Will Bitcoin (BTC) See a V-Shaped Recovery? Historical Pattern Hints at Reversal

Date: Thu, March 13, 2025 | 01:48 PM GMT

The cryptocurrency market has faced a sharp correction, with major assets experiencing significant pullbacks after their explosive rallies in late 2024. Bitcoin (BTC), which had reached a new all-time high of $109,000 on January 20, has since retraced to a low of $76,000 before jumping around $82,000 at the time of writing.

While this drop has caused fear among investors, historical price action suggests that a strong V-shaped recovery could be on the horizon.

Bitcoin (BTC) Mirrors the Feb-May 2021 Trend

According to the latest analysis by prominent crypto analyst Alex Clay , Bitcoin’s current price structure bears a striking resemblance to its market behavior in early 2021. Back then, Bitcoin experienced a parabolic rally, reaching its then all-time high of $64,000 in April 2021. However, instead of continuing its upward momentum, BTC entered a distribution phase, where price movement became choppy and range-bound.

During this period, Bitcoin traded within a tight range, repeatedly testing resistance levels before eventually breaking down. The market then experienced a steep correction, with BTC plunging nearly 50% in just a few weeks, hitting lows around $30,000 in May 2021. However, what followed was a textbook V-shaped recovery, where Bitcoin rebounded sharply, regaining bullish momentum and eventually reaching a new all-time high of $69,000 by November 2021.

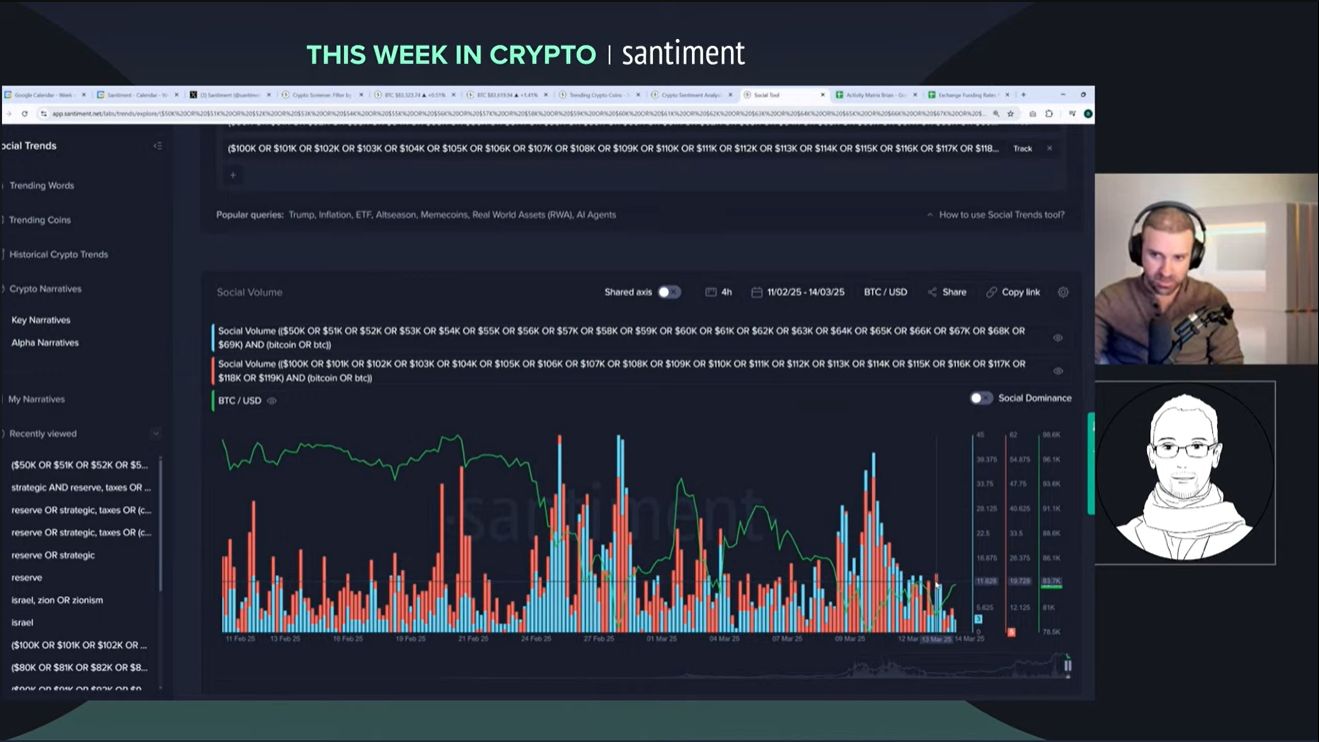

Fast forward to 2025, and a similar pattern is playing out. Bitcoin recently saw a distribution phase around the $100K mark, where the price remained range-bound for weeks before breaking down. This led to a rapid sell-off, with BTC dipping to $76K before bouncing back to the $81K–$83K level.

Just as in 2021, this sharp drop is now being followed by signs of a potential recovery. Analysts suggest that if Bitcoin can reclaim key resistance levels in the coming weeks, the current structure could lead to yet another V-shaped rebound, potentially pushing BTC back toward $100K and beyond.

What’s Next for BTC?

If Bitcoin follows the historical 2021 pattern, a strong bullish V-recovery could be in play, potentially pushing prices back into the $95K–$100K zone in the coming weeks. If bullish momentum accelerates, BTC could attempt a new all-time high beyond $110K.

However, investors should remain cautious—while historical patterns provide valuable insights, market conditions in 2025 remain unpredictable, with macroeconomic factors playing a crucial role in Bitcoin’s next move.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before making any investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating Crypto Volatility: How Bitcoin and Altcoins Influence Your Trading Choices

Understanding the Impact of Market Volatility on Crypto Trading: A Look at the Risk and Reward in Bitcoin and Altcoins

Crypto Whales Bought These Coins in the Second Week of March 2025

Crypto whales have been active in accumulating BTC, PEPE, and ENS this week, signaling potential price movements despite recent market fluctuations.

James Howells Loses Appeal to Dig Up Landfill for $675 Million Bitcoin Hard Drive

James Howells has faced years of legal setbacks in his attempt to recover 8,000 lost Bitcoins from a Newport landfill. Despite offering millions, he now plans to approach the European Court of Human Rights.