Crypto ETPs Record $1.7 Billion Sell-Offs: CoinShares

Investors retreat as crypto ETPs face market pressure amid declining trends, while early technical cues and rising institutional moves hint at a possible shift in investor sentiment.

Key Takeaways:

- Crypto ETPs saw notable withdrawals as market uncertainty alters investor strategies.

- Bitcoin experienced the largest pull while select digital assets attracted renewed interest.

- Early technical cues and institutional moves add a cautious angle to market shifts.

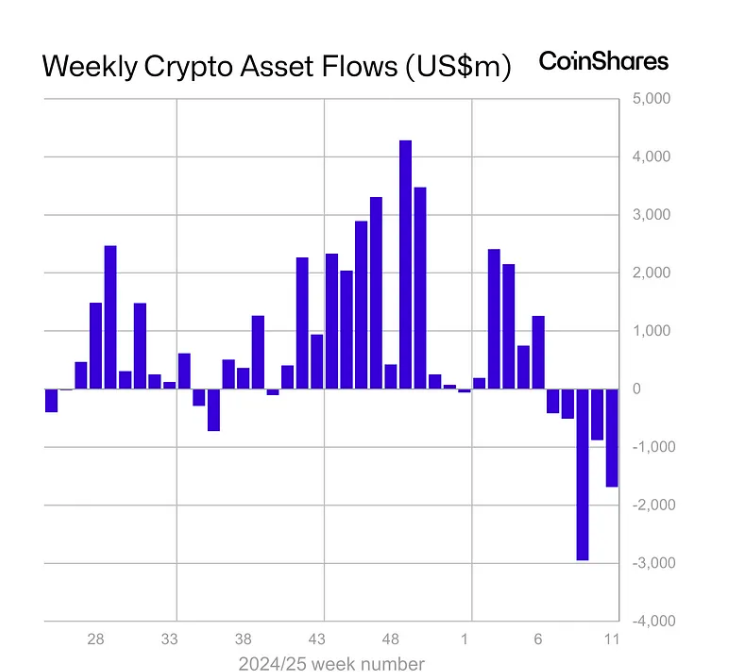

cryptocurrency exchange-traded products (ETPs) saw outflows totaling $1.7 billion last week, as global investors continued pulling capital amid broader market declines, according to a March 17 CoinShares report.

Crypto ETPs Liquidation Streak Reaches $6.4 Billion Over Five Weeks

The latest report shows that the market downturn has triggered cumulative outflows of $6.4 billion over the past five weeks.

While last week’s outflows softened slightly to $876 million compared to prior weeks, the trend remains negative.

March10-14 Crypto Asset flows / Source: CoinShares

March10-14 Crypto Asset flows / Source: CoinShares

CoinShares’ Head of Research, James Butterfill, noted that the sell-offs have extended to 17 consecutive days, marking the longest outflow streak since CoinShares began tracking ETP flows in 2015.

Despite the prevailing bearish sentiment, year-to-date inflows remain positive at $912 million.

However, the sustained withdrawals have caused a major drop in total assets under management (AuM), which declined by $48 billion.

Bitcoin Leads Crypto ETP Sell-Offs, While XRP and Cardano Record Inflows

Bitcoin ETPs bore the brunt of the sell-off, with total outflows hitting $5.4 billion over the past five weeks.

This has nearly erased year-to-date inflows, which now stand at $612 million.

US-based ETFs led the sell-off, contributing $1.16 billion in outflows, which accounted for 93% of total weekly liquidations.

Crypto ETP outflow by country/ source: CoinShares

Crypto ETP outflow by country/ source: CoinShares

Switzerland also faced heavy selling pressure, with $528 million exiting due to a seed investor’s withdrawal. Meanwhile, Germany recorded a minor inflow of $8 million.

The broader decline in crypto ETPs was further reflected in Ethereum and Solana products, which posted outflows of $176 million and $2.2 million, respectively.

However, not all digital assets experienced declines. XRP and Cardano recorded positive flows, with XRP seeing $1.8 million in inflows and Cardano attracting a modest $400,000.

Market Sentiment Pressures Crypto ETPs, Bitcoin’s Technical Signals Suggest Possible Recovery

Unlike the previous CoinShares report , which cited factors such as the $1.4 billion Bybit hack and hawkish Federal Reserve comments as reasons for early March outflows, the latest report attributes the continued decline to broader negative market sentiment.

Technical indicators, however, suggest Bitcoin may be approaching a potential turning point.

Bitcoin’s stochastic RSI has printed a bullish cross, a setup that has historically preceded strong price rebounds.

Historically, Bitcoin has seen price recoveries averaging 55% within three to five months following such signals, with some rallies extending beyond 90%.

Meanwhile, institutional players have been adjusting their strategies amid the ongoing correction.

Data shows that global crypto hedge funds have increased their Bitcoin exposure , with accumulation levels rising to a four-month high.

Despite the current downturn in crypto ETPs, some institutional investors remain optimistic, anticipating a possible price recovery in the coming months.

Frequently Asked Questions (FAQs)

Investors pull funds from crypto ETPs amid market volatility and shifting regulations that drive a shift toward safer assets. Technical signals hint at a subtle change in risk appetite.

Technical indicators often mark subtle shifts in market trends, prompting investors to reconsider positions. These cues offer one view among factors that shape cautious moves.

Institutional players adjust portfolios amid market shifts. Their moves signal strategic shifts that shape trends and reflect cautious outlook in the digital asset space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Whale Nets $10 Million in Profit on 40x Leverage Bitcoin Short

The investor shorted 6,210 BTC at an entry price of $84,043 per Bitcoin, using borrowed funds to increase the size of the position.

On-chain Activity Collapse: Is Ethereum In Danger?

Canary Capital Apply for SUI ETF Registration with the SEC

Ripple Accelerates RLUSD Issuance After Dubai License, Doubling Supply in Two Months