SushiSwap (SUSHI) Retesting Descending Triangle Breakout: What’s Ahead?

Date: February 2, 2025 | 05:31 PM GMT

The cryptocurrency market is experiencing a sharp sell-off today, with Bitcoin (BTC) dropping below $98,000 and Ethereum (ETH) falling by 9 percent. This downturn appears to be driven by ongoing U.S. tariff wars and a rise in Bitcoin dominance, which has now increased to 60.23 percent.

Amid this market-wide correction, SushiSwap (SUSHI) has also suffered a significant decline of over 17 percent, currently trading around $1.0.

Source: Coinmarketcap

Source: Coinmarketcap

However, technical indicators suggest that a potential bullish reversal could be on the horizon, as highlighted by chart analyst @bitamberly.

Analyst Insight

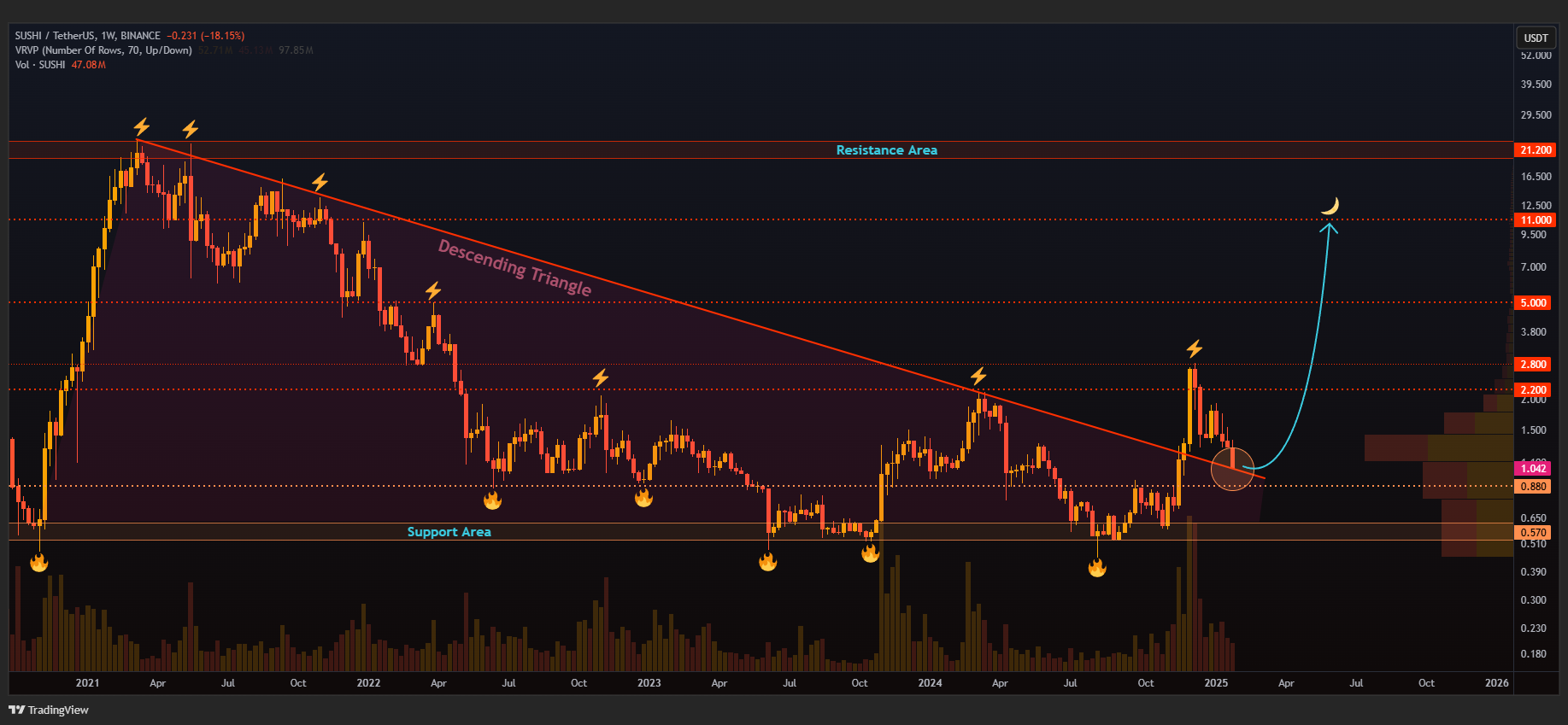

According to technical analysis, SushiSwap has broken out from a descending triangle formation and is now retesting the breakout zone on the weekly chart.

SushiSwap (SUSHI) Weekly Chart/ Source: @bitamberly (X)

SushiSwap (SUSHI) Weekly Chart/ Source: @bitamberly (X)

The chart indicates that SUSHI has broken out of a three-year-long descending triangle pattern and is now testing previous resistance as support. The price is currently hovering around the $1 support level, a critical area to hold for further upside momentum.

If SUSHI successfully bounces from this retest, potential upside targets include $2.20, $2.80, $5.00, and $11.00.

What’s Ahead?

As SUSHI is retesting this long-awaited breakout, the ongoing market decline remains a major concern. However, broader market indicators hint at a possible altcoin resurgence.

According to Jonathan , a prominent chart analyst, the altcoin market capitalization (OTHERS) is bouncing off a strong ascending support level and is poised for potential upside movement against Bitcoin.

OTHERS Chart/Source: @JohncyCrypto (X)

OTHERS Chart/Source: @JohncyCrypto (X)

The ascending trendline has historically acted as a strong support level. If the trend holds, altcoins could witness a significant rally targeting previous highs.

Previous Bitcoin halving cycles have triggered major altcoin rallies, typically starting in January following a peak in Bitcoin dominance. If Ethereum recovers, it could lead to renewed investor interest in decentralized finance (DeFi) tokens like SushiSwap.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US media: Trump plans to further tighten control over the hiring and firing of federal employees

SEC Leadership Shift Brings New Hope for Crypto Industry

Arbitrum exits Nvidia accelerator program after it refuses to work with crypto firms

Institutional Demand Spurs BTC Rally, Bitcoin ETF Inflows Peak at $442M with IBIT Leading the Charge

IBIT Emerges as Key Player in the Bitcoin ETF Space, Could Soon Challenge Wall Street's Largest Counterparts