Proof of Staking Liquidity: The Missing Link in Staking

Bridging Liquidity, Governance, and Sustainability in BTCFi 2.0

The staking and DeFi landscape is at a crossroads. While protocols promise growth, most struggle with fragmented liquidity, unsustainable rewards, and misaligned incentives—problems that stifle Bitcoin’s $1 trillion potential in decentralized finance.

Bedrock reimagines this paradigm with Proof of Staking Liquidity (PoSL), a groundbreaking framework powered by its dual-token model: BR and veBR. Together, they forge a self-sustaining ecosystem where liquidity providers, governance participants, and long-term stakeholders thrive in unison.

Why Does PoSL Change the Game? The PoSL Flywheel

Traditional staking models prioritize short-term gains over ecosystem health. Bedrock’s PoSL flips this script.

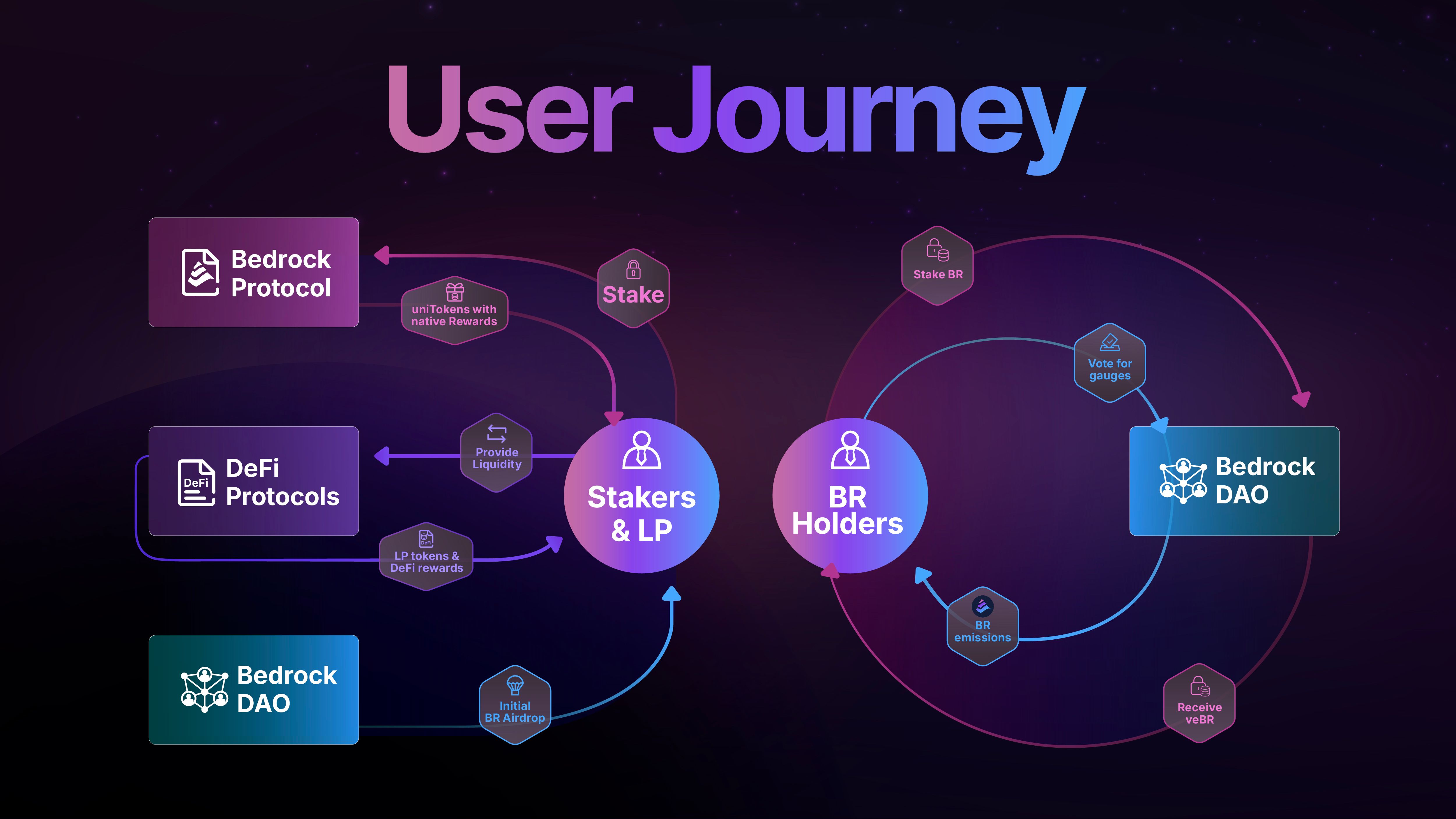

At the heart of Bedrock’s Proof of Staking Liquidity (PoSL) lies a self-sustaining flywheel that continuously drives growth, liquidity, and value creation throughout the ecosystem. The cycle begins when users stake their assets into the protocol, earning BR tokens as rewards. This staking activity enhances liquidity within the Bedrock ecosystem, ensuring efficient capital flow and enabling deeper participation across multiple chains. As liquidity providers and stakers earn BR, they are motivated to engage more actively with the protocol, which in turn strengthens the liquidity base even further.

