Tesla vs. Bitcoin vs. Gold: Which Is the Best Investment for 2025?

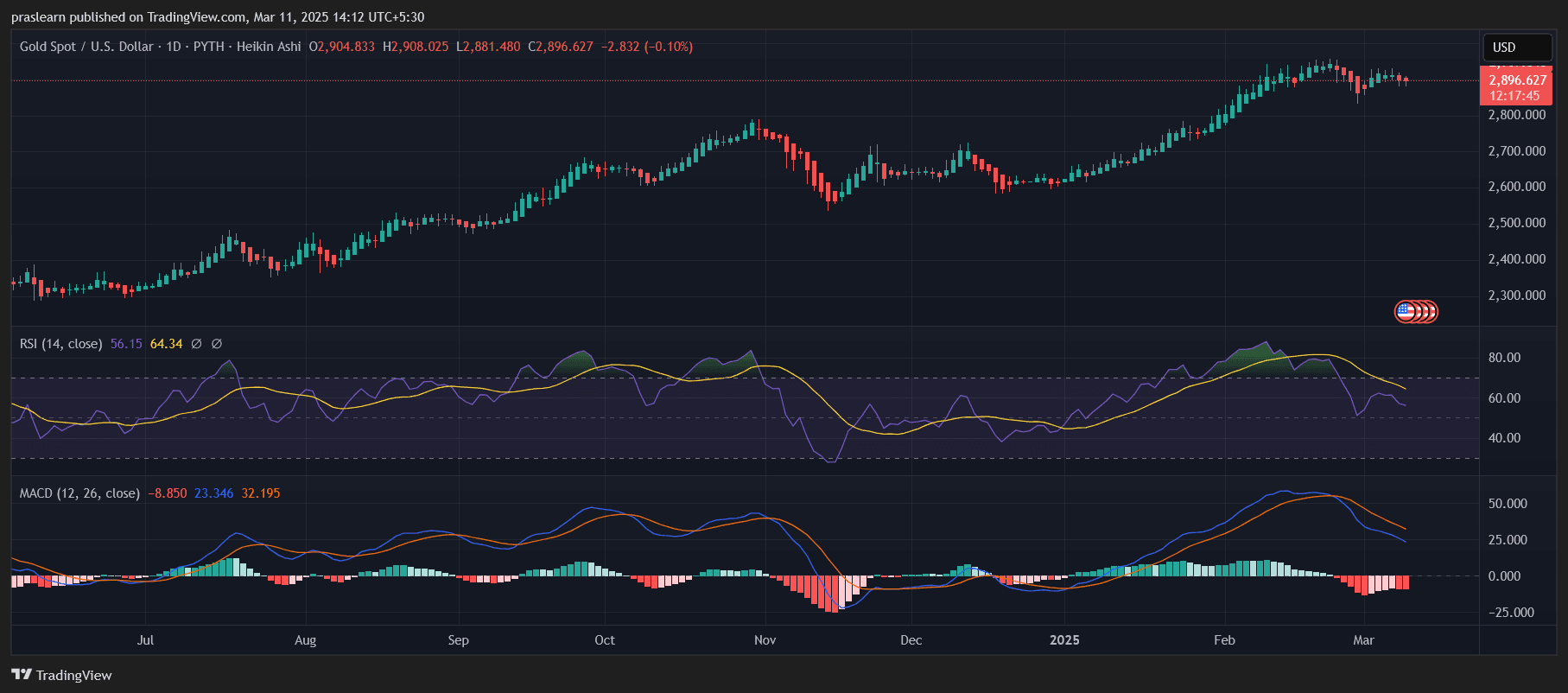

As markets remain volatile, investors are debating where to put their money for maximum returns in 2025. Tesla (TSLA) , Bitcoin (BTC) , and Gold (XAU) have all played different roles in the financial landscape, but which one will be the best-performing asset moving forward?

Currently, Tesla price is trading at $237 (-8.74%), Bitcoin price at $79,289 (-1.10%), and Gold price at $2,896 (-0.10%). While Tesla represents growth and innovation, Bitcoin is the digital store of value, and Gold remains the traditional safe-haven asset.

Will Tesla bounce back from its recent crash? Can Bitcoin recover from its correction? Or will Gold continue its strong performance? Let’s analyze each asset’s price trends, key indicators, and predict their price movements for 2025.

Tesla: Is the Stock in Free Fall?

