Research Report | In-Depth Analysis of the RedStone & RED Token Market Value

1. Project Introduction

RedStone is a modular blockchain oracle, similar to Chainlink and Pyth Network, designed to provide efficient and cost-effective data feeds. It has been deployed across more than 70 blockchains and supports over 140 leading DeFi projects, including Morpho, Pendle, Spark, Venus, Ethena, and Etherfi. RedStone stands out as the only cross-chain data provider that simultaneously supports both Push and Pull oracle models. Additionally, it integrates EigenLayer AVS for on-chain validation, optimizing gas costs while maintaining security and significantly enhancing scalability.

Functionally, RedStone offers extensive adaptability, delivering precise data for BTC staking, yield-bearing stablecoins, Liquid Staking Tokens (LSTs), Liquidity Restaking Tokens (LRTs), and various DeFi protocols. Even under extreme market conditions, it ensures low-latency, high-frequency data updates. For instance, during the $2 billion DeFi liquidation event in February 2024, RedStone reportedly pushed 119,000 updates within 24 hours, with ETH/USDC price updates surpassing Chainlink by 30%, ensuring more accurate market feedback.

RedStone is also leading in market expansion. In 2024 alone, it onboarded over 100 top-tier clients and expanded to more than 30 emerging blockchains, driving its Total Value Secured (TVS) to new highs. Unlike Chainlink, which primarily focuses on the Ethereum ecosystem, RedStone strategically targets emerging blockchain networks such as Monad, Berachain, MegaETH, and Unichain while maintaining strong integrations with Layer 2 ecosystems like Base, Arbitrum, and Optimism.

2. Project Highlights

The Only Modular Oracle Supporting Both Push Pull Models

RedStone is the only oracle solution that simultaneously supports both Push and Pull models. Unlike traditional oracles, it provides flexible data retrieval methods tailored to different DeFi protocol requirements. The Push model is ideal for low-frequency applications like on-chain lending and stablecoins, while the Pull model is optimized for high-frequency use cases such as derivatives, options, and perpetual contracts. This approach significantly reduces gas costs while ensuring faster and more accurate data transmission.

Rapid Expansion into Emerging Blockchains, Covering 70+ Ecosystems

RedStone has integrated with over 70 blockchains, including major networks like Ethereum, Base, and Arbitrum, while also pioneering adoption in emerging ecosystems such as Monad, Berachain, MegaETH, and Unichain. Unlike traditional oracles that primarily focus on the EVM ecosystem, RedStone offers broader cross-chain compatibility and future scalability, delivering efficient and secure data feeds across both DeFi and Layer 2 ecosystems.

AVS Integration for Enhanced Data Validation and Cost Efficiency

By leveraging EigenLayer AVS (Actively Validated Services), RedStone enhances data validation through off-chain computation, maintaining data security while significantly reducing gas costs compared to traditional oracles. This innovative approach allows RedStone to provide high-frequency data updates more cost-effectively, ensuring the stability of DeFi protocols, particularly during periods of market volatility.

Industry-leading Data Update Speed for Precise Pricing During Extreme Market Conditions

RedStone excels in maintaining real-time accuracy, even during volatile market events. Reports indicate that during the $2 billion DeFi liquidation event in February 2024, RedStone pushed 119,000 updates within 24 hours, with ETH/USDC price updates exceeding Chainlink by 30%. By delivering faster and more precise market prices, RedStone plays a crucial role in stabilizing DeFi trading and liquidation mechanisms, giving it a competitive edge.

3. Market Valuation Expectation

As a modular blockchain oracle, RedStone’s valuation can be compared to major industry players such as API3, PYTH, and Chainlink.

4. Tokenomics

Total RED Supply: 1 billion tokens

Current Circulating Supply: 280 million tokens

Token Allocation and Vesting:

- Community Genesis: 10% (Distributed to the community through initial claim events)

- Protocol Development: 10% (Supports essential research and development)

- Core Contributors: 20% (Rewards team members who drive protocol development)

- Ecosystem Data Providers: 28.3% (Fuels innovation and community growth)

- Early Supporters: 31.7% (Rewards investors who backed RedStone’s growth)

Token Utility:

- Payment for Oracle Services: Protocols using RedStone must pay fees in RED tokens.

