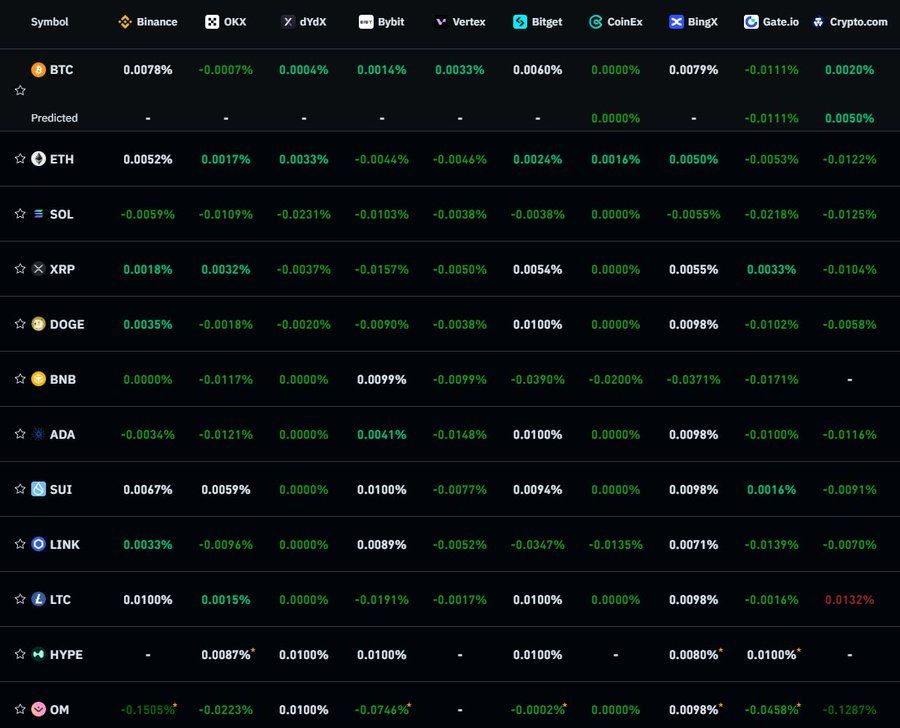

Crypto Market Shifts Bullish as Funding Rates Surge Above 0.01%

- Crypto funding rates exceed 0.01%, signaling growing bullish sentiment across exchanges

- Bitcoin leads with high funding rates, while OM and ADA show negative market sentiment

- ETP outflows reach $1.7B in the past week, marking the longest selling streak since 2015

Funding rates on major centralized and decentralized exchanges now exceed 0.01% for most mainstream cryptocurrencies, signaling a shift in market sentiment. Traders increasingly favor long positions, reflecting optimism after a prolonged bearish phase.

According to Satoshi Club’s X account on March 17, 2025, Bitcoin (BTC) and Ethereum (ETH) and DogeCoin (DOGE) as well as Binance Coin (BNB) dominate cryptocurrency markets through their elevated asset prices. The increasing investor confidence signals doubts about maintaining this current market trajectory.

Source; X

Source; X

Analysts observe that positive funding rates indicate traders pay a premium to hold long positions, a hallmark of bullish markets. The chart shared by Satoshi Club highlights BTC and ETH with notably elevated rates, while coins like OM and ADA lag with negative figures. This disparity shows uneven enthusiasm across the market, yet the overall trend leans toward growth. CoinShares’ James Butterfill emphasized that such shifts often precede broader price increases, though volatility remains a risk.

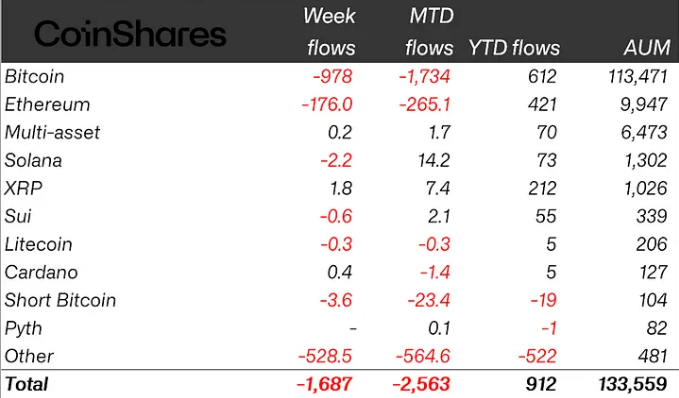

ETP Outflows Contrast Market Optimism

Cryptocurrency exchange-traded products (ETPs) face a starkly different reality, with $1.7 billion in outflows recorded last week. CoinShares reported on March 17 that this marks the fifth consecutive week of liquidations, totaling $6.4 billion over that period. The streak, now at 17 days, stands as the longest negative run since tracking began in 2015. Bitcoin ETPs alone shed $978 million in the latest week, bringing five-week outflows to $5.4 billion.

Despite this, year-to-date inflows for ETPs remain positive at $912 million, offering a glimmer of resilience. Ether and Solana ETPs also saw outflows of $175 million and $2.2 million, respectively, while XRP bucked the trend with $1.8 million in inflows. The contrast between rising funding rates and ETP sell-offs paints a complex picture, suggesting institutional caution amid retail optimism.

Source Coinshares

Source Coinshares

Regional and Issuer Impacts Reveal Market Divide

Europe’s 21Shares led ETP outflows with $534 million in liquidations last week, according to CoinShares. The United States, however, recorded the largest regional decline at $1.2 billion, underscoring significant selling pressure. BlackRock , a major crypto holder, reported $401 million in outflows, with month-to-date losses reaching $594 million. Meanwhile, ProShares stands out with $2 million in month-to-date inflows, joined by BlackRock and ARK Invest in maintaining positive year-to-date figures.

Binance faced a near-total wipeout of its assets under management, dropping to $15 million after a seed investor exit, Butterfill noted. This regional and issuer-specific data highlights a divide in market behavior.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket Predicts Fed QT Will End Before May

Polymarket shows 100% odds that the Fed ends QT before May, signaling possible policy shift impacting stocks, Bitcoin, and the dollar.How Ending QT Affects MarketsCrypto and Stocks Stand to Gain

Tron’s Justin Sun Announced that TRX Will Soon Launch on Solana

Canary Capital Apply for SUI ETF Registration with the SEC