Bitcoin Price Eyes $150K: Bullish Signals Flash Despite ETF Outflows

Bitcoin’s Stoch RSI crossover signals a potential rally toward $150K. ETF outflows and tariff concerns weigh on market sentiment. March 15 is a key date for Bitcoin’s next price move.

Bitcoin price is flashing bullish signals despite ETF outflows and macroeconomic concerns. A Stochastic RSI crossover has reappeared, which last preceded a 97% surge.

Analysts see resistance levels ahead, with traders eyeing a move toward $150,000. However, ETF outflows and Trump’s tariff policies could pressure the market.

Bitcoin Price Technical Setup Hints at a Major Move

Bitcoin (BTC) price is flashing bullish signals, with traders watching key resistance levels as historical patterns hint at a potential breakout.

Source: Merlijn The Trader/X

Source: Merlijn The Trader/X

BTC’s price hovers around $83,954, down 22% from its all-time high of $109,312 recorded on Jan. 20. Despite this correction, analysts remain confident that Bitcoin’s bullish trajectory is intact.

Crypto trader Merlijn The Trader pointed to a Stochastic RSI crossover, noting that the last time this pattern emerged, BTC surged 97%.

“The signal we’ve been waiting for! Bitcoin to $150K incoming,” he posted on X.

Bullish Patterns Fuel Optimism

Captain Faibik highlighted a bullish pennant on the hourly chart, suggesting an upside target of $85,600 in the near term.

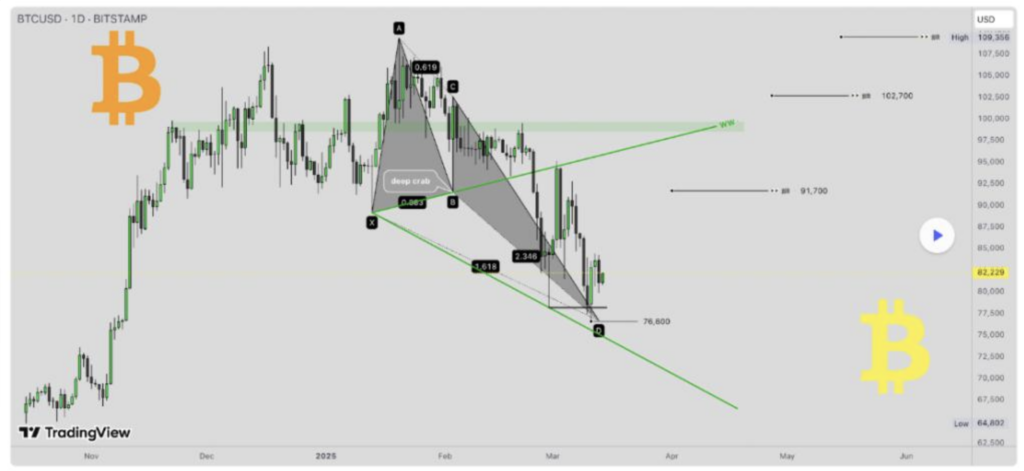

Meanwhile, crypto analyst Madden sees Bitcoin price reclaiming $100K soon, citing a Deep-Crab harmonic and Wolfe wave pattern.

Bitcoin Tests Key Support Amid Bearish Pattern. Source: Madden/X

Bitcoin Tests Key Support Amid Bearish Pattern. Source: Madden/X

Madden’s analysis indicates that BTC has bottomed out at $76,600 and is now reversing upwards. His roadmap suggests that, assuming bullish momentum continues, BTC could reach $125K by year-end.

Source: Captain Faibik/X

Source: Captain Faibik/X

Meanwhile, Captain Faibik also noted a bullish pennant formation on the hourly chart, calling for a move to $85,600 in the near term.

