Trader Issues Urgent Bitcoin Alert, Says BTC Could Crash 25% if One of the ‘Most Critical’ Support Levels Breaks

A closely followed crypto strategist is warning that Bitcoin ( BTC ) could collapse by double-digit percentage points if it loses one key level.

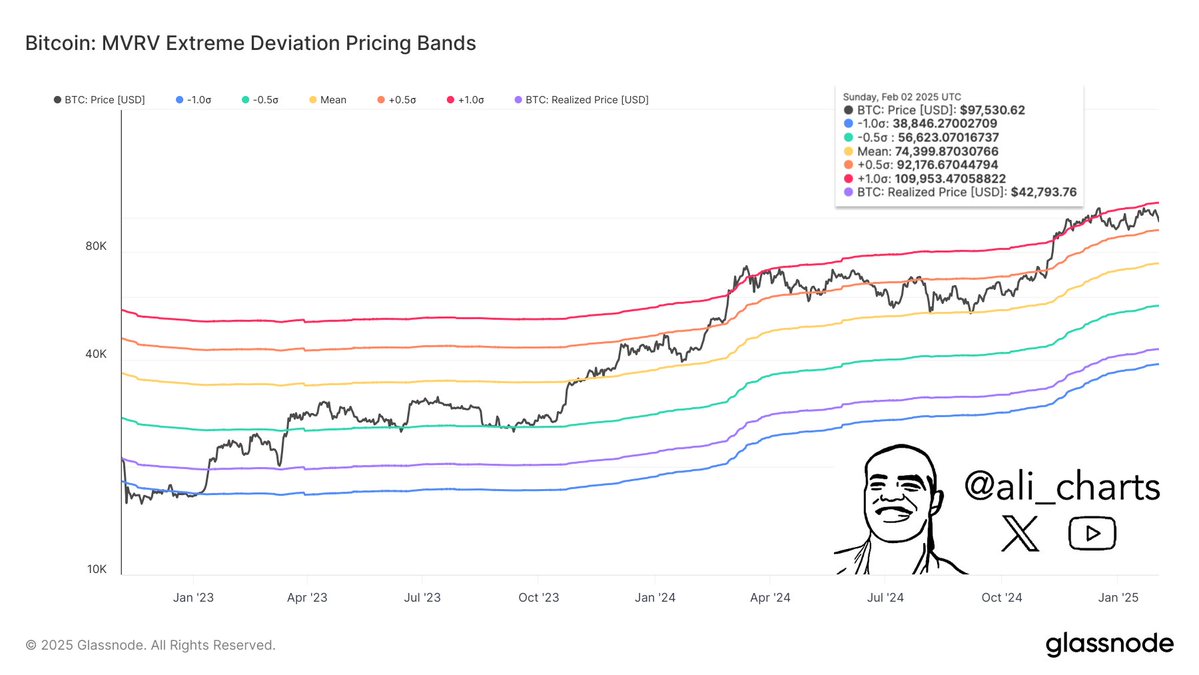

Analyst Ali Martinez tells his 122,900 followers on the social media platform X that Bitcoin could plummet to $74,400, a level last seen in November, if BTC cannot hold $92,180 as support.

Martinez uses pricing bands derived from Bitcoin’s Market Value to Realized Value (MVRV) to identify the key levels of support.

The MVRV is the ratio of a crypto asset’s market capitalization relative to its realized capitalization or the value of all the coins at the price they were bought. When the MVRV value drops below zero, it indicates that the asset is oversold as traders who bought it at a certain time frame are witnessing losses.

“$92,180 is now one of the most critical support levels for Bitcoin, based on the MVRV Pricing Bands. If this level breaks, $74,400 becomes the next target.”

