PEPE’s 50% Crash Brings A Death Cross And Hidden Opportunity

PEPE faces a looming Death Cross after a 54% drop, but a hidden opportunity may emerge. Can the meme coin reclaim support and bounce back?

PEPE has suffered a sharp downturn, dropping nearly 50% over the past month and reaching its lowest price in three months. Investors have faced significant losses as bearish sentiment grips the meme coin market.

While the possibility of further correction remains, an emerging technical pattern could also signal a buying opportunity for long-term holders.

PEPE Is Facing a Bearish Cycle

The exponential moving averages (EMAs) indicate growing bearish pressure, with the 200-day EMA approaching a crossover above the 50-day EMA. This event, known as a Death Cross, is typically a strong bearish signal.

If the crossover occurs, selling momentum could intensify, further dragging PEPE’s price lower.

Currently, the 200-day EMA is just 8% away from completing the Death Cross formation. If bearish conditions persist, PEPE could struggle to recover in the short term. This technical pattern often leads to extended downtrends across various assets.

PEPE Death Cross. Source:

TradingView

PEPE Death Cross. Source:

TradingView

Despite bearish signals, PEPE’s Market Value to Realized Value (MVRV) ratio suggests a possible shift in momentum. The MVRV ratio has reached -29%, placing PEPE within the “Opportunity Zone.”

Historically, when this metric drops between -17% and -30%, it indicates that selling pressure is nearing exhaustion.

A negative MVRV ratio suggests investors are holding unrealized losses, making them less likely to sell further. This can create an accumulation period where long-term holders start buying at discounted prices.

If this trend follows previous patterns, PEPE price could be setting up for a potential recovery.

PEPE MVRV Ratio. Source:

Santiment

PEPE MVRV Ratio. Source:

Santiment

PEPE Price Prediction: Recovering The Losses

PEPE is currently trading at $0.00000941, slipping below the critical support level of $0.00001000. This marks a three-month low for the meme coin, making it one of the worst-performing assets of the month. The sustained selling pressure has made it difficult for PEPE to regain upward momentum.

The looming Death Cross raises concerns about further declines, potentially pushing PEPE below the $0.00000839 support level. A drop below this threshold would likely trigger additional selling, worsening investor losses.

If bearish momentum remains dominant, PEPE could see prolonged consolidation at lower price levels.

PEPE Price Analysis. Source:

TradingView

PEPE Price Analysis. Source:

TradingView

However, a reversal remains possible if PEPE can reclaim $0.00001000 as support. If the meme coin flips $0.00001146 into support, it would invalidate the bearish outlook and shift momentum toward recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin traders eye ‘huge’ US jobs data as BTC price risks $95K dip

BTC price strength faces further risks as prediction markets see a giant beat on US January jobs.

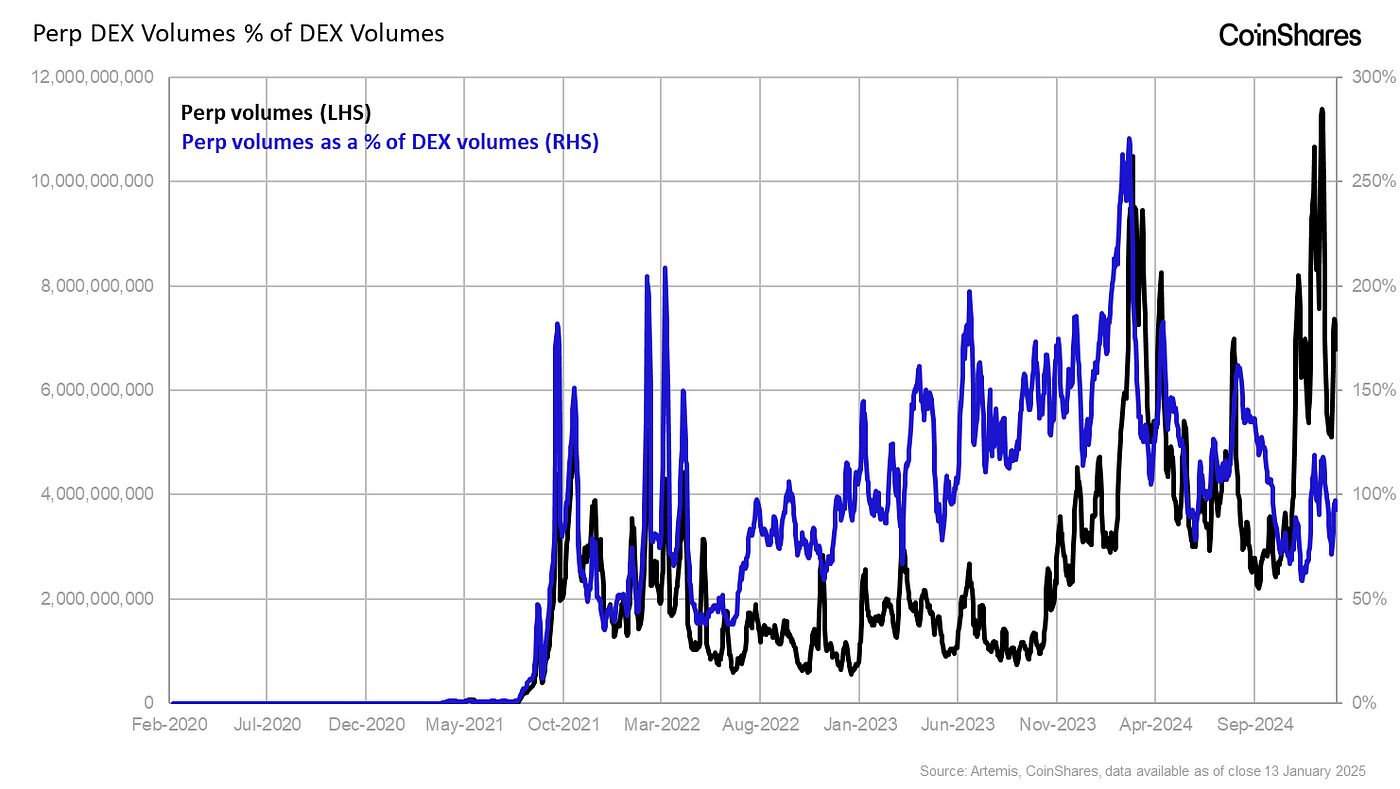

The Perpetual DEX Sector: A Great Leap Forward

Engage now, or forever hold your peace

Speakers at yesterday’s Ondo Summit in Manhattan urged the industry to engage with regulators as crypto policy efforts unfold

ETH Price Outlook: Will Pectra Upgrade Reinstate Ethereum’s ‘Ultra Sound Money’ Status?