XRP Price Prediction: Could a 700% Rally Push XRP to Double Digits?

- Despite XRP’s 7.50% dip, analysts predict a potential breakout, citing whale activity and historical patterns pointing to double-digit prices.

- Optimism grows for an XRP ETF approval, with odds nearing 80%, which could boost institutional investment and price momentum.

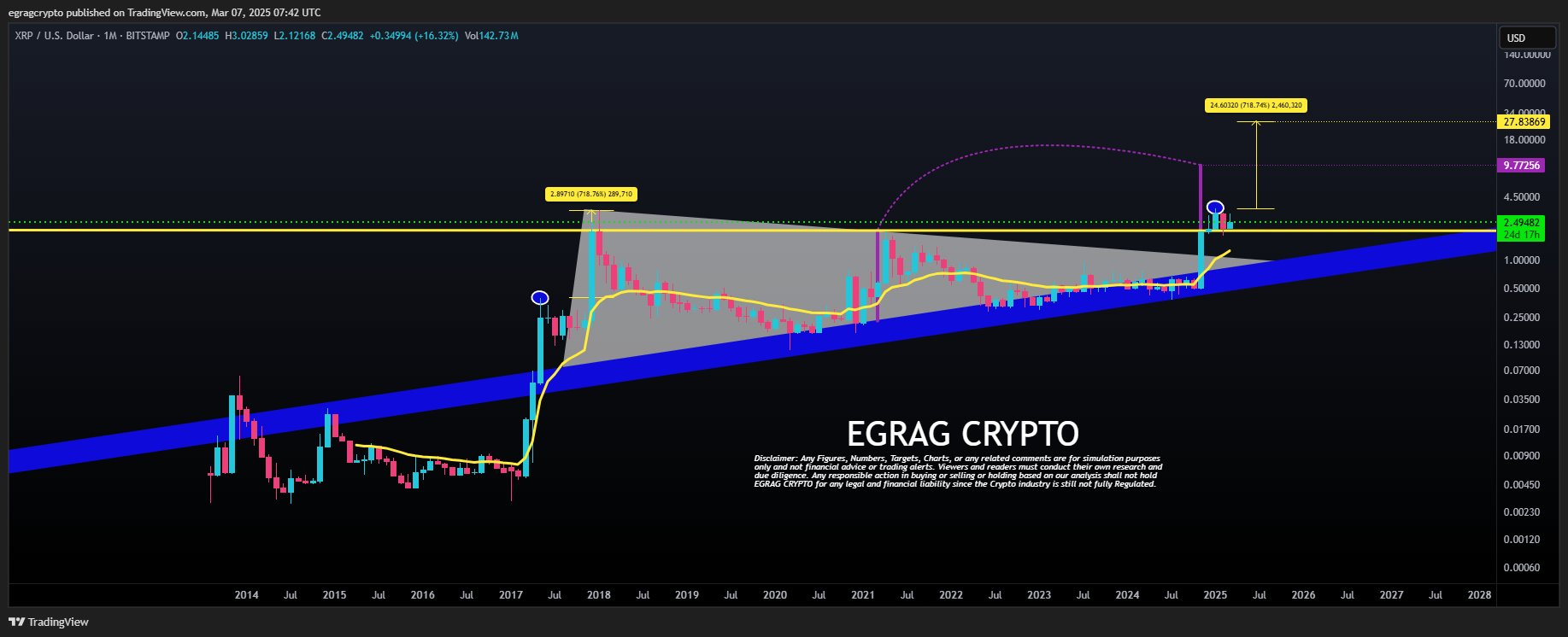

Ripple’s XRP has struggled to stay afloat amid a broader market downturn following the White House Crypto Summit . Despite a 7.50% dip to $2.35 today, analysts remain bullish , drawing comparisons to the historic 2017-2018 surge that saw XRP soar by 718%. If that pattern repeats, some suggest the price could reach double digits, igniting investor excitement.