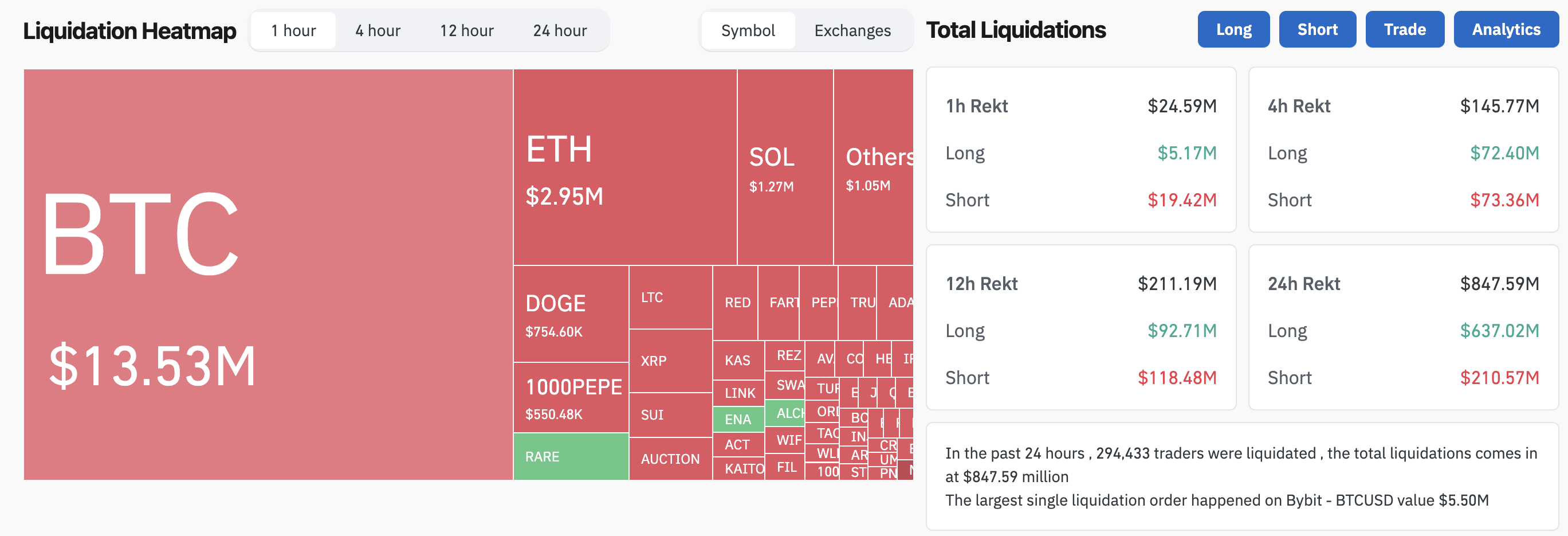

TESL Daily Chart- TradingView

TESL Daily Chart- TradingView

Tesla’s stock has been under heavy selling pressure, losing nearly 50% from its highs. The price action has been in a consistent downtrend, forming lower highs and lower lows, a classic bearish market structure.

The Relative Strength Index (RSI) stands at 17.72, deep in oversold territory, suggesting that a short-term bounce may occur. However, the MACD remains heavily negative, confirming ongoing bearish momentum.

Key support is at $220, and if Tesla breaks below this level, it could slide toward $200 or even $180 in the coming months. For a bullish reversal, Tesla must regain $275, which currently serves as resistance.

Unless a strong catalyst emerges, Tesla price appears to be in bear market territory, making it a risky bet in the short term.

Bitcoin: Will BTC Hold Support or Crash Further?

