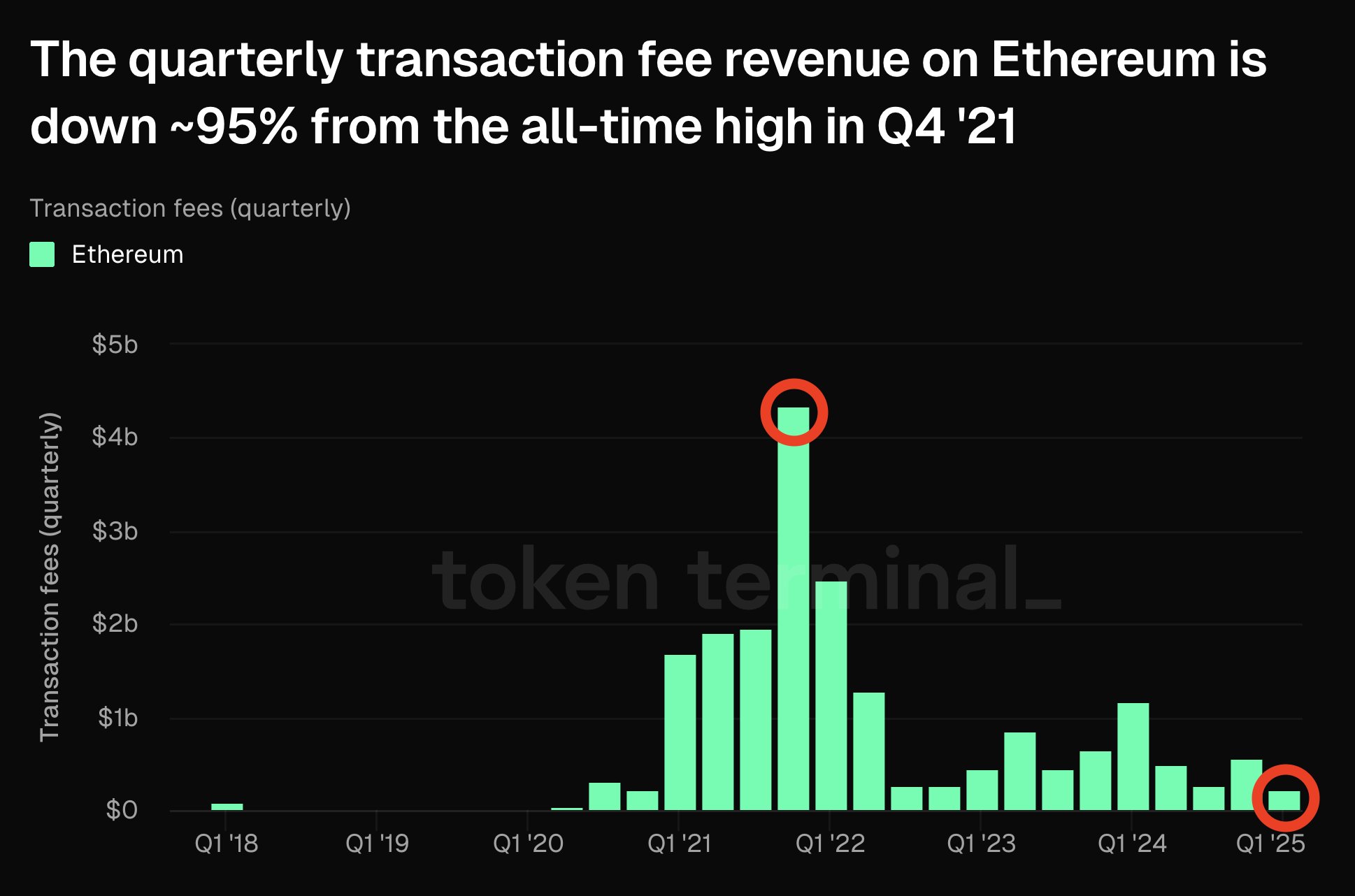

Ethereum Faces 95% Revenue Drop Amid Shifting Layer 2 and NFT Trends

Ethereum’s transaction fee revenue has dramatically decreased, primarily due to a drop in Layer 2 activity and the NFT market slowdown. ETH’s price also follows a sharp downward trend, falling 58.8% from its all-time high.

