$8.35B Bitcoin Options and $1.93B Ethereum Options Expire Tomorrow

Over $10 billion in crypto options are set to expire tomorrow morning on Deribit

Key Points

- Tomorrow’s $10.28 billion in Bitcoin and Ethereum options expiry is the largest one in January.

- BTC is trading near $105,000 and ETH is trading above $3,200.

A significant amount of crypto options is set to expire tomorrow, January 31 on Deribit, potentially bringing volatility into the market.

Bitcoin and Ethereum Options Expiry Details

Tomorrow morning, at 08:00 (UTC), $10.28 billion in BTC and ETH options will expire on Deribit, marking the largest options expiration event in January.

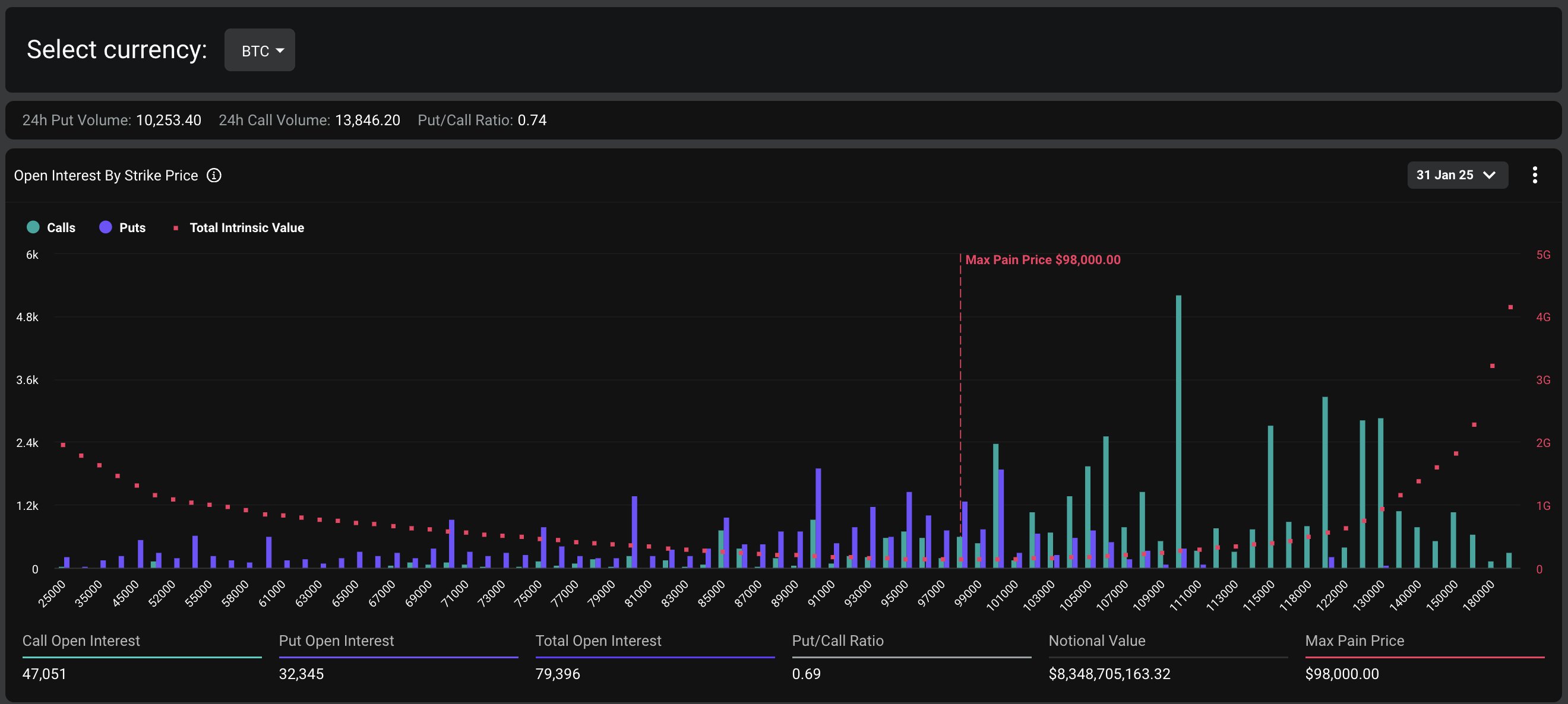

$8.35 billion in BTC options will expire with a Max Pain Point of $98,000 and a Put/Call Ratio of 0.69.

