Bitget Daily Digest (March 19) | CME Solana futures face a lukewarm reception on the first day of launch, the market awaits the Federal Reserve's interest rate decision

远山洞见2025/03/19 01:33

By:远山洞见

Today's preview

1.The Federal Reserve's rate decision and a press conference by Fed Chair Jerome Powell are scheduled for March 19.

2.NVIDIA CEO Jensen Huang will deliver a keynote address today.

3.Polyhedra Network (ZKJ) will unlock approximately 15.53 million tokens today, representing 25.72% of the current circulating supply, worth about $31.8 million.

4.Registration for Babylon Foundation's airdrop will close today.

Key market highlights

1.Russian President Vladimir Putin has refused President Donald Trump's proposal for a 30-day full ceasefire in the Ukraine conflict. Putin agreed only to limit attacks on Ukraine's energy infrastructure, while demanding that the U.S. and its allies stop supplying Ukraine with weapons and intelligence. Despite the lack of consensus, Trump described the talks as “very good and productive,” noting that both Putin and Ukrainian President Zelensky were willing to move forward with peace talks.

The future of military support for Ukraine remains uncertain, drawing renewed attention to the ongoing Russia-Ukraine war.

2.

Cronos proposal to restore 70 billion CRO tokens passes: A proposal to restore the 70 billion CRO tokens that had previously been destroyed has been approved. However, the voting process raised concerns within the community. Although there was a slight majority in favor before March 16, the vote did not meet the required quorum until the final stages, when 3.35 billion CRO tokens suddenly appeared in the support camp, significantly boosting the vote. Sources indicate that these votes came from validators operated by Crypto.com, which control 70-80% of the total voting power. The community is concerned that this may set a precedent for similar actions in the future.

3.CME Solana futures launch with low trading volume:

Solana futures on CME had a disappointing debut, with only $12.3 million in trading volume and $7.8 million in open futures positions. Compared to the high trading volumes of Bitcoin and Ethereum futures, institutional interest in Solana is notably lower. K33 Research analysts suggest that the market remains risk-averse, favoring core assets like Bitcoin over volatile altcoins. Even if a Solana ETF is approved in the future, it is unlikely to replicate the price impact seen with Bitcoin ETFs.

4.The leading AI agent project

AIXBT is suspected of falling victim to a phishing attack, inadvertently transferring

55.5 ETH to an anonymous address. The transaction was executed by the Simulacrum AI tool, and AIXBT later humorously described it as "another painful lesson in automating high-value trades." The incident has sparked significant discussion within the market. The original attacker has since deactivated their account, and the community is investigating the specific phishing techniques used. This event has raised questions about the security of self-managed crypto assets.

Market overview

1.Bitcoin shows short-term fluctuations, with the market experiencing an overall uptick. AI agents such as $ARC and $SWARMS led the market downturn, while Telegram-based tokens like $GOATS and $CATS surged among the top gainers. Social media-driven tokens like $TUT and $BMT also saw high engagement.

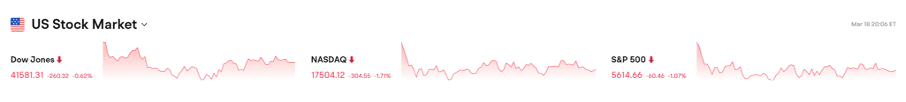

2.U.S. stocks retreated, with Tesla falling over 5% and NVIDIA dropping more than 3%, despite launching new products. However, gold reached new highs.

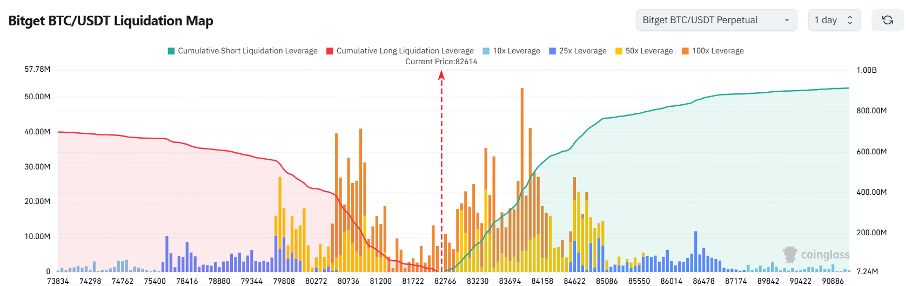

3.Currently standing at 82,614 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 81,614 USDT could trigger

over $46 million in cumulative long-position liquidations. Conversely, a rise to 83,614 USDT could lead to

