Cardano’s Supply Tightens as Whales Buy 190 Million ADA in 24 Hours – What Next?

Whale activity and a negative NPL suggest tightening supply and reduced selling pressure for ADA, setting the stage for a possible price increase.

Cardano has noted significant whale activity over the past 24 hours, aligning with the broader market recovery. During that period, the total crypto market capitalization has added another $50 billion, signaling renewed bullish momentum.

As bullish pressure strengthens, ADA appears poised to re-commence an upward trend.

Cardano Sees Heavy Whale Accumulation

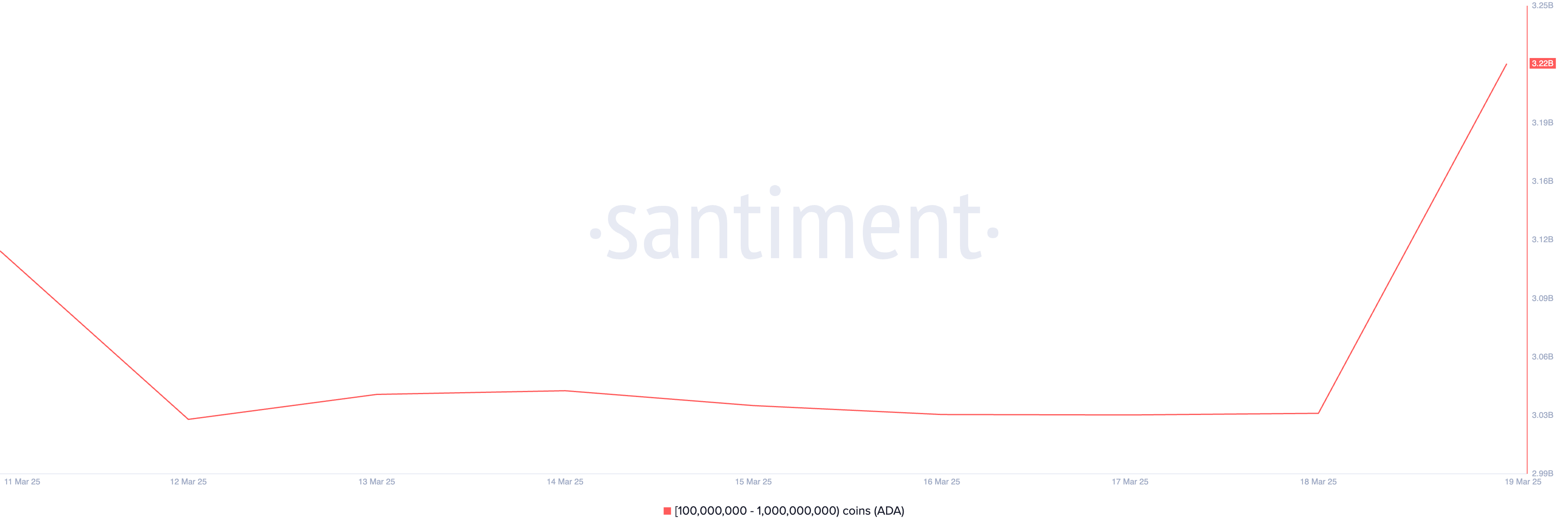

On-chain data shows that Cardano whales, holding between 100 million and 1 billion coins, have acquired 190 million ADA in the past 24 hours. This cohort of large ADA investors currently holds 3.22 billion coins.

ADA Supply Distribution. Source:

Santiment

ADA Supply Distribution. Source:

Santiment

When whales increase their coin holdings, it signals strong confidence in the asset’s future price potential.

Large-scale accumulation like this would reduce ADA’s available supply in the market, which can drive up its price if demand remains steady. The trend indicates a bullish outlook, as whales typically buy in anticipation of higher prices.

