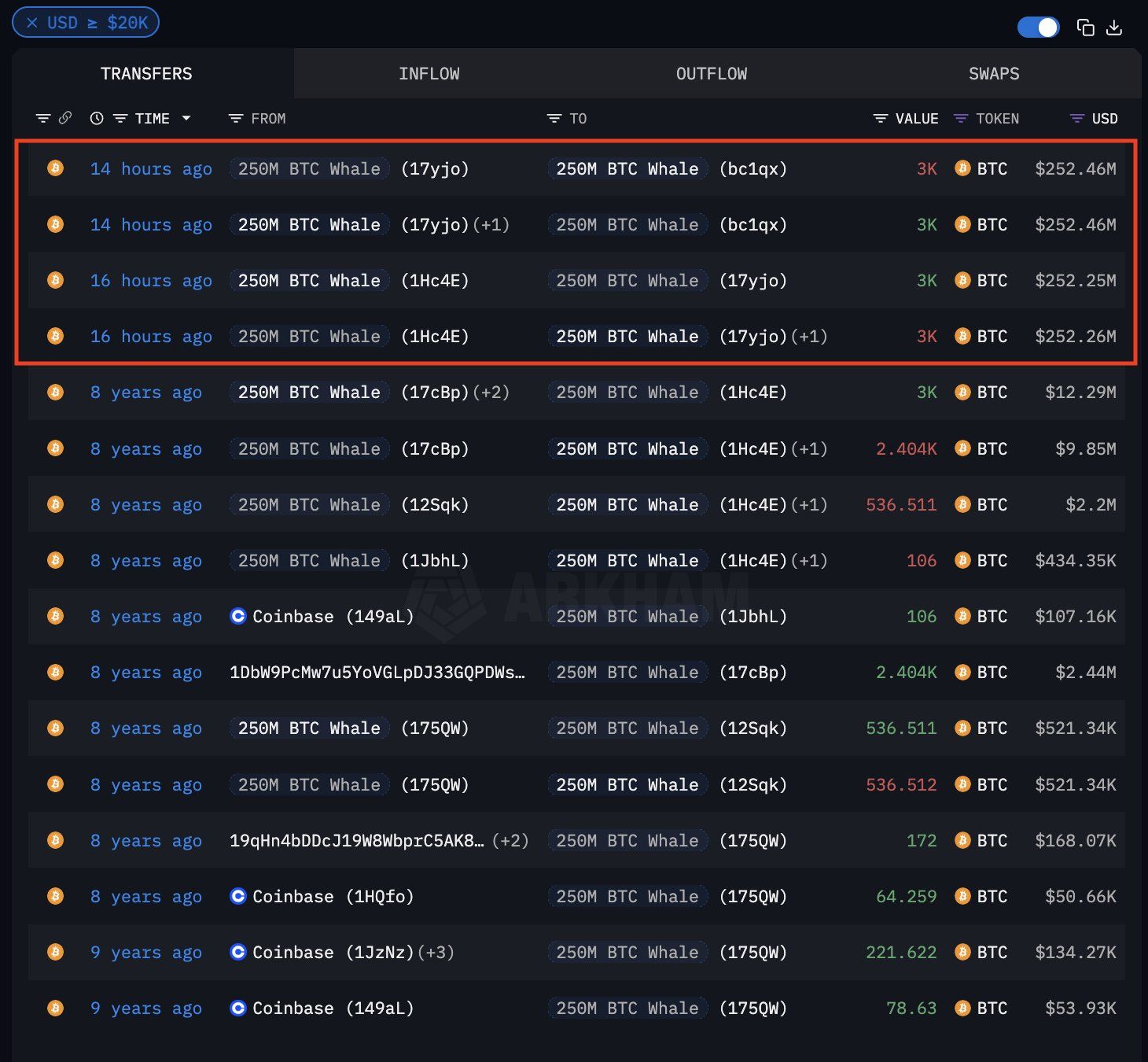

Dormant Bitcoin Whale Wallet From 2016 Moves 3,000 BTC

The Bitcoin whale funds were moved to another wallet rather than an exchange, indicating a possible restructuring rather than intent to sell.

An early Bitcoin investor has resurfaced after nearly a decade of inactivity, drawing attention across the crypto space.

On March 22, the Bitcoin whale transferred 3,000 BTC—worth over $250 million at the time of the move. A Bitcoin whale is an individual or entity that holds more than 1000 BTC.

Why is the Bitcoin Whale Active After 8 Years?

According to Arkham, the Bitcoin whale’s wallet dates back to late 2016, when Bitcoin was trading below $1,000.

The investor’s original stake—estimated at around $3 million—has since grown into a massive fortune, reflecting the asset’s long-term potential.

During this holding period, Bitcoin hit an all-time high of almost $110,000 in January 2025. Though the price has since pulled back to around $84,274, the whale’s ROI remains staggering.

Dormant Bitcoin Whale Shifts 3000 BTC. Source:

Arkham Intelligence

Dormant Bitcoin Whale Shifts 3000 BTC. Source:

Arkham Intelligence

The motive behind the transfer remains unclear. However, analysts noted that the funds were moved to another wallet—not an exchange—indicating the holder may be restructuring rather than preparing to sell.

This detail appears to have calmed fears of a market dump. BeInCrypto data shows that the broader crypto market has stayed stable despite the whale’s activity. Bitcoin and other top assets have shown little price volatility in response.

Meanwhile, this transfer is not an isolated case. Over the past year, several long-dormant wallets have shown signs of activity.

Some analysts believe early holders are reassessing their positions as Bitcoin trades near historic highs. Others suggest these investors may be preparing for more complex strategies involving futures or options.

Nevertheless, this case reinforces Bitcoin’s reputation as a long-term store of value. The whale’s decision to hold for nearly a decade shows how the asset has outperformed traditional stores of wealth like gold and the US dollar.

Moreover, the top crypto’s recent integration into traditional finance—bolstered by the launch of a spot Bitcoin ETF and plans for a US Strategic Bitcoin Reserve—only strengthens that narrative.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report | Immortal Rising 2 Project Overview & IMT Market Analysis

Analysts Say Ethereum Struggles as Competition Intensifies: FT

Ethereum’s fading dominance in decentralized finance is testing its place in a changing crypto market.

Meme Coin Comeback? TRUMP Bounces 11% – What This Could Mean for the Entire Market

BlackRock Expands BUIDL Fund to Include Solana (SOL)

BlackRock’s expansion of its tokenized money market fund, BUIDL, to Solana comes amid a growing integration of blockchain technology in traditional finance. For BlackRock, it aims to leverage Solana’s speed and scalability.