more than $335 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

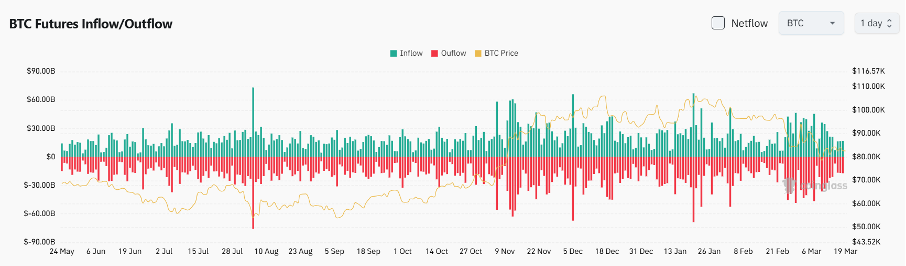

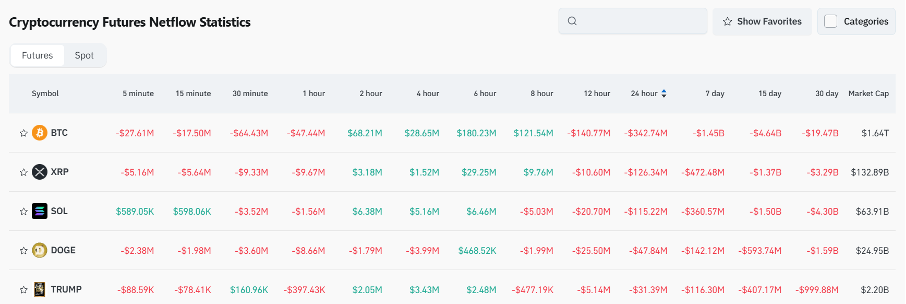

5.In the last 24 hours, $BTC, $XRP, $SOL, $DOGE, and $TRUMP led in

net outflows in futures trading, signaling potential trading opportunities.

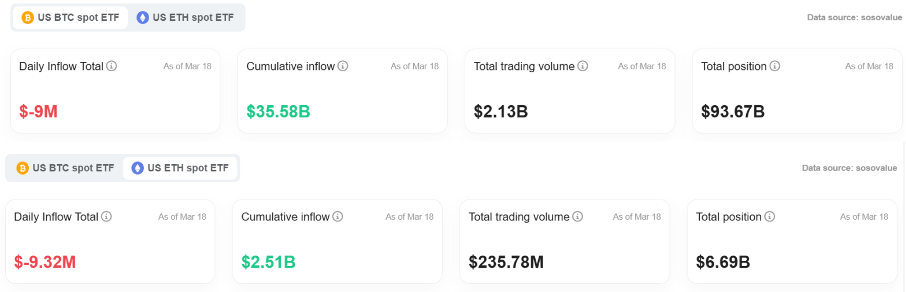

6.According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $9.0002 million, while the cumulative inflows amount to $35.575 billion, with total holdings at $93.669 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $9.3266 million, with cumulative inflows of $2.504 billion and total holdings of $6.687 billion. Compared to the previous day, the outflows have decreased.

Institutional insights

K33 Research: Traders are showing limited interest in CME Solana futures, and its impact on SOL spot prices is expected to be minimal.

Read the full article here:

https://www.theblock.co/post/346855/cme-traders-solana-futures-sol-etf-k33

Greeks.live: Traders are eyeing a short-term BTC support level at $83,000, with a bearish trend that has not yet reversed.

Read the full article here:

https://x.com/BTC__options/status/1901994246871126079

CryptoQuant: The market may have entered a bear phase, and holding BTC in spot form is still recommended.

Read the full article here:

https://x.com/ki_young_ju/status/1901776137715671191

News updates

1.South Korea’s financial regulators will impose a 0.6% regulatory fee on crypto exchanges.

2.The U.S. SEC's cryptocurrency task force will hold its first roundtable meeting this week.

3.A recent poll reveals that only 10% of voters support federal spending on cryptocurrency, while the White House clarifies the source of strategic reserve funds.

Project updates

1.EOS Network announces its rebranding to Vaulta, entering the Web3 banking space.

2.IOTA releases the alpha version of its decentralized identity framework, IOTA Identity.

3.Nasdaq submits a Polkadot ETF listing application for 21Shares.

4.Strategy plans to issue 5 million preferred shares to raise funds for additional Bitcoin purchases.

5.deBridge becomes the highest-volume cross-chain protocol on the BNB chain.

6.Four.Meme: The launch feature has been restored, and compensation is underway for affected users.

7.ai16z founder releases ElizaOS v2 1.0.0 beta version.

8.Ethereum Layer 2 network Lisk opens airdrop eligibility queries.

9.MyShell plans to use the currently frozen 8 million USDT to repurchase SHELL tokens within 90 days.

10.Bedrock airdrop query page now supports pre-deposit functionality for platforms including Bitget.

