Vitalik fired the first shot of EF reform, where is the Ethereum Foundation heading?

Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

On January 18, Ethereum founder Vitalik posted a message saying that “a large-scale change is being made to the leadership structure of the Ethereum Foundation (EF)”.

As soon as the news came out, it caused a huge uproar: some people thought that he had finally repented and returned to the right path; some people said that EFs leadership who are just sitting there doing nothing should have been rectified long ago; others believed that because of the rapid development of the Solana ecosystem, the sense of crisis in the Ethereum ecosystem is unprecedentedly strong, and he is anxious.

What is certain is that Vitalik is not the only one who is anxious.

On the evening of January 22, Konstantin Lomashuk, the founder of the Lido project, an important infrastructure of the Ethereum ecosystem, first retweeted a tweet about the second foundation, and later clarified that it was not the second EF, but just an ordinary tweet. Last September, in response to the weak development of the Ethereum ecosystem, we gave a reference plan in the article Ethereum is sick, are these three medicines suitable for the disease? Now it seems that it is just as we expected.

But a more important question has surfaced: How to revive the glory of the Ethereum ecosystem? Will the EF reform be the dawn of revival? With such questions, Odaily Planet Daily will systematically analyze the subsequent possibilities of EF reform and the subsequent direction of the Ethereum ecosystem in this article for readers reference.

Pride and Prejudice: The Light and Dark Side of the Ethereum Foundation

On January 18, Ethereum ecosystem spiritual leader and Ethereum co-founder Vitalik Buterin wrote: , the large-scale transformation of EFs leadership structure has lasted for nearly a year. In other words, throughout 2024, the EF leadership headed by Vitalik has actually begun a self-revolution, but at present, the interim conclusion we can draw is that this self-revolution has achieved little success for the time being.

The signal released by the reform goal: Focus on ecology, not on politics and ideology

In view of this, Vitalik also mentioned that the main goals of this change are:

Increase technical expertise among EF leadership;

Improve two-way communication and connections between EF leadership and new and existing ecosystem participants. Our role is to support users (individuals and institutions), application developers, wallets, L2;

Introduce fresh blood to improve execution capabilities and speed;

More actively supporting application developers to ensure that important values and inalienable rights (especially privacy, open source, censorship resistance) are available to users, including at the application layer;

Continue to increase the use of decentralized and privacy technologies and the Ethereum chain, including for payments and funds management.

Furthermore, he stressed that the goals of EF change *do not* include :

Implement a certain ideological/atmospheric shift (it is worth mentioning that what he mentioned here is: from the feminine wef soyboy mentality to the Bronze Age mentality, Odaily Planet Daily Note: that is, from a soft, feminine perspective to a male perspective that overly emphasizes practical interests and success);

Actively lobbying regulators and powerful politicians (especially in the United States, with a stronger focus on large countries) and risking compromising Ethereum’s position as a globally neutral platform;

It has become an arena for vested interests;

Become a highly centralized organization and even become the protagonist of Ethereum.

Finally, he mentioned: These things are not what EF does, and that will not change. People who seek a different vision are welcome to start their own organizations.

After careful consideration, the goals mentioned by Vitalik are roughly as follows: adhere to the technical thinking; adhere to the concept of decentralization; unswervingly implement the L2 development route; but the specific measures are not yet clear. It can be seen that Vitaliks reform of EF is still superficial, and the results are self-evident.

EFs most controversial issues: transparency, workload, and speed of dumping

Back to the root cause of EFs current predicament, I think it mainly comes from the following three aspects:

First, there is a lack of information transparency . This is not only reflected in the ambiguity of the foundations related funding expenditures, but also related to the delay in public disclosure, which is in sharp contrast to the agility and efficiency of the Solana ecosystem. Last December, EF officially released an update report on the third quarter of 2024 funding projects , during which the total funding amounted to US$12,848,780.33, covering community education, consensus layer, cryptography and zero-knowledge proof, developer experience and tools, execution layer, L2, protocol growth and support and other fields. Among them, community education projects accounted for the highest proportion, including Blockchain Summer Bootcamp, BlockHack, Building Builders and other activities. In addition, the foundation continues to support the development of consensus layer clients such as Lighthouse, Nimbus, and Grandine, as well as development tools such as Web3.js and OpenZeppelin account abstraction contracts. It is worth mentioning that, as far as I know, EFs funding has not been audited by a third-party independent agency. (If there are relevant examples, please correct me)

