Strategy Eyes Further Bitcoin Purchases After Recent Stock Offering, Signals Potential BTC Acquisition

-

Strategy has paused its Bitcoin purchases briefly, but whispers of an impending acquisition circulate among crypto enthusiasts after a significant capital raise.

-

Recent capital-raising efforts through preferred stock highlights Michael Saylor’s ongoing commitment to increasing the company’s Bitcoin holdings, fueling speculation on future purchases.

-

Saylor’s recent quote, “Gold still underperforms the SP Index by a factor of two or more,” underscores his firm belief in Bitcoin as a superior investment commodity.

Michael Saylor hints at new Bitcoin acquisitions following substantial capital raise; the executive advocates for US government investment in cryptocurrency.

Strategy’s Tactical Resumption of Bitcoin Purchases

Following a 12-week consecutive buying streak, Strategy’s recent pause in Bitcoin purchases has garnered attention within the cryptocurrency community. Co-founder Michael Saylor recently indicated that further acquisitions are on the horizon, especially after the company successfully raised approximately $711 million through its latest preferred stock offering. This capital is expected to bolster Strategy’s already significant Bitcoin portfolio, presently standing at 499,226 BTC.

Notably, on March 17, Strategy executed a smaller acquisition of 130 BTC valued at around $10.7 million. This acquisition marked a shift in buying strategy, as it followed a two-week hiatus. The company’s ongoing strategy appears focused on leveraging favorable market conditions to accumulate Bitcoin, especially given Saylor’s recent social media post hinting at the next buy right when the traditional markets reopen.

The Financial Implications of Strategy’s Stock Offering

The recent preferred stock offering, priced at $85 per share and featuring a 10% coupon, presents a substantial financial strategy for Strategy. Designed to enhance liquidity, this move is poised to support the company’s ongoing investments in Bitcoin and diversify its financial base. According to analysts, this capital infusion is critical for maintaining the momentum needed to pursue substantial Bitcoin holdings while managing market volatility.

Saylor Advocates for Government Involvement in Bitcoin

In a bold proposal, Saylor articulated that the US government should aim to acquire 25% of Bitcoin’s total supply by 2035. This ambitious target would coincide with the near-completion of Bitcoin’s mining cycle, offering the government a strategic opportunity to secure this digital asset as the supply becomes increasingly limited. Saylor’s call for a comprehensive framework for digital assets, highlighted in his proposal titled, A Digital Assets Strategy to Dominate the 21st Century Global Economy, reflects a push for regulatory clarity and support for the burgeoning cryptocurrency market.

Significance of Saylor’s 21 Truths of Bitcoin Speech

At a recent industry summit, Saylor delivered a thought-provoking speech entitled 21 Truths of Bitcoin, where he underscored Bitcoin’s resilience and potential outperformance against traditional commodities. His statement on Bitcoin being “the only commodity in the history of the human race that was not a garbage investment” resonates with the growing institutional interest in crypto as a viable asset class. Despite prevailing market fluctuations, Strategy’s position remains robust, with over $9.3 billion in unrealized gains from its Bitcoin investments — a testament to the strategic foresight of Saylor and his team.

Conclusion

As the cryptocurrency landscape evolves, Michael Saylor’s leadership at Strategy marks a significant chapter in Bitcoin’s adoption narrative. The company’s recent capital raise and hints at upcoming acquisitions position it advantageously amidst market dynamics. Observers will be keen to follow how Strategy navigates these changes and Saylor’s call for increased governmental involvement, both of which could shape the future trajectory of Bitcoin adoption across corporate and public sectors alike.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

