Will Ethereum’s (ETH) Fortunes Return? Analytics Firm Cites Surprise Moves

Will Ethereum, the world's largest altcoin, see its fortunes reverse after its recent underperformance?

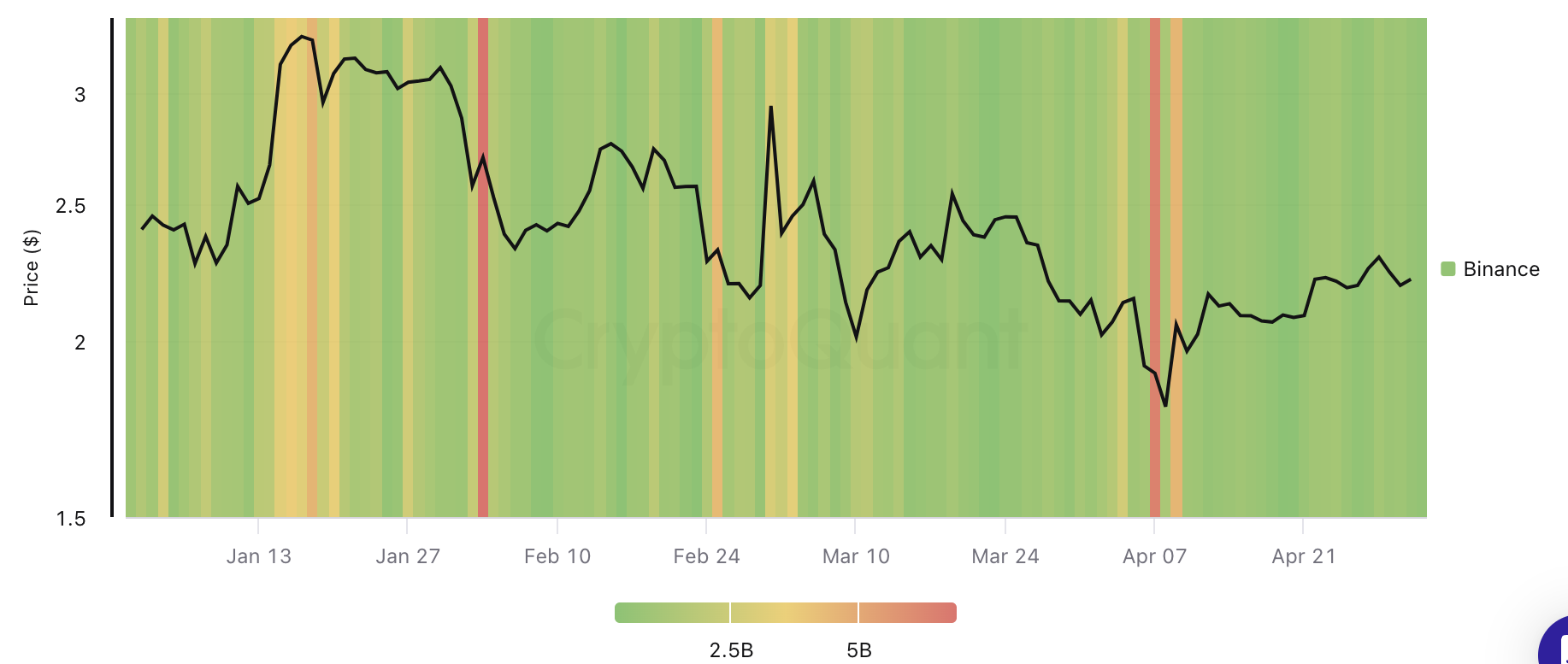

Cryptocurrency analytics firm Santiment has published a new assessment of Ethereum (ETH), which has been criticized by the crypto community for its recent poor price performance.

Ethereum’s total market cap has fallen by 36% compared to just seven weeks ago. According to the analytics firm, this decline has brought a major drop in the percentage of ETH currently in profit since its initial release. When the percentage of coins in profit at the time of the daily close is evaluated, it has fallen to its lowest relative value in the last four months, and in terms of the number of coins in profit, it has marked a three-month low.

According to Santiment analysts, the crypto community has become increasingly negative towards the world’s second-largest cryptocurrency due to its poor performance compared to other major altcoins. Given the rising FUD and the increasing tendency of retail investors to sell their coins, analysts predict that there could be surprise jumps in ETH prices as the cryptocurrency market begins to stabilize.

The world's largest altcoin is trading at $2,622 at the time of writing.

*This is not investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Whale Activity Surges With Billions in Binance Deposits Per Day

$IMX Soars 24% in 4-Hour Rally – Can Immutable Lead the Next Web3 Gaming Boom?

VIPBitget VIP Weekly Research Insights

The Sui ecosystem has performed exceptionally well over the past six months, driven by a positive flywheel effect built on DeFi incentives, ecosystem partnerships, and support for high-quality projects. This cycle — subsidizing staking participation, boosting TVL and liquidity, empowering new projects with exposure and expanding its user base — has propelled Sui to the forefront. Currently, the market is speculating on a potential SUI ETF launch and anticipating another TVL milestone for the ecosystem. Recently launched Sui-based tokens, such as DEEP and WAL, have already been listed on Korea's leading exchange Upbit, demonstrating the strong backing and resources of the Sui Foundation. Additionally, an upcoming token unlock worth over $250 million has drawn further market attention. While large unlocks can trigger price concerns, as seen with Solana, SOL remains resilient, and many investors are optimistic about SUI's long-term price action. A post-unlock pullback could present an attractive entry point.

Ethereum (ETH) Price Prediction May 2025: Will ETH Break $2,100 or Face Rejection?