Crypto Fear & Greed Index: Market Sentiment Inches Away From Extreme Fear – Should You Be Worried?

Navigating the volatile world of cryptocurrency requires more than just technical charts and market caps. Understanding market sentiment is crucial, and the Crypto Fear & Greed Index serves as a vital tool for gauging the emotional temperature of the crypto market. Let’s dive into the latest reading and what it signifies for your crypto investments.

Crypto Fear and Greed Index: A Glimmer of Hope or Still in the Fear Zone?

As of March 22nd, the Crypto Fear & Greed Index , a widely tracked metric by Alternative.me , registered a score of 32. This marks a slight uptick of one point from the previous day. While any improvement is welcome, it’s important to note that the index remains firmly entrenched in the “Fear” zone. This indicates that market participants are still exhibiting significant anxiety and caution in the cryptocurrency space.

Decoding the Crypto Sentiment: What Does ‘Fear’ Really Mean?

The Fear and Greed Index is not just a random number; it’s a composite score designed to reflect the overall sentiment of the cryptocurrency market. It operates on a scale of 0 to 100:

- 0-24: Extreme Fear – Suggests investors are extremely worried, potentially indicating a market bottom or oversold conditions.

- 25-49: Fear – Indicates caution and risk aversion among investors, often seen during market corrections or uncertainty.

- 50-74: Greed – Points to increasing optimism and potential for market growth, but also carries the risk of overvaluation.

- 75-100: Extreme Greed – Signals excessive optimism and a potential market bubble, often preceding corrections.

Currently, with the index at 32, we are still in the ‘Fear’ territory. This implies that while there might be some positive momentum pushing the index up slightly, the overarching feeling in the crypto market is still one of apprehension. Investors are likely hesitant to make bold moves and are prioritizing risk management.

Unpacking the Factors: How is the Bitcoin Fear Index Calculated?

To provide a holistic view of market sentiment, the Bitcoin fear index (which is used as a proxy for the broader crypto market sentiment) considers a range of diverse factors, each contributing a specific weightage to the final score. These factors are:

- Volatility (25%): Measures the current volatility and maximum drawdowns of Bitcoin, comparing it with the 30-day and 90-day averages. Unusually high volatility can indicate fear in the market.

- Market Momentum/Volume (25%): Examines Bitcoin’s market momentum and trading volume compared to recent averages. High buying volume suggests greed, while low volume can signal fear.

- Social Media (15%): Analyzes sentiment on social media platforms, particularly Twitter and Reddit, to gauge public opinion on Bitcoin and the crypto market.

- Surveys (15%): Conducts weekly crypto polls to understand investor sentiment directly. This provides a snapshot of how traders and investors are feeling.

- Bitcoin Dominance (10%): Tracks Bitcoin’s dominance in the overall crypto market. Increased dominance can sometimes indicate a flight to safety during fearful times, while decreasing dominance might suggest a higher risk appetite.

- Google Trends (10%): Analyzes Google Trends data for Bitcoin-related search queries. Spikes in searches like “Bitcoin price manipulation” or “Bitcoin crash” can indicate fear.

Cryptocurrency Market Sentiment: Why Does It Matter to You?

Understanding cryptocurrency market sentiment , as reflected by the Fear & Greed Index, can offer valuable insights for both short-term traders and long-term investors. Here’s why it’s important:

- Identifying Potential Buying Opportunities: Extreme Fear levels can sometimes present buying opportunities. When everyone is fearful, assets can become undervalued, potentially setting the stage for future price appreciation.

- Recognizing Potential Selling Opportunities: Conversely, Extreme Greed levels might signal an overheated market. Recognizing this can help investors take profits and reduce risk before potential corrections.

- Gauging Market Mood: The index provides a quick snapshot of the prevailing market mood, helping you understand the overall psychology driving price movements.

- Informed Decision Making: By incorporating sentiment analysis into your strategy, you can make more informed trading and investment decisions, rather than solely relying on technical or fundamental analysis.

Navigating Fear: Challenges and Considerations

While the Fear and Greed Index is a helpful tool, it’s essential to remember its limitations:

- Not a Crystal Ball: The index is not a foolproof predictor of market movements. It reflects sentiment, which can be volatile and influenced by unforeseen events.

- Lagging Indicator: Sentiment can sometimes lag behind actual market changes. It’s crucial to use it in conjunction with other indicators and analysis methods.

- Oversimplification: Reducing complex market emotions to a single number can be an oversimplification. Deeper analysis of the underlying factors is always recommended.

- Market Manipulation: Sentiment itself can be manipulated, particularly in the crypto market. Be wary of relying solely on sentiment-based indicators.

Actionable Insights: How to Use the Fear & Greed Index

So, how can you effectively use the Fear and Greed Index in your crypto strategy?

- Combine with Technical Analysis: Use the index to confirm signals from technical indicators. For instance, if technical analysis suggests a potential bottom, and the index is in ‘Extreme Fear,’ it might strengthen the buy signal.

- Consider Dollar-Cost Averaging (DCA): During periods of ‘Fear’ or ‘Extreme Fear,’ consider employing DCA to gradually build your positions, potentially benefiting from lower prices.

