the cost of drafting the S-1 filing."

Earlier on March 6, Canary Capital applied to the U.S. SEC to launch an ETF tracking the cross-chain protocol Axelar. At the time, Jason Chen pointed out, "After Canary submitted the S-1 for the AXL ETF, AXL experienced a price surge. I am familiar with the AXL project and have even written two lengthy articles about it. Fundamentally, the project is decent but falls far short of meeting the ETF qualifications. On the other hand, Canary, the company that submitted the materials, was only established in September 2024, less than half a year ago. So, can you believe that there is nothing fishy going on when a newly established company submits an obviously unqualified coin for an ETF and is widely reported by major media outlets?"

Crypto KOL @qinbafrank recently expressed a viewpoint similar to Chen Jian's: "In addition to the three largest mutual funds by BlackRock, Franklin, and Fidelity, as well as fund companies like Bitwise, Grayscale, and Ark which were the first to receive approval for a BTC ETF, if we see some unknown fund companies announcing the submission of a mysterious altcoin ETF to the SEC, undoubtedly these fund companies have likely received advertising fees, and the main manipulators behind the scenes may take advantage of the opportunity to pump up the price and unload their holdings."

SOL Futures Listing Debut Sees Weak Demand, Small-Cap Coins May Struggle to Sustain High Demand

Meanwhile, Solana futures began trading on March 17 on the Chicago Mercantile Exchange (CME) Group's American derivatives exchange, seen as a key step towards applying for a SOL spot ETF and a test of market demand.

However, according to preliminary data from the CME website, on March 17, the first day of trading, approximately 98,250 SOL (equivalent to around $12 million) in SOL futures changed hands on the trading platform. This performance, compared to major cryptocurrencies like Bitcoin and Ethereum, showed a lackluster early trading performance.

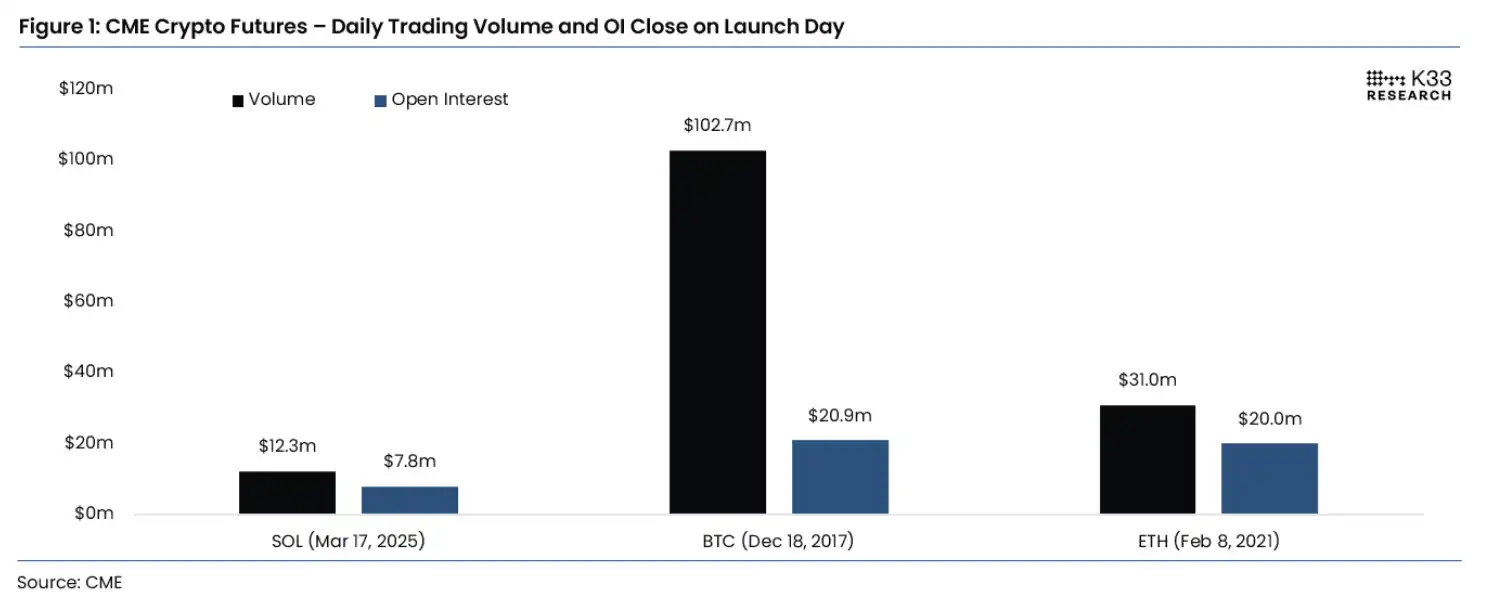

According to a report by research firm K33, the total trading volume for Solana futures on the first day was $12.3 million with $7.8 million in open interest. This is starkly contrasting to Bitcoin futures, which attracted a trading volume of $102.7 million and $20.9 million in open interest when they first appeared on the CME in December 2017. Ethereum also had a better performance with its futures launching in February 2021 with a trading volume of $31 million and $20 million in open interest.

K33 analysts Vetle Lunde and David Zimmerman attributed the lukewarm performance to the broader market conditions, noting that Solana's launch occurred during a period of low risk appetite without a strong bull market or favorable period for altcoin rebounds. The K33 report stated: "Despite a more reasonable performance post-market cap adjustment, Solana's figures are a far cry from previous futures listings."

The analysts added that despite the underwhelming start, the listing does align with the pattern typically associated with ultimate approval of a spot ETF. However, they cautioned that the lower trading activity for Solana compared to the surge triggered by Bitcoin's spot ETF approval in early 2024 suggests that any future ETFs tied to the token may have a more subdued impact on the price.

Overall, the discussion of the PENGU ETF reflects a collision between NFT and memecoin culture and traditional finance, with community users holding their own views. As for Canary Capital's frequent applications for meme ETFs, is it an innovative attempt or simply a marketing tactic? The future of meme coin ETFs awaits answers from the cryptocurrency market, users, and regulatory agencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This week, the U.S. Bitcoin spot ETF had a cumulative net inflow of US$3.0629 billion

AAVE drops below $170

The total locked value of Ethereum Layer2 network is 31.21 billion US dollars, up 13.2% on the 7th

1inch team investment fund sold 70.76 WBTC again 30 minutes ago