Deribit – BTC options expiry data

Deribit – BTC options expiry data

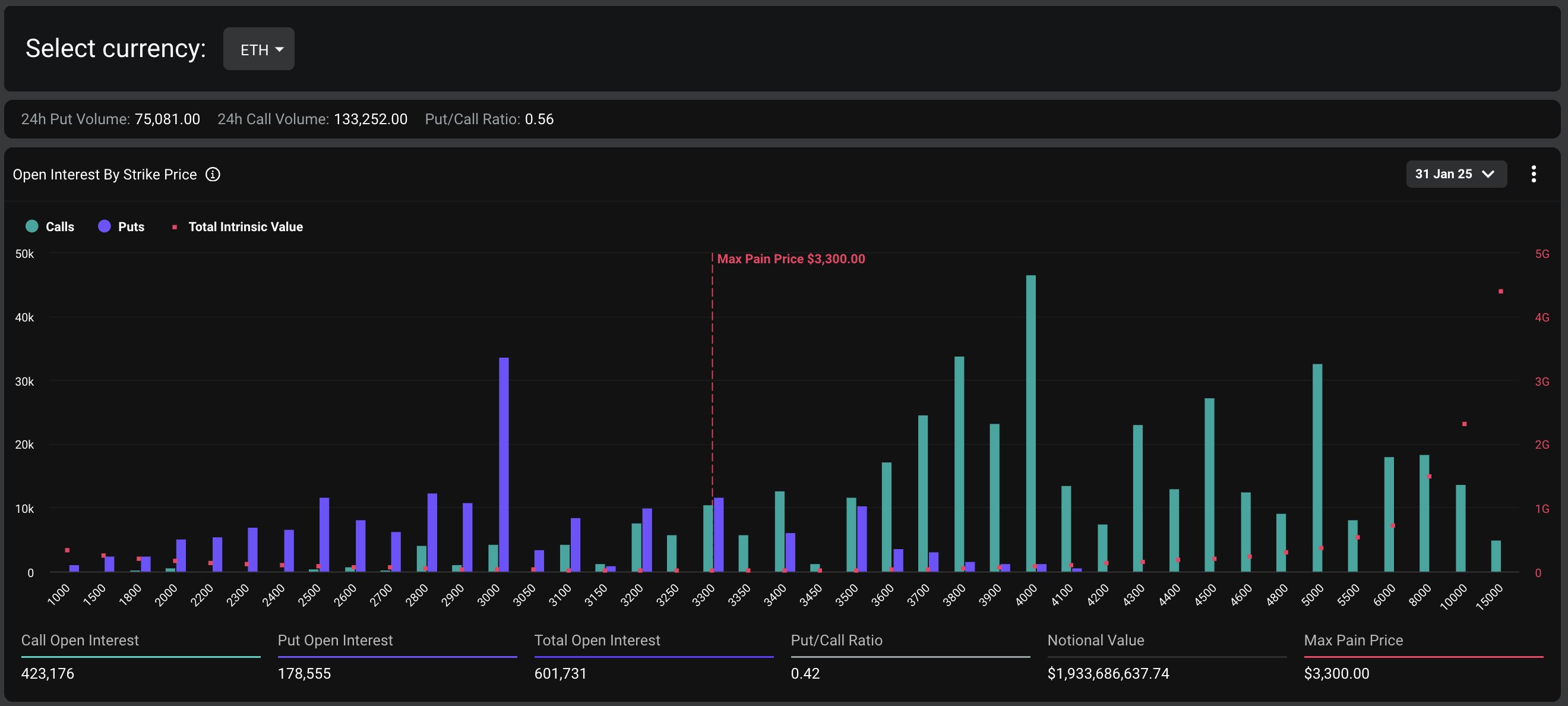

Also, $1.93 billion in ETH options will expire with a Max Pain Point of $3,300, and a Put/Call Ratio of 0.42, according to Deribit’s notes via X.

Deribit – ETH options expiry data

Deribit – ETH options expiry data

Tomorrow’s expiry details are revealed in a volatile crypto market that saw BTC price fluctuating between $98,000 and $105,000 this week.

BTC Trades Near $105,000

At the moment of writing this article, BTC is trading near $105,000, up by almost 3% in the past 24 hours.

BTC price in USD todayAfter dropping to $101,000 levels, yesterday, January 29, BTC rebounded above $105,000 earlier today amidst optimistic predictions and rising institutional interest.

Upcoming SBR in More Countries

Apart from the US which is preparing to establish Strategic Bitcoin Reserves, according to the latest reports, the Head of the Czech central bank plans to buy billions of Euros in Bitcoin.

Financial Times

Financial Times

On December 6, 2024, a no-capital tax on Bitcoin was passed in the Czech Republic with all members of the parliament voting for it.

Apart from optimism stemming from countries potentially creating BTC reserves, growing institutional interest in BTC is also fueling the renewed rally.

Rising Institutional Interest in BTC

An important trigger of institutional adoption is the SEC’s decision to rescind SAB 121 – the policy that previously limited financial institutions from custodying crypto.

This reversal eliminates an important adoption-related barrier, allowing more traditional institutions to enter the Bitcoin market.

Standard Chartered’s head of forex and digital assets research, Geoff Kendrick, stated recently that institutional flows into BTC will continue to gather pace as a result of the latest move.

He also expects BTC to re-test its previous ATH soon, before entering a $112,000-$130,000 in February and March.

Unlike BTC, ETH was not such a good performer.

ETH Trades Above $3,200

At the moment of writing this article, ETH is trading above $3,250, up by over 5% today, but the coin still failed to reach its previous ATH.

ETH price in USD todayWhile BTC continues its ascendant trajectory , ETH and other altcoins fail to keep pace.

However, considering the new crypto-friendly policies in the US and the rising global adoption the crypto market has a bright future in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EMCD CEO Michael Gerlis: I've Always Said Altcoins Are the Future

Cryptocurrency mining planned to develop in the Far East

Securitize and Apollo Team Up to Tokenize Private Credit

Securitize and Apollo Global have hit a major milestone in on-chain private credit.