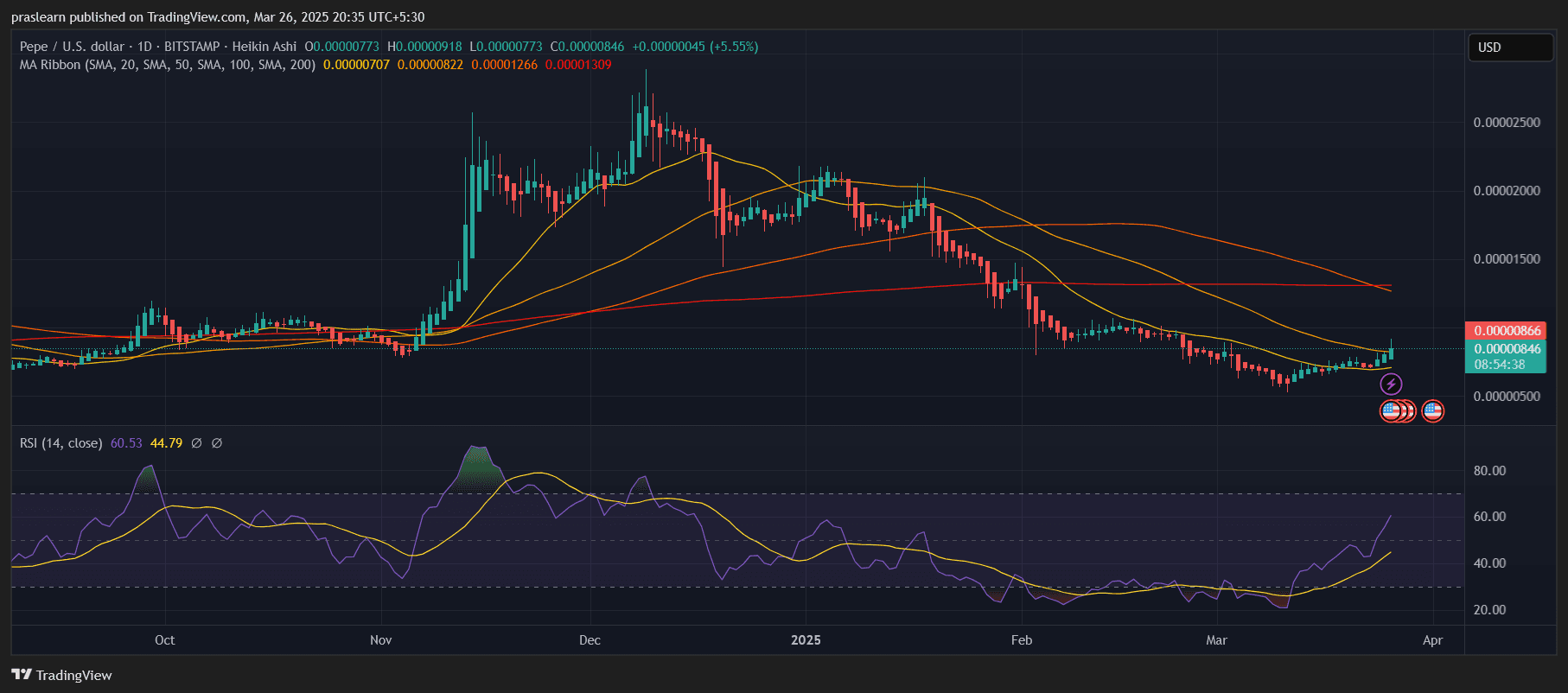

PEPE Price Prediction: Massive PEPE Breakout Incoming?