- Staking and Governance: Users can stake RED tokens to participate in governance and network security.

- Ecosystem Incentives: Tokens are used to reward data providers, developers, and contributors.

5. Team Funding

Team Information:

RedStone was co-founded by Jakub Wojciechowski (Co-founder CEO) and Marcin Kaźmierczak (Co-founder COO). The project began in 2020 when Jakub shared his vision for a new type of oracle with Marcin, inviting him to join in disrupting the oracle market. Marcin accepted without hesitation, leading to the birth of RedStone. Today, RedStone has grown into a 28-member team, emerging as one of the fastest-growing oracle providers in 2024. It delivers high-reliability and high-accuracy data services for renowned DeFi projects such as Pendle, Venus, and Lido.

Marcin’s contributions to cryptocurrency and Web3 development earned him recognition as one of Poland’s "30 Under 30" rising talents.

Funding:

RedStone has successfully raised over $22 million across three funding rounds:

- Seed Round (August 30, 2022): Raised $7 million, led by Lemniscap, with participation from Coinbase Ventures, Blockchain Capital, and others.

- Angel Round (May 22, 2023): Secured backing from prominent figures, including Stani Kulechov (Aave), Sandeep Nailwal (Polygon), Emin Gün Sirer (Avalanche), and others.

- Series A (July 2, 2024): Raised $15 million, led by Arrington XRP Capital, with participation from Spartan Group, IOSG Ventures, Kenetic Capital, Amber Group, and others.

6. Potential Risks

-

Competition from Established Oracle Providers:

Chainlink, Pyth, Tellor, and other oracle providers already dominate the market. Whether RedStone can continue expanding and attracting more DeFi protocols remains uncertain. -

Reliance on Underlying Blockchains:

RedStone depends on networks like Ethereum, Solana, and Base. If these blockchains experience congestion, high gas fees, or outages, RedStone’s data transmission could be affected, potentially impacting service stability.

7. Official Links

- Website: https://www.redstone.finance/

- Twitter: https://x.com/redstone_defi

- Telegram: https://t.me/redstonefinance/

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Abandon illusions and prepare for the most challenging moments in the crypto market.

Teucrium CEO States What’s Coming for XRP

Arthur Hayes Reveals Altcoin Season Thrives Beyond Expectations

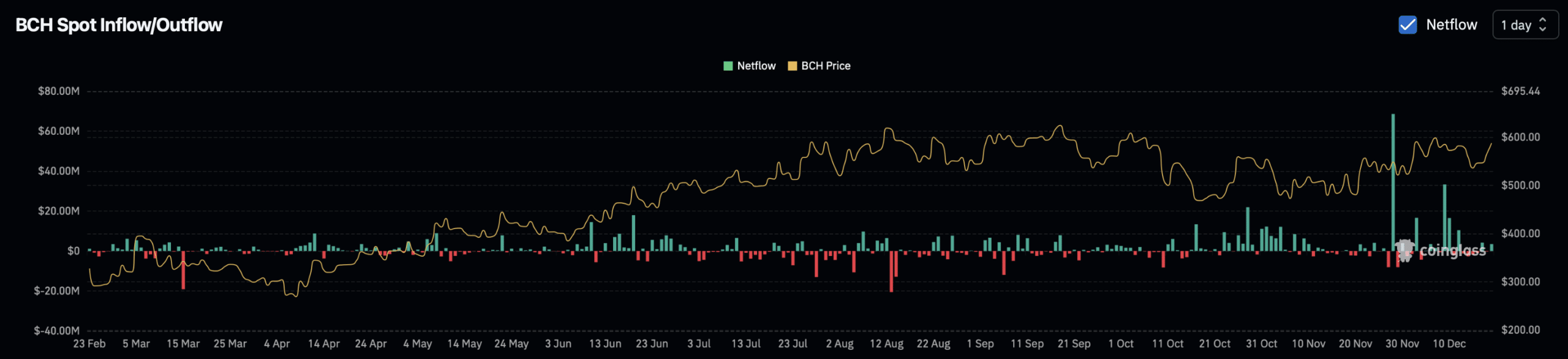

Understanding Bitcoin Cash’s 10% jump amid BCH’s spot–derivatives divide