Bitcoin chart signals ‘decisive price move’ in coming weeks: Analyst

From cointelegraph by Ciaran Lyons

Bitcoin could be headed for a “decisive price move” in the coming weeks as the US decides on its next Bitcoin move, amid other macroeconomic developments.

Some analysts anticipate that direction is likely upward, as Bitcoin

BTC$96,953has yet to fully price in the US government’s pro-crypto stance.

Clearer signals on Bitcoin’s price in the coming weeks

Bitfinex analysts said in a recent markets report that Bitcoin could shift “especially as more macroeconomic developments unfold.”

They pointed out that Bitcoin has been trading within a 15% price range since mid-November when it hovered around $90,000. Historically, 15-20% consolidated price ranges tend to “resolve in either direction within 80 - 90 days.”

They said that despite Bitcoin's “high correlation” with macro conditions, its recent ability to hold above its pre-US election price of around $70,000 — despite turbulence in the crypto market triggered by US President Donald Trump imposing tariffs on Canada, Mexico and China — demonstrates the asset’s relative strength.

Trump’s tariff news led to the “largest liquidation event in crypto history” on Feb. 3, with over $2.24 billion liquidated from the crypto markets within 24 hours .

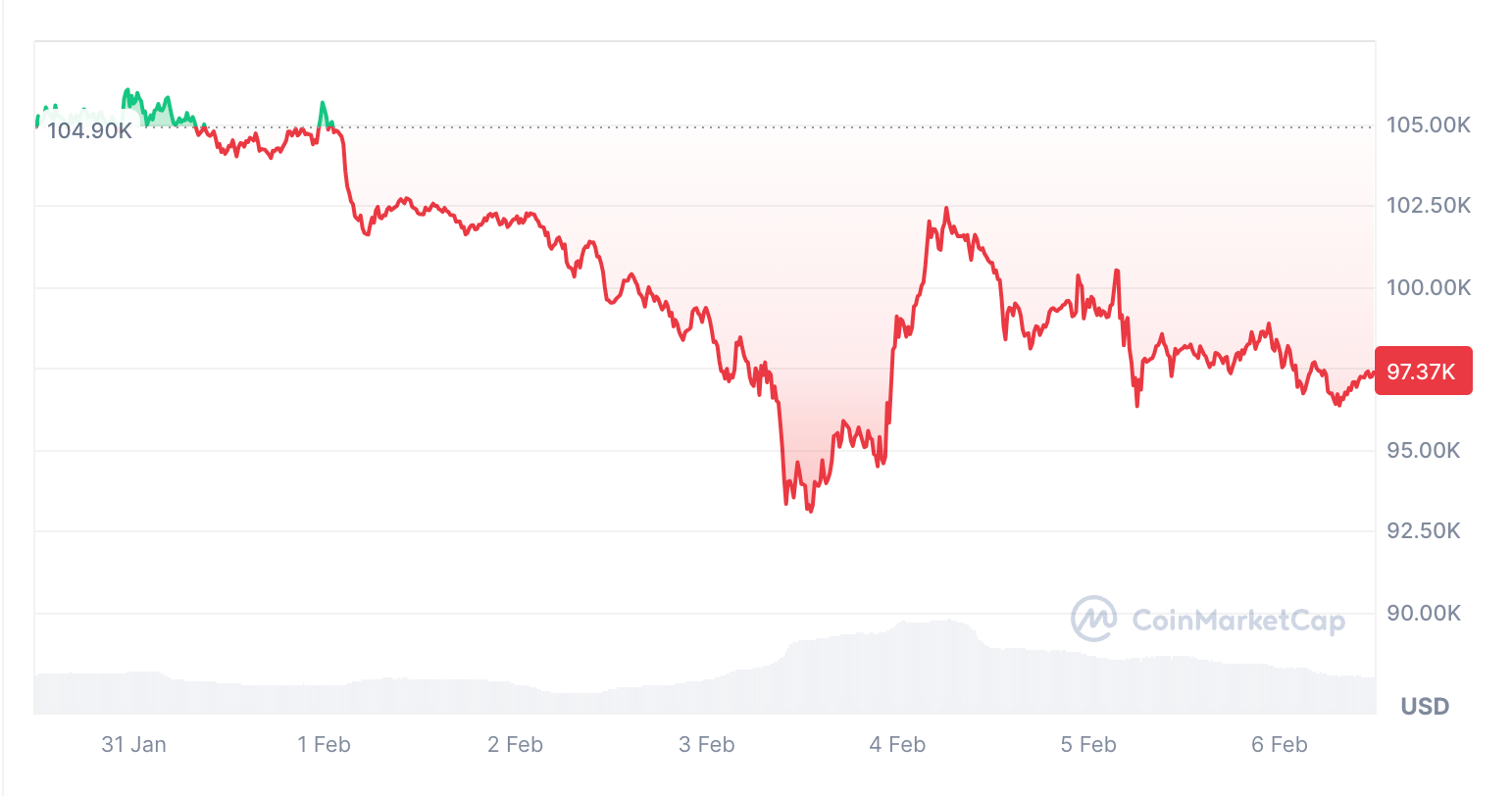

Bitcoin is trading at $97,370 at the time of publication. Source: CoinMarketCap

Bitcoin’s price slipped below the psychological $100,000 level, dropping to $92,584 before rebounding to $97,370 at the time of publication. However, analysts aren’t ruling out the possibility of another near-term scare event shaking Bitcoin’s price.

“While Bitcoinʼs short-term volatility may continue in response to macroeconomic influences, its long-term outlook remains positive,” they said.

Other analysts say once the US government confirms its highly anticipated Bitcoin plans , BTC could potentially clock a significant surge.

Crypto analyst Thomas Fahrer said in a Feb. 5 X post, “The day the US government announces they are buying Bitcoin, the price will go up $50,000 in a single 1-minute candle.”

Expressing similar sentiment, MN Capital founder Michaël van de Poppe said in an X post on the same day, “If there’s a case where the US government understands that it needs to become positive about the adoption of crypto, it’s now.”

“Bitcoin is still neutrally valued, where the altcoins are criminally undervalued. The entire sector is criminally undervalued,” van de Poppe said.

“The adoption is bigger than ever,” he said.

“That’s quite often not a period where you’d be saying: I’m going to log out, and I expect this market to be peaked. Far from it,” he added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock now owns 5% of Strategy as the latter's bitcoin exposure grows

BlackRock has increased its stake in Strategy (formerly MicroStrategy) from 4.09% to 5%, acquiring 1.78 million additional shares.Its total holding now stands at 11.26 million shares, worth over $3.67 billion at current prices.

VanEck Forecasts Solana Price Target for End of 2025

Galaxy Digital CEO Criticizes Ethereum’s Struggles Amid Regulatory Pressure

Here Are the Altcoins Crypto Whales Are Buying Right Now