At the same time, due to regional and time constraints, the decision-making power of EF funding is only in the hands of a few people, which should be expected. This has also led to the work of some community members who have contributed to the development of the ecosystem not being supported as they should be. In early January, Evan Van Ness, founder of Week in Ethereum News (WiE), wrote : Due to a conversation with EF leadership at the beginning of this year, I announced that this newsletter will cease operations because the communication showed that they believed there was no value in continuing to operate WiE. For the rest of 2024, WiE received only minimal financial support from EF. Although most of this support is symbolic, the EF leadership chose to cut off this insignificant support, making it clear that WiE will end immediately.

Secondly, the proof of work is missing. For EFs work, the outside world cannot see effective proof of work. For the blockchain world, although the Ethereum ecosystem has turned to the POS mechanism, POW is still the most direct and relatively efficient operating mode at the organizational level. In this regard, EF is a well-deserved negative example. What you did and others know what you did are two completely different things.

In addition, this result is also due to the influence of the organizational structure. This is also one of the hotly discussed topics in the crypto field recently. For example, the crypto KOL @0xAllending pointed out that one of the important reasons why Solana can stand out in the competition of blockchain networks is to challenge the market position of ETH with the concept and strength of corporate management; in contrast, the Ethereum ecosystem, especially EF, is still in the community organization form stage of decentralized community autonomy, senior leaders + middle-level researchers/developers + ordinary community members/holders similar structure, dreaming of Mass Adoption under the banner of world computer, which is nothing but a fools dream.

Finally, the market crash was extremely fast. This is the most criticized point of EF by countless people. It is not that there is no similar phenomenon of selling ecological tokens in other ecosystems, but that EFs market crash always seems to be a signal of a staged peak, and often no one mentions faith in Ethereum, firm HODL ETH at this time. Previously, according to Lookonchain monitoring , since EF sold 100 ETH on December 17, the price of ETH has fallen by about 17%. EF sold 4,466 ETH (about 12.6 million US dollars) in 32 transactions in 2024, of which 15 transactions were sold at the highest point in a short period of time.

EF has been a “Top Signal” for quite some time.

It is worth mentioning that Token Terminal data previously showed that Ethereum L1 network revenue has fallen sharply, down 99% since March 2024. On March 5, Ethereum Layer 1 network revenue peaked at more than $35 million; on September 2, daily revenue had fallen to about $200,000, hitting the lowest point of daily revenue for the year. At that time, cryptocurrency analyst Kun warned that if this trend continues, the L2 network may dominate and may abandon Ethereums mainnet, especially for consumer applications. Although this revenue eventually returned to the level before the Dencun upgrade at the end of 2024, the Ethereum mainnet protocol revenue has begun to decline.

If we look closely at the reasons behind this, perhaps pride and prejudice are the first to be blamed.

The reason behind this: Pride is the original sin, prejudice is the shackles

EF researcher Justin Drake said in early December last year that Solanas golden age is coming to an end and will not pose a threat to Ethereum. Despite Solanas strong development momentum, Drake said that Ethereum is focused on long-term gains (is this statement familiar?). Solana is at its peak now, but I think this will be the end of Solanas golden age, because all of Solanas competitive advantages in latency and throughput will disappear because the fundamental differences in the architecture make it non-scalable. Currently, Ethereum developers rely heavily on Layer 2 to provide faster and lower transaction fees. Drake said: I think Ethereum L1 is competing with the Bitcoin ecosystem, and the L2 network is competing with Solana. Therefore, competing with Solana is not even within the scope of Ethereum L1s responsibilities. We should compete in terms of security and health. Therefore, if Solana has any competition, it needs to come from applications and L2 networks.

