Bitcoin Climbs Above $84K as Investors Brace for Fed’s Next Move

Bitcoin ( BTC) climbed 3.49% over the past 24 hours, reaching $84,191.67 at the time of reporting, according to Coinmarketcap. Despite this daily increase, the top cryptocurrency is up only 1.20% over the past seven days as market uncertainty lingers ahead of the Federal Open Market Committee (FOMC) meeting conclusion today.

( BTC price / Trading View)

- 24-hour price range: $81,179.99 to $84,303.97

- 24-hour trading volume: $24.29 billion, reflecting a slight increase of 0.83%

- Market capitalization: $1.67 trillion, down 3.54% from yesterday

- BTC dominance: 61.20%, down 0.45% over the past 24 hours

- Total BTC futures open interest: $49.71 billion, down 2.43%

- 24-hour bitcoin liquidations: $38.34 million (long liquidations: $9.89 million; short liquidations: $28.45 million). The liquidation data indicates that bearish traders faced greater losses, as BTC’s upward price movement went against short sellers’ bets.

Investors are keenly watching the conclusion of the FOMC meeting, with an official statement expected at 2 p.m. ET today, followed by Federal Reserve Chairman Jerome Powell’s press conference at 2:30 p.m. While markets widely anticipate that interest rates will remain unchanged, the Fed’s economic outlook could influence risk assets, including bitcoin.

The combination of steady rates and a less hawkish outlook from the central bank could provide a bullish catalyst for BTC. However, any signals of prolonged high rates or economic uncertainty may trigger renewed selling pressure.

With BTC showing resilience above $84,000, traders will closely monitor Powell’s remarks and broader macroeconomic conditions. If sentiment remains favorable, BTC could attempt a move toward recent resistance levels above $85,000. Conversely, any hawkish rhetoric from the Fed could result in a pullback below $82,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