-

Stake to Earn BR

Users deposit assets to secure the network, earning BR tokens—Bedrock’s governance and utility backbone. Staking amplifies liquidity, enabling seamless cross-chain transactions. -

Convert BR → veBR for Power

Lock BR to mint veBR, a non-transferable governance key. This "skin-in-the-game" mechanism:-

Reduces BR supply, driving scarcity.

-

Grants voting rights on emissions, upgrades, and treasury decisions.

-

-

Revenue Fuels Buybacks

Protocol fees fund BR buybacks (governed by veBR holders), creating upward price pressure. As BR appreciates, demand surges—accelerating staking, governance participation, and ecosystem liquidity.

A self-reinforcing loop where growth brings deeper liquidity, stronger governance, and higher token value.

Two Tokens, One Powerful Ecosystem

The dual-token model of BR and veBR powers Bedrock’s Proof of Staking Liquidity (PoSL) system, balancing liquidity with governance and sustainable rewards.

BR: Bedrock’s Governance Token

BR is the core utility token of Bedrock, designed to fuel incentives, governance participation, and liquidity provisioning. Here’s what it offers:

-

Ecosystem Participation

Distributed to participants who contribute to Bedrock’s growth—such as liquidity providers and stakers—BR enables ongoing engagement and activity within the ecosystem. -

Tradable and Liquid

BR is a freely tradable asset integrated into DeFi protocols for lending, borrowing, and liquidity pools. -

Conversion to veBR for Governance

Users can commit BR to acquire veBR, gaining governance power and enhanced rewards.

veBR: Vote-Escrowed BR for Governance and Enhanced Rewards

veBR represents the vote-escrowed version of BR and is central to Bedrock’s PoSL governance and reward system. Users obtain veBR by converting their BR tokens for a specified period, signaling their long-term commitment to the protocol. veBR is non-transferable and designed to incentivize governance participation and sustainable ecosystem growth.

To bring this vision to life, Bedrock is partnering with Aragon, one of the most established DAO frameworks, known for its work with leading protocols like Curve and Mode. This collaboration ensures that Bedrock’s governance is robust, transparent, and designed for long-term sustainability.

-

Governance Participation: veBR holders can propose and vote on key decisions, including protocol upgrades, BR emissions, validator selection, and treasury management.

-

Boosted Rewards: Holding veBR boosts staking yields and enhances reward allocations, providing additional incentives for long-term participants.

-

Seasonal Voting Power: veBR voting influence operates in governance seasons, ensuring fair and dynamic participation. Voting power resets each season, encouraging ongoing activity and preventing voter fatigue.

Together, BR and veBR create a self-sustaining cycle of liquidity, governance, and incentives—pioneering a new standard for BTCFi and multichain decentralized finance.

Join the PoSL Revolution

PoSL isn’t just another staking model—it’s Bitcoin’s gateway to BTFCI 2.0 and the broader decentralized ecosystem. Whether you’re a liquidity provider chasing sustainable yields, a governance maximalist shaping protocol futures, or a Bitcoin holder seeking multichain utility—Bedrock’s dual-token ecosystem offers a seat at the table.

About BedrockDAO

Bedrock DAO is the decentralized community at the core of the Bedrock ecosystem. Built on the principles of transparency, collaboration, and long-term alignment, the DAO empowers veBR holders to participate in the collective decision-making process that shapes Bedrock’s future.

By joining Bedrock DAO, participants become part of a global movement redefining Bitcoin’s role in DeFi through Proof of Staking Liquidity (PoSL)—unlocking new opportunities for sustainable growth and innovation across the multichain ecosystem.

About Bedrock

Bedrock is the first multi-asset liquid restaking protocol, pioneering Bitcoin staking with uniBTC. As the leading BTC liquid staking token, uniBTC enables holders to earn rewards while maintaining liquidity, unlocking new yield opportunities in Bitcoin’s $1T market. With a cutting-edge approach to BTCFi 2.0, Bedrock is redefining Bitcoin’s role in DeFi—while integrating ETH and DePIN assets into a unified PoSL framework.

Official Links

Website | App | Documentation | Blog | X (Twitter) | Discord | Telegram

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Significant Outflows Hit Bitcoin Spot ETFs

31,000 BTC Options Expire Amid $105,000 Max Pain Point

Crypto Market Faces $384 Million Liquidation Hit

Maple Finance Deploys Yield-Bearing Stablecoin on Solana