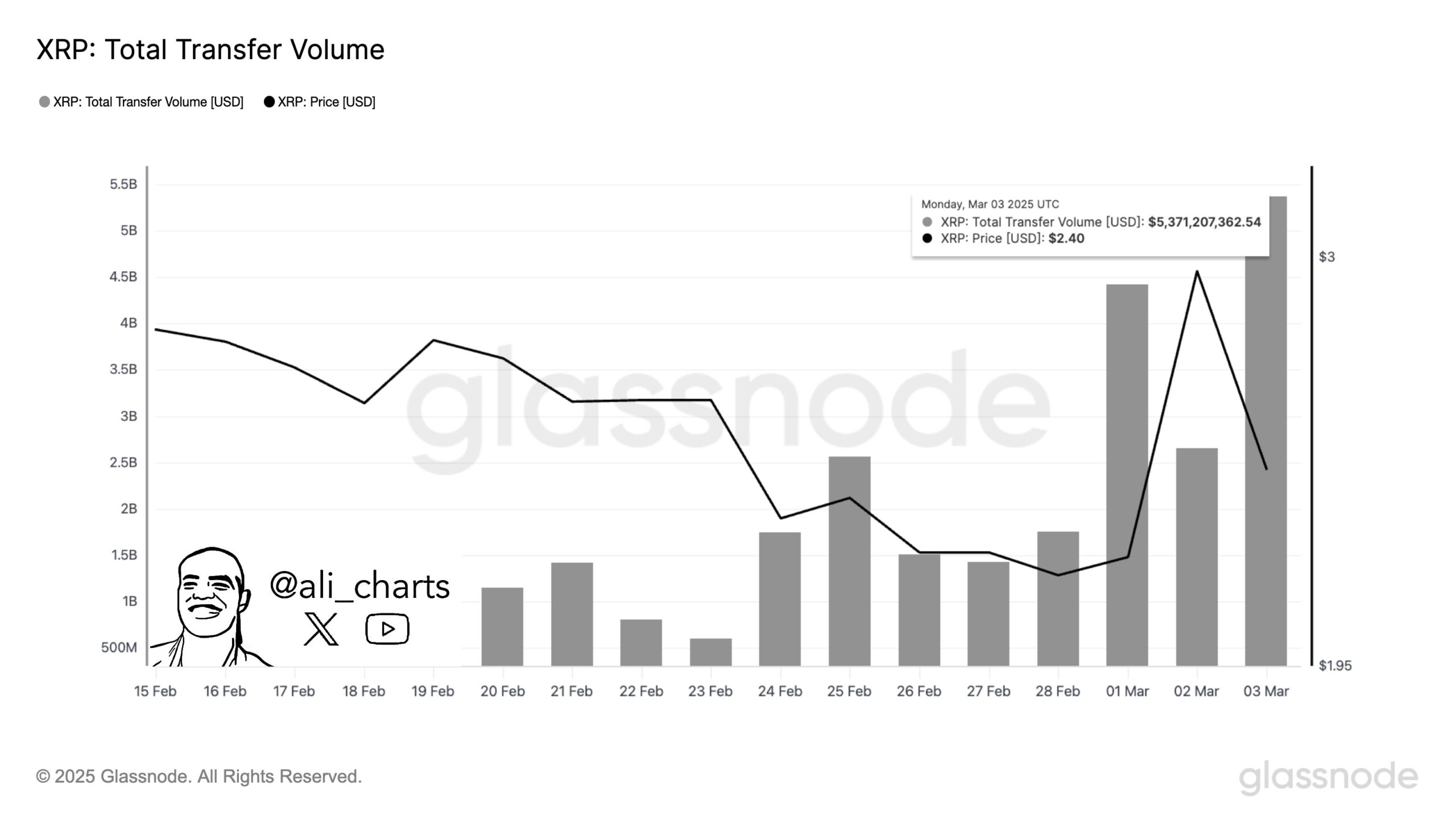

The crypto market has seen its fair share of volatility, but optimism still lingers. Experts have pointed to whale activity and technical patterns as indicators of a potential breakout. Recent reports show that large investors have moved $5.37 billion worth of XRP, a sign that major players are making moves. However, whether they are buying or selling remains a mystery.

XRP Price Targets: $9.7, $9.50, $2.70 — Breakouts Could Trigger Surge

EGRAG CRYPTO, a well-known analyst, has set ambitious targets for XRP. The first, at $9.7, is based on a historical triangle breakout pattern. He advises traders to take profits at $8, $9, and $10 rather than waiting for the perfect peak. The more optimistic projection of $27 stems from applying the 718% gain from XRP’s 2017 rally to a local high of $3.4.

While a jump to $27 seems far-fetched, the projection signals confidence in XRP’s ability to rally. Other analysts have also pointed to XRP’s symmetrical triangle pattern, which suggests a 23% price move if a breakout occurs. Ali Martinez recently noted that XRP could be in the early phases of Wave 3, a technical pattern hinting at a surge to $9.50.

Adding to the bullish sentiment, CasiTrades emphasized that XRP is testing a critical resistance level at $2.54. A successful breakout could propel it toward $2.70 and $3.05, reinforcing the idea that higher price targets remain within reach.

XRP ETF Approval Odds Near 80% Despite Legal Hurdles

XRP’s legal battles have played a crucial role in shaping market sentiment. The ongoing lawsuit between Ripple and the SEC has kept investors on edge, but optimism is growing that the case may soon be resolved. The SEC has recently dropped cases against Coinbase, Uniswap, and Gemini, fueling speculation that Ripple could receive a similar outcome.

Another factor at play is the potential launch of an XRP exchange-traded fund (ETF) . Odds of an approval have surged to nearly 80%, according to Polymarket. If granted, an ETF could bring institutional investment into XRP, potentially accelerating its price momentum.

However, not all analysts are convinced. Willy Woo, a prominent voice in the crypto space, has argued against the idea of XRP becoming a strategic reserve asset. “No other country would buy a US-controlled XRP,” he claimed, reinforcing Bitcoin’s status as the only geopolitically neutral asset.

Recommended for you:

- Buy Ripple (XRP) Guide

- Ripple XRP Wallet Tutorial

- Check 24-hour XRP Price

- More Ripple (XRP) News

- What is Ripple (XRP)?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Team Stands Firm: ‘SHIB Is Our BTC’ as Market Faces Uncertainty

Arbitrum Devs Initiate ARB Buyback to Bolster Ecosystem Growth

Best Cryptos for Beginners? Qubetics Sells Over 499 Million Tokens, Monero’s Privacy and Kaspa’s Speed

Discover the best cryptos for beginners! Learn how Qubetics raised over $14.9 million, plus explore the privacy features of Monero and the speed of Kaspa.Qubetics – Revolutionizing Cross- Border TransactionsMonero – The Unmatched Leader in Privacy CoinsKaspa – A Fresh Take on Blockchain SpeedConclusion – Building a Strong Foundation in Crypto

Whales Withdraw $14.35M USDC After ETH Long Exit

8 whale wallets withdrew $14.35M USDC from Hyperliquid after closing ETH long positions for profit.Whales Take Profits on ETHMarket Impact & SpeculationsWhat’s Next for Ethereum?