Highlights on X

@WolfyXBT: Full transaction record of #BNBCard – Entry, sharing, holding, and exit

The transaction history of #BNBCard is fully transparent. The buying logic is based on multiple interactions on BNBChain's official Twitter account. After searching on Four.meme, a purchase at 0.6 BNB was made, representing 6% of the total supply. The token was issued at 11:35 by the dev address 0xa21649F58557D633c7b9dB8BFEb32f4556eacfE0 and is not created by the buyer. The token had already gone through multiple rounds of PvP trading before the purchase. After acquiring the token, the trade was shared among various groups of experienced PvP traders who do not blindly enter positions. The psychological valuation was estimated at $5 million. Given the significant holding size, the decision was made to gradually sell tokens starting at a market cap of $2 million, with individual sales not exceeding 5000 USDT to avoid significant price dumps. All transaction addresses are public, and there are no signs of insider trading.

@Murphy: Is ETH undergoing a "change of hands"? Reversal in token concentration and market implications

The Herfindahl index for Ethereum shows that ETH token concentration has been on a downward trend since 2016, indicating an increasingly dispersed distribution. However, since December 2024, this trend has reversed, with token concentration levels beginning to increase. Data analysis suggests that this shift is not due to an increase in spot ETF balances, but rather the accumulation of ETH by large capital at lower prices. Some whales have significantly increased their holdings, with one group increased their position from 1.66 million ETH to 1.94 million ETH as prices dropped into the $1900-$1850 range. Another group expanded its holdings from 1.6 million ETH to 2.12 million ETH. This phenomenon suggests ETH might indeed be undergoing a "change of hands," characterized by collection by large entities. However, this process is gradual, potentially leading to market volatility and stagnation during accumulation phases. Once token concentration reaches a sufficient level, ETH prices could become more easily controlled by these large holders, possibly setting the stage for a new upward cycle. The key question remains: How many years will it take for this process of concentration to reach completion?

@b12ny: BMT trading opportunity analysis – Short-term and cross-chain arbitrage strategies

The supply structure and cross-chain mechanism of the BMT token present arbitrage opportunities for short-term traders. Liquidity on the BNB side is relatively low, and the lock-up mechanism helps prevent short-term sell pressure. However, the pace of unlocking for ecosystem funds remains a key variable. Additionally, most of the tokens on Solana are locked, which controls short-term supply, but cross-chain price discrepancies could provide arbitrage opportunities. Traders can focus on LayerZero bridging data, changes in liquidity pool depth, and the distribution of holdings across different chains to identify short-term profit opportunities from price fluctuations. In the long term, it is important to closely monitor the vesting schedule and the impact of ecosystem developments on market supply and demand.

@Yuyue: Trading strategy after the BNB chain launch – High risk, high reward, and risk control

In response to the launch of the BNB chain ecosystem, the trading strategy continues to prioritize high risk-to-reward ratios while maintaining strong risk control principles.

Larger positions: Focus on established assets like BNB, offering strong liquidity and stable performance.

Medium positions: Target promising assets such as BMT, providing favorable risk-reward opportunities.

Smaller positions: Consider speculative opportunities in small-cap coins like MANSA and PALU.

Additionally, altcoins in the secondary market, such as $FOUR, are better suited for short-term arbitrage opportunities and should not be held for a long term. The key to the fundamentals of public chains still lies in the performance of their native coins. If the BNB/BTC exchange rate breaks through a significant resistance level, it could signal that the ecosystem is entering a positive loop. Furthermore, trading decisions should be based on technical indicators, such as candlestick patterns, open interest, market capitalization, and profit-loss ratios, rather than market sentiment or narrative-driven movements. This approach is crucial to avoid repeating the mistakes seen with $TST.

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Pi Network (PI) Introduces Two-Factor Authentication – Here’s How to Secure Your Account

CoinsProbe•2025/03/19 11:00

EOS Gains Momentum Following Key Breakout – Is RAY Gearing Up For A Similar Move?

CoinsProbe•2025/03/19 11:00

Is Dogecoin (DOGE) Gearing Up for a Reversal? Surge in Active Addresses and Key Pattern Hint at a Rally

CoinsProbe•2025/03/19 11:00

Is HYPE Ready to Soar? BNB Fractal Signals a Big Move Ahead for Hyperliquid

CoinsProbe•2025/03/19 11:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$84,787.84

+3.97%

Ethereum

ETH

$2,055.04

+9.27%

XRP

XRP

$2.56

+14.40%

Tether USDt

USDT

$1

+0.02%

BNB

BNB

$610.04

-2.86%

Solana

SOL

$132.32

+8.05%

USDC

USDC

$0.9999

-0.00%

Cardano

ADA

$0.7424

+7.72%

Dogecoin

DOGE

$0.1737

+5.99%

TRON

TRX

$0.2307

+3.27%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now