Hayden Davis Exposed: WOLF Token Tied to Previous Crypto Scams

Hayden Davis orchestrated $WOLF’s pump-and-dump, mimicking past crypto scams and siphoning millions from investors. Blockchain analysts traced $WOLF’s creator to Davis via 17 addresses, exposing cross-chain laundering tactics. Davis’s wallet, 0xcEAe, linked to scams like MELANIA and LIBRA, netting millions through sniping and liquidity manipulation.

- Hayden Davis orchestrated $WOLF’s pump-and-dump, mimicking past crypto scams and siphoning millions from investors.

- Blockchain analysts traced $WOLF’s creator to Davis via 17 addresses, exposing cross-chain laundering tactics.

- Davis’s wallet, 0xcEAe, linked to scams like MELANIA and LIBRA, netting millions through sniping and liquidity manipulation.

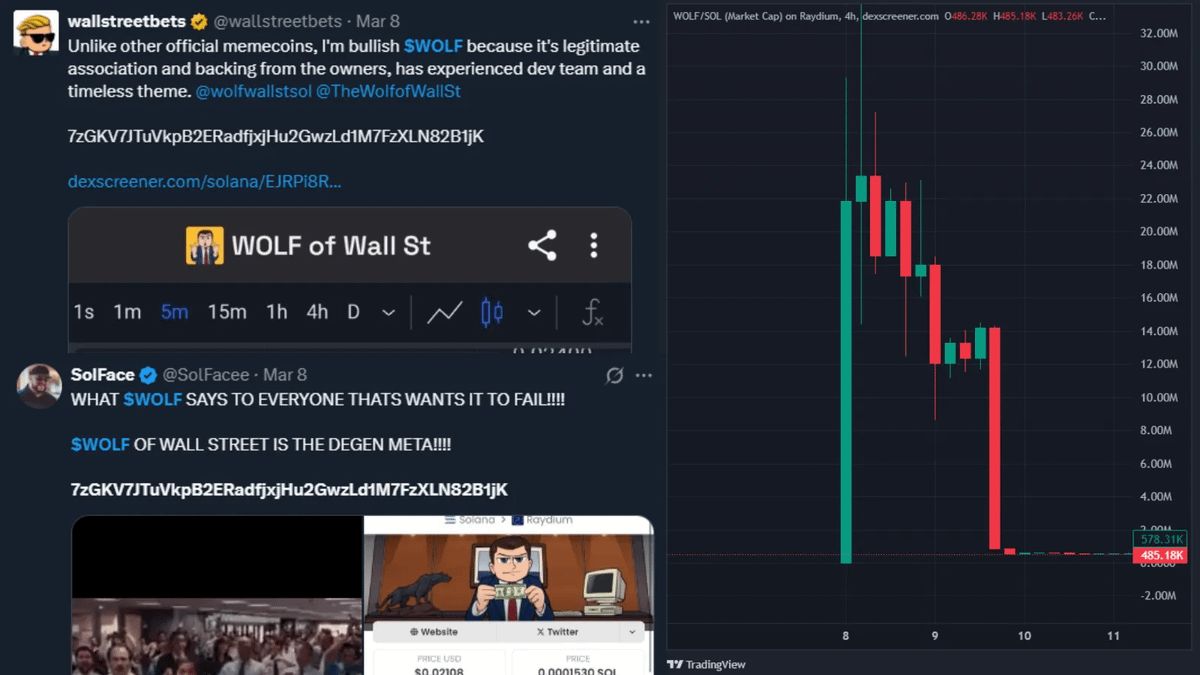

Hayden Davis, already linked to multiple fraudulent crypto projects, has surfaced again in connection with $WOLF. This token, widely promoted by WallStreetBets, skyrocketed to a $40 million market cap before collapsing. Blockchain analysts uncovered undeniable links between $WOLF and Davis’s past exploits, revealing an intricate laundering process through multiple wallets and cross-chain transfers. Consequently, Davis remains a key player in orchestrated rug pulls , siphoning millions from unsuspecting investors.

$WOLF Token and the Hidden Trail

On March 8, WallStreetBets promoted $WOLF, sparking a buying frenzy. However, blockchain analysis exposed suspicious activities. Notably, the developer sniped the token with multiple wallets, manipulated its liquidity, and dumped it for massive profits.

Source: X

Source: X

Bubble maps showed an identical transaction pattern to $HOOD, another token linked to Davis. Investigators traced $WOLF’s creator, 6MsuHd, through 17 addresses and five cross-chain transfers, all leading to a familiar wallet: 0xcEAe. This wallet has been directly associated with Davis in past scams. Moreover, Davis pre-funded these addresses months before launching $LIBRA and $WOLF, attempting to obscure his involvement.

A Pattern of Deception

Davis’s history of deception extends beyond $WOLF. Previously, he was linked to MELANIA and LIBRA, two tokens orchestrated as pump-and-dump schemes. Blockchain analysis revealed that 0xcEA sniped MELANIA, making over $2.4 million before transferring the gains via the USDC Cross-Chain Transfer Protocol (CCTP).

This same address later funded DEfcyK, the creator of LIBRA, who cashed out $87 million. Additionally, 0xcEA personally sniped LIBRA, amassing another $6 million. Analysts confirmed that the same entity launched multiple short-lived tokens, including $TRUST, $KACY, $VIBES, and $HOOD.

The Bigger Picture

Davis’s tactics remain consistent— launching tokens under false pretenses , sniping them for profits, and then abandoning them. Consequently, investors continue to lose millions. Regulators and blockchain analysts are tightening surveillance on repeat offenders like Davis. However, the crypto space remains vulnerable. Investors must exercise caution and verify token legitimacy before engaging in speculative trades.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP’s 16-Day $3 Surge Sparks Hopes of Breaking All-Time Highs

Trump turns on ‘buddy’ Putin over Ukraine, says he’ll slap Russia with sanctions now

Share link:In this post: Trump warned he may hit Russia with new sanctions after fresh missile attacks on civilians. Trump met with Zelenskyy in Rome and called the meeting productive, but gave no full details. Trump offered a peace deal that includes recognizing Crimea as Russian territory, which Zelenskyy rejected.

Trump’s economic and geopolitical failures took center stage at Pope Francis’ funeral

Share link:In this post: Trump’s economic and diplomatic tensions took over the spotlight at Pope Francis’ funeral. Trump met briefly with Zelenskyy, Macron, and Starmer during the service but made little progress. Trump skipped a second meeting with Zelenskyy and left Rome quickly after the Mass.

Elon Musk and Nobel laureates call for investigation into OpenAI’s nonprofit mission

Share link:In this post: Elon Musk called OpenAI restructuring plan the “scam of the century” after experts oppose it. Legal and AI experts have called on Attorneys General of Delaware and California to OpenAI core mission as a non-profit. Concerns about Open AI deviating from its non-profit origins is not limited to Musk.