Fidelity files for Ethereum-based US Treasury fund ‘OnChain’

Fidelity Investments has filed to register a tokenized version of its US dollar money market fund on Ethereum — joining the likes of BlackRock and Franklin Templeton in the blockchain tokenization space.

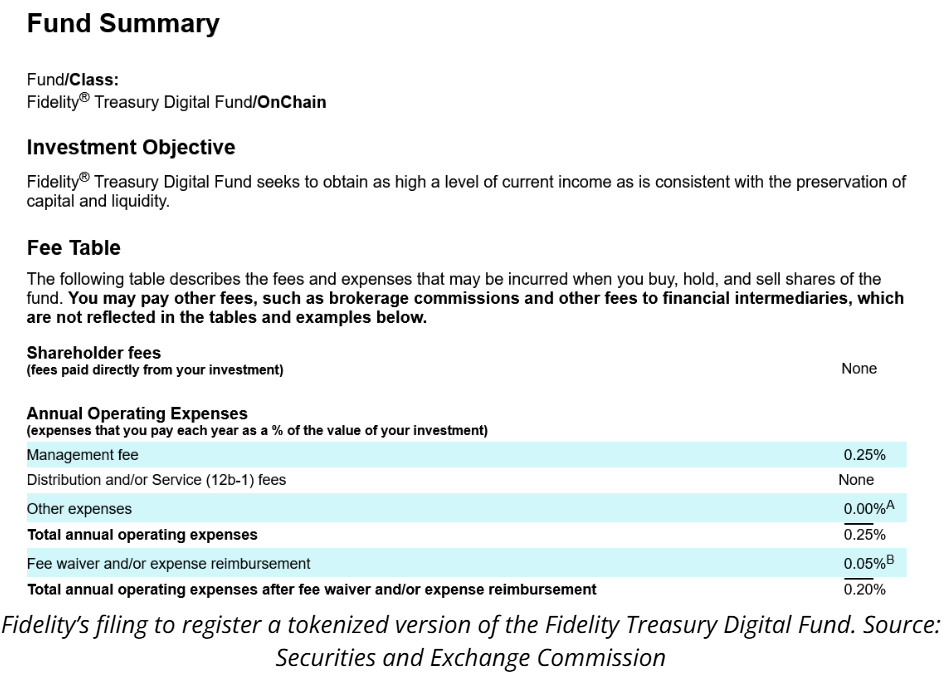

Fidelity’s March 21 filing with the US securities regulator said “OnChain” would help track transactions of the Fidelity Treasury Digital Fund (FYHXX) — an $80 million fund consisting almost entirely of US Treasury bills.

While OnChain is pending regulatory approval, it is expected to take effect on May 30, Fidelity said.

The OnChain share class aims to provide investors transparency and verifiable tracking of share transactions of FYHXX, although Fidelity will maintain traditional book-entry records as the official ownership ledger.

“Although the secondary recording of the OnChain class on a blockchain will not represent the official record of ownership, the transfer agent will reconcile the secondary blockchain transactions with the official records of the OnChain class on at least a daily basis.”

Fidelity said the US Treasury bills wouldn’t be directly tokenized.

The $5.8 trillion asset manager said it may also expand OnChain to other blockchains in the future.

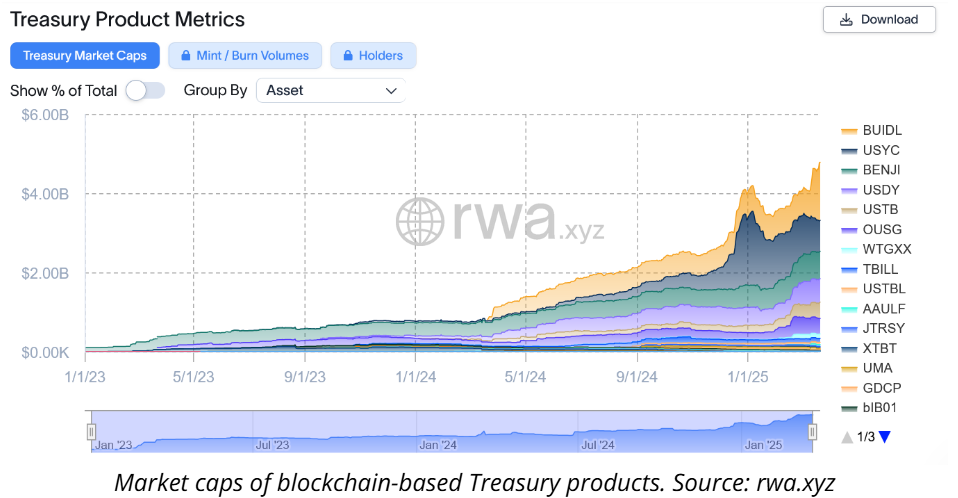

Asset managers have increasingly turned to blockchain to tokenize Treasury bills, bonds and private credit over the past few years.

The RWA tokenization market for Treasury products is currently valued at $4.78 billion, led by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) at $1.46 billion, according to rwa.xyz.

Over $3.3 billion worth of RWAs are tokenized on the Ethereum network, followed by Stellar at $465.6 million.

BlackRock’s head of crypto, Robbie Mitchnick, recently said Ethereum is still the “natural default answer” for TradFi firms looking to tokenize RWAs onchain.

“There was no question that the blockchain we would start our tokenization on would be Ethereum, and that’s not just a BlackRock thing, that’s the natural default answer.”

“Clients clearly are making choices that they do value the decentralization, they do value the credibility, and the security and that’s a great advantage that Ethereum continues to have,” he said at the Digital Asset Summit in New York on March 20.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Expected to Pump Over 10x in the Altseason, How High Can ADA Go This Bull Cycle

Ripple Rules Out 2025 IPO as Company Maintains Solid Financial Position

Google Chrome’s success ‘impossible to recreate,’ exec testifies in DOJ antitrust trial

Share link:In this post: Parisa Tabriz believes Google Chrome would decline in another company’s hands, saying it would be hard to disentangle Google from the search engine’s success. Google plans to infuse artificial intelligence into Chrome to make it more agentic. OpenAI showed interest in buying Google Chrome.

SEC Commissioner Hester Peirce calls for better crypto regulation

Share link:In this post: SEC Commissioner Hester Peirce has called for better crypto regulation in the United States. Peirce mentioned that financial firms have been approaching crypto in a way like playing “the floor is lava” children’s game. SEC commissioners want flexible regulation as SEC chairman Paul Atkins wants clear regulations for digital assets.