Coincidentally, in a tweet by Evan Van Ness, the founder of Ethereum Newsweek, responding to the newsletters impending closure, he referred to Solana as Sqlana, which seemed to imply that Solana is a centralized database, and someone in the comment section also mentioned this. Senior node operator @JustDoingItBig expressed his confusion : In 2018, Bitcoin believers ridiculed Ethereum nodes for running centralized databases; and now, Ethereum fans are doing the same.

I can only say that history always rhymes

As for the views on EF, from my personal observation, most Ethereum community members still support it positively, and those who express dissatisfaction are mostly ETH traders or retail investors. Among them, perhaps the views of community member fishbiscuit (@not_qz) can represent a considerable number of EF loyalists. He previously published an article to respond to the communitys multiple questions about the foundation, clarifying that:

Social media activity: Similar to the Solana Foundation, EF used to mainly retweet content, but has recently begun to post more actively;

On-chain use: The foundation has pledged 42,000 ETH to support client development, and has also funded on-chain projects such as EIP-1559 NFT and Beacon Book, and issued grants through the mainnet and L2. Events such as Devcon also support crypto payments;

ETH sell-off: In response to the accusation that the foundation sold ETH, he pointed out that the foundation was taking multiple strategies to balance market pressure, and called on the community to avoid double standards, while emphasizing the regulatory challenges faced by the foundation. He called on the community to look at the foundations contributions rationally and encouraged more constructive discussions.

I have to say that despite the many problems with EF, the community attitude is still extremely tolerant.

To some extent, this also once again verifies a fact: the head is determined by the butt. Now that we have boarded the Ethereum ship, we can only stick together through thick and thin.

Focus of conflict: Vitalik under heavy pressure, Aya, the executive director under attack, and the fragmented Ethereum community

As time goes by, many contradictions related to the EF transformation have gradually surfaced, with the spearhead directed at Ethereum founder Vitalik, EF executive director Aya, and the Ethereum community, which is currently facing serious fragmentation problems.

The dilemma of Ethereum’s spiritual leaders: proactive change vs. past friendship

Since the announcement of the EF transformation on the 18th, Vitalik has undoubtedly been in the eye of the storm under multiple pressures: on the one hand, ETH prices have performed poorly and the ETH ecosystem has deviated from its high-speed growth period, and this situation urgently needs to be changed; on the other hand, the EF core team has also ushered in a period of transformation pain, with EF researchers Justin Drake and Dankrad Feist joining Eigenlayer, and core researcher Danny Ryan leaving EF last year as landmark events, and the past revolutionary friendship is facing a test.

Recently, the news that Eric Conner, an early core developer of Ethereum , announced his withdrawal from the Ethereum community has also sparked heated discussions (although, according to an Ethereum community member, this is not the first time he has made such a farewell), but unlike in the past, he also said that as Vitalik Buterin gradually retreated behind the scenes, EFs opacity and sense of disconnection from the community became stronger and stronger. He pointed out that EF currently presents an anti-victory and competitive mentality, which has led many community members to question whether to stay (this coincides with the non-goals mentioned in Vitaliks previous Reform Manifesto).