Source: Ali Martinez/X

Source: Ali Martinez/X

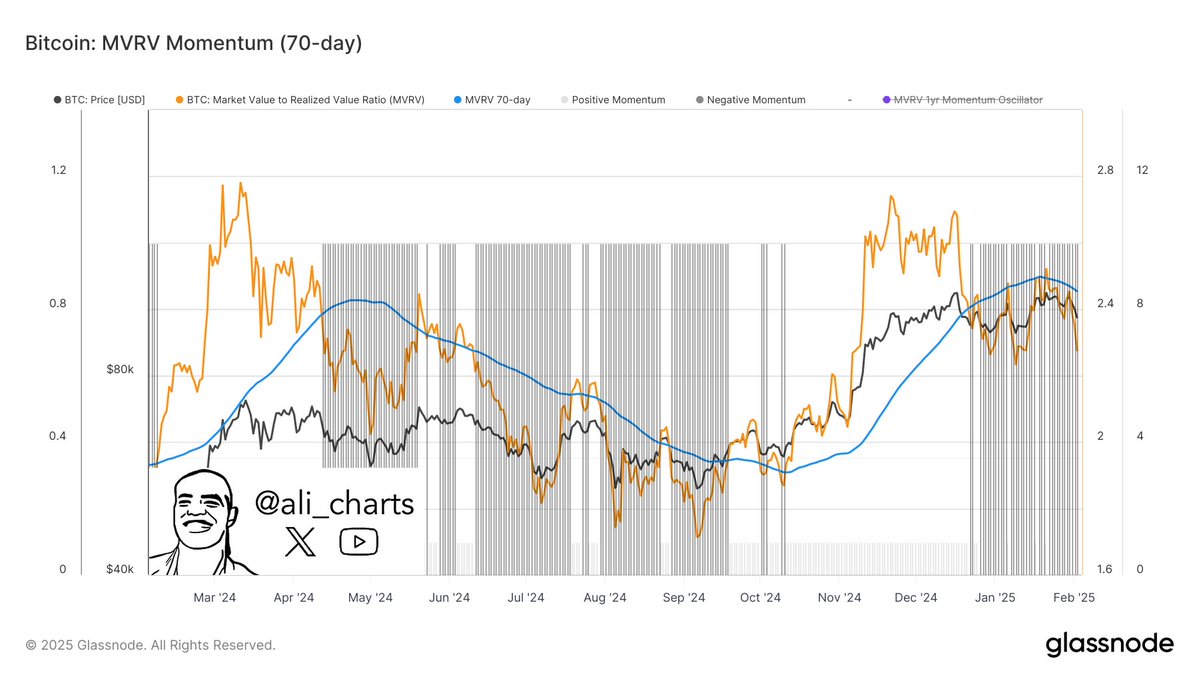

He also says that Bitcoin’s MVRV metric indicates that the flagship crypto asset has remained in a downtrend since January 1st.

“The MVRV Momentum indicator shows that Bitcoin has remained in negative territory since the start of the year, signaling potential weakness in the market!”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading for $96,234 at time of writing, down 1.6% in the last 24 hours.

Next up, the analyst warns that memecoin dogwifhat ( WIF ) may be forming a bearish flag pattern and is at risk of declining by more than 35% from its current value.

“If this is a bearish flag, WIF targets $0.51!”

Source: Ali Martinez/X

Source: Ali Martinez/X

WIF is trading for $0.79 at time of writing, down marginally in the last 24 hours.

He also says scaling solution Optimism ( OP ) may be forming a head-and-shoulders pattern, which typically suggests that an asset is losing momentum and could reverse its uptrend if the price breaks below the structure’s support.

“OP appears to form a head-and-shoulders pattern, signaling a potential price correction ahead!”

Source: Ali Martinez/X

Source: Ali Martinez/X

OP is trading for $1.09 at time of writing, down 2.6% in the last 24 hours.

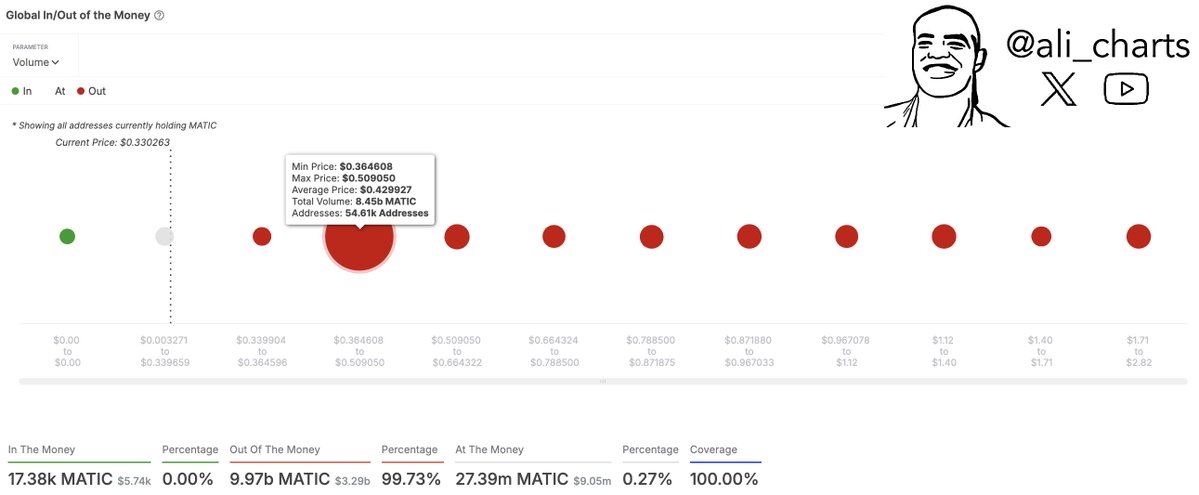

Lastly, he says that Optimism rival Polygon ( POL ) may correct even further.

Martinez uses the In/Out of the Money Around Price (IOMAP) metric – which classifies crypto addresses as either profiting, breaking even, or losing money – to determine support and resistance levels for POL.

“On-chain data reveals that most Polygon tokens were accumulated between $0.364 and $0.509. Reclaiming this zone as support is crucial! Failure to do so could trigger another sell-off as investors look to minimize losses.”

Source: Ali Martinez/X

Source: Ali Martinez/X

POL is trading for $0.3115 at time of writing, down marginally on the day.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Easing inflation could ignite another BTC rally: 10x Research

10x Research’s Markus Thielen sees a “real possibility” of a lower CPI print in the US on Feb. 12, which could defy consensus expectations and trigger a Bitcoin rally.