Solana Adoption Soars To ATH, Implication For SOL Price

Solana price is in the spotlight amid growing network adoption. Institutional and retail investors and users are now embracing Solana in diverse ways. Solana is facing consolidation but longer term prospect remains bright.

Solana is seeing record growth that is in line with major ecosystem development. The protocol now boasts more wallets holding SOL amid growing network activity.

Institutional interest is also rising, raising questions about how these developments will impact Solana’s price.

While market experts speculate a momentum that could push SOL higher, real-time uncertainties remain a factor.

Network Adoption Hits Record High

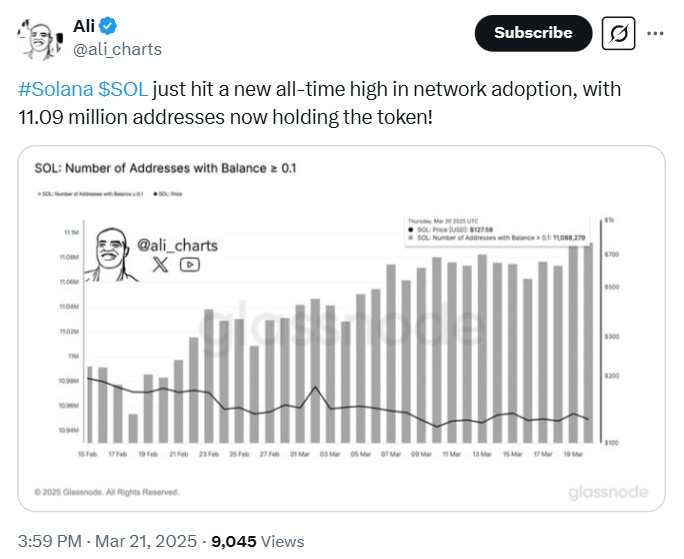

According to Ali Charts on X, Solana has reached a new milestone: 11.09 million addresses now hold the coin.

This is the highest number ever recorded, reinforcing Solana’s position as a major player in the crypto space.

Image Source: Ali Charts on X

Image Source: Ali Charts on X

Furthermore, market data shows that many crypto traders and investors are shifting from Ethereum to Solana.

In just a short time, over $72 million in assets have been bridged to the network. Solana’s weekly active addresses have surged to 17 million, significantly higher than Ethereum’s 1.8 million.

Meanwhile, DeFiLlama data shows that Solana’s total value locked (TVL) in decentralized finance (DeFi) has climbed to 54.87 million SOL.

Per its historical trend, this is its highest level since at least June 2022. In related news, Binance’s SOL wallet balance is rising as the trading platform has started accumulating back all the Solana sold recently.

This new pivot marks a bullish accumulation shift for the digital currency. As of this publication, SOL has retained its spot as the 8th largest cryptocurrency. Solana’s price was $131.56, up 2.31% in the last 24 hours.

Solana Price Prediction and Market Outlook

It is worth mentioning that the increasing adoption of Solana is driving bullish momentum for price in general.

In addition, the 4-hour price chart shows a pattern of higher lows, suggesting potential for an upward move.

Solana currently holds support at $117, with a key resistance level at $154.

Technical indicators present a mixed picture of Solana’s price prediction. The Relative Strength Index (RSI) is at 42.9, showing almost neutral momentum.

Meanwhile, the Moving Average Convergence Divergence (MACD) suggests a possible breakout. However, the derivatives market shows signs of weakness.

According to Coinglass data, open interest and trading volumes have dropped by 3% and 38%, respectively.

Similarly, long liquidations reached $6.21 million in the past 24 hours. This figure has pushed the long-to-short ratio to 0.95, indicating that short traders are gaining control.

Per this outlook, reclaiming the $150 price level might prove to be a tough ask for Solana bulls.

ETFs and Institutional Interest

It is important to state that institutional interest in Solana is growing.

For example, Volatility Shares recently announced the launch of two Solana futures ETFs, SOLZ and SOLT. These ETFs went live on the Nasdaq exchange on March 21, 2025.

These funds will provide exposure to Solana’s price movements through futures contracts.

Several asset managers, including Franklin Templeton and VanEck, have also applied for spot Solana ETFs.

While the Securities and Exchange Commission has not yet approved them, the launch of futures ETFs signals that regulators may be open to more Solana-based financial products.

With rising adoption and increasing institutional interest, Solana’s future remains promising.

However, its price trajectory will depend on market sentiment, regulatory progress, and sustained network growth.

Investors will be watching closely to see if SOL can break past key resistance levels and potentially reach $300.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IMX surges 15% after Immutable says SEC ended probe

Ripple agrees to drop SEC cross-appeal

Bitcoin miners’ revenue stabilises post-halving

GameStop eyes Bitcoin purchases with $4.8B in cash