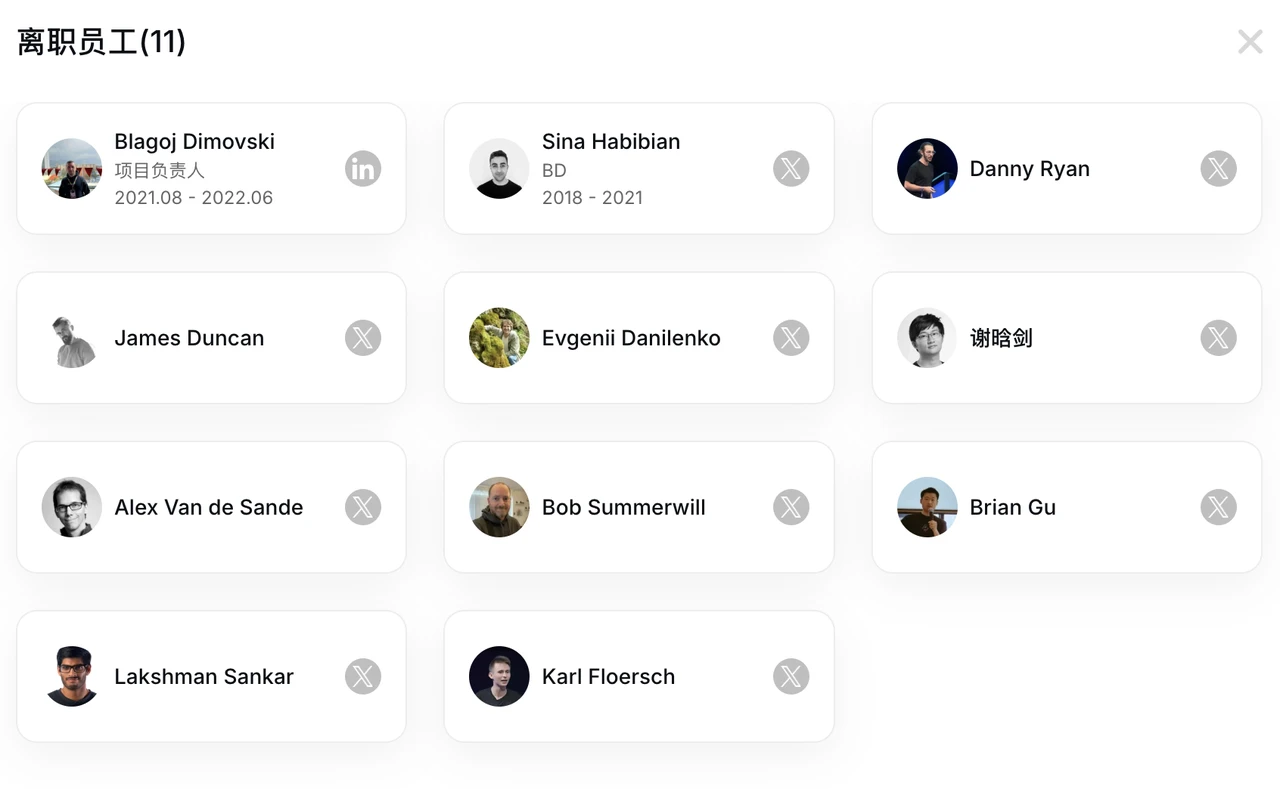

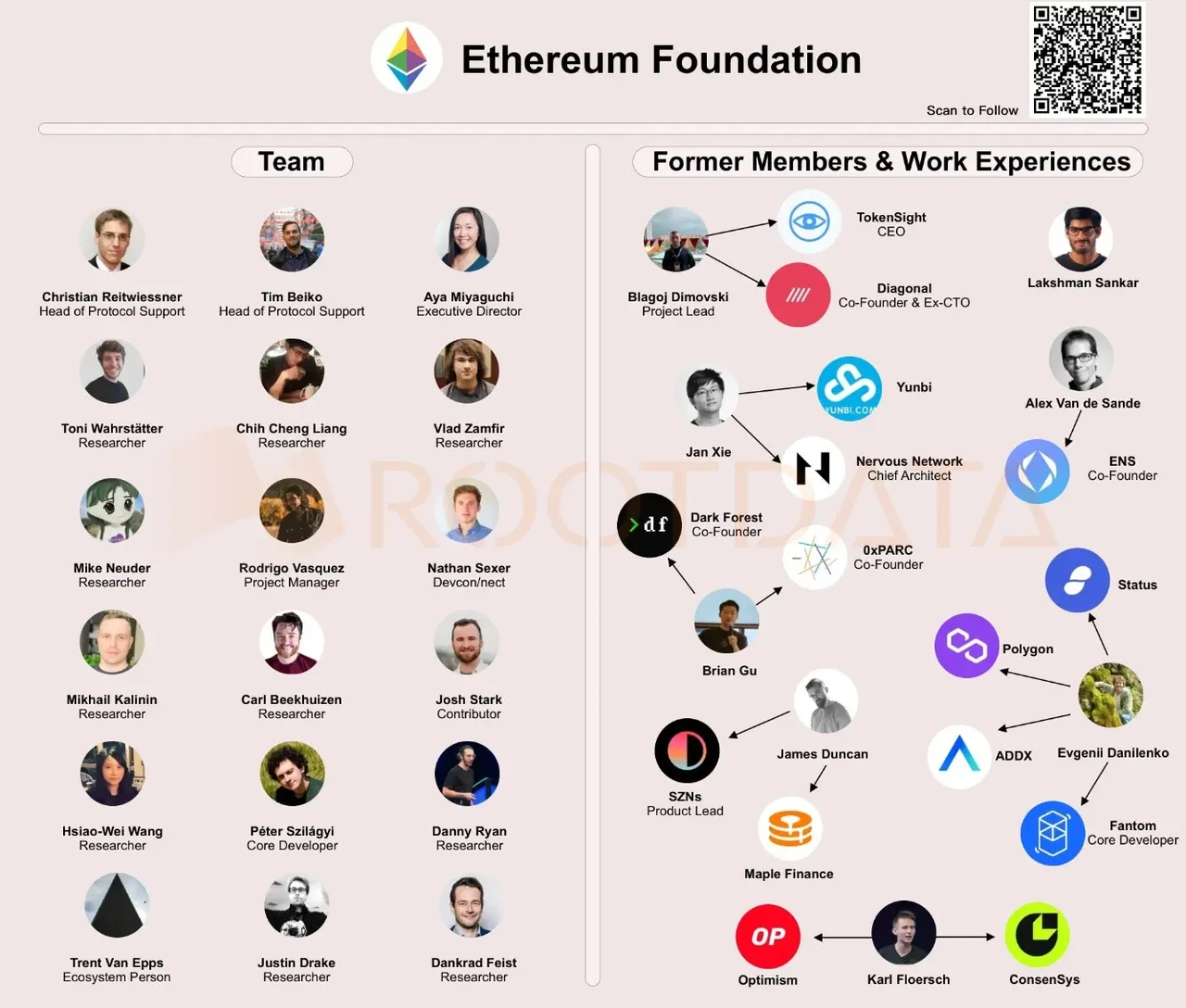

According to the information on the Rootdata website , there are currently 11 employees who have resigned from EF, including early BD personnel and Danny Ryan who led the POS transition. According to a chart from May last year, most of the resigned EF members chose to start their own projects. Of course, most of them are still in the EVM ecosystem.