Ethereum (ETH), the world’s second-largest blockchain by market capitalization, has seen its quarterly transaction fee revenue drop dramatically by approximately 95% from its all-time high in Q4 2021.

This decline can be primarily attributed to a decrease in Layer 2 contributions, coupled with a significant dip in activity within the non-fungible token (NFT) market.

What’s Driving the Drop in Ethereum’s Transaction Fee Revenue?

Token Terminal highlighted this shift in the latest X (formerly Twitter) post. Based on their estimate, Ethereum’s transaction fee revenue for Q1 2025 is projected to reach approximately $217 million.

Ethereum Transaction Fee Revenue. Source:

X/TokenTerminal

Ethereum Transaction Fee Revenue. Source:

X/TokenTerminal

This figure represents a dramatic 95% reduction from the all-time high of $4.3 billion recorded in Q4 2021. At that time, Ethereum’s revenue surged by 1,777% year-over-year, according to Bankless. It climbed from $231.4 million in Q4 2020 to $4.3 billion by the last quarter of 2021.

Moreover, Ethereum’s DeFi ecosystem saw significant growth in Total Value Locked (TVL), decentralized exchange (DEX) volumes, NFT sales, and Layer 2 TVL. However, the dynamics have changed since then.

This is evident from Ethereum’s recent performance. In 2025, monthly revenues sharply declined, with January recording $150.8 million and February only $47.5 million. Assuming the trend of declining transaction fees continues, March could also see similarly low figures.

Furthermore, in the fourth quarter of 2024, Ethereum generated only $551.8 million in transaction fee revenue, emphasizing the continued downward trend.

One of the major contributors to the decline is the shift to Layer 2 solutions. These have become increasingly popular for their ability to process transactions off-chain while settling on Ethereum’s mainnet.

In addition, the activation of EIP-4844 has significantly reduced the data cost of posting to Ethereum’s chain, further lowering L2 fee contributions. According to a CoinShares report, this upgrade has made transactions cheaper but has also diminished the revenue Ethereum’s mainnet collects from L2 activity.

“Layer 2-related fees, which were high in 2023 and early 2024, have since declined due to cost savings introduced by EIP-4844,” the CoinShares report read.

The decline in NFT activity has also played a significant role. Q4 2021 marked the peak of the NFT craze, with platforms like OpenSea recording billions of dollars in monthly trading volume. Nonetheless, now the interest has waned, leading to a sharp drop in transaction volume and, consequently, fee revenue.

ETH Suffers its Worst Quarterly Decline Since 2018

This decline extends beyond transaction fee revenue. The price of Ethereum has followed a similar downward trend. After reaching an ATH in November 2021, ETH has dropped substantially, now trading 58.8% below that peak.

Even during the election euphoria, when many cryptocurrencies, including Bitcoin (BTC), saw new highs, Ethereum failed to keep pace.

“ETH has experienced the sharpest decline in Q1, dropping by -40%, marking its biggest quarterly loss since 2018,” an analyst wrote on X.

Ethereum (ETH) Price Performance. Source:

BeInCrypto

Ethereum (ETH) Price Performance. Source:

BeInCrypto

Over the past month alone, ETH has fallen by 25.1%. As of press time, the altcoin was trading at $1,997, representing a slight gain of 0.45% over the past day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report | Immortal Rising 2 Project Overview & IMT Market Analysis

Analysts Say Ethereum Struggles as Competition Intensifies: FT

Ethereum’s fading dominance in decentralized finance is testing its place in a changing crypto market.

Meme Coin Comeback? TRUMP Bounces 11% – What This Could Mean for the Entire Market

BlackRock Expands BUIDL Fund to Include Solana (SOL)

BlackRock’s expansion of its tokenized money market fund, BUIDL, to Solana comes amid a growing integration of blockchain technology in traditional finance. For BlackRock, it aims to leverage Solana’s speed and scalability.