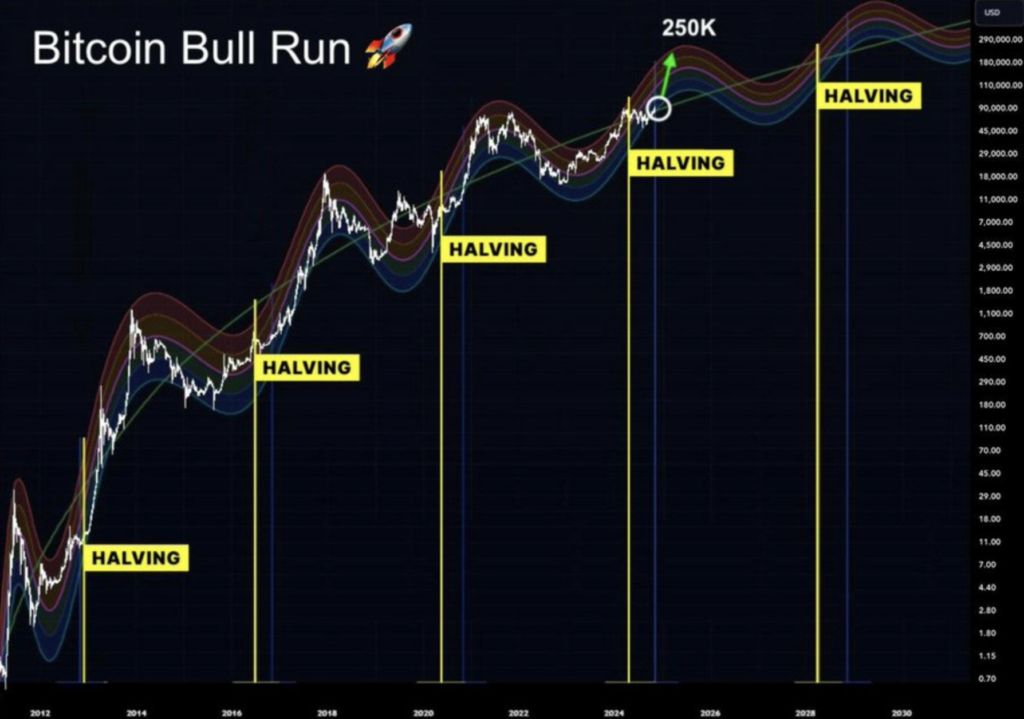

Historically, Bitcoin has followed a four-year cycle tied to its halving events. Analyst Danny_Crypton noted that BTC’s major bull runs tend to start 170 days after a halving and peak 320 days later. This cycle places March 15 as a key date for Bitcoin’s next surge.

Source: X

Source: X

Adding to this narrative, BTC closed above $84,000 on March 15 for the first time since March 8, reinforcing bullish sentiment.

However, analysts at Bitfinex warn that while historical cycles matter, macroeconomic conditions could still impact Bitcoin’s trajectory.

Bitcoin’s Four-Year Cycle Remains Intact

Despite short-term volatility, Bitcoin price’s long-term cycle remains a key factor. The most recent halving event on April 20, 2024, reduced block rewards to 3.125 BTC, triggering a 31% price increase since then.

Historically, halvings have set the stage for sustained bull runs, and analysts argue this time may be no different.

Tom Lee Predicts Bitcoin Will Outperform Gold in 2025 | Source: X

Tom Lee Predicts Bitcoin Will Outperform Gold in 2025 | Source: X

Fundstrat’s Tom Lee remains confident. “Bitcoin is still our favorite asset,” he said, maintaining that BTC will outperform gold and traditional markets.

While gold has surged 13.7% year-to-date, Bitcoin has declined 9.6%, but Lee sees long-term potential.

With Bitcoin holding above $84,000, traders are watching closely. A break above $90,000 could confirm a bullish reversal, while further ETF outflows or macroeconomic shocks could push Bitcoin toward $72,000–$73,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MicroStrategy executives snap up newly issued preferred shares, earning nearly 12% annually

26 US states have proposed Bitcoin reserve bills

Video sharing platform Rumble may launch crypto wallet Rumble Wallet

CME Group and Google Cloud Partner on Tokenization: A Game-Changer for the Future of Crypto?