EF Member Information for May 2024

EF Resigned Employees List

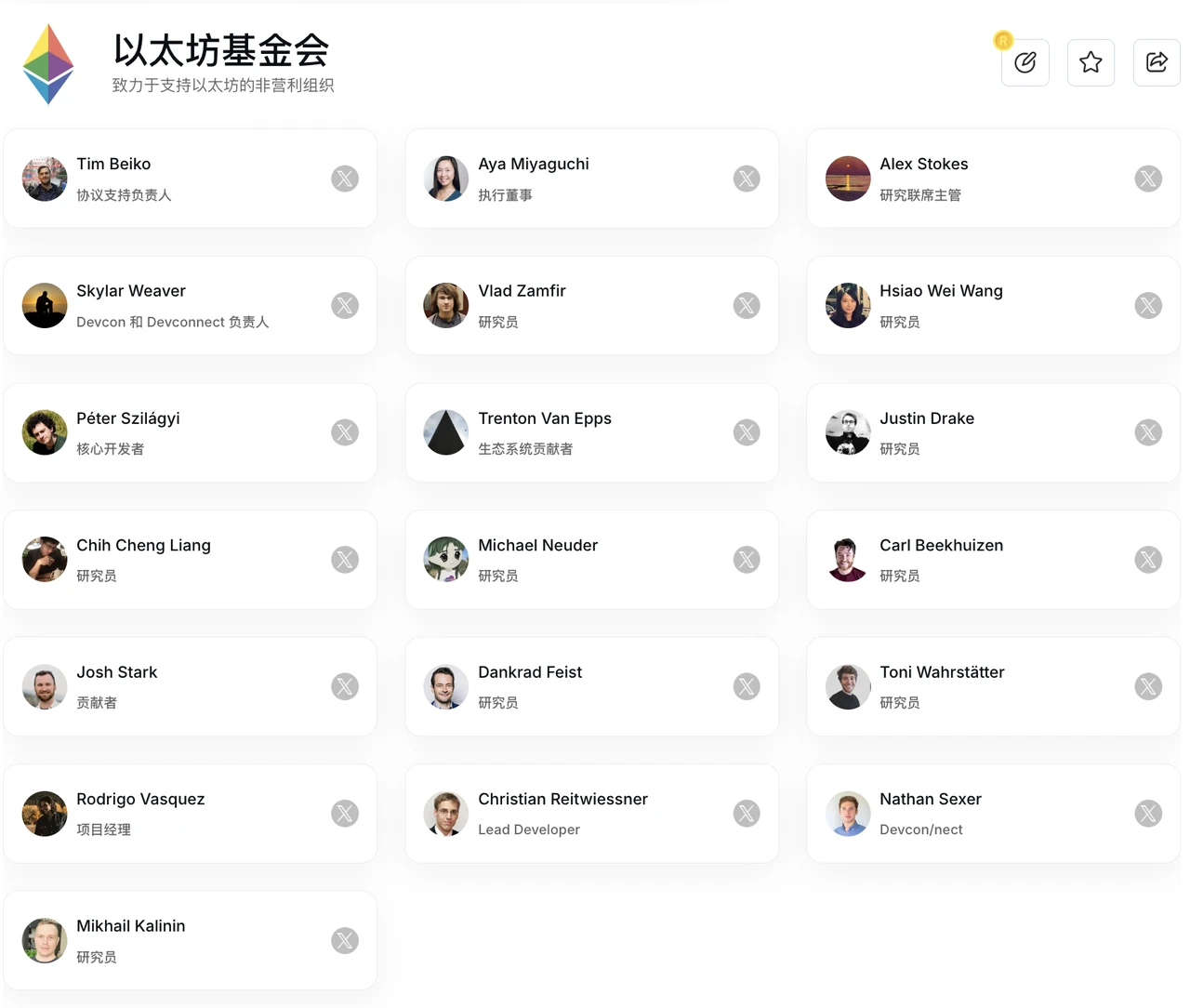

At the same time, EF’s current staff includes executive director Aya, Tim Beiko and other protocol support leaders, as well as many researchers including Justin Drake. However, the chaos in organizational management has also been revealed: not long ago, Ethereum Foundation researcher Alex Stokes announced that he and barnabe.eth would serve as co-directors of EF’s research department. Until then, many people first learned that EF’s research department includes five teams: application research group, consensus development, cryptography, protocol security, and RIG. This is just like when Tim Beiko posted information about new candidates in the department on his X platform account, people only knew that EF’s personnel flow was so rigid.

EF current staff, 16 people in total

The complex organizational management has brought about overwhelming doubts and debates, and many people have directed their criticism at EF Executive Director Aya.

In order to protect his long-time comrades, Vitalik, who has always been emotionally stable, had to take the initiative to play the role of dictator - on January 21, he responded to community doubts by saying, I am the one who decides the new EF leadership team. One of the goals of the ongoing reforms is to provide EF with a proper board of directors, but before that, there was only me. If community members put pressure on the EF leadership, they are creating an environment that is harmful to top talent.

EF Executive Director Ayas Doctrine of the Mean: Oppose speculation and advocate Zen

Many people may not know much about EF Executive Director Aya, but she is a key member of the development of the Ethereum ecosystem.