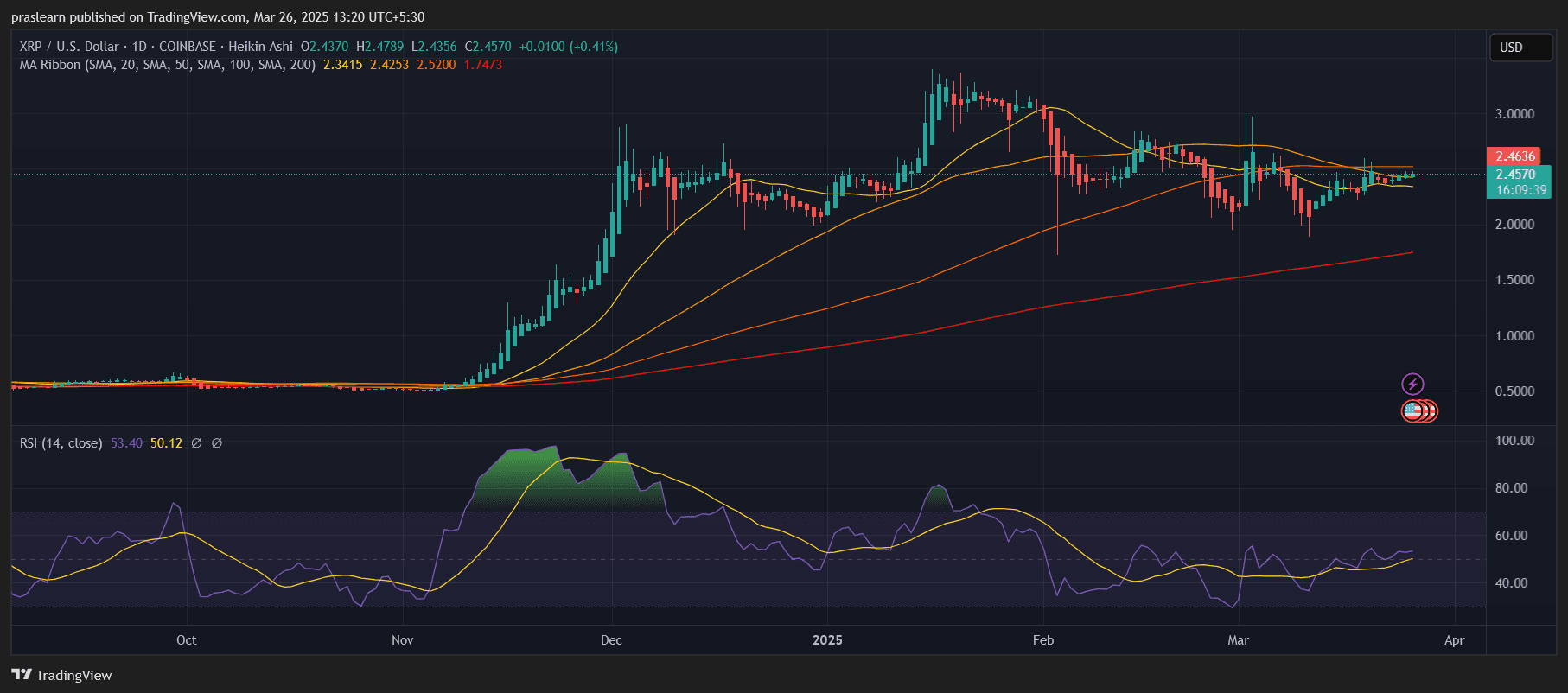

XRP News Today: XRP Gearing Up for a Big Pump?

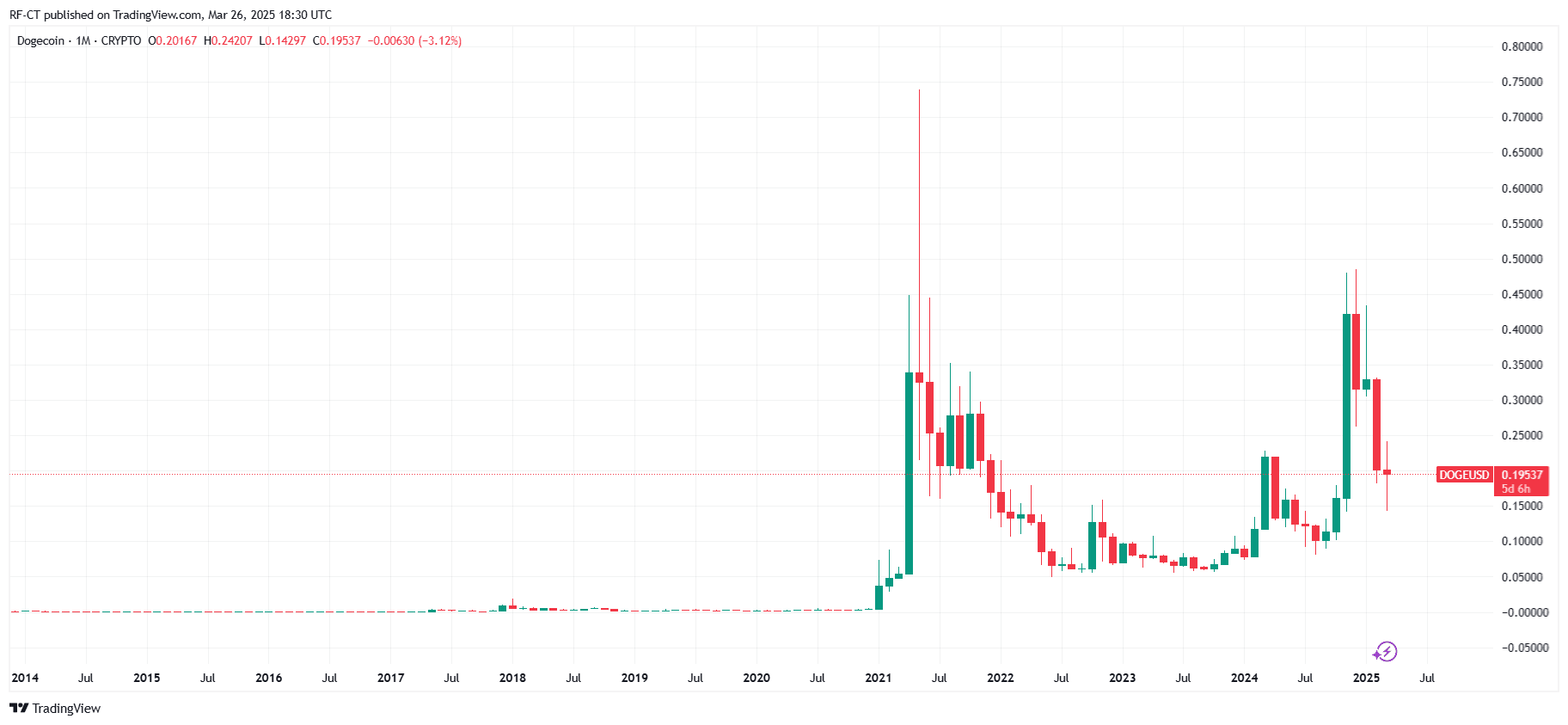

Can Dogecoin Price Hit $1 and Be the Surprise Winner of 2025?

Is Cardano About to Break Out? 3 Reasons ADA Could Hit New Highs Soon