Chainlink (LINK) Price Outlook: Potential Breakout Signals and Influencing Factors to Consider

-

Chainlink (LINK) is poised for potential growth amid rising trading volume and strategic developments in its network, captivating investor interest.

-

The altcoin, despite its recent price fluctuations, has demonstrated a significant uptick in trading activity, with a 24.59% increase in volume over the past day.

-

As highlighted by Solberg Invest, a sustained rally for LINK could be in play if it successfully breaks through the crucial $20 resistance.

The latest trends in Chainlink (LINK) suggest a potential rally, fueled by increased trading volumes and strategic developments. Can it reach $30?

Technical Analysis Indicates Potential Bullish Trends for Chainlink (LINK)

Currently trading at $17.08, Chainlink (LINK) has faced a slight dip, yet this has not deterred its overall bullish sentiment. Observations on the 1-day chart reveal LINK’s consolidation within a descending channel—a pattern observed since Q4 2024—suggesting potential for a breakout.

According to market analysis from Solberg Invest, a break above the significant $20 resistance may pave the way for a potential rally, aiming for a target price near $30. This momentum will depend on continued support from bullish traders, given that a failure to hold could result in a retest of key support at approximately $12.

Source: X

On-Chain Metrics Reveal Promising Accumulation Patterns

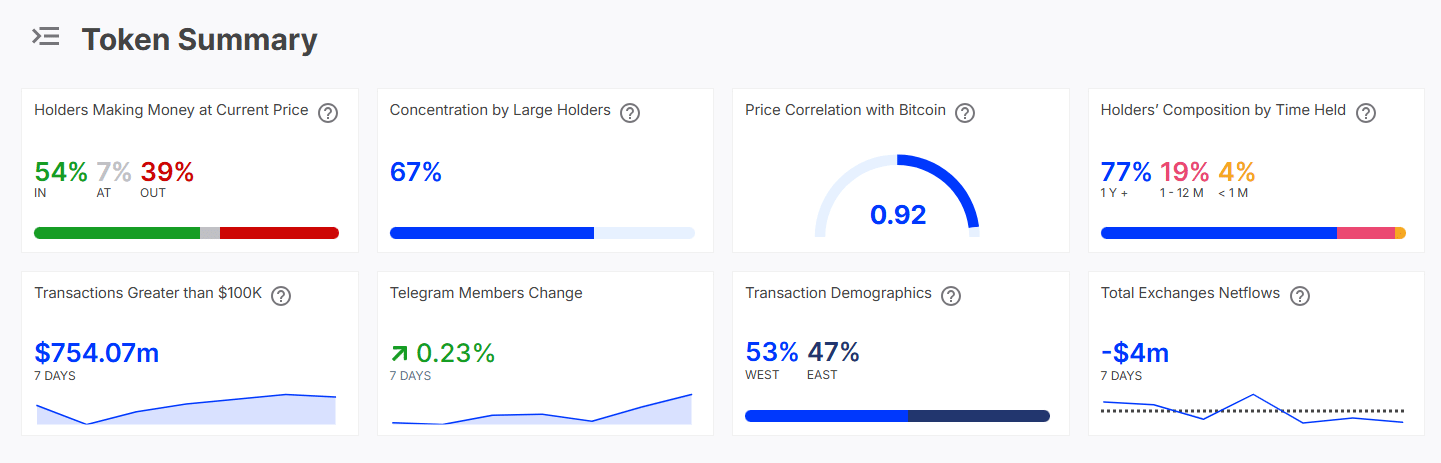

Recent on-chain data showcases Chainlink’s bullish momentum, supported by a notable surge in trading volume. Notably, IntoTheBlock reports significant exchange withdrawals, totaling around $4 million within the last week, indicating solid investor confidence.

Additionally, 67% of LINK’s holders classed as large-scale investors suggest that whale accumulation may be a factor aiding in price stability. With more than 54% of these holders currently in profit, the metrics reveal a decrease in selling pressure alongside a verified long-term investment sentiment.

Source: IntoTheBlock

Furthermore, LINK’s IO-weighted funding rate has recently turned positive, pointing to a potential trend reversal, reaffirming bullish momentum.

Source: Coinglass

Market Developments and Chainlink’s Strategic Position

Chainlink’s growing utility in decentralized finance (DeFi) cultivates a strong foundation for its long-term prospects. The ongoing collaboration with U.S. authorities to establish compliant smart contracts further enhances its reputation and potential adoption within traditional finance.

As LINK’s price consolidates while exhibiting signs of a trend reversal, these market developments suggest an optimistic outlook for its future. Additionally, given its significant correlation with Bitcoin (0.92), traders are advised to monitor BTC movements closely as they may directly impact LINK price dynamics.

Investors should remain vigilant, observing both LINK’s price patterns and whale activities for optimal trading strategies.

Conclusion

In summary, Chainlink (LINK) is experiencing a critical juncture, with several factors aligning for possible upward movement. As the altcoin navigates through technical patterns and showcases strong on-chain support, market participants should be prepared for potential opportunities as LINK attempts to break past resistance levels. Monitoring developments closely could yield rewarding insights and inform trading decisions moving forward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The 10-year U.S. Treasury yield fell 6 basis points to 4.257%.

Utah Bitcoin Bill Passes State Senate, But Key Provisions Are Deleted

Today's Fear and Greed Index dropped to 20, and market sentiment turned to "extreme panic"