In the article Where to Go? A Brief Analysis of the Three Major Abstract Problems Currently Facing the Ethereum Ecosystem , we briefly introduced her. In a 2019 interview, she mentioned: When it comes to a blockchain full of infinite possibilities (such as the current Ethereum), the way forward may include not only one, two, or three voices, but many voices. Our (EF) job is to coordinate, but not to make actual decisions. Decisions can be made by our members, and they can certainly be part of the decision-making process, but not necessarily all of it.

In a June 2023 interview with Wired magazine , Aya reiterated: If I were the only one saying no to the cryptocurrency speculation wave, it wouldnt mean much, so I try to spread the same mentality among others, just like I am a Zen follower. Once this mentality takes root, people can be motivated without money, punishment, rules or laws. This is because we are thinking about how to protect the Ethereum culture after we and EF leave. It would be great if this mentality becomes a Zen way.

In this regard, Aya and Vitalik have highly consistent views, which has also been strongly criticized by the current market. Countless people have attacked Aya and called for her to step down as soon as possible . Some people suggested that Danny Ryan should take over as the executive director of EF, forcing Ryan to come out and clarify : EF Executive Director Aya has made a lot of contributions to the development of Ethereum, please dont slander her at will, and reiterated : With or without me, EF is constantly developing and getting better. I believe that the Ethereum community will be a community that develops in a respectful and rational way.

According to LinkedIn information , Aya graduated from the College of Business at Seattle State University in the United States. She was previously responsible for Japan work at the cryptocurrency exchange Kraken. She joined EF as executive director in 2018 and has been in this position ever since.

The fragmented Ethereum community: consensus, liquidity, and attention

The third biggest contradiction currently facing the Ethereum community is “fragmentation”.

First, there is the fragmentation of consensus on Ethereum’s value, role, mission, vision, short-, medium- and long-term goals;

Secondly, the L2 route has led to the fragmentation of capital liquidity in the Ethereum ecosystem, causing ETH to lose price support;

Finally, the most critical issue in the cryptocurrency industry is attention fragmentation. In the past, the focus of attention has gradually shifted from the heavily populated ETH to Solana, which has a concentrated hotspot and obvious wealth-creating effect.

In this regard, the thinking of Solanas ecological leaders is undoubtedly clearer. Previously, Solana co-founder Anatoly Yakovenko once wrote: Solana is a pure blockchain. There is no DA layer, no L2, no L3, no interference. Its just a fast and cheap blockchain. Multiple L2s dont make any sense. If a single L2 can handle parallel execution, then it can use up all the blobs space and run every use case. Only 6 important underlying smart contracts are required, and any developer optionality that increases business risk is negative. In addition, he once said in a debate with EF researchers: The biggest problem facing Ethereum is the uncertainty of the long-term value of DA and the uncertainty of ETHs vision of ultrasonic currency. This view was also echoed by Uniswap founder Arthur Hayes.

Of course, to get out of this predicament, Ethereum needs a more detailed solution.

Three-dimensional solution to the “Ethereum dilemma”: ideas, communication and positioning

Based on the above information, I believe that EF’s solution to the “Ethereum dilemma” includes the following three aspects:

Let go of prejudice and obsession

First of all, the EF leadership headed by Vitalik needs to correct its mindset: stop obsessing over the long-term goal of becoming the “world computer” and focus on doing practical things in the short and medium term.

Progress in this regard includes the Ethereum Foundation’s announcement of the launch of a new X account, the establishment of Etherealize, an institutional marketing arm that promotes ETH to Wall Street (the company has received support from Vitalik and EF), and EF’s decision to use 50,000 ETH (approximately US$150 million) through 3/5 of its multi-signature wallets to participate in the Ethereum DeFi ecosystem.

