Bracket Launches New Platform to Simplify Liquid Staking on Ethereum

Bracket's platform enhances Ethereum liquid staking by addressing fragmented liquidity with brktETH, offering optimized yields through managed vaults.

Bracket, a DeFi platform backed by Binance Labs, has introduced its strategy management platform. The platform will offer liquid staking token (LST) holders access to higher staking yields on Ethereum.

Known as ‘ETH+,’ this feature will reportedly address inefficiencies in traditional LST liquidity pools. These pools are often fragmented and prevent seamless yield optimization.

Bracket is Changing Liquid Staking on Ethereum

According to the announcement, brktETH is at the core of Bracket’s platform. This is a non-rebasing token backed by a treasury of diverse LSTs and liquid restaking tokens (LRTs).

The token aggregates assets from providers like Lido, Rocket Pool, and Ether.fi. This simplifies staking on Ethereum and creates a unified approach to yield generation.

“The launch of our strategy management platform is a defining moment for Bracket. Phase II takes us closer to our vision of creating a secure, user-friendly platform where DeFi participants can maximize their yields without compromising transparency or safety,” Mike Wasyl, CEO of Bracket, told BeInCrypto.

Unlike conventional staking tokens that increase in quantity, brktETH gains value through a rising conversion rate relative to ETH.

The platform excludes users from the US and sanctioned regions due to regulatory restrictions.

Previously in an interview with BeInCrypto, Wasyl noted growing interest in passive investment strategies centered on LSTs.

The DeFi sector has seen increased adoption of these tokens as investors favor stable returns over speculative trading. Industry leaders like Lido continue to drive this trend, benefiting from a broader interest in liquid staking solutions.

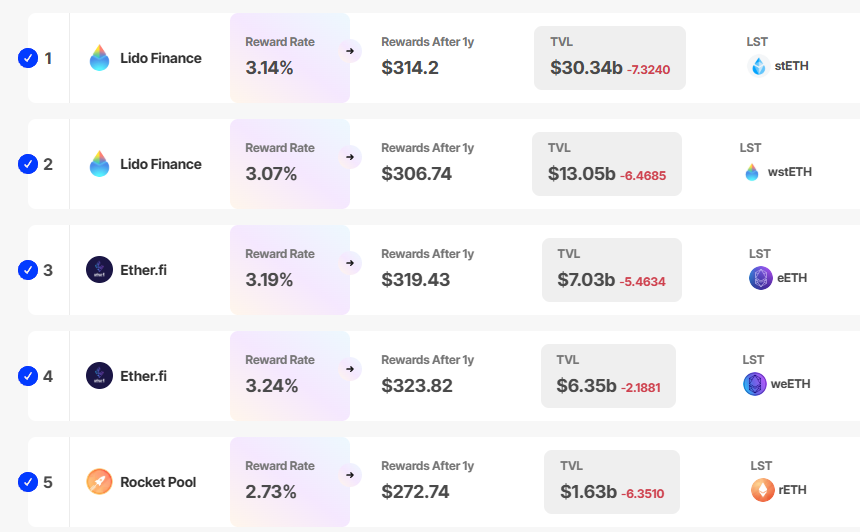

Current Ethereum Staking Reward Rate Across Different Providers. Source:

Staking Rewards

Current Ethereum Staking Reward Rate Across Different Providers. Source:

Staking Rewards

Ethereum Staking Trends and Challenges

In 2024, Ethereum achieved a major milestone: 24% of its total supply was staked. This reflected the community’s preference for passive income options over immediate liquidity.

The Shapella upgrade further boosted flexibility by enabling withdrawals of staked ETH, yet staking activity has continued to rise.

Despite this growth, Ethereum’s staking rewards declined to 3% in Q3 2024. This drop has contributed to reduced validator interest. Queue times for staking shrunk from 45 days in mid-2024 to less than a day.

The Ethereum Foundation is now reevaluating its stance on staking ETH. Previous hesitations stemmed from regulatory concerns and the need to maintain neutrality in contentious hard forks.

Vitalik Buterin recently suggested that regulatory risks have diminished. However, challenges around neutrality persist.

Bracket’s platform launch and the continued evolution of Ethereum staking highlight the growing importance of innovative new solutions in addressing inefficiencies and boosting returns for DeFi participants.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UAE to teach AI to students from 2025

House Republicans Unveil Revised Crypto Market Bill Aiming to Curb Big Firm Dominance

House Republicans have introduced a revised version of the Digital Asset Market Structure Discussion Draft, signalling a pivotal shift in U.S. crypto regulation aimed at decentralizing market power and creating clearer rules for digital asset innovation.

Trump-Appointed Interim US Attorney Takes Over EDNY as SafeMoon CEO’s Criminal Trial Begins

The U.S. Attorney’s Office for the Eastern District of New York (EDNY) has appointed Joseph Nocella as interim U.S. Attorney, according to a May 5 notice, following the departure of Acting Attorney John Durham. Nocella, selected by President Donald Trump, will serve for 120 days or until a Senate-confirmed successor is in place.

Former Celsius CEO Alex Mashinsky Challenges DOJ’s 20-Year Prison Request

Former Celsius CEO Alex Mashinsky is pushing back hard against the U.S. Department of Justice’s request for a 20-year prison sentence, accusing prosecutors of painting him as a “venom-laced” villain and ignoring his clean business record.