Michael Saylor’s Strategy will settle the sale of its 8.5 million shares of 10% Series A Perpetual Strife Preferred Stock offering to fund its Bitcoin purchases.

The company is expected to earn a little over $711 million in net proceeds after deducting underwriting costs, which is slightly higher than its initial expectation of $500 million.

The firm revealed that it will offer the preferred stock at a public offering price of $85.00 per share.

Strategy expects about $711 million from its stock sale

The preferred stock will also accrue cumulative dividends at a fixed annual rate of 10% on the stated value of $100 per share, with payments made quarterly beginning June 30, 2025. However, if Strategy fails to pay the dividends on time, compounded dividends will pile up at a starting rate of 11%, increasing by 1% each quarter, up to 18% per year.

Meanwhile, the company is expected to finalize its share sales on March 25 and earn roughly $711.2 million in net proceeds. Strategy even claimed it would use its sales gains for general corporate purposes, such as buying Bitcoin and for working capital.

The company will still have the right to redeem all of its perpetual strife preferred stock anytime for cash if outstanding shares are less than 25% of the originally issued shares or if specific tax-related events occur. However, if an event brings about “fundamental change”, the perpetual strife stock offering holders can have Strategy repurchase some or even all of the shares.

See also Bitwise urges Strategy to lend Bitcoin to strengthen revenue and reduce liquidity risk

Moreover, the liquidation preference for Perpetual Strife Preferred Stock will start at $100 a share. Nevertheless, the amount will adjust daily at the close of business after issuance. Morgan Stanley, Barclays, Citigroup, Moelis Company, Cantor Fitzgerald, Keefe, Bruyette Woods, Mizuho Securities, and SG Americas Securities will serve as joint book-running managers.

AmeriVet Securities, Bancroft Capital, BTIG, and The Benchmark Company will act as co-managers for the offering.

Strategy’s BTC holdings are close to reaching 500,000

Strategy has actively been buying Bitcoin since 2020. The company even commented, “We strategically accumulate Bitcoin and advocate for its role as digital capital.”

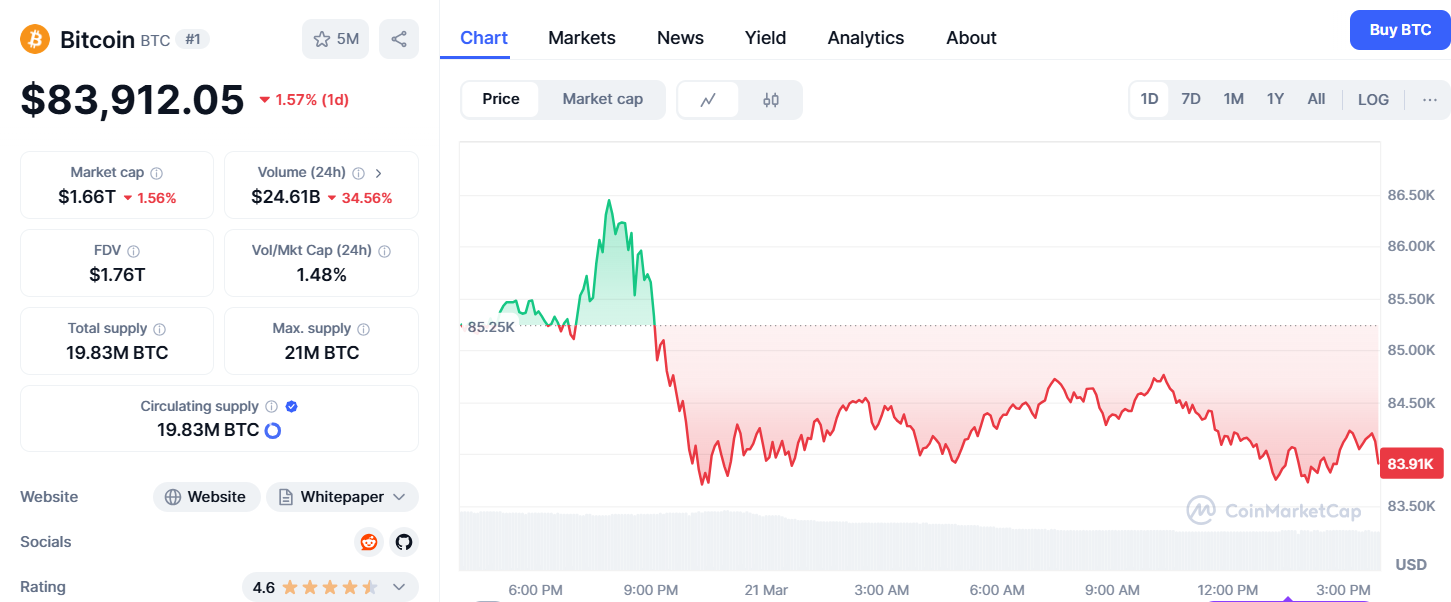

Just recently, the firm bought 130 BTC for about $10.7 million at roughly $82,981 per Bitcoin using funds it had received from a previous stock sale of “STRK ATM.” By March 21, Strategy and its subsidiaries held 499,226 BTC at an average price of $66,360 per Bitcoin.

Strategy still needs to acquire 774 BTC to reach a total holding of 500,000 BTC.