- Manage Risk: In ‘Greed’ or ‘Extreme Greed’ zones, consider taking profits, tightening stop-loss orders, or reducing your overall portfolio risk.

- Stay Informed: Regularly monitor the index and understand the factors driving sentiment changes. This will help you contextualize the index readings and make more informed decisions.

Conclusion: Cautious Optimism or Lingering Doubt?

The slight rise in the Crypto Fear & Greed Index to 32 offers a sliver of hope, suggesting that the extreme pessimism may be easing slightly. However, the market remains in the ‘Fear’ zone, indicating that significant caution is still warranted. As an investor, staying informed, understanding market sentiment, and using tools like the Fear & Greed Index can empower you to navigate the crypto landscape more effectively. Remember to combine sentiment analysis with your own research and risk management strategies for informed and balanced decision-making in this exciting yet unpredictable market.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Solana Skyrocket if Fidelity Files an ETF?

Ether’s supply shock is coming?

U.S. Spot Bitcoin ETFs Buy $750M in BTC This Week

U.S. Spot Bitcoin ETFs purchased nearly $750M in BTC this week, signaling strong institutional confidence.Institutional Investors Are Doubling DownWhy Are ETFs Buying So Much BTC?What This Means for Bitcoin’s Price

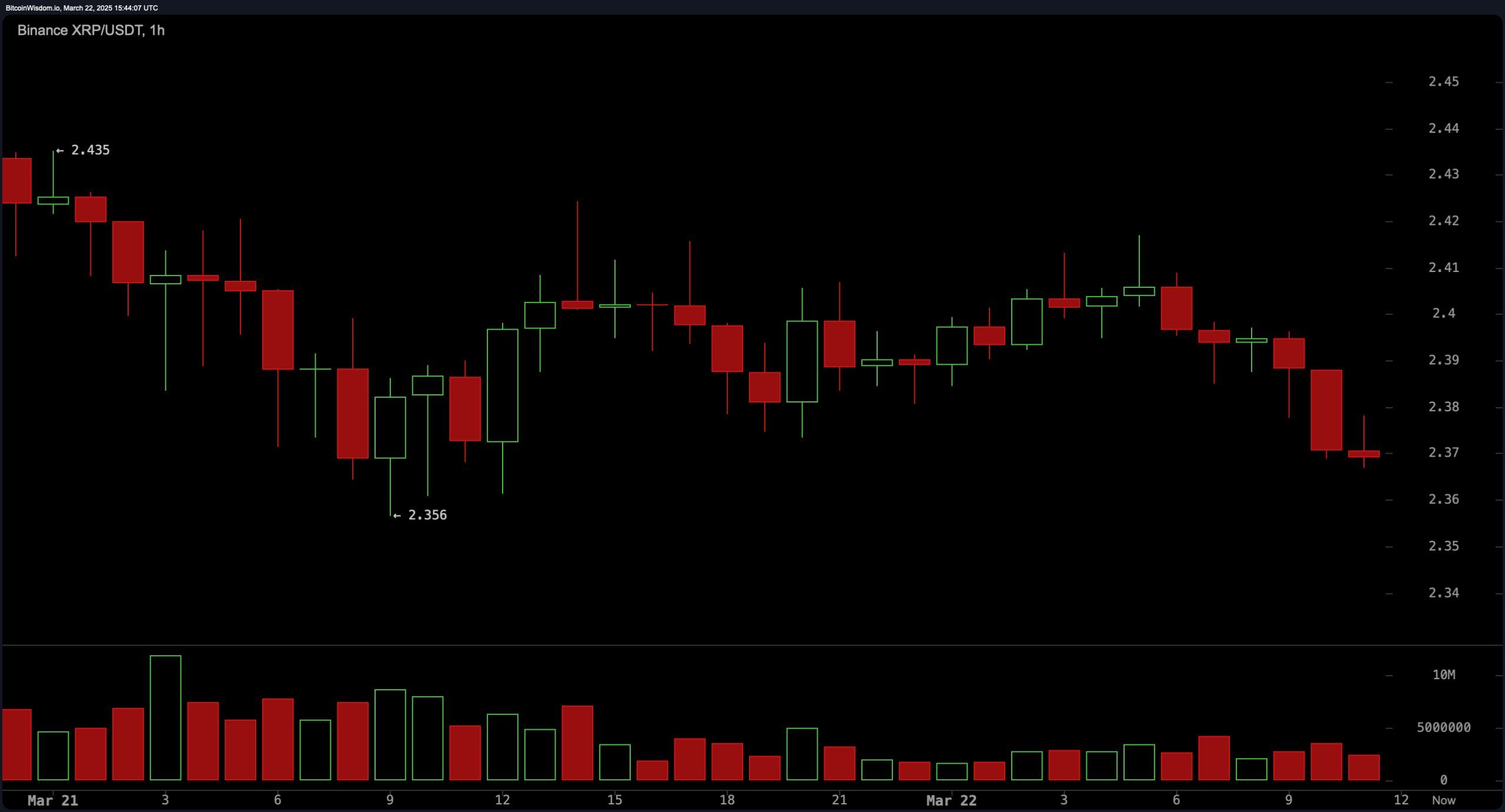

XRP Price Update: XRP Teeters on $2.35 Support—Next Move Critical