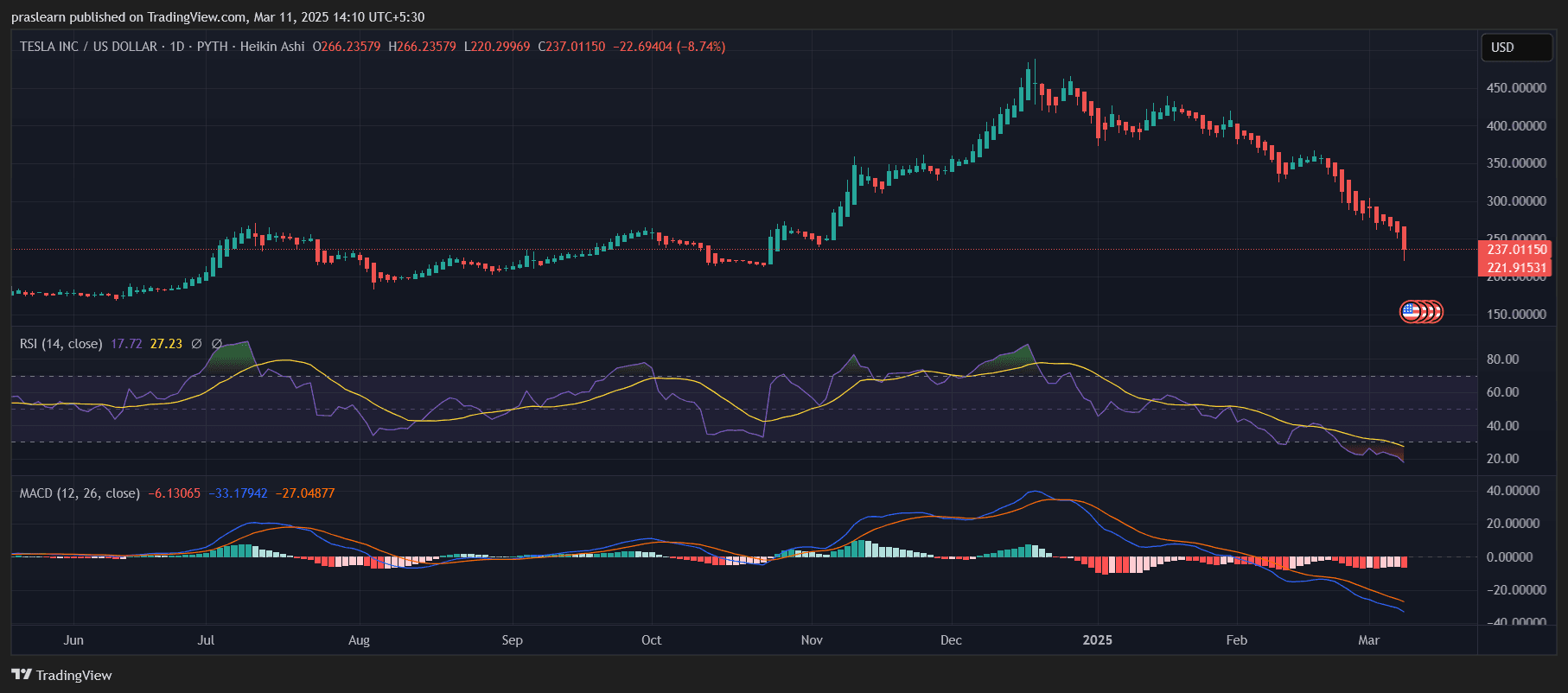

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

Bitcoin price has been in a corrective phase, failing to maintain momentum above $100,000 and now struggling to hold $79,000 support. BTC’s RSI is at 29.43, indicating that it has entered oversold conditions, making a short-term bounce likely.

However, the MACD is still bearish, showing no clear signs of a reversal. If Bitcoin loses its current support, the next major demand zone is around $75,000-$70,000. In the worst-case scenario, BTC could drop as low as $60,000 or even $47,000, where strong buyer interest is expected.

For Bitcoin to reclaim bullish momentum, it must break above $85,000 and hold that level as support. If BTC remains below this zone, the downtrend could continue, making it a neutral-to-bearish investment at this stage.

Gold: The Safe-Haven Champion?