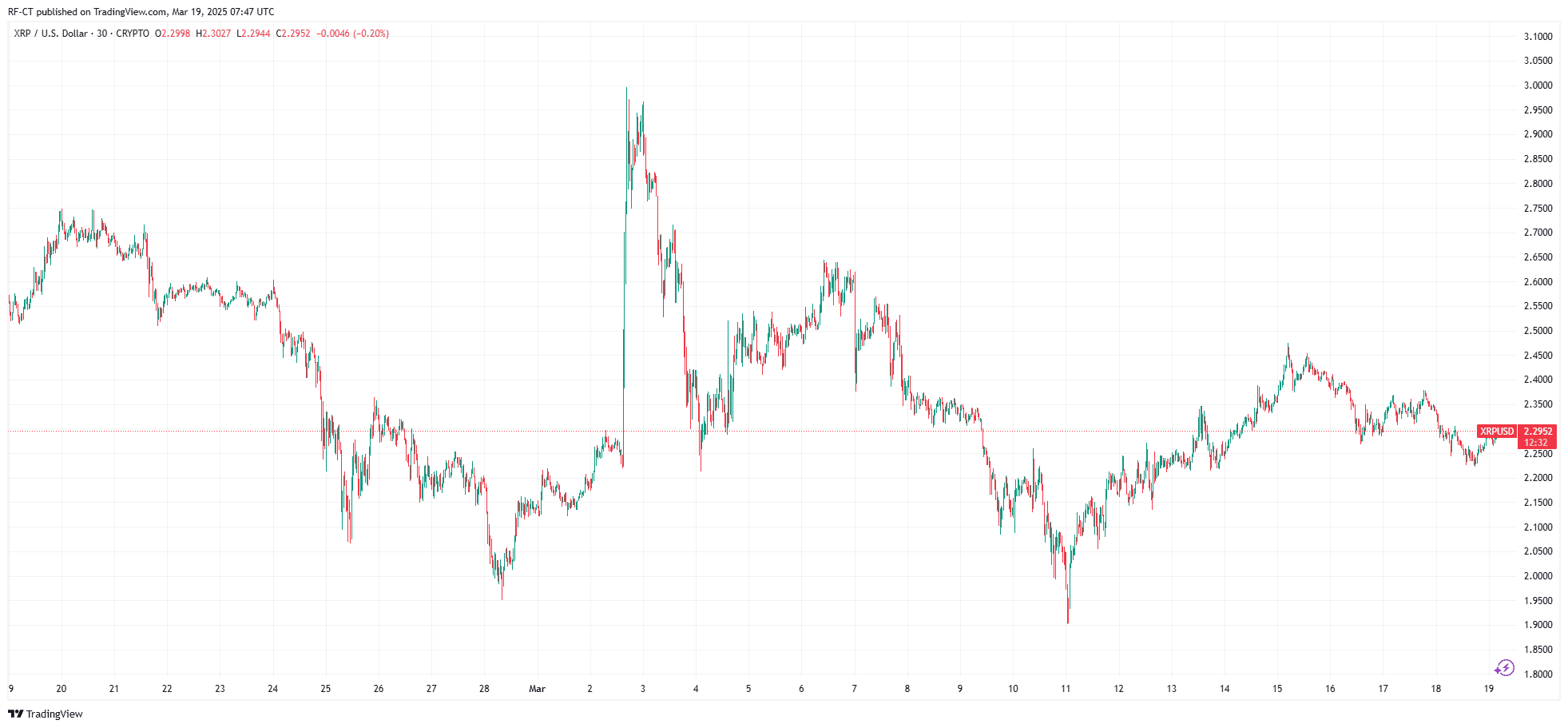

XRP Price Prediction: Can XRP Price Reach $10 after FOMC Meeting?

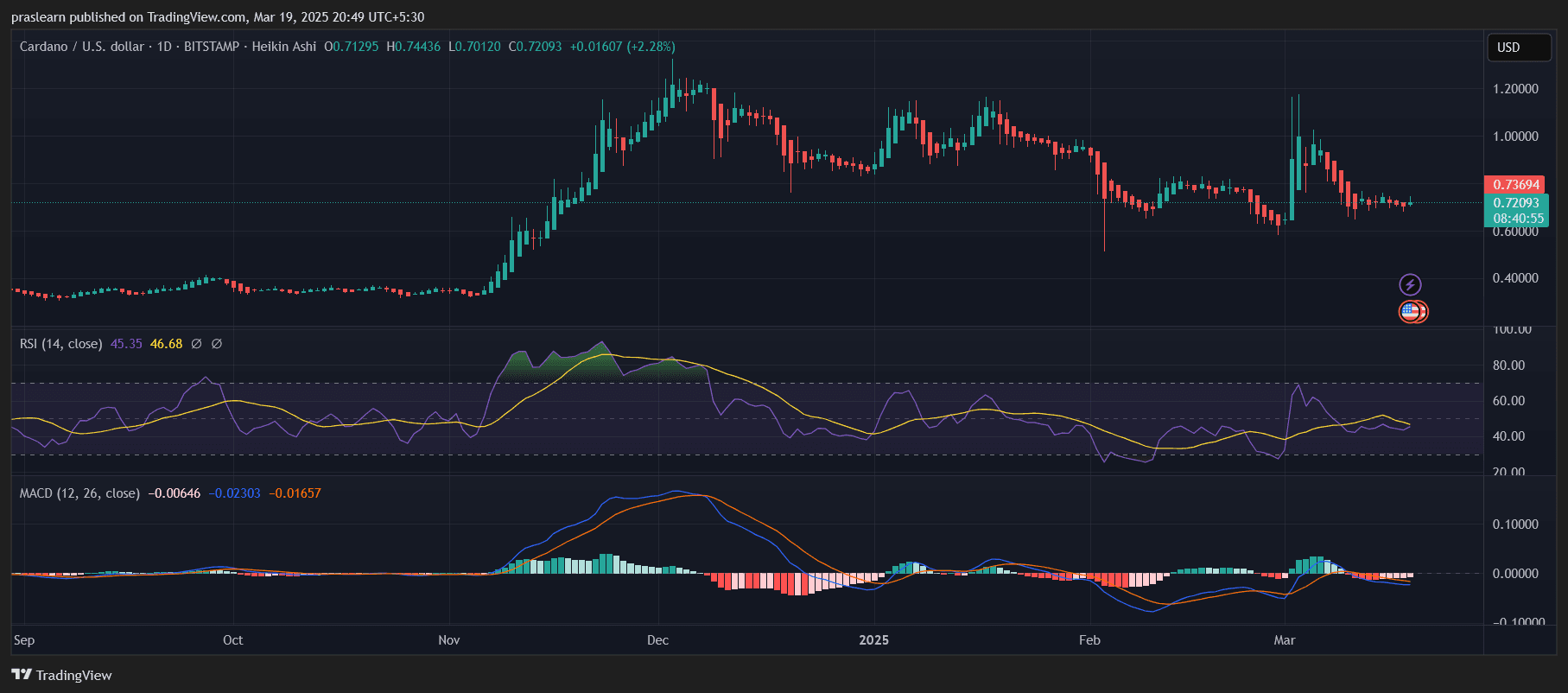

Can Cardano Price Reach $100?

Kadena (KDA) Holds Key Support – Can the Double Bottom Pattern Spark a Recovery?

XRP Pumps as SEC Drops Ripple Lawsuit – Key MA Resistance Holds the Key to Uptrend