Stablecoins Thrive as Crypto Stumbles: A $4.23B Growth Spree in 2 Weeks

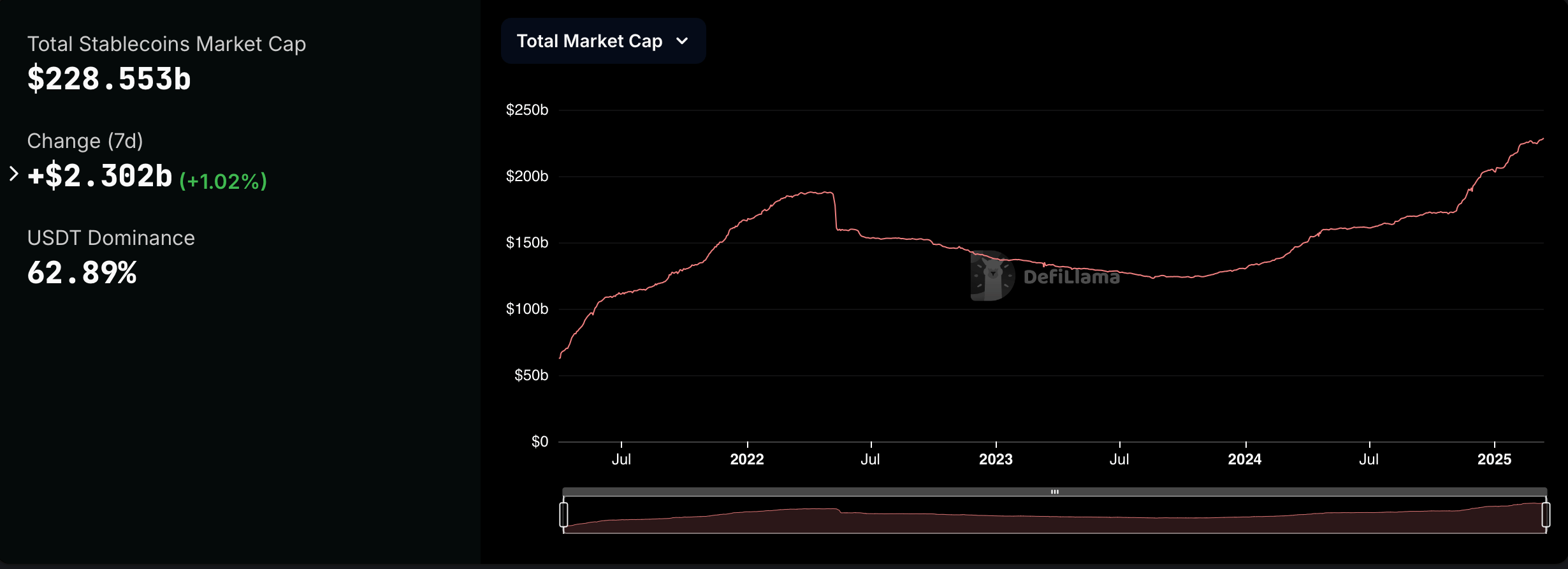

The stablecoin ecosystem—fiat-pegged digital tokens—now sits at $228.553 billion after a $4.23 billion boost in just 14 days. Leading the pack is tether (USDT), which commands a whopping $143.74 billion, or 62.89%, of the stablecoin pie.

Altogether, these steady-value coins account for roughly 8.34% of the $2.74 trillion crypto market, with USDT alone holding 5.25% of the entire digital asset space. Circle’s USDC holds strong with a $58.371 billion market cap, claiming 25.54% of the total stablecoin ecosystem’s value.

Stablecoin economy after the first two weeks of March 2025.

Over the past seven days, USDT’s supply inched up 0.44%, while USDC’s stash jumped 1.97%. Ethena’s USDe secures third place with $5.458 billion, fueled by a gentle 0.82% supply bump this week. Meanwhile, Sky’s USDS climbed 3.63% this week, hitting $4.811 billion.

Top five stablecoins by market cap in mid-march 2025.

But not everyone’s riding high: Sky’s DAI tumbled 5.27% to $4.185 billion. First Digital’s FDUSD slid 2.48% over seven days, dropping to $1.796 billion. Usual’s USD0 also dipped below the billion mark, falling 5.72% to $978.18 million.

Paypal’s PYUSD, however, edged up 0.33% this week—and over the past month, it skyrocketed 29.14%, adding $172.29 million to the supply. PYUSD’s market cap now sits pretty at $763.46 million in eighth place, according to defillama.com stablecoin metrics.

Rounding out the list, USDX Money’s USDX holds ninth place with $625 million, ticking down 0.05% this week but edging up 0.21% over 30 days. Ondo’s USDY wraps things up with $592.73 million, slipping 0.45% in a week yet smashing PYUSD’s monthly growth with a 55.55% leap.

Stablecoins are thriving amid crypto’s slump, showcasing a dynamic mix of competition and innovation. While established giants like USDT maintain dominance, newer entrants are still shaking things up with aggressive growth. The sector’s resilience highlights a balancing act—stability for users and gathering yield for holders—as digital dollars carve out an ever-larger slice of the crypto pie.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Expected to Pump Over 10x in the Altseason, How High Can ADA Go This Bull Cycle

Ripple Rules Out 2025 IPO as Company Maintains Solid Financial Position

Google Chrome’s success ‘impossible to recreate,’ exec testifies in DOJ antitrust trial

Share link:In this post: Parisa Tabriz believes Google Chrome would decline in another company’s hands, saying it would be hard to disentangle Google from the search engine’s success. Google plans to infuse artificial intelligence into Chrome to make it more agentic. OpenAI showed interest in buying Google Chrome.

SEC Commissioner Hester Peirce calls for better crypto regulation

Share link:In this post: SEC Commissioner Hester Peirce has called for better crypto regulation in the United States. Peirce mentioned that financial firms have been approaching crypto in a way like playing “the floor is lava” children’s game. SEC commissioners want flexible regulation as SEC chairman Paul Atkins wants clear regulations for digital assets.