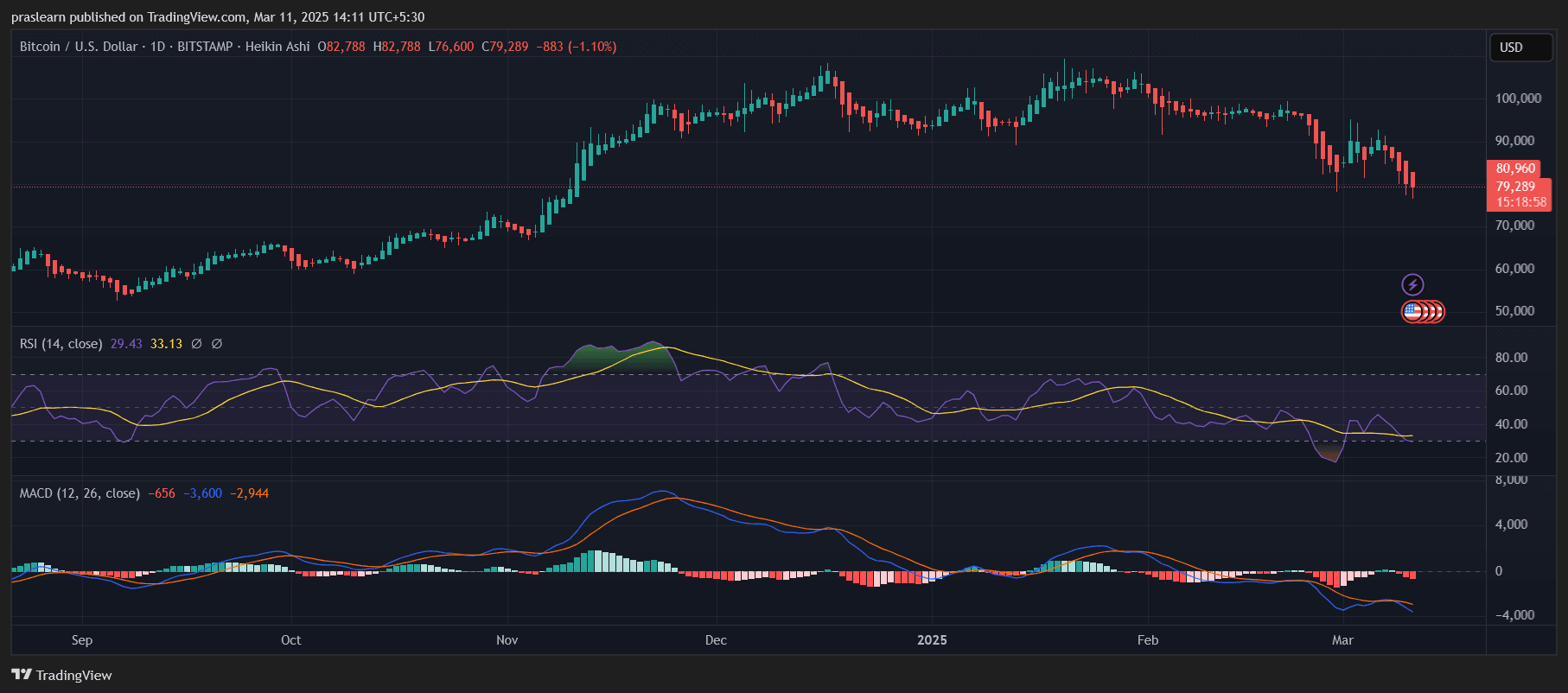

XAU/USD Daily Chart- TradingView

XAU/USD Daily Chart- TradingView

Gold has been the strongest performer among the three assets, maintaining an uptrend while both Tesla and Bitcoin struggle. Unlike the others, Gold’s price action remains above key support levels, indicating strength in the current macroeconomic climate.

The RSI is at 56.15, sitting in a healthy range, showing that Gold is neither overbought nor oversold. The MACD remains in positive territory, supporting the bullish outlook for Gold.

If Gold price maintains momentum, the next resistance level is at $3,000, with a potential breakout leading to new all-time highs. The key support zone remains at $2,750, and a drop below this level could indicate a weakening trend.

Tesla vs. Bitcoin vs. Gold: Which Is the Best Investment for 2025?

Each asset presents different opportunities and risks, making the decision dependent on an investor’s risk tolerance and market outlook.

- Tesla (TSLA): High risk, high reward. Tesla is oversold but remains in a strong downtrend. If it recovers, it could rally significantly, but further declines are possible.

- Bitcoin (BTC): Long-term potential, but facing short-term weakness. BTC could drop to $47,000 , but if it holds support, it remains the best-performing asset historically.

- Gold (XAU): The most stable and currently the strongest asset. If economic uncertainty persists, Gold could hit $3,500+ in 2025.

For short-term safety, Gold remains the best bet, as it continues to hold its uptrend and benefits from economic uncertainty, inflation hedging, and institutional demand. Unlike Bitcoin and Tesla, Gold has maintained stable growth, making it an attractive safe-haven asset for risk-averse investors.

For those seeking high-risk, high-reward potential, Bitcoin is the top choice, as its long-term growth trajectory remains intact, despite the current correction. While BTC faces short-term downside risks, its historical ability to recover and outperform traditional assets makes it a compelling option for those with a higher risk tolerance.

On the riskiest end of the spectrum, Tesla presents a potential recovery play, but remains weak amid heavy selling pressure, valuation concerns, and market competition. While oversold conditions could spark a temporary bounce, Tesla’s downtrend is still dominant, making it a speculative investment until a clear reversal is confirmed.

In 2025, Bitcoin and Gold are likely to outperform Tesla, but Bitcoin has the highest upside potential if it can reclaim momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Correction Might Be Ending Amid Weak Dollar and Stable Derivatives Markets

Trump’s New Tariffs on Canada: Potential Impacts on Bitcoin and Market Uncertainty