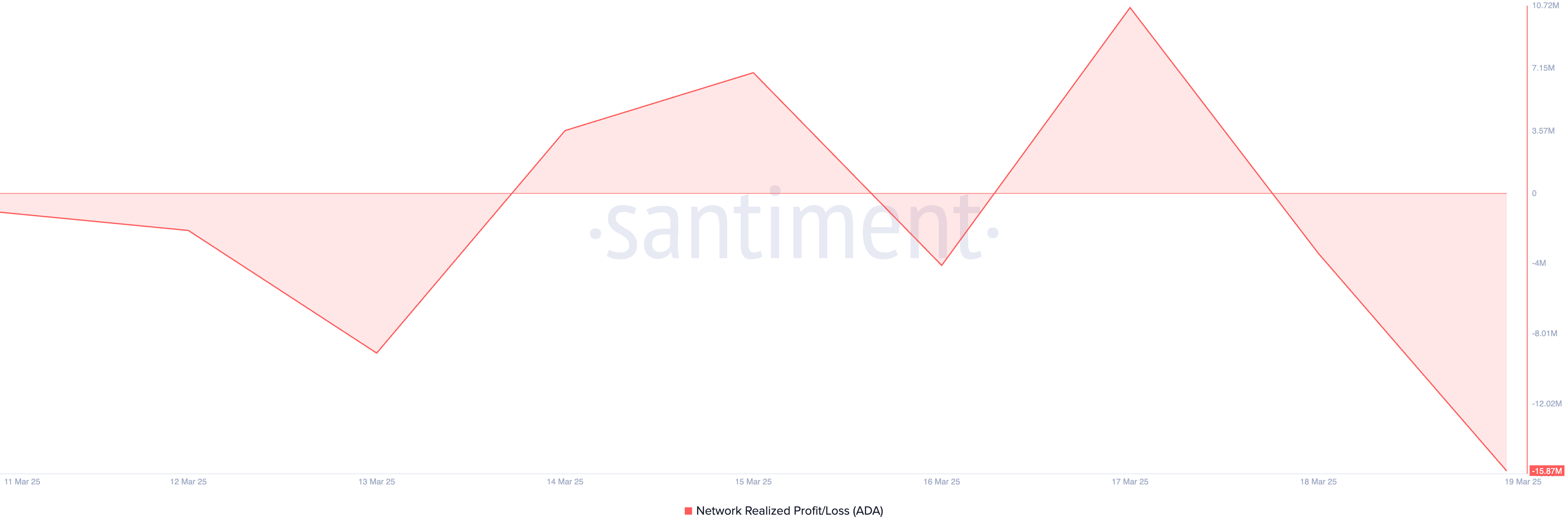

ADA’s Network Realized Profit/Loss (NPL) further supports this bullish outlook. At press time, it stands at -15.87 million.

ADA NPL. Source:

Santiment

ADA NPL. Source:

Santiment

This metric measures the net profit or loss of all coins moved on the blockchain depending on their acquisition cost. When an asset’s NPL is negative, many investors are holding at a loss.

This situation is known to reduce the selling pressure in the market, as traders may choose to hold their assets instead of realizing losses, which could support a potential price rebound.

The steady dip in ADA’s NPL indicates that many holders are sitting on unrealized losses. To avoid selling at a loss, they may choose to hold onto their investments, reducing selling pressure. The increased holding time could, in turn, drive up ADA’s price as supply tightens in the market.

ADA’s Buying Pressure Increases—Will It Fuel a Price Breakout?

At press time, ADA trades at $0.72. On the daily chart, the coin’s Chaikin Money Flow (CMF) is in an uptrend and poised to cross above the zero line, highlighting the rise in buying pressure.

The indicator measures fund flows into and out of an asset. When it attempts to break above the zero line, it signals a potential shift from selling pressure to buying pressure.

If the breakout is sustained, it would confirm strengthening bullish momentum in the ADA market and hint at a potential price uptrend. In this case, the coin’s price could rally toward $0.82.

ADA Price Analysis. Source:

TradingView

ADA Price Analysis. Source:

TradingView

However, if selloffs intensify, this bullish projection will be invalidated. In that scenario, ADA’s price could fall to $0.60.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Etoro Files for IPO With Tripled Revenue, 96% From Crypto Trading

Bitcoin flips ‘macro bullish’ amid first Hash Ribbon buy signal in 8 months

ETH price to $1.2K? Ethereum's PoS ‘deflation’ ends with fees at all-time lows

Abracadabra.Money’s GMX pools hacked, $13M lost