In addition, the latest news shows that Vitalik is no longer obsessed with maintaining the neutrality and transcendent status of the Ethereum mainnet ecosystem and unilaterally transfusing blood to the L2 network. Instead, he directly stated that Layer 2 is encouraged to support ETH by contributing a certain proportion of fees. This can be achieved by destroying part of the fees, permanently staking and donating the proceeds to public products in the Ethereum ecosystem or some other solutions. For more information, see the article Under the pressure of public opinion, Vitalik issued a message to L2: Return to support ETH.

As for the issue of “cutting down the vassal states”, once the action is taken, I believe the “ghost chain” problem in the EVM system will be further resolved.

Listen to the community and communicate regularly

Secondly, EF can no longer bury its head in the sand like an ostrich, ignoring the external environment and the opinions of the community. It is worth mentioning that although Vitalik is not the emperor at present, he is indeed a leader. Therefore, be close to virtuous officials and stay away from villains is also a piece of advice. Dont be blinded by the flattery, flattery, and pandering of those who want to get Grants funding and incentives.

Fewer academic discussions and more regular AMAs with representative figures at the organizational level - if they are technical personnel, then talk more about technology; if they are marketing personnel, then talk more about the market; if they are just earning a salary and making decisions based on their own ideas, then they should be kicked out of EF as soon as possible.

The most important thing is not to trap yourself in an information cocoon.

Store of value or means of payment? That is the question

Finally, there is the positioning of ETH and the Ethereum network. The fragmentation problem caused by dozens of L2 networks and the excessive power of ETH’s vested interest groups in the past (that is, too many profit-taking groups) have made it increasingly difficult to realize the value storage function of ETH. The narrative of simply talking about “digital silver” has been difficult for the market to accept.

The means of payment are more in line with market demand. In this regard, the Coinbase Wallet consumer chain mentioned in the Base ecosystem may be one of the subsequent ecological focuses of Ethereum. Although Vitalik insists on ensuring the neutrality and decentralization of the Ethereum ecosystem, it is difficult to promote cooperation with the United States in the short term, but in the medium and long term, this is still an unavoidable problem.

In addition, as Marc Zeller, founder of Aave Chan Initiative (ACI), the Aave contribution team, mentioned in an earlier article , To solve the Ethereum Foundations problems, it is necessary to: convert the remaining ETH of EF into a market-tested LST combination, cut 95% of the current subsidies, especially initiatives like running nodes in Vorkuta, do not sell ETH, but use LST to borrow stablecoins through Sky/Aave, while reducing operating costs which is also of certain reference value.

Of course, the proposals to “fire 80% of non-developers and current leaders” and “hand over the official account to several extremely active ETH Maxi” are a bit one-sided.

Finally, the ultrasound.m oney community once created by the Ethereum ecosystem once united many ETH Maxi, but eventually it became lost in the crowd. It has to be said that this is a pity. Perhaps with the EF transformation, related communities will also usher in an opportunity for transformation.

Conclusion: Dont rest on your laurels, make new contributions

Perhaps in the early days of Ethereum’s ecosystem development, EF’s hands-off leadership style led to the rapid development of the Ethereum ecosystem. However, after experiencing several bull and bear cycles, since we have the ambition of “mass adoption”, we need new solutions, rather than indulging in the past glory of “Ethereum is the first crypto ecosystem”, being complacent and refusing to make progress.

The TRUMP token has allowed millions of people to enter the world of cryptocurrency. It is understandable that people come here for the wealth-creating effect. After all, compared to the Web2 world that gives up privacy and data, the eye-catching effect and wealth-creating craze are the Trojan Horse that the crypto world can offer to the traditional financial world. When the future arrives when the crypto economy is further connected with the worlds financial system, we will be able to see the presence of the crypto flower throughout the universe.

Only by eliminating wrong answers can we have more courage and strength to face new problems raised by the crypto world.

There are countless people who share my path in this regard, so I am confident and I hope you are too.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KBW gives mining companies Bitdeer, CleanSpark and Core Scientific "outperform" ratings

Sahara announces DeepSeek-R1 will be the flagship model of its AI Studio

Analysis: The release of DeepSeek R1 has a significant impact on AI-related token prices

Circle has minted 5.25 billion USDC on Solana since January 2