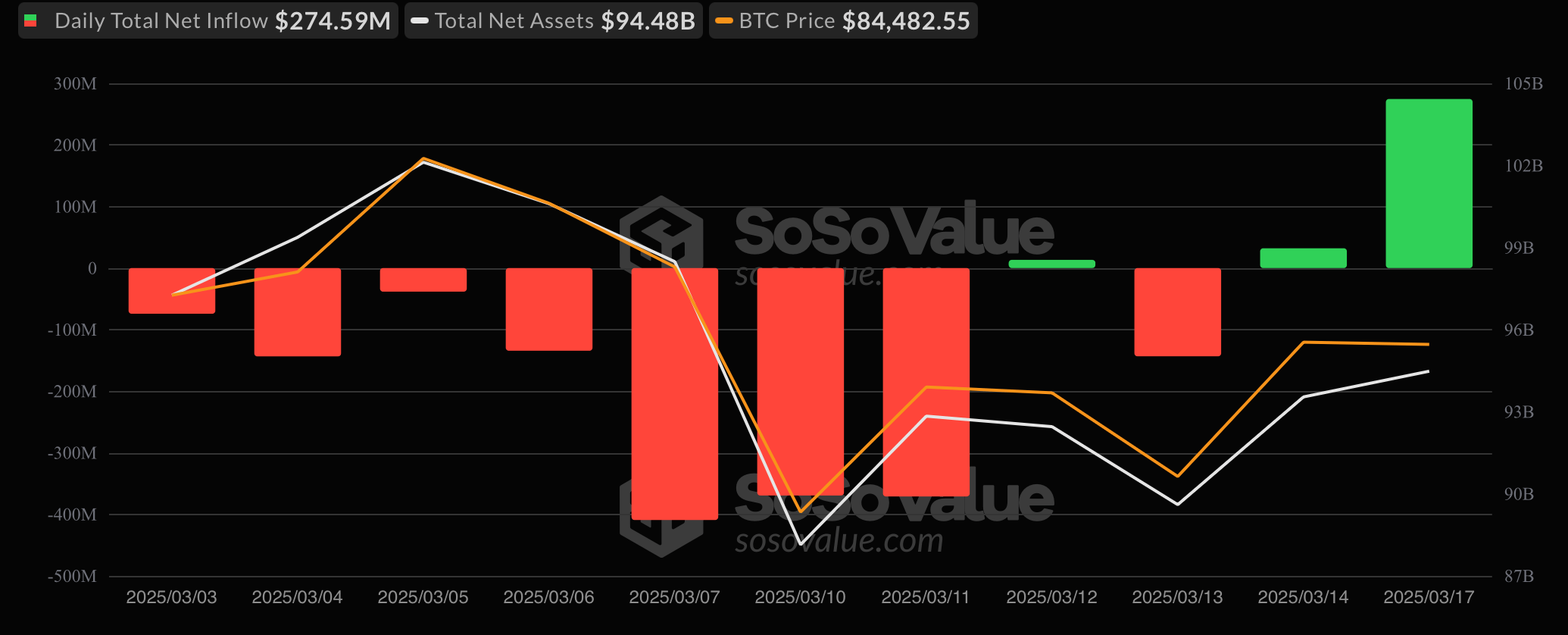

Bitcoin ETFs Rebound $275 Million Inflows, Ether ETFs Extend Outflows to 9th Day

After an over two weeks of persistent outflows, bitcoin ETFs experienced a notable resurgence on Monday, March 17, with a substantial inflow of $274.59 million. This positive fund movement signaled returning investor confidence in bitcoin-based exchange-traded funds.

Leading the inflows, Fidelity’s FBTC saw an impressive addition of $127.28 million. Ark 21Shares’ ARKB followed closely, attracting $88.53 million, while BlackRock’s IBIT received $42.26 million. Other contributors included Grayscale’s GBTC with $14.22 million and Bitwise’s BITB with $2.30 million. These collective inflows elevated the total net assets for bitcoin ETFs to $94.48 billion, reflecting returning bullish market sentiment.

In contrast, ether ETFs continued to face challenges, recording a net outflow of $7.29 million on the same day. This marks the 9th consecutive day of outflows for ether ETFs, indicating ongoing investor caution. The sole outflow was observed in Grayscale’s ETHE, which saw a withdrawal of $7.29 million.

Consequently, the total net assets for ether ETFs remained below the $7 billion threshold, closing at $6.77 billion.

The contrasting trends between bitcoin and ether ETFs highlight the current choppy market conditions. While bitcoin ETFs are witnessing returning inflows, ether ETFs continue to experience outflows, reflecting a more cautious approach among investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cosmos gets native EVM framework via open source Evmos

South Korean man faces 10 years in prison for